KGI DAILY TRADING IDEAS – 4 October 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

IPO Watch

Abbisko Cayman Limited (2256 HK)

IPO Info:

| Industry Sector | Pharmaceutical |

| Issue Price (HK$) | 12.16 to 12.46 |

| Total Share Offer Size (HK$ Mn) | 1,753.6 |

| Sponsor | Morgan Stanley, J.P. Morgan, and CICC |

| Dealing of Shares | 13 October 2021 |

About Abbisko

- Abbisko Cayman Limited is a clinical-stage biopharmaceutical company dedicated to the discovery and development of innovative and differentiated small molecule oncology therapies. Since its inception in 2016, it has strategically designed and developed a pipeline of 14 candidates focused on oncology, including five candidates at clinical stage. Their product candidates are primarily small molecules that focus on small molecule precision oncology and small molecule immuno-oncology therapeutic areas. The company has two Core Product Candidates, ABSK011 and ABSK091, and 12 other pipeline product candidates.

- ABSK011 developed in-house is a potent and highly selective small molecule inhibitor of fibroblast growth factor receptor 4 (FGFR4);

- ABSK091, licensed from AZ, and previously known as AZD4547, is a molecularly targeted product candidate and a highly potent and selective inhibitor of FGFR subtypes 1, 2 and 3.

The Core Product Candidates are primarily being developed for hepatocellular carcinoma (HCC), urothelial cancer (UC) and gastric cancer (GC) at the current stage.

- The company currently has no product approved for commercial sale and has not generated any revenue from product sales. It has incurred operating losses during the track record period. Loss before tax was RMB133.9mn/706.6mn/123.5mn in FY19/20/3M21. Substantially, all of the losses come from research and development expenses and administrative expenses.

- Key risk factors

- Fierce competition from existing products and product candidates under development in the entire oncology market, in particular in the FGFR inhibitor market, in addition to approved oncology therapy options.

- Business and financial prospects depend substantially on the success of their clinical stage and pre-clinical stage drug candidates. If the company is unable to successfully complete their clinical development, obtain relevant regulatory approvals or achieve their commercialization, or if it experiences significant delays in any of the foregoing, its business, results of operations and financial condition may be adversely affected.

- Its rights to develop and commercialize some of their drug candidates are subject to the terms and conditions of licenses granted to them by others.

- It relies on third parties to supply active pharmaceutical ingredients (APIs) and/or manufacture its drug products when approved, and its business could be harmed if those third parties fail to provide them with sufficient quantities of the APIs or the drug product or fail to do so at acceptable quality levels or prices.

- All material aspects of the research, development, manufacturing and commercialization of pharmaceutical products are heavily regulated and the approval process is usually lengthy, costly and inherently unpredictable. Any failure to comply with existing or future regulations and industry standards or any adverse actions by the drug-approval authorities against them could negatively impact their reputation and business, financial condition, results of operations and prospects.

- 11 cornerstone investors have subscribed HK$990mn worth of shares which account for 56.6% to 58% of the offering. Well-known strategic investors include Qiming Venture, GIC, Temasek, Blackrock and Carlyle.

SINGAPORE

Geo Energy (GERL SP): Winter is coming

- BUY Entry – 0.27 Target – 0.42 Stop Loss – 0.24

- Geo Energy is one of Indonesia’s leading coal producers. The company has four mining concessions located in South and East Kalimantan. Geo Energy’s two key mines have a total estimated coal reserve of 84 million tonnes, based on a Joint Reserves Committee (JORC) Compliant report issued in December 2020.

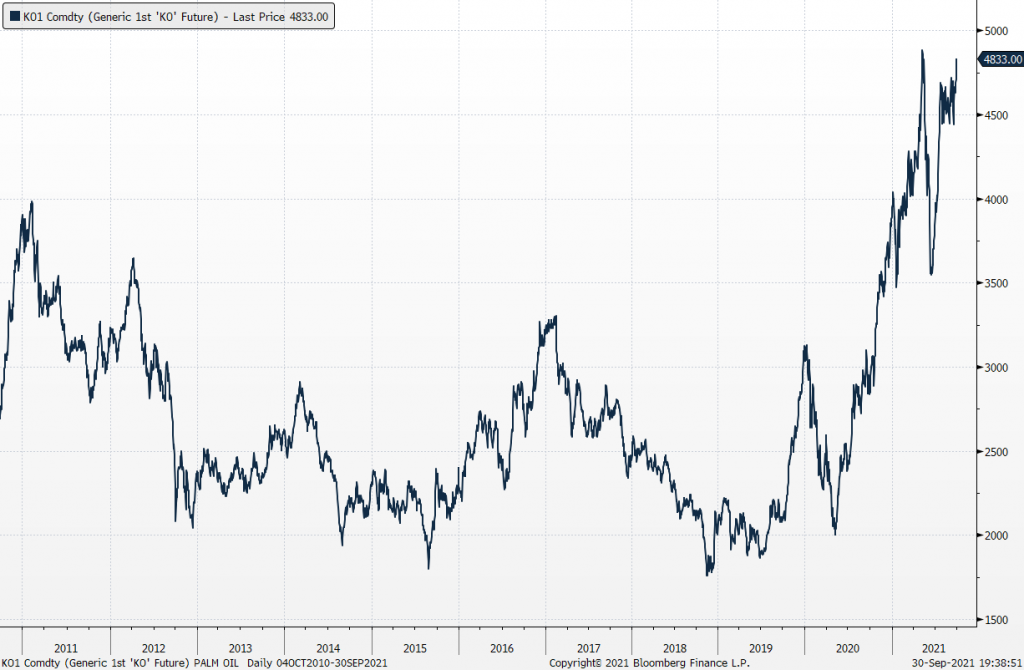

- Coal prices are going ballistic. Geo Energy is set to have a record year ahead as coal prices have essentially gone through the roof. ICI 4 prices (4,200 kcal) are at more than 10-year highs, gaining almost 80% YTD. Current dynamics are very favourable for coal miners given the shortages being experienced in India and China. On the supply side of the question, there’s less risk of an oversupply-related correction for coal markets as ESG pressure has pushed capital towards clean energy (e.g., solar, electric vehicles, wind farms), thus limiting rapid coal supply growth.

- Cash generating machine. We estimate Geo Energy will generate at least US$247mn (S$333mn) of free cash flows in 2021 and 2022, almost equivalent to its current market cap of S$385mn. Our estimates are based on US$58/US$50 coal prices and 10.5mn/11.0mn tonnes of coal production in 2021 and 2022, respectively. Our assumptions are very conservative given that current ICI4 future prices are trading well above US$100/tonne. Even when accounting for the domestic market obligation (25% of production volume) where prices can be as much as 60-70% discount to export prices, our assumption of US$60 and US$50 per tonne for 2021 and 2022 is very conservative.

- We currently have an Outperform and DCF-backed TP of S$0.42 on Geo Energy. Our fair value is based on DFC with a conservative set of assumptions: 1) 13.5% discount rate, 2) six-year mine life up to 2026, and 3) no terminal value. The strong cash flows over the next two years will provide the group options to diversify via acquisitions. The group currently trades at an average 3x P/E for 2021-2023F and offers an above-industry dividend yield of 8%, 5% and 4% for 2021-2023F, based on a conservative 30% payout ratio.

- Read our full report here.

Indonesia ICI 4 Coal Price Index (4,200 kcal/kg)

Wilmar (WIL SP): Palm oil prices to the moon

- BUY Entry – 4.20 Target –4.85 Stop Loss – 4.03

- Among the big boys. Wilmar is ranked among the largest listed companies by market cap (S$27bn market cap as of 30 Sep) on SGX. The company’s business activities include oil palm cultivation, oilseed crushing, edible oils refining, sugar milling and refining, manufacturing of consumer products, specialty fats, oleochemicals, biodiesel and fertilisers as well as flour and rice milling.

- Negatives priced in. Shares of Wimar have declined almost 30% from the 5-year peak of S$5.57 reached in February 2021. This rally and subsequent decline was driven by the IPO of its China subsidiary, Yihai Kerry Arawana (YKA), on the ChiNext board of the Shenzhen Stock Exchange. There was further selling pressure over the past month after the planned IPO of Wilmar’s JV with Adani Group of India was placed on hold amid probes by the Indian regulators.

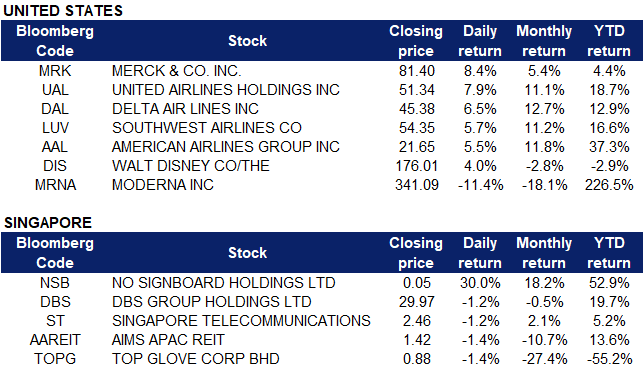

- Upside catalyst from robust palm oil prices. Palm oil prices ended the quarter near record highs amid concerns over tight vegetable oil supplies while demand has remained strong. Futures for December delivery rose 3% yesterday, and have gained 28% in 3Q2021 as other edible oil and oilseed prices gained, including soybean oil, canola and rapeseed. Adding salt to the wound, there’s growing concerns that the power crunch in China will impact production of soybean oil, thus driving demand for palm oil.

- Bullish consensus forecast. There are 13 BUYS / 1 HOLD / 0 SELL and an average 12m TP of S$6.00 (+43% upside potential). Wilmar currently trades at 12x and 11x FY2021 and FY2021 P/E, driven by 6-8% EPS growth in the next two years. Dividend yield is a decent 3-4%.

Crude Palm Oil Futures

HONG KONG

CNOOC Limited (883 HK): Oil price just broke a 52-week high

- Buy Entry – 7.9 Target – 9.3 Stop Loss – 7.5

- CNOOC Limited is a Hong Kong-based investment holding company principally engaged in the exploration, production and trading of oil and gas. Its businesses include conventional oil and gas businesses, shale oil and gas businesses, oil sands businesses and other unconventional oil and gas businesses. The company mainly operates businesses through three segments. The Exploration and Production segment is engaged in the exploration, development and production of crude oil, natural gas and other petroleum products. The Trading segment is engaged in the trading of crude oil, natural gas and other petroleum products. The company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, Indonesia and Brazil, among others.

- Stellar results. Previously, the company announced 1H21 results. Revenue jumped by 47.8% YoY to RMB 110.2bn. Net profit attributable to the shareholders of the company jumped by 221% YoY to RMB 33.3bn. The company declared an interim dividend of HK$0.3 per share.

- International oil price rebound. As of 1st October, WTI closed at US$75.72/bbl, representing a 2.38% weekly gain, and Brent closed at US$79.14/bbl, representing a 1.45% weekly gain. The oil prices edged up due to a strong demand amidst gradual re-opening of borders in US and Europe.

- The new wave of COVID-19 outbreak in China is under control. The recent oil price correction was partly due to concerns over the delta variant outbreak in China, which could result in weaker demand for petroleum. However, after China adopted draconian measures to control the outbreak, the new wave has been contained. The recovery in oil demand is expected to resume for the rest of 2021.

- Updated market consensus of the estimated net profit growth in FY21 and FY22 are 204.2% and 2.9% respectively, which translates to 4.7x and 4.5x forward PE. The current PE is 6.7x. The FY21F/22F dividend yield is expected to be 9.0% and 9.3% respectively. Bloomberg consensus average 12-month target price is HK$12.09.

Fuyao Glass Industry Group Co Ltd (3606 HK): Double whammies are the buy-the-dip opportunity

- RE-ITERATE Buy Entry – 40 Target – 37 Stop Loss – 50

- Fuyao Glass Industry Group Co Ltd is a China-based company, principally engaged in the manufacture and distribution of float glasses and automobile glasses. The company’s products portfolio consist of automobile glasses, such as coating glasses and others, which are applied in passenger cars, buses, limousines and others, and float glasses. The company distributes its products within domestic markets and to overseas markets.

- Key financial highlights:

| (RMB mn) | 1H21 | 1H20 | YoY change |

| Revenue | 11,543.2 | 8,121.3 | 42.1% |

| Gross profit | 4,586.7 | 2,807.6 | 63.4% |

| GPM (%) | 39.7 | 34.6 | 5.1 ppt |

| Net profit | 1,766.7 | 962.5 | 83.6% |

| NPM (%) | 15.3 | 11.9 | 3.4 ppt |

- Chip shortage. Impacted by shortage of automobile chips, the automobile production recovery has slowed down even as demand for passenger vehicles continue to rise. Global automakers are forced to shut several plants due to insufficient chip supply. Automobile glass is one of the parts in a vehicle, and hence, its sales are highly correlated to the auto production volume.

- Power shortage. Due to extraditionarily high coal prices, China is facing a power outage which directly affects industrial production. Glass production demands a huge amount of electricity usage.

- Headwinds are transitory. Currently, shares are hammered due to the abovementioned unfavourable macro factors. However, unsustainable high coal prices are more impactful in the near term. Gradually, we believe that the negatives will be mitigated as China has resumed operations in some coal mines. Meanwhile, infections in Southeast Asia countries are decreasing, especially in Malaysia where most auto chip packaging is done. Hence, we could see some improvements in auto ship supply in 4Q21.

- Consensus estimates per the 12-month target price is at HK$60.85, implying a 47.3% upside potential. EPS is forecasted to grow at 52.8%/25.3%/16.5% for FY2021/22/23F, which would bring forward P/Es down to 21.6x/17.2x/14.8x FY2021/22/23F.

Market Movers

United States

- Moderna Inc (MRNA US) shares plunged 11.37% on Friday after rival Merck (MRK US) released positive data for the clinical trial of a new oral antiviral treatment for the COVID-19 virus. Merck shares traded 9% higher in premarket, and closed 8.37% higher. Merck announced that its oral antiviral medication molnupiravir cut the risk of hospitalization for COVID-19 by half. Additionally, none of the patients who received molnupiravir in the study passed away, whereas eight patient deaths were recorded in the placebo wing of the trial. Moderna is currently banking on its COVID-19 vaccine being a big seller for the next few years at least.

- Following the positive news of the clinical trial of Merck’s oral drug, airline stocks United Airlines (UAL SP), Delta Air Lines (DAL SP), American Airlines (AAL SP) rose 7.93%, 6.5% and 5.51% respectively. Shares of Southwest Airlines (LUV US) closed 5.68% higher as well, following an upgrade by JP Morgan analyst Jamie Baker from neutral to overweight, and increased his target price to $70. Baker wrote in his report that airline stocks have “room to run”, citing the recent easing of U.S. border restrictions.

- Walt Disney (DIS US) stock jumped 4.04% after it was announced that the company had settled a lawsuit with actress Scarlett Johansson. The actress previously sued Disney, alleging that her contract to star in the Marvel movie Black Widow was breached when Disney decided to release the film on its Disney+ streaming service at the time it was released in theatres. Johansson claimed that the studio sacrificed box-office collections to boost its streaming service. Disney then countered that Johansson was paid $20 million for the film.

Singapore

- No Signboard Holdings (NSB SP) saw its shares surging as much as 42%, bef closing 30% higher at a three-month high following news of its proposed share placement. The company announced on Thursday night that it was proposing the share placement to boost its cash reserves which have been eroded by the impact of the pandemic. The investor, Henry Chandra Tjiang, an Indonesian private investor with business interests in food manufacturing, is looking to subscribe to about 14.4% of No Signboard’s shares post-completion at 4.5 Singapore cents apiece, totalling S$3.5 million. The company also said that the investor has no connection with No Signboard, its directors or shareholders.

- DBS Group Holdings (DBS SP). The company announced on Friday that it has received formal approval from the Monetary Authority of Singapore (MAS) to provide digital payment token services as a major payment institution, which will enable DBSV to directly support asset managers and companies to trade in digital payment tokens through DBS Digital Exchange (DDEx). The stock rose 0.7% higher after the announcement on Friday morning, before closing 1.15% lower.

- Singtel (ST SP) shares closed 1.22% lower on Friday, after the company announced that its wholly-owned subsidiary Singtel Optus Pty Limited (Optus) has entered into a conditional agreement with AS Infra Tower to sell 70% of its shares in Australia Tower Network. The aggregate cash proceeds of A$1.9 billion consists of A$900 million to be paid by AS Infra, A$500 million as a return of capital by ATN to Singtel, and A$500 million as repayment of outstanding loans by ATN to Optus. The sale is expected to be completed by the end of October 2021.

- AIMS APAC Reit (AAREIT SP) announced on Thursday after market close that the company would be acquiring the headquarters of Woolworths in Sydney, Australia for a consideration of S$454 million. Upon successful acquisition, the company’s assets under management will increase 26.6% to S$2.18 billion, with the Australian properties accounting for 38.4% of its portfolio by valuation. The stock rose as much as 1.4% in early trading on Friday before closing 1.39% lower at $1.42.

- Top Glove Corporation (TOPG SP) saw its stock decline 3.3% on Friday after RHB Group analysts maintained a NEUTRAL rating on the rubber products sector, taking into consideration the expectations of ASP moderation. The selling prices of rubber gloves have fallen significantly recently; current ASPs of nitrile and latex gloves now range between US$40 – US$45 and US$30 to US$35 respectively per 1,000 pieces. RHB analyst Sean Chew maintains “neutral” on the rubber products sector, with a “neutral” recommendation on six out of the eight regional stocks covered as the expectation of average selling price (ASP) moderation has been largely priced in.

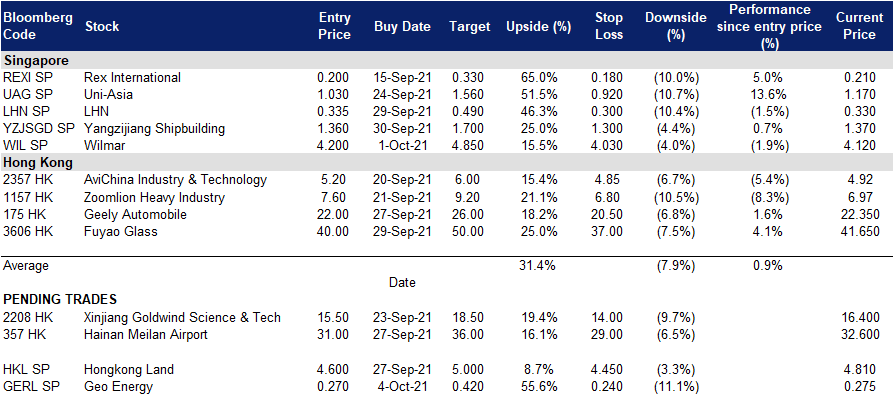

- Trading Dashboard: Add Wilmar (WIL SP) at S$4.20. Remove China Sunsine (CSSC SP) at S$0.50

Hong Kong

The Hong Kong market was closed last Friday in observance of the National Day holiday. Trading resumes today, Monday, 4 October 2021.

Trading Dashboard

Related Posts: