Technical Analysis: 25 February 2022

United States | Singapore | Hong Kong

United States

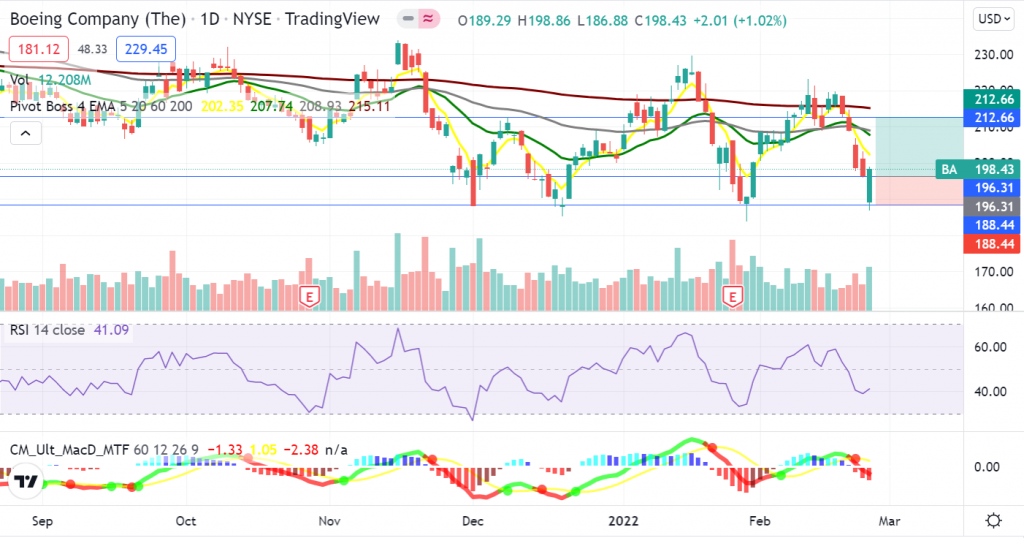

Boeing Company (BA US)

- Range bound trade with strong support levels around US$196. Shares tested the level 4 times.

- RSI shows signs of turnaround however MACD is laggard.

- Long – Entry 196.31, Target 212.66, Stop 184.44

Barrick Gold Corporation (GOLD US)

- Shares retreated from oversold levels (RSI >70) and closed at the 5dMA yesterday.

- MACD remains constructive.

- Long – Entry 22.32, Target 24.38, Stop 21.16

SINGAPORE

Olam International (OLAM SP)

- The 200d EMA has held up well and has supported shares three times year-to-date.

- Long on potential pullbacks to the 200d EMA at 1.68

- Long – Entry 1.68, Target 1.85, Stop 1.60

OCBC (OCBC SP)

- Both momentum indicators (MACD and RSI) are pointing to further downside.

- A potential entry will be at the 23.60% Fib at 11.56, which is also a key buying support level.

- Long – Entry 11.56, Target 12.49, Stop 11.28

HONG KONG

China Oilfield Services Limited (2883 HK)

- Shares formed a bullish engulfing pattern on Thursday.

- MACD shows weak momentum, and RSI is at an overbought level.

- Long – Entry: 8.7 Target: 9.5, Stop: 8.3

CNOOC (883 HK)

- Shares are trending upward.

- MACD shows weak momentum, and RSI is at an overbought level.

- Long – Entry: 10.1., Target: 10.6, Stop: 9.6

Related Posts: