01 August 2024: Wealth Product Ideas

REITs Revival: Benefitting from Cooling Inflation

- Decreasing inflation expectations are increasing the attractiveness of yield-oriented products, benefiting REITs ETFs.

- The U.S. inflation continues to cool down, with the CPI annual rate falling to 3.0% in June. This trend suggests that the start of an interest rate cut cycle is approaching.

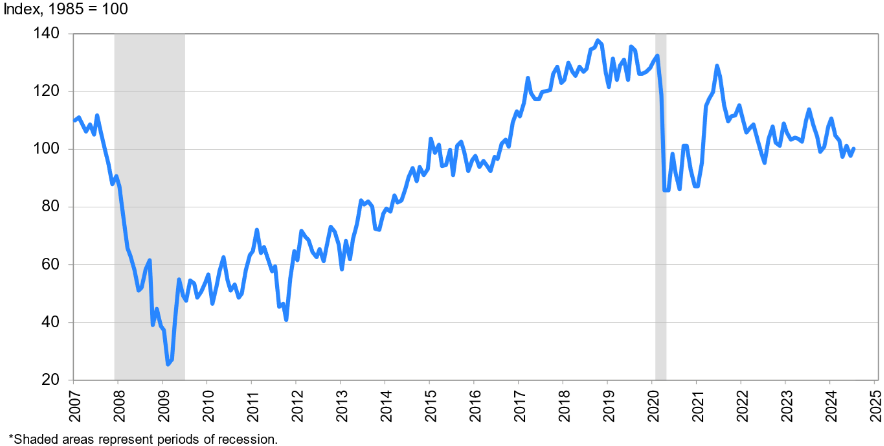

- Improving consumer sentiment. The U.S. consumer confidence index rose to 100.3 in July, compared to a downwardly revised 97.8 in June. This boosts consumer spending outlook in the future, increasing consumer spending as well as increasing demand for housing, benefitting the real estate sector.

United States Consumer Confidence Index

(Source: The Conference Board, NEBR)

- Business Sentiment. Business investment increased in 2Q24, with spending on equipment surging at an 11.6% rate, up from just 1.6% in the first quarter. While spending on intellectual property products continued to grow, the pace slowed from the brisk rate seen in the January-March quarter. These improved business sentiments are likely to positively impact the real estate sector as well.

- Federal Reserve Chairman Powell has hinted at upcoming rate cuts, stating that the Fed won’t wait for inflation to reach the 2% target before cutting rates. A better rate cut outlook is also likely to bring capitalization rates for REITs. This will result in an upward re-rating for REITs, as investors believe the REIT is worth more than previously assessed, resulting in an upward momentum in share prices in the real estate sector.

Fund Name (Ticker) | Schwab U.S. REITs ETF (SCHH US) |

Description | The fund’s goal is to track as closely as possible, before fees and expenses, the total return of an index composed of U.S. real estate investment trusts classified as equities. |

Asset Class | Real Estate |

30-Day Average Volume (as of 30 Jul) | 2913295 |

Net Assets of Fund (as of 30 Jul) | US$6,993,182,780 |

12-Month Yield (as of 30 Jul) | 3.08% |

P/E Ratio (as of 30 Jul) | 44.724 |

P/B Ratio (as of 30 Jul) | 2.532 |

Management Fees (Annual) | 0.07% |

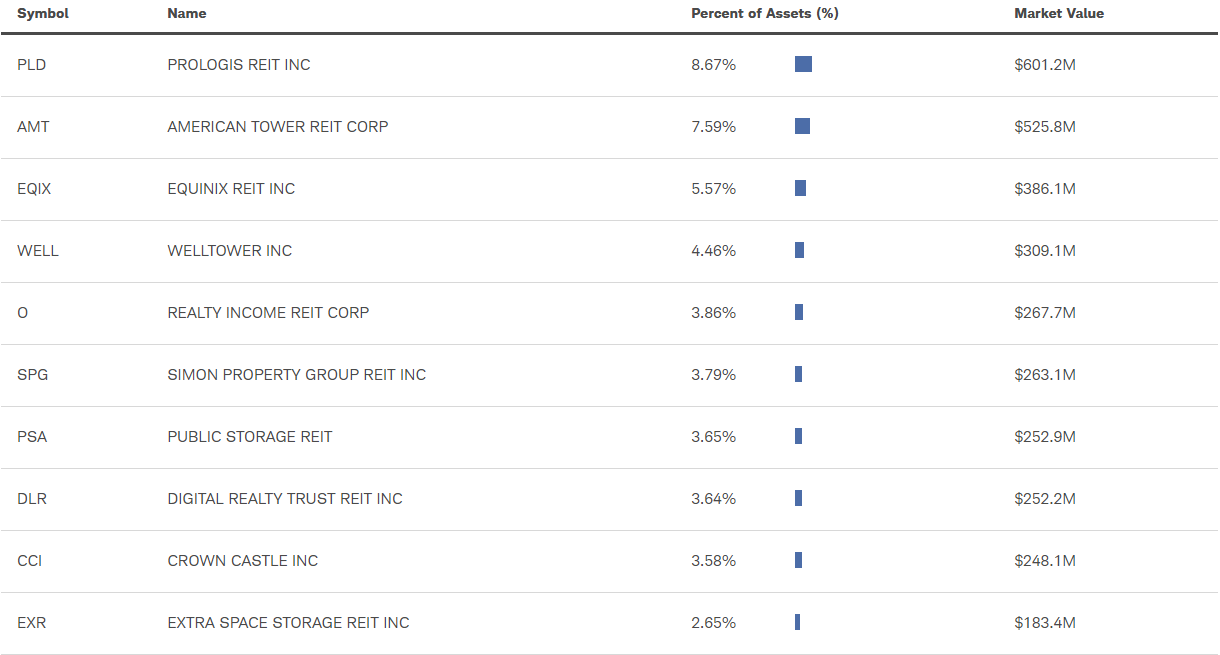

Holdings

(as of 30 July 2024)

(Source: Bloomberg)

Fund Name (Ticker) | Vanguard Real Estate ETF (VNQ US) |

Description | The fund invests in stocks issued by real estate investment trusts (REITs), companies that purchase office buildings, hotels, and other real property. The fund’s goal is to closely track the return of the MSCI US Investable Market Real Estate 25/50 Index. |

Asset Class | Real Estate |

30-Day Average Volume (as of 30 Jul) | 3240269 |

Net Assets of Fund (as of 30 Jul) | US$34,732,832,000 |

12-Month Yield (as of 30 Jul) | 3.92% |

P/E Ratio (as of 30 Jul) | 45.205 |

P/B Ratio (as of 30 Jul) | 2.348 |

Management Fees (Annual) | 0.13% |

Holdings

(as of 30 June 2024)

(Source: Bloomberg)