Technical Analysis: 13 January 2022

United States | Singapore | Hong Kong

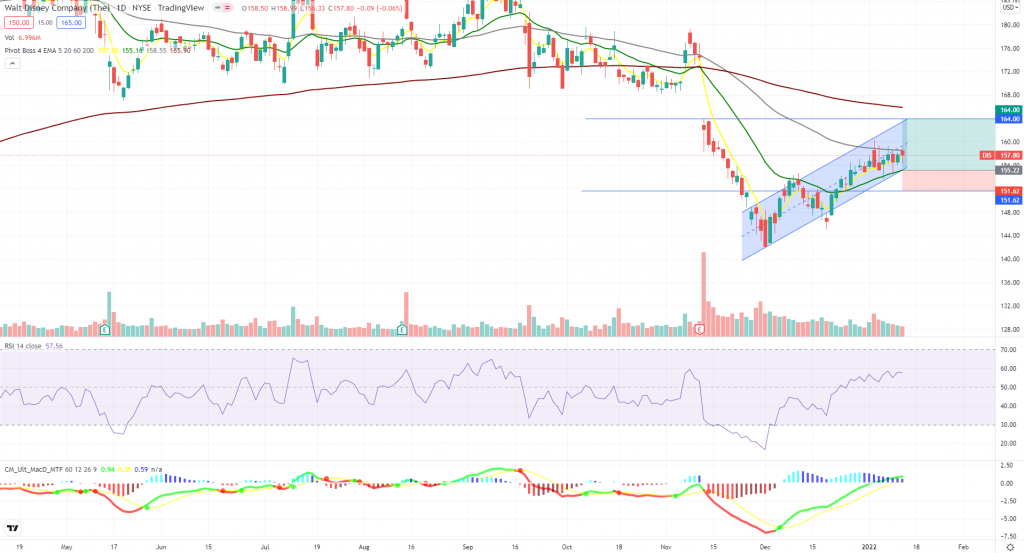

Walt Disney Company (DIS US)

- Shares are forming an upward parallel channel, with higher highs and higher lows.

- Both MACD and RSI are on a positive momentum.

- Long – Entry 155.22, Target 164.00, Stop 151.62

Southern Copper Corporation (SCCO US)

- Shares gapped up and closed above the previous resistance level yesterday (~US$67.80).

- Both MACD and RSI are on a positive momentum, however RSI is currently overbought and might see some correction soon.

- To long at the previous resistance level.

- Long – Entry 67.80, Target 72.47, Stop 65.59

SINGAPORE

Singtel (ST SP)

- Shares of Singtel are finding support at the confluence of the critical 50% Fib of 2.41 and long-term trend line of 200d EMA of 2.42

- MACD and RSI are on an uptrend, which may portend the potential start of a new uptrend move after completing a 3-wave correction in 4Q2021.

- Long – Entry 2.42, Target 2.58, Stop 2.36

Valuetronics (VALUE SP)

- Shares of Valuetronics have firmly bounced off from the strong buying support of 0.53, thus limiting downside risk to 5% from the current price of 0.56.

- Both MACD and RSI are on an upward trend on increasing volumes.

- Long – Entry 0.560, Target 0.605, Stop 0.535

HONG KONG

Meituan (3960 HK)

- Shares form an island reversal pattern, and the stock closed near the intraday high and above the 20dEMA with an increase in volume.

- MACD shows an early sign of turnaround, and RSI is constructive.

- Long – Entry: 222, Target: 240, Stop: 215

Kingsoft Corporation Limited (3888 HK)

- Shares closed above the consolidation channel with an increase in volume.

- Both MACD and RSI are constructive.

- Long – Entry: 36.50, Target: 39.85, Stop: 35.00

Related Posts: