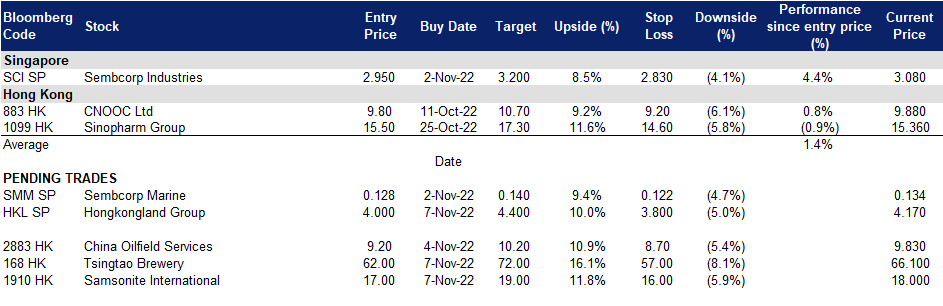

7 November 2022: Hongkong Land Holdings Ltd (HKL SP), Samsonite International S.A. (1910 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Hongkong Land Holdings Ltd (HKL SP): Light at the end of the tunnel

- BUY Entry – 4.00 Target – 4.40 Stop Loss – 3.80

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages more than 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- China easing air travel. China is working on plans to scrap a system that penalises airlines for bringing virus cases into the country, a sign authorities are looking for ways to ease the impact of the Covid Zero policy. The State Council, which oversees China’s bureaucracy, recently asked government agencies including the civil aviation regulator to prepare for ending the so-called circuit-breaker mechanism. The system sees airlines banned temporarily from specific routes into China for one-to-two weeks, depending on how many Covid-positive passengers they bring into the country.

- Hope for reopening of borders in China. With news of China increasing international flights into the country, investors are hopeful that China will soon ease their strict Covid zero restrictions and allow for a gradual recovery of their economy. Furthermore, news of the Chinese government planning to ease the circuit breaker rule and drawing up a game plan to slowly open up their country has led to the rise in yuan and the Hong Kong market.

- Updated market consensus of the EPS growth in FY22/23 is -8.2%/12.9% YoY respectively, which translates to 10.9x/9.7x forward PE. Current PER is 11.9x. Bloomberg consensus average 12-month target price is S$5.67.

(Source: Bloomberg)

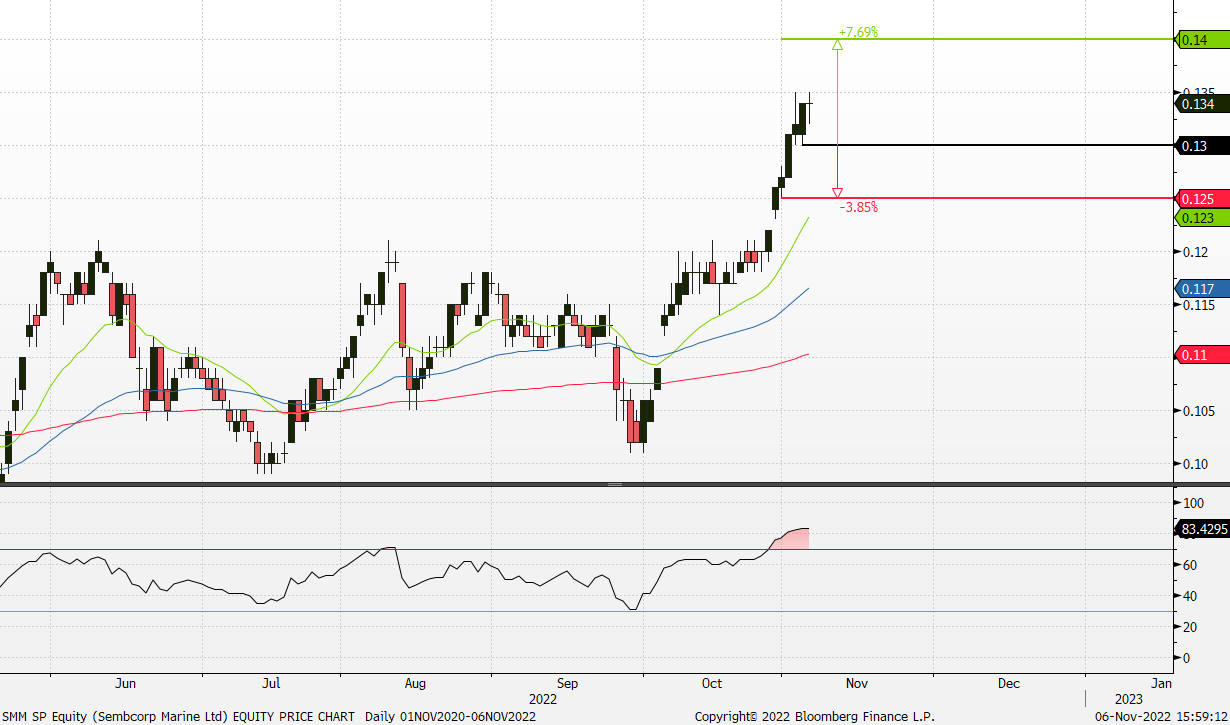

Sembcorp Marine Ltd (SMM SP): Acquisition of KOM

- RE-ITERATE BUY Entry – 0.130 Target – 0.140 Stop Loss – 0.125

- Sembcorp Marine Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialised shipbuilding. With a combined docking capacity of 2.3 million dwt, it offers one of the largest ship repair, ship conversion, and offshore and marine-related facilities in East Asia. Its global hub now spans eight shipyards strategically located around the world.

- Revision of previous merger deal. On October 27, Sembcorp Marine Ltd scrapped a deal to merge with Keppel Corp’s offshore and marine unit and form a new company, in favour of directly acquiring 100% of Keppel O&M from Keppel for S$4.50 billion ($3.19 billion). This will lower the value of Keppel’s unit by S$378 million from the S$4.87 billion valuation it received in April. Hence, giving Sembcorp Marine’s shareholders a larger stake, of 46 percent, compared with 44 percent in the previous deal, in the combined firm and shortens the time required to complete the deal, which is expected to close by the end of the year. Additionally, Keppel will distribute 49 percent of Sembmarine shares in-specie to its shareholders and retain a 5 percent stake, half the size of the stake it would have had under the older terms.

- Enlarged entity. With a larger entity after the acquisition of Keppel O&M, Sembcorp Marine will be in a better position to deal with deteriorating macroeconomic conditions such as high inflation, rising interest rates, volatile oil prices, and concerns about energy security amid geopolitical tensions. Post-acquisition the enlarged Sembmarine would have a total net order book of more than S$18bn.

- Secured new projects. Prior to the announcement of the acquisition, Sembcorp Marine announced on 20 October that it secured two floating liquefied natural gas (LNG) facilities conversion projects from global infrastructure company New Fortress Energy. The hull conversion and fabrication of topsides for the first floating LNG liquefaction facility is scheduled for delivery in the first half of 2024. Work on the second floating LNG liquefaction facility project is expected to be contracted to Sembcorp Marine at a later date.

- Updated market consensus of the EPS growth in FY22/23 is 90.8%/96.7% YoY respectively, which translates to 28.2x/18.0x forward PE. Current PER is 53.1x. Bloomberg consensus average 12-month target price is S$0.12.

(Source: Bloomberg)

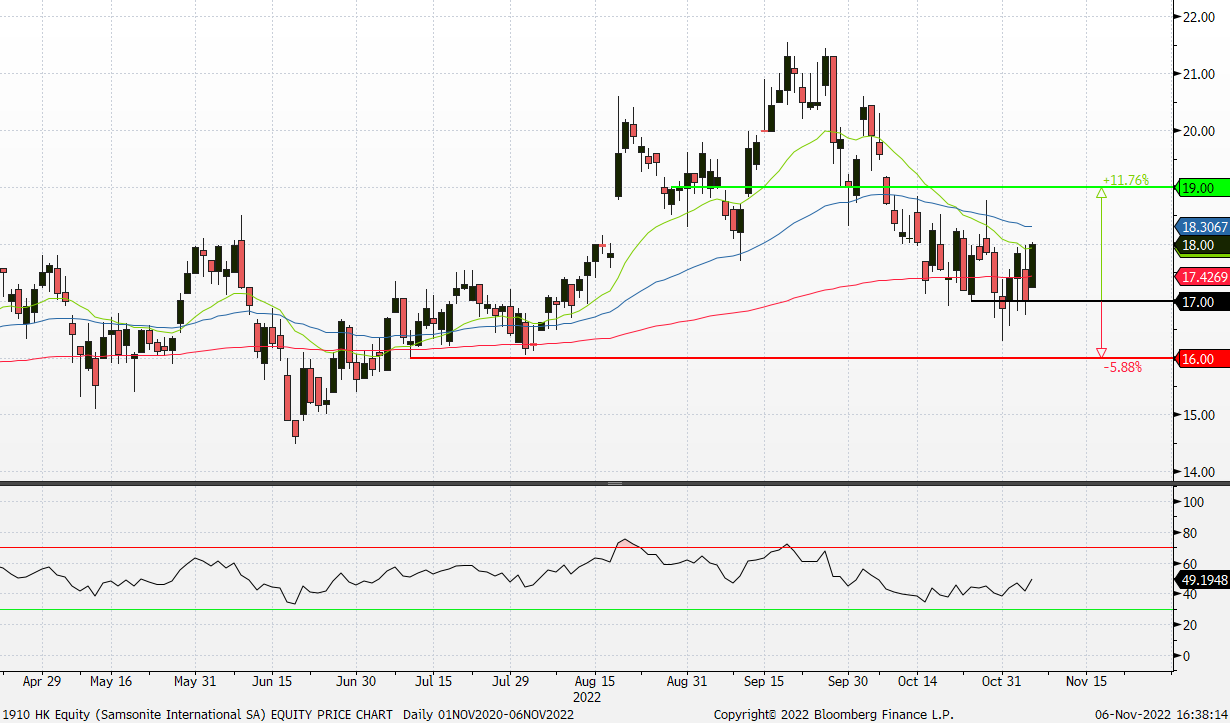

Samsonite International S.A. (1910 HK): China to gradually reopen

- Buy Entry – 17.0 Target – 19.0 Stop Loss – 16.0

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- China easing air travel. China is working on plans to scrap a system that penalises airlines for bringing virus cases into the country, a sign authorities are looking for ways to ease the impact of the Covid Zero policy. The State Council, which oversees China’s bureaucracy, recently asked government agencies including the civil aviation regulator to prepare for ending the so-called circuit-breaker mechanism. The system sees airlines banned temporarily from specific routes into China for one-to-two weeks, depending on how many Covid-positive passengers they bring into the country.

- Global tourism to continue to recover in 2023. According to the Economist Intelligence Unit Tourism in 2023 report, the global tourism arrivals will increase by 30% YoY in 2023, following growth of 60% YoY in 2022, but will remain below pre-COVID levels. Meanwhile, EIU also expects international arrivals to recover back to 2019 levels in 2024.

- 1H22 results review. Net sales jumped by 58.9% (+66.9% constant currency) YoY to US$1,270.2mn. Operating profit arrived at US$159.9mn compared to a loss of US$86.4mn during the same period last year. Profit attributable to the equity shareholders arrived at US$56.3mn in 1H22 compared to a loss of US$142.5mn in 1H21. The turnaround of the business and financials was due mainly to the continued easing of COVID restrictions and the ensuing recovery of both domestic and overseas travel. North America, Latin America, and Europe saw a strong recovery. But the slowdown in China dragged the accelerated recovery in Asia.

- The updated market consensus of the EPS growth in FY22/23/24 is 1,222.2%/42.0%/20.2% YoY respectively, translating to 17.4×/12.2x/10.2x forward PE. The current PER is 15.5x. Bloomberg consensus average 12-month target price is HK$25.17.

(Source: Bloomberg)

Tsingtao Brewery Company Limited (168 HK): FIFA World Cup is coming

- RE-ITERATE Buy Entry – 62.0 Target – 72.0 Stop Loss – 57.0

- Tsingtao Brewery Company Limited, together with its subsidiaries, engages in the production, distribution, wholesale, and retail sale of beer products worldwide. The company sells its beer products primarily under the Tsingtaoand and Laoshan brand names. It also provides wealth management, and agency collection and payment services; and financing, construction, and logistics services, as well as technology promotion and application services.

- FIFA World Cup Qatar 2022 in two weeks. The once in every four years FIFA World Cup is going to take place from November to December 2022. This is the largest global sports event after the Tokyo Olympic Games, and it is expected to attract a record high of spectators as most countries have eased COVID restrictions. Accordingly, it will stimulate sales of alcohol and other drinks. The beer feast will take place during the world cup period.

- 3Q22 earnings review. 3Q22 revenue grew by 16.0% YoY to RMB9.8bn. 3Q22 net profit attributable to shareholders of the company grew by 18.4% YoY to RMB1.4bn. 9M22 revenue grew by 8.7% YoY to RMB29.1bn. 9M22 net profit attributable to shareholders of the company grew by 18.2% YoY to RMB4.3bn.

- The updated market consensus of the EPS growth in FY22/23 is 19.7%/14.3% YoY, respectively, translating to 23.1×/20.2x forward PE. The current PER is 20.0x. Bloomberg consensus average 12-month target price is HK$87.04.

(Source: Bloomberg)

United States

Top Sector Gainers

Sector | Gain | Related News |

Other Metals/Minerals | +9.24% | Friday feeding frenzy for mining stocks Rio Tinto PLC (RIO US) |

Steel | +8.33% | Iron ore turns hot as China reopening hopes persist BHP Group Ltd (BHP US) |

Apparel/Footwear | +5.05% | Why Nike Stock Was Bouncing Higher Today Nike Inc (NKE US) |

Top Sector Losers

Sector | Loss | Related News |

Managed Health Care | -1.37% | UnitedHealth Group Third Quarter 2022 Earnings: EPS Beats Expectations UnitedHealth Group Inc (UNH US) |

Motor Vehicles | -0.55% | Tesla stock has dropped more than 35% since Elon Musk first said he’d buy Twitter Tesla Inc (TSLA US) |

Oil Refining/Marketing | -0.19% | Saudi Arabia Cuts Oil Prices for Asia as Growth Slows Marathon Petroleum Corp (MPC US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Airline Services | +5.63% | China Is Preparing a Plan to End Covid Flight Suspensions Cathay Pacific Airways Ltd (293 HK) |

Environmental Energy Material | +5.46% | China – Hydrogen Energy Sector Advances Amid Green Transformation Xinyi Solar Holdings Ltd (968 HK) |

Automobiles & Components | +5.08% | Chinese scientists’ new gel filling could triple lifespan of lithium batteries for EVs, drones BYD Co Ltd (1211 HK) |

Top Sector Losers

Sector | Loss | Related News |

Telcomm. Services | -0.50% | China Telecom Denies Signing Strategic Cooperation Agreement On Nov 2 With Alibaba China Mobile Ltd (941 HK) |

Trading Dashboard Update: No stocks additions/deletions.