04 January 2024: Wealth Product Ideas

India 2024 Economic Growth Dominates Emerging Markets

- The global economy is expected to slow down, but India still maintains high growth, Bloomberg estimates. The real GDP growth rate in 2024 is 6%. India announced that the latest GDP growth rate in 2023Q3 was 7.6%, which was significantly better than the 6.8% expected by market analysis and India. The 7% forecast by the Reserve Bank of India (RBI) comes from the strong expansion of manufacturing and domestic construction-related industries.

- In the 2024 Indian Prime Ministerial Election, Modi has a high chance of being re-elected, with policies supporting infrastructure construction and continued openness to foreign investment. India has a cabinet system, and the prime minister can be re-elected if he obtains a majority in Congress. As of December’s local elections, Modi’s alliance has won the election, winning 16 out of 29 states, accounting for 60% of the population. Policies to build additional airports, bring roads to rural areas, and electrify railways are expected to sustain domestic demand.

- Chance: Support India’s integration into the global supply chain and benefit from the relocation of industries due to the competition between China and the United States.

- Risk: Food inflation has pushed overall inflation to a record high, which may suppress private consumption and increase the central bank’s tighter stance on policy interest rates.

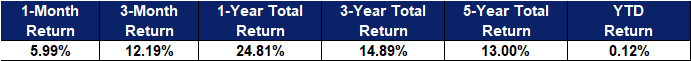

Fund Name (Ticker) | WisdomTree India Earnings Fund (EPI US) |

Description | WisdomTree India Earnings Fund seeks to track the investment results of profitable companies in the Indian equity market. |

Asset Class | Equity |

30-Day Average Volume (as of 2 Jan) | N/A |

Net Assets of Fund (as of 20 Jun) | US$1,993,186,110 |

12-Month Trailing Yield (as of 28 Dec) | N/A |

P/E Ratio (as of 28 Dec) | 17.07 |

P/B Ratio (as of 28 Dec) | 2.80 |

Management Fees (Annual) | 0.85% |

Top 10 Holdings

(as of 2 January 2024)

(Source: Bloomberg)

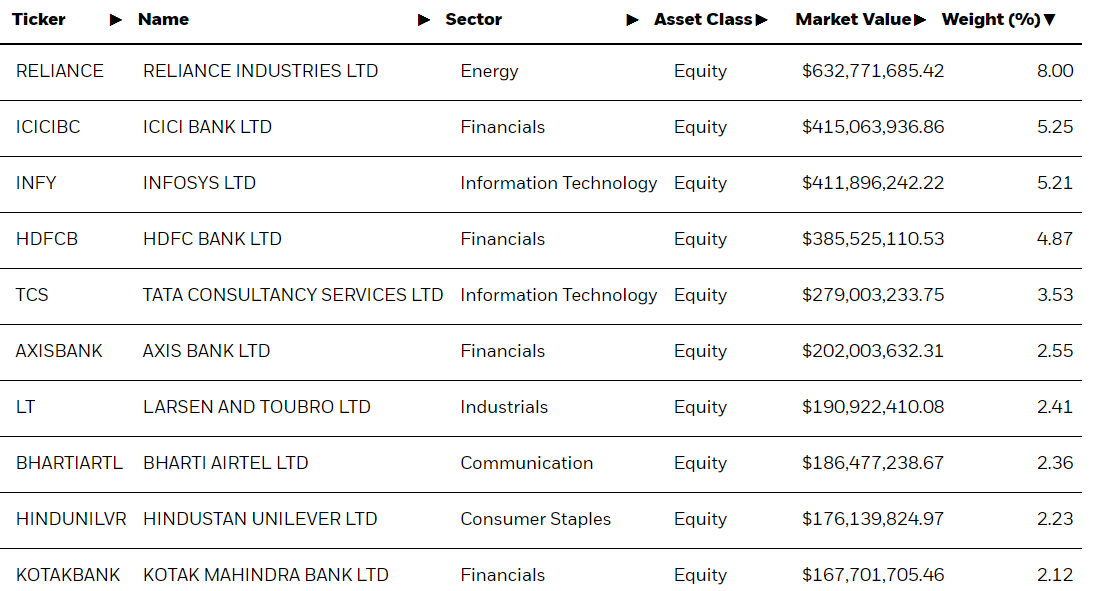

Fund Name (Ticker) | iShares MSCI India ETF (INDA US) |

Description | The iShares MSCI India ETF seeks to track the investment results of an index composed of Indian equities. |

Asset Class | Equity |

30-Day Average Volume (as of 29 Dec 2023) | 3,658,208 |

Net Assets of Fund (as of 02 Jan) | USD$$7,873,292,078 |

12-Month Trailing Yield (as of 30 Nov 2023) | 0.17% |

P/E Ratio (as of 29 Dec 2023) | 29.24 |

P/B Ratio (as of 29 Dec 2023) | 4.10 |

Management Fees | 0.65% |

Top 10 Holdings

(as of 29 December 2023)

(Source: Bloomberg)