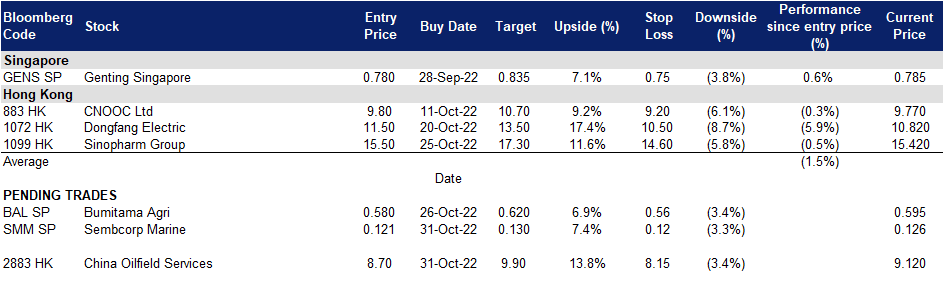

31 October 2022: Bumitama Agri Ltd (BAL SP), China Oilfield Services Limited (2883 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Bumitama Agri Ltd (BAL SP): Seasonally strong palm oil prices

- RE-ITEREATE BUY Entry – 0.580 Target – 0.620 Stop Loss – 0.560

- Bumitama Agri Ltd produces Crude Palm Oil (CPO) and Palm Kernel (PK), with its oil palm plantations and mills located in Indonesia. The Company’s primary business activities are cultivating and harvesting oil palm trees, processing fresh palm fruit bunches from its oil palm plantations, plasma plantations and third parties into CPO and PK, and selling CPO and PK in Indonesia.

- Rising palm oil prices. Palm oil prices are likely to strengthen further as excessive rain in key producing countries curbs output, while demand increases for its use in food and biofuels. The increase in exports and decrease in production would help reduce the buildup of inventory for palm oil producers in Indonesia and Malaysia. Since the prices of palm oil as compared to other edible oils is lower, the demand of palm oil has been gradually increasing, which would also contribute to the rise in palm oil prices.

Palm oil futures price one-year performance

(Source: Bloomberg)

- Lower production quantities. Indonesia and Malaysia account for more than 80% of the global production of palm oil. From November, palm oil output is normally seen to taper off in the two countries. Furthermore, with the heavy rainfall across Southeast Asia, the floods and heavy rain make it difficult for workers to harvest the palm oil crop and move the fruit to factories for processing.

- 1H22 results review. On 12 August, Bumitama Agri Ltd reported IDR8,968.35 billion in revenue during 1H22, which translates to a 65% YoY. Sales contribution from CPO spiked during the period, attributable to 75% YoY growth in selling price, which averaged IDR 14,327/kg. Following the operational outperformance amidst good commodity pricing environment, Bumitama Agri has accumulated a considerable amount of cash liquidity in recent quarters. Both current and net gearing ratios have improved, from 1.49x and 0.50x in 1H21 to 3.02x and 0.20x in 1H22, respectively.

- Updated market consensus of the EPS growth in FY22/23 is 101.31%/-38.12% YoY respectively, which translates to 3.29x/5.31x forward PE. Current PER is 3.31x. Bloomberg consensus average 12-month target price is S$0.83.

(Source: Bloomberg)

Sembcorp Marine Ltd (SMM SP): Acquisition of KOM

- BUY Entry – 0.121 Target – 0.130 Stop Loss – 0.117

- Sembcorp Marine Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialised shipbuilding. With a combined docking capacity of 2.3 million dwt, it offers one of the largest ship repair, ship conversion, and offshore and marine-related facilities in East Asia. Its global hub now spans eight shipyards strategically located around the world.

- Revision of previous merger deal. On October 27, Sembcorp Marine Ltd scrapped a deal to merge with Keppel Corp’s offshore and marine unit and form a new company, in favour of directly acquiring 100% of Keppel O&M from Keppel for S$4.50 billion ($3.19 billion). This will lower the value of Keppel’s unit by S$378 million from the S$4.87 billion valuation it received in April. Hence, giving Sembcorp Marine’s shareholders a larger stake, of 46 percent, compared with 44 percent in the previous deal, in the combined firm and shortens the time required to complete the deal, which is expected to close by the end of the year. Additionally, Keppel will distribute 49 percent of Sembmarine shares in-specie to its shareholders and retain a 5 percent stake, half the size of the stake it would have had under the older terms.

- Enlarged entity. With a larger entity after the acquisition of Keppel O&M, Sembcorp Marine will be in a better position to deal with deteriorating macroeconomic conditions such as high inflation, rising interest rates, volatile oil prices, and concerns about energy security amid geopolitical tensions. Post-acquisition the enlarged Sembmarine would have a total net order book of more than S$18bn.

- Secured new projects. Prior to the announcement of the acquisition, Sembcorp Marine announced on 20 October that it secured two floating liquefied natural gas (LNG) facilities conversion projects from global infrastructure company New Fortress Energy. The hull conversion and fabrication of topsides for the first floating LNG liquefaction facility is scheduled for delivery in the first half of 2024. Work on the second floating LNG liquefaction facility project is expected to be contracted to Sembcorp Marine at a later date.

- Updated market consensus of the EPS growth in FY22/23 is 90.8%/96.7% YoY respectively, which translates to 28.2x/18.0x forward PE. Current PER is 53.1x. Bloomberg consensus average 12-month target price is S$0.12.

China Oilfield Services Limited (2883 HK): Upbeat outlook and sound fundamentals immune to the market sell-off

- Buy Entry – 8.70 Target – 9.90 Stop Loss – 8.15

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- Longlasting high oil prices to uphold ongoing Capex. The oil and gas sector will be the best performer among the rest in 2022 thanks to upbeat oil prices. The underinvestment in the oil and gas sector since 2015 started to turn this year as the supply gap widened due mainly to the Russia-Ukraine military conflict. The expectation of long-lasting high oil prices attracts increasing fund flows to the upstream sector. According to Bloomberg, the capex in exploration and production from global integrated oil companies is expected to grow by 9.2%/8.6% in 2022/2023.

- A large-size contract was secured. The company announced that it has made a major breakthrough in overseas markets, signing several long-term drilling rig service contracts with a first-class international oil company in the Middle East, with a total contract amount of approximately RMB14bn.

- 9M22 earnings review. 3Q22 revenue grew by 26.4% YoY to RMB9.0bn, and 9M22 revenue grew by 21.9% YoY to RMB24.2bn. 3Q22 net profit attributable to shareholders of the company jumped by 47.6% YoY to RMB960.7mn, and 9M22 net profit attributable to shareholders of the company jumped by 48.2% YoY to RMB2.0bn. The improvement was driven by the recovery in the upstream E&P activities.

- The updated market consensus of the EPS growth in FY22/23 is 827%/27% YoY, respectively, translating to 14.8×/10.8x forward PE. The current PER is 43.5x. Bloomberg consensus average 12-month target price is HK$10.87.

(Source: Bloomberg)

Dongfang Electric Corp Ltd. (1072 HK): 4Q22 more power-related projects to commence construction

Dongfang Electric Corp Ltd. (1072 HK): 4Q22 more power-related projects to commence construction

- RE-ITERATE Buy Entry – 11.5 Target –13.5 Stop Loss – 10.5

- Dongfang Electric Corp Ltd is a China-based company mainly engaged in the manufacturing and sales of power generation equipment. The Company operates five major reporting segments: Clean and High-Efficiency Energy Equipment segment, Renewable Energy Equipment segment, Engineering and Trade segment, Modern Manufacturing Service Industry segment, and Emerging Growth Industry segment. The Company’s main products include water turbine generator sets, steam turbine generators, wind turbine generator sets, power station steam turbines and power station boilers as well as gas turbines. he Company distributes its products within the domestic market and to overseas market.

- Ongoing investment in power grid and power source infrastructure. As of August, the cumulative investment of power grid and power source infrastructure in 8M22 grew by 10.7% and 18.7% YoY to RMB266.7bn and RMB320.9bn respectively. In August, China’s Power Grid announced that it planned to invest more than RMB150bn (US$22 billion) in the 2H22 in ultra-high voltage power transmission lines. Owing to the slowdown in economic growth in China, the central government has been pushing for infrastructure expansion. We expect more power projects to kickstart in 4Q22 as the authority tries to maintain full-year economic growth.

- 1H22 results review. Operating income grew by 23% YoY to RMB27.3bn, driven by the growth of thermal power, engineering contracting, international trade, wind power and other segments. Net profit attributable to shareholders of the company jumped by 31.6% YoY to RMB1.8bn. The new effective orders grew to RMB36.7bn. The company will announce its 3Q22 results on 28th October.

- The updated market consensus of the EPS growth in FY22/23 is 15.9%/22.7% YoY respectively, which translates to 13.0x/10.6x forward PE. The current PER is 12.7x. Bloomberg consensus average 12-month target price is HK$14.17.

(Source: Bloomberg)

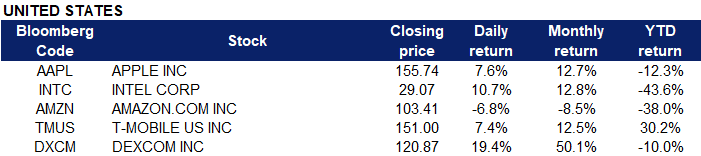

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Telecommunications Equipment | +6.97% | Apple stock closes out its best day since 2020 Apple Inc (AAPL US) |

| Biotechnology | +4.47% | Gilead Breaks Out In Bullish Volume As Its Cancer Drug Sales Nearly Double Gilead Sciences Inc (GILD US) |

| Insurance Brokers/Services | +4.26% | Arthur J. Gallagher (AJG) Q3 Earnings Top, Revenues Miss Arthur J. Gallagher & Co. (AJG US) |

Top Sector Losers

| Sector | Loss | Related News |

| Internet Retail | -4.84% | Amazon shares slump, Big Tech peers stay afloat Amazon.com Inc (AMZN US) |

| Steel | -3.44% | Vale Profit Misses Estimates as Iron-Ore Prices Slump Vale SA (VALE US) |

| Other Metals/Minerals | -2.28% | Iron Ore Collapses to Lowest Since 2020 as Demand Suffers Rio Tinto PLC (RIO US) |

- Apple Inc (AAPL US) jumped 7.6% after the technology giant beat both top and bottom line estimates when it reported earnings results for its latest quarter.

- Intel Corp (INTC US) popped 10.7% after surpassing analysts’ estimates for the recent quarter and outlining a plan to reduce costs by $10 billion over the next three years.

- Amazon.com Inc (AMZN US) slipped 6.8% Friday after the retailer on Thursday reported quarterly revenue that fell short of Wall Street’s expectations. The company also projected weaker holiday sales than analysts expected.

- T-Mobile US Inc (TMUS US) jumped 7.4% after the telecom company reported the largest jump in subscriber numbers since 2020, when it merged with Sprint.

- Dexcom Inc (DXCM US) jumped 19.4% after it reported quarterly results that beat analyst expectations.

Singapore

- Keppel Corp Ltd (KEP SP) and Sembcorp Marine Ltd (SMM SP) climbed 4.7% and 3.3% respectively on Friday. It was announced on October 27 (Thursday), Sembcorp Marine scrapped a deal to merge with Keppel Corp’s offshore and marine unit and form a new company, in favour of directly buying the unit for S$4.50 billion ($3.19 billion).

- DBS Group Holdings Ltd (DBS SP), United Overseas Bank Ltd (UOB SP) and Oversea-Chinese Banking Corp Ltd (OCBC SP) rose 3.0%, 4.0% and 1.8% respectively on Friday. Singapore’s banking trio is expected to reap substantial gains in the third quarter of 2022, as interest rate hikes finally make themselves felt considerably in the local financing environment. While funding costs are set to rise, as deposits in current and savings accounts are moved into products that command higher rates, higher loan yields should still dominate returns for the local banks, analysts said.

Hong Kong

Top Sector Losers

Sector | Loss | Related News |

Gamble | -6.03% | Macau Casinos Rally on Report City Issues Rules for Group Tours Galaxy Entertainment Group Ltd (27 HK) |

Telecomm. & Networking Equipment | -4.88% | Xiaomi discontinues financial services business in India -TechCrunch Xiaomi Corp (1810 HK) |

Automobiles & Components | -4.51% | China Stocks in Worst Ever Post-Congress Rout as Gloom Persists BYD Co Ltd (1211 HK) |

- Xpeng Inc (9868 HK) and Li Auto Inc (2015 HK) Shares slumped by 14.9% and 10.9% respectively. The Hang Seng China Enterprises Index slumped 4.1% in Hong Kong on Friday, the lowest since the 2008 global financial crisis. That took its losses for the week to over 8.9%, the most for any five-day period following a party meeting since the gauge’s inception in 1994. The expiry of monthly futures and options contracts for the Hang Seng China gauge as well as a raft of earnings announcements boosted market volatility on Friday. The Hang Seng Tech Index lost 5.6% on Friday. On the mainland, China’s benchmark CSI 300 Index sank 2.5% on Friday, taking its losses for the week to over 5%, the worst in 15 months.

- Smoore International Holdings Ltd (6969 HK) Shares dropped 11.9% on Friday. Recently, China implemented a domestic e-cigarette consumption tax, plaguing the industry. The sector has performed very strongly in the past two days, and the leader Smoore has accumulated a cumulative increase of 47%. Anxin said that the bank has always been optimistic about the development prospects of the e-cigarette industry. The ban on fruit flavors will not change the addictive nature of nicotine. The harm reduction effect of e-cigarettes has been confirmed by the US FDA, the bank believes that there will be more good than bad news released in the future. The bank also pointed out that the consumption tax will cause a significant decline in corporate profit margins and expects the performance of leading companies in the industry such as Smoore and RELX to bottom out next year.

- Xinjiang Goldwind Science & Technology Co Ltd (2208 HK) Shares fell 11.4% on Friday. According to the research report of Sinolink Securities, subject to the decline in the price of delivered units, the company’s Q3 gross profit margin decreased month-on-month, mainly due to the drop in the price of delivered units. In addition, as of the end of the third quarter of 2022, the company’s orders on hand reached 26.07GW, a record high, of which MSPM product orders reached 17.52GW, accounting for 69%. This year’s domestic wind power installed capacity is slightly lower than expected, the bank adjusted the company’s 2022-2024 net profit forecast to 35.75 (-10%), 42.22 (-5%), 4.747 (-5%) billion yuan, maintaining “increase” rating.

- Greentown China Holdings Ltd (3900 HK) Shares tumbled 10.7% on Friday. The International Monetary Fund does not see a speedy resolution to China’s real estate problems, an official said on Friday. The Hang Seng China Enterprises Index slumped 4.1% in Hong Kong on Friday. Traders are struggling to determine how long the rout will persist after a lack of supportive policies for the beaten-down property sector and the recommitment to the Covid Zero strategy at the congress left markets dismayed.

Trading Dashboard Update: Cut loss on China Resources Power (836 HK) at HK$12.1.