KGI DAILY TRADING IDEAS – 5 March 2021

US Trading Ideas

UWM (UWMC US): Meme stock alert

- BUY Entry – 8.0 Target – 10.0 Stop Loss – 7.0

- UWMC is the second-largest residential mortgage lender and largest wholesale mortgage lender in the US. Residential mortgages make up the largest segment of the broader US consumer finance market, with annual residential mortgage origination volume rising to US$4.0 trillion in 2020, which is a historical high compared to the average volume of US$2.4 trillion in the last five years.

- UWMC proprietary technology is a key competitive differentiator which has enabled the company to provide lower cost of loans that are below industry averages and with faster close times.

- UWMC was one of the most talked about stocks on social platforms. With 13% of its float being shorted, the stock had followed the short squeeze of its larger rival Rocket Companies (RKT US) to surge 20% earlier this week, and inflicted losses of about US$813mn on short-sellers, according to data from financial analytics firm Ortex.

- Unlike the realistic valuations of earlier short squeezed stocks such as GameStop and AMC Entertainment, UWMC actually trades at reasonable valuations, with forward P/Es of 5.4/6.9/6.9x for FY20/21/22F, while offering a dividend yield of 4.6% over the next two years.

JD.Com (JD US): Trade the upcoming IPO in HK

- RE-ITERATE BUY Entry – 89 Target – 110 Stop Loss – 80

- JD is an online direct sales company in China. The Company offers a wide selection of products through its website and mobile applications. JD sells appliances, computers, digital products, communication products, garments, books, and household items to consumers and vendors.

- The upcoming catalyst is the pending JD logistics IPO in HKEX. The spin-off of the sub-business segment is expected to increase the parent company’s valuation.

- Market consensus of net profit growths in FY21 and FY22 are 36.4x%YoY and 39.8% YoY, which implies forward PERs of 41.8x and 29.9x. Current PER is 57x.

- Big tech companies recently sold off due to rising interest rates, which has raised concerns of faster-than-expected inflation. However, we believe this is a short-term panic-sell down as Fed Chair Powell mentioned it could take three years for the US to reach the 2% inflation target, and that the Fed has multiple tools to rein in inflation. In the long-term, tech giants remain the key economic drivers, and their growth prospects are better off if inflation kicks in.

HK Trading Ideas

Ganfeng Lithium (1772 HK): Correction is about done

- BUY Entry – 90 Target –110 Stop Loss – 80

- Ganfeng Lithium Co., Ltd is a China-based company principally engaged in the research, development, production and sales of deeply processed lithium products. The Company’s main products include lithium compounds, lithium metal and lithium batteries. The Company’s products are mainly used in electrical vehicles, chemicals and pharmaceuticals. The Company distributes its products in the domestic market and to overseas markets.

- The company announced FY20 full year results where revenues grew by 3.4% YoY to RMB5.5bn, and net profits grew by 175% YoY to RMB985mn. The phenomenal growth was due mainly to the increase in production and sales volume of the lithium salt products and gain on change in the fair value of financial assets.

- Electric vehicle hype has been tapering since February. However, the demand for raw materials of batteries remains robust. As the world largest limitium and related compounds producer, the company has a moat that provides the required raw materials to various EV makers. It is likely that only a few EV producers will survive in the future, but the ultimate winners will still be the litimium and related compounds providers. Ganfeng is expected to be the leader in the foreseeable future.

- Market consensus of net profit growth in FY21 and FY22 are 123.6%YoY and 57.5% YoY, which implies forward PERs of 67.7x and 43x. Current PER is 151.4x.

Xinyi Glass Holdings Ltd. (868 HK): A value stock with sound fundamentals

- RE-ITERATE BUY Entry – 20.5 Target –26 Stop Loss – 18

- Xinyi Glass Holdings Ltd engages in the manufacturing and sales of automobile, architectural, float, and other glass products for commercial and industrial applications. The company is also involved in the manufacture and sales of rubber and plastic products and the provision of logistics services.

- Float glass prices in China remain at high levels as the demand after Chinese New Year has resumed. The current average prices are close to RMB2,143/tonne, declining from the recent high of RMB2,350/tonne. It is expected that prices will stay around RMB2,000/tonne in 1H21.

- Because of the accelerating development of solar energy supported by the central government, domestic float glass capacity will shift to produce solar panels. Hence, float glass for construction is expected to be in short supply, keeping prices at 10-year highs. Market research estimates the average float glass prices will grow by 10% to 15% YoY in 2021.

- Market consensus of net profit growths in FY21 and FY22 are 28.6%YoY and 7% YoY, which implies forward PERs of 13.3x and 12.4x. Current PER is 23.7x.

SG Trading Ideas

Rex International (REXI SP): Gushing forth oil

- BUY Entry – 0.170 Target – 0.19 Stop Loss – 0.160

- REXI is an oil and gas exploration and production company with assets mainly in Oman and Norway. As one of Singapore’s only publicly listed oil producing company, its share price is highly correlated to the movement in oil prices.

- This is a pivotal year for REXI as the group ramps up production in Oman. Its Oman field started producing 9,000 barrels of oil last year and the company is in the process of upgrading its maximum processing capacity to handle up to 30,000 barrels per day.

- Meanwhile, OPEC+ surprised markets by maintaining production for April 2021, which will be supportive of oil prices going into the second quarter. Brent and WTI are both higher by 35% year-to-date, with potential upside if Chinese refineries were to start buying again. At least for now, the Chinese refineries are holding out and not chasing the rally in oil prices given that they have sufficient crude inventories and that it is refinery maintenance season.

SPH (SPH SP): A short-term trade on Coupang’s IPO

- BUY Entry – 1.34 Target – 1.58 Stop Loss – 1.19

- SPH publishes newspapers, magazines and books in both print and digital editions. The company also owns investments in property-related assets, such as its 65% stake in SPH REIT (Paragon, The Clementi Mall, The Rail Mall) and The Seletar Mall. Other investments overseas include Purpose-Built Student Accommodations (PBSA) in the UK and Germany.

- While the core media publishing business has been disrupted by the tech giants such as Facebook and Google, positive developments in other countries may indicate light at the end of the tunnel. Last month, Australia passed a bill mandating Big Tech to pay media publishers for the news content they produce, which includes those that are posted on Facbeook and those that appear in Google searches. Other countries like the UK and Canada, and the entire European Union, have expressed their support for the new last passed in Australia.

- While its 0.1% stake in Coupang is estimated to be only around $50mn, we think Coupang may trade much higher than its initial IPO price and therefore give a higher valuation to SPH. SPH’s stakes in other firms such as iFAST (IFAST SP) is also expected to boost it portfolio of investments. iFAST shares have gained 469% over the past one year.

Market Movers – What’s Hot

United States

- Highly valued technology stocks are seeing large outflows, dragging the main indices lower, while value stocks are outperforming. Oil-related stocks in particular ripped higher thanks to OPEC+’s surprise decision to maintain production for April 2021. Among the largest gainers included Diamondback Energy (FANG US; +9%; US$81.26), EOG Resources (EOG US; +7%; US$71.43) and Marathon Oil Corp (MRO US; +6%; US$12.36).

- Palantir (PLTR US) +4.8% to US$24.73, bucking the broader market selldown, as Cathie Wood’s ARK Investment Management added more than 2.6mn shares earlier. ARK Innovation ETF (ARKK US) bought 2.0mn shares while ARK Next Generation Internet ETF (ARKW US) added 0.7mn shares. The ARK ETFs also added almost 90,000 of Zoom (ZM US) shares.

- Semiconductor stocks were among the largest losers with stocks of Applied Material (AMAT US), Micron (MU US) and Xilinx (XLNX US) dropping by 4% and 6%.

Hong Kong

- Smoore International Holdings Ltd (6969 HK) -14.31%, closing at HK$61.7. Apart from being dragged down by the overall market sell-off, the stock was also hammered due to the concern of more regulation proposed in the upcoming two sessions.

- The Hong Kong market continued to weaken due to US market sell-off and decline in southbound fund flows. The top sectors that plunged included:

- Basic metals: Zijin Mining Group Co Ltd (2899 HK) -12.99%, closing at HK$10.72. Ganfeng Lithium Co Ltd (1772 HK) -9.01%, closing at HK$101. Jiangxi Copper Company Limited (358 HK) -8.76%, closing at HK$17.28.

- Clean energy: Xinte Energy Co Ltd (1799 HK) -17.42%, closing at HK$17.92. Xinyi Solar Holdings Ltd (968 HK) -14.68%, closing at HK$13.14. China Datang Corp Renewable Power Co Ltd (1798 HK) -14.29%, closing at HK$1.50.

- Software and cloud sector: Kingsoft Corporation Limited (3888 HK) -12.28%, closing at HK$50.7. Weimob Inc (2013 HK) -12.79%, closing at HK$20.45. Ming Yuan Cloud Group Holdings Ltd (909 HK) -10%, closing at HK$40.05.

Singapore

- Sarine Tech (SARINE SP) +5.1, closing at S$0.52. The company announced that it was seeking to dual list on Israel’s Tel Aviv Stock Exchange (TASE) in the second quarter of 2021. Management believes the dual listing will increase the company’s exposure to a broader investing public and facilitate liquidity. Its shares have gained 121% over the past six months.

- DBS (DBS SP) +2.0%, closing at S$28.04 and outperforming UOB and OCBC. DBS has gained 35% over the last six months compared to UOB’s 29% return and OCBC’s 32% return.

- Tech stocks were once again sold off following the lead from wall street. Stocks of UMS (-3.6% to S$1.06), Nanofilm (-2.9% to S$4.76) and AEM (-2.0% to S$3.86) declined yesterday as investors rotated into the banks.

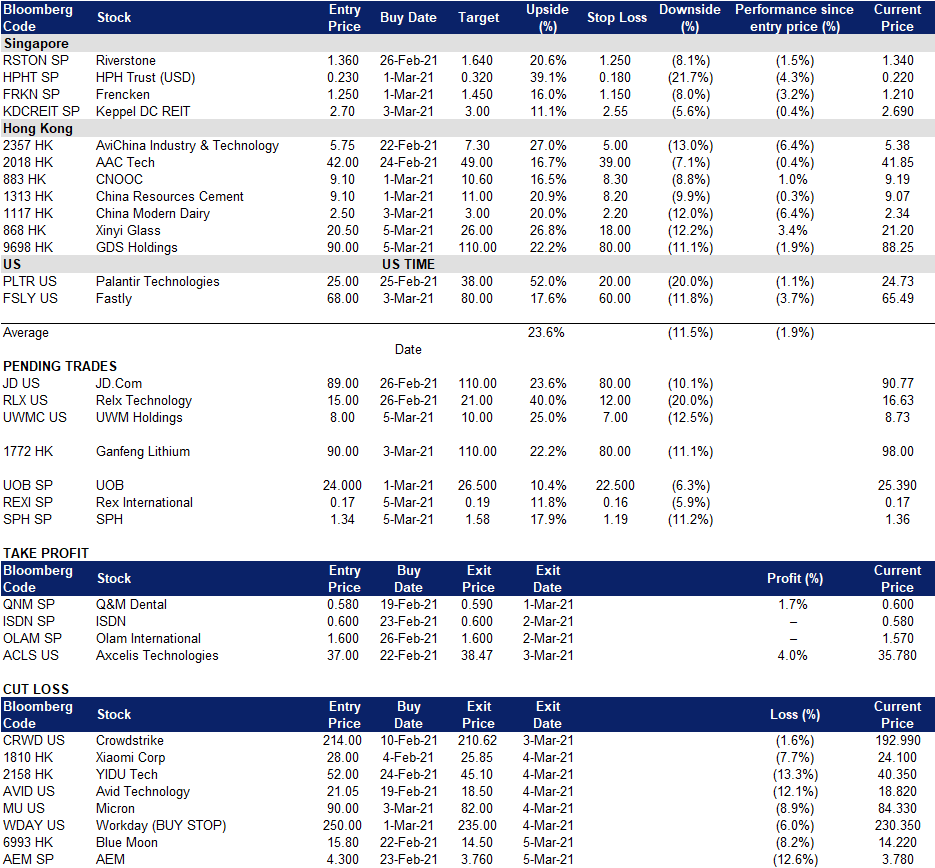

Trading Dashboard