31 August 2022: RH Petrogas Limited (RHP SP), China Oilfield Services Limited (2883 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

RH Petrogas Limited (RHP SP): Second leg-up of oil prices in 3Q22

- BUY Entry 0.215 – Target – 0.250 Stop Loss – 0.200

- RH Petrogas Limited is an independent upstream oil and gas company headquartered in Singapore and listed on the mainboard of the Singapore Stock Exchange. It operates across the full range of upstream activities covering the exploration, development and production of oil and gas resources. Geographically, RHP is focused on the Asia region with existing assets in Indonesia and Malaysia.

- Prospect of OPEC+ output cut. Saudi Arabia, the top producer in the OPEC last week raised the possibility of production cuts, which sources said could coincide with a boost in supply from Iran should it clinch a nuclear deal with the West. OPEC+ will meet to set policy on 5th September. Brent closed at US$105.05/bbl, and WTI closed at US$96.93/bbl on Monday.

- 1H22 earnings review. 1H22 revenue jumped by 43.5% YoY to US$56.7mn. Gross profit jumped by 48.3% YoY to US$28.2mn. Net profit attributable to the owners of the company jumped by 78.3% to US$12.4mn.

- Cheap valuation. Currently, shares are trading at 5.0x PE based on its FY21 EPS. The average 5-year historical PER is 5.7x.

Yangzijiang Shipbuilding (YZJSGD SP): Solid fundamentals to buffer impacts from a volatile market

Yangzijiang Shipbuilding (YZJSGD SP): Solid fundamentals to buffer impacts from a volatile market

- RE-ITERATE BUY Entry 0.95 – Target – 1.05 Stop Loss – 0.90

- Yangzijiang (YZJ) produces a range of commercial vessels, including mini bulk carriers, bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels and lifting vessels. It operates two shipyards, with the older yard located in Jiangyin city. The yard spans about 800 m of deep-water coastline and covers an area of about 200,000 sqm (excluding the coastal area). YZJ’s newer yard is located in Jingjiang city. The yard has 1,940 m of deep-water coastline, production area of 1,508,857 sqm, a drydock that can accommodate two 100,000 dwt vessels and two half 100,000 dwt vessels at one time.

- FY22 (YE June) earnings review. 4Q22 revenue grew by 14.8% YoY to S$22.0mn, and FY22 revenue grew by 11.8% YoY to S$82.5mn. 4Q22 gross profit grew by 9.6% YoY to S$11.3mn, and FY22 gross profit grew by S$44.0mn. 4Q22 Net profit grew by 22.7% to S$5.9mn. FY22 new profit grew by 9.7% YoY to S$19.8mn. The company proposed a final dividend of 6 SG cents and a special dividend of 2 SG cents.

- Secures additional orders for green vessels. YZJ announced that it clinched orders for four 8,000 TEU LNG dual-fuel containerships by repeat customer PIL and will be progressively delivered in 2025. The vessels will be equipped with a membrane containment tank system that was co-developed in-house, and demonstrates its focus on moving up the value chain to more complex LNG vessels. The orders bring total new orders secured YTD to USD990m for 16 vessels. As at writing, YZJ has a total order book value of US$8.15bn for 137 vessels, which is expected to keep its yard facilities at a healthy utilisation rate till mid-2025.

- Undemanding valuations with a decent DPS. The Street is fairly bullish on YZJ’s prospects with 7 BUY, and only 1 HOLD ratings, and an average 12M TP of S$1.30. The street expects FY23F/24F EPS growths to be 11.9%/12.6%. YZJ is currently trading at an undemanding 6.5x and 5.8x FY23F/24F P/E and 5.2%/6.6% FY23F/24F dividend yield respectively.

(Source: Bloomberg)

China Oilfield Services Limited (2883 HK): Near-term tailwinds to boost oil prices

- RE-ITERATE Buy Entry – 8.0 Target – 9.0 Stop Loss – 7.5

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- Possible OPEC output cut. Oil prices closed slightly higher amid the overall market sold-off, driven by signals from Saudi Arabia that OPEC could cut output. Brent crude futures rose US$0.98 to settle at US$100.79/bbl. U.S. West Texas Intermediate (WTI) crude futures dropped 4 US cents to settle at US$92.95/bbl.

- Upcoming US$1tn China infrastructure expansion. To turn the downturn of the economy, China’s central government announced an allocation of RMB6.8tn (US$1tn) of government funds for construction projects. The key sectors to be benefited are renewable energy (solar and wind), water, urban infrastructure, and data centers. The fiscal spending will indirectly boost the demand for oil, pushing oil prices to edge higher. The long-lasting high oil prices help positive sentiment and activities of the upstream exploration and production.

- 1H22 earnings review. Revenue increased by 19.5% YoY to RMB15.1bn. Profit attributable to owners of the company grew by 37.6% YoY to RMB1.1bn. The growth was driven by the gradual recovery of the offshore oil and gas industry and the demand for drilling rigs. As of 30 June 2022, the company operated and managed a total of 57 drilling rigs, including 44 jackup drilling rigs and 13 semi-submersible drilling rigs. In 1H22, the operating days for the company’s drilling rigs amounted to 8,017 days, representing an increase of 1,439 days or 21.9% compared with the same period of last year. The calendar day utilisation rate of drilling rigs was 77.4%, representing an increase of 12.1 percentage points compared with the same period of last year.

- Updated market consensus of the EPS growth in FY22/23 is 827.0%/23.5% YoY respectively, which translates to 11.8x/9.6x forward PE. Current PER is 56.1x. Bloomberg consensus average 12-month target price is HK$10.4.

(Source: Bloomberg)

China State Construction International Holdings Limited (3311 HK): Infrastructure theme to turn around

China State Construction International Holdings Limited (3311 HK): Infrastructure theme to turn around

- RE-ITERATE Buy Entry – 9.0 Target – 10.0 Stop Loss – 8.5

- China State Construction International Holdings Limited is an investment holding company principally engaged in construction contracts business. The Company is also engaged in infrastructure project investments, facade contracting business and infrastructure operation. The Company operates its business through four segments: Hong Kong, Mainland China, Macau and Overseas. Through its subsidiaries, the Company is also engaged in building construction, civil and foundation engineering works.

- Upcoming US$1tn China infrastructure expansion. To turn the downturn of the economy, China’s central government announced an allocation of RMB6.8tn (US$1tn) of government funds for construction projects. The key sectors to be benefited are renewable energy (solar and wind), water, urban infrastructure, and data centers.

- 1H22 results review. Revenue jumped by 47.9% YoY to RMB53.8bn. Gross profit grew by 20.0% YoY to RMB 7.2bn. Profit attributable to owners of the company grew by 20.1% YoY to RMB4.2bn. The company declared an interim dividend of HK$0.24. As of 30 June 2022, the company registered a steady growth with newly signed contracts amounting to HK$90.48bn, representing a YoY increase of 28.3%.

- Updated market consensus of the EPS growth in FY22/23 is 22.8%/14.7% YoY respectively, which translates to 6.0x/5.2x forward PE. Current PER is 6.2x. FY22F/23F dividend yield is 5.1%/5.8%. Bloomberg consensus average 12-month target price is HK$12.06.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Regional Banks | +0.06% | Fed officials see U.S. interest rates rising further ICICI Bank Ltd (IBN US) |

Top Sector Losers

| Sector | Loss | Related News |

| Steel | -3.87% | Steel price drops on China’s covid, emission led production curbs BHP Group Ltd (BHP US) |

| Oil & Gas Production | -3.85% | Oil Falls 5% On Growing Inflation Fears ConocoPhillips (COP US) |

| Other Metals/Minerals | -3.80% | Copper prices slide after Fed’s growth warning triggers sell-off Freeport-McMoRan Inc (FCX US) |

- Big Lots Inc (BIG US) jumped 11.7% after the discount retailer posted a smaller-than-expected loss for the recent quarter. Revenue also beat expectations, and comparable store sales fell 9.2% year-over-year, but beat analysts’ expectations of a wider decline.

- Bed Bath & Beyond Inc (BBBY US) slipped 9.3% as investors await its plan for a turnaround, which is set to be released Wednesday. What happens next for the stock depends on the update, according to Morgan Stanley.

- Shares of electric vehicle makers Lucid Group Inc (LCID US) and Nikola Corp (NKLA US) slipped 6.3% and 9.4%, respectively, after both companies this week moved to raise additional cash. Lucid said in a Monday filing that it intends to issue $8 billion in new stock over the next three years. Nikola said in a filing Tuesday it plans to issue up to $400 million of new shares at market prices.

- Jack in the Box Inc (JACK US) dropped 9.7% after the California state legislature passed a bill that would form a statewide panel to regulate wages for workers in the industry. The panel would be allowed to raise the minimum wage up to $22 per hour in 2023. Shares of Chipotle also fell about 2% on the news.

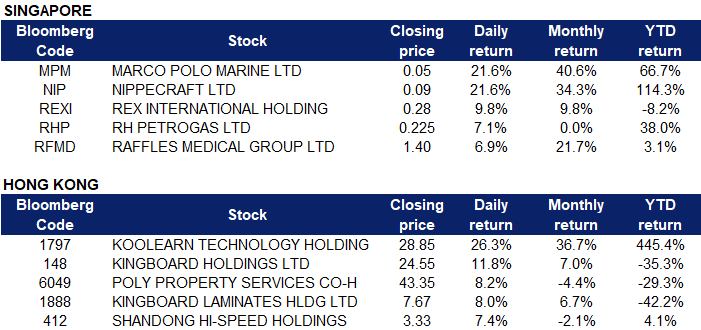

Singapore

- Marco Polo Marine Ltd (MPM SP) rose 21.6% yesterday. RHB on Tuesday (Aug 30) raised its target price on the marine logistics group to S$0.05, while maintaining its “buy” call as analyst Jarick Seet foresees charter rates will continue rising on strong demand. The research house noted that revenue for the company had more than doubled in the third quarter of FY2022, due to a “strong recovery in its utilisation rate of close to 90 per cent, driven by strong demand from the oil and gas and offshore wind farm sectors”.

- Nippecraft Ltd (NIP SP) rose 21.6% yesterday. There was no company specific news that led to this increase in share price.

- Rex International Holding Ltd (REXI SP) and RH PetroGas Ltd (RHP SP) rose 9.8% and 7.1% respectively yesterday. Oil prices were stable on Tuesday as the market balanced supply concerns with fears that an inflation-induced weakening of global economies would soften fuel demand. Saudi Arabia last week raised the possibility of production cuts from the Organization of the Petroleum Exporting Countries (OPEC) and allies such as Russia, known as OPEC+, which sources said could coincide with a boost in supply from Iran should it clinch a nuclear deal with the West. Russia is set to reduce oil and gas condensate production in August by 2 per cent from July, the Kommersant newspaper said on Tuesday, citing sources familiar with the data, as Gazprom cuts output.

- Raffles Medical Group Ltd (RFMD SP) gained 6.9% yesterday. China is gradually getting back to normal after disruptions earlier this year in connection with the Covid pandemic. Raffles Medical Group has been operating in China since 2010. It provides healthcare service in eight cities, including Hong Kong. That accounts for more than half of its current total of 14 across Asia. This year, Raffles China Healthcare will open an In-Vitro Fertilisation/Assisted Reproductive Therapy Centre in Hainan – dubbed the “Hawaii of China.” Overall, Raffles plans to increase the number of cities it serves to 20 in the next three to five years, said Dr. Vincent Chia, managing director of Raffles China Healthcare.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Construction Materials | +2.85% | China’s Main Power Firm Shifts to Longer Debt Amid Project Boom Anhui Conch Cement Company Limited (914 HK) |

Telecomm. & Networking Equipment | +1.80% | China shuts down world’s largest electronic market after COVID spike ZTE Corp (763 HK) |

Consumer Electronics | +1.71% | China’s Pinduoduo beats revenue estimates, eyes overseas growth TCL Electronics Holdings Ltd (1070 HK) |

Top Sector Losers

Sector | Loss | Related News |

Coal | -2.92% | China’s Record Drought Is Drying Rivers and Feeding Its Coal Habit Shougang Fushan Resources Group Ltd (639 HK) |

Environmental Energy Material | -1.86% | China’s clean energy investments growing rapidly in Africa Tianneng Power International Limited (819 HK) |

Biotechnology | -1.50% | China imposes COVID-19 lockdowns for millions Beigene Ltd (6160 HK) |

- Koolearn Technology Holding Ltd (1797 HK) rose 26.3% yesterday. It recently announced its fiscal year results. As of May 31, it achieved a total revenue of 899 million yuan, a year-on-year decrease of about 36.7%. The adjusted net loss was 364 million yuan, a year-on-year decrease of 72%. Among them, the live broadcast e-commerce revenue was 24.6 million yuan.

- Kingboard Holdings Limited (0148 HK) rose 11.8% yesterday, despite the group releasing weak interim results. Citigroup issued a research report saying that it maintained the “buy” rating of Kingboard and lowered its profit forecast for this year by 7%, reflecting that the operation of the laminate business is worse than expected, and the forecast for next year was raised by 8% to 9%, mainly due to the increase in the revenue assumption of the new chemical plant, and the target price was lowered from HK$35 to HK$33. The bank said that the company’s profit in the first half of the year was partly affected by the impairment loss of Guangzhou R&F Properties bonds of 1.575 billion yuan, but it seems that there will be no further impairment in the second half of the year, so it is expected that the company’s profit in the second half of the year may be higher than the first half.

- Poly Property Services Co Ltd (6049 HK) gained 8.2% yesterday, after the release of its interim results on the evening of August 29. In the first half of this year, the company’s profit attributable to the parent increased by 28.01% year-on-year, and the gross profit margin increased slightly from 20.02% to 20.23%.

- Kingboard Laminates Holdings Ltd (1888 HK) rose 8.0% yesterday. Citigroup released a research report saying that the rating of Kingboard Laminate was raised from “sell” to “neutral”, and the 2022 earnings estimate was lowered by 7%, but the 2023-24 earnings estimate was raised by 1% to 2%, with a target price of HK$7.5. Although the group’s medium-term dividend payout ratio is only 26%, the bank believes that the dividend payout ratio can be maintained above 45% in 2022, and believes that the downside is limited. In addition, it is believed that the company’s sales in June/July will be lower than 8 million yuan/month, but will start to improve in August.

- Shandong Hi-Speed Holdings Group Ltd (0412 HK) shares rose 7.4% yesterday after the release of its interim results showing that the group recorded a profit of approximately HK$1.217 billion, a year-on-year increase of approximately 125.16%; the profit for the period was approximately HK$300 million, compared with approximately HK$258 million in the same period last year, an increase of approximately 16.41% year-on-year.

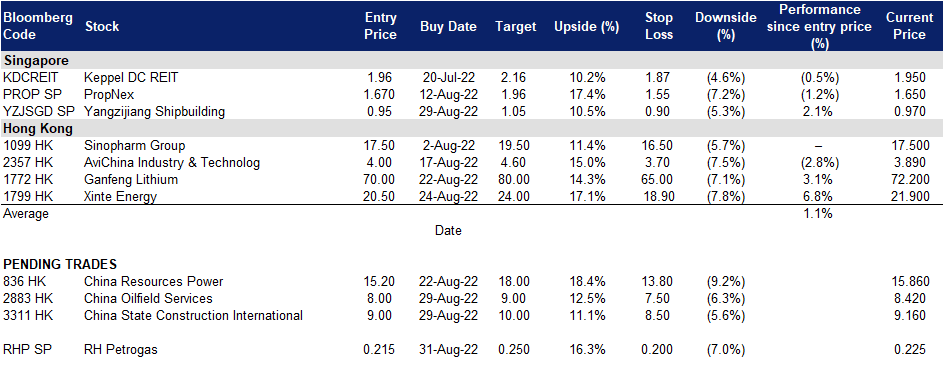

Trading Dashboard Update: Take profit on CNOOC (883 HK) at HK$11.0.