KGI DAILY TRADING IDEAS – 30 August 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Geo Energy (GERL SP): Cash generating machine

- BUY Entry – 0.22 Target – 0.42 Stop Loss – 0.20

- Geo Energy is one of Indonesia’s leading coal producers. The company has four mining concessions located in South and East Kalimantan. Geo Energy’s two key mines have a total estimated coal reserve of 84 million tonnes, based on a Joint Reserves Committee (JORC) Compliant report issued in December 2020.

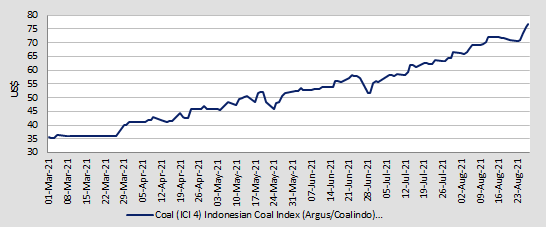

- Record year. Geo Energy is set to have a record year ahead as coal prices remain resilient. ICI 4 prices (4,200 kcal) are at more than 10-year highs. While we expect coal prices to soften in 2H2021, dynamics favour coal miners given the buoyant demand from India and China. On the other side of the equation, there’s less risk of an oversupply-related correction for coal markets as ESG pressure has pushed capital toward clean energy (e.g., solar, electric vehicles, wind farms), thus limiting rapid coal supply growth.

- Cash generating machine. We estimate Geo Energy will generate around US$247mn (S$333mn) of free cash flows in 2021 and 2022, more than its current market cap of S$330mn. Our estimates are based on US$58/US$50 coal prices and 10.5mn/11.0mn tonnes of coal production in 2021 and 2022, respectively. Our 10.5mn tonnes production assumption is 12.5% below the group’s application to increase production to 12.0mn tonnes in 2021. Meanwhile, Current ICI4 future prices are trading well above US$70/tonne. Even when accounting for the domestic market obligation, (25% of production volume) and where prices can be as much as 46% discount to export prices, our assumption of US$60 and US$50 per tonne for 2021 and 2022 is reasonable.

- Upgrade to Outperform and raise TP. We upgrade Geo Energy to Outperform and raise our TP to S$0.42. Our fair value is based on DFC with a conservative set of assumptions: 1) 13.5% discount rate, 2) six-year mine life up to 2026, and 3) no terminal value. The strong cash flows over the next two years will provide the group options to diversify via acquisitions. The group currently trades at an average 2.8x P/E for 2021-2023F and offers an above-industry dividend yield of 8.7%, 5.8% and 4.6% for 2021-2023F, based on a conservative 30% payout ratio.

- Read our full report here.

ICI 4 (4,200 GAR) Indonesian Coal Index (Argus/Coalindo)

Fortress Minerals Limited (FMIL SP): Rebounding in tandem with iron ore

- BUY Entry – 0.50 Target –0.59 Stop Loss – 0.46

- Iron ore play. Fortress Minerals engages in the exploration, mining, production, and sale of iron ore concentrates. The company is also involved in the wholesale trade of various goods; transportation of iron ore and minerals; rental of transport equipment and vehicles; extraction, dredging, and dealing of industrial sand; acquisition of mines, mining rights, metalliferous land, and quarries; and provision of supporting services for transport equipment and vehicles. It sells its iron ore concentrate primarily to steel mills in Malaysia. The company also exports its products to China and Vietnam.

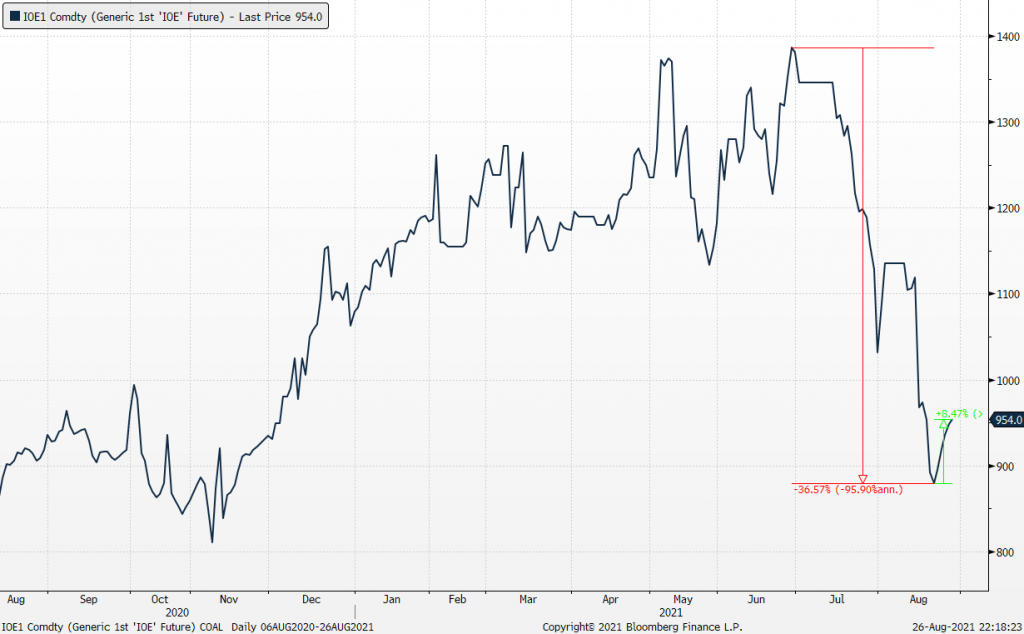

- Recovery in iron ore prices. The strong iron ore price rally this year was sharply interrupted last month when China urged steel mills to reduce output in hopes of cutting back on pollution. According to S&P, China’s manufacturing production index of steel consumption stood at 91 points in July, a five-month low but still 3 points higher than the same period in 2020. Despite China’s policy, iron ore prices rose on Wednesday amid signs of resilient demand. China’s announcement on Monday that it had reported no new local Covid-19 cases for the first time since July eased concerns about the sizable impact to commodity demand in the world’s largest consumer for raw materials.

- Huge upside potential. Iron ore prices have declined by 36.6% since its high of US$1,386.50 in June. Prices started to rebound from last Friday, with total gains of 7.9% as of yesterday. Potential downside to its 52-week low is 7.7%, which is relatively conservative. Consequently, as of yesterday’s closing price, FMIL’s share price has declined by 41.6% since its high in May, rebounding by approximately 19.7% from its consolidation range over the past week.

- Strong financials. Revenue increased by 84.9% YoY to US$65.5mn in 2021 whereas net income increased by a significant 182.2% YoY to US$25.1mn. 1Q22 financial performance remained strong, with an increase of revenue by 143.8% YoY to US$17.3mn. 1QFY2022 (YE Feb) revenue already represents approximately 36.3% of full year FY2021’s revenue. In addition, ASP for 1Q22 was US$143, an increase of 61.6% YoY.

Generic 1st Iron Ore (IOE1 Comdty)

HONG KONG

CNOOC Limited (883 HK): A dirt cheap stock at 6x PE and 10% dividend yield

- BUY Entry – 7.7 Target – 8.5 Stop Loss – 7.5

- CNOOC Limited is a Hong Kong-based investment holding company principally engaged in the exploration, production and trading of oil and gas. Its businesses include conventional oil and gas businesses, shale oil and gas businesses, oil sands businesses and other unconventional oil and gas businesses. The company mainly operates businesses through three segments. The Exploration and Production segment is engaged in the exploration, development and production of crude oil, natural gas and other petroleum products. The Trading segment is engaged in the trading of crude oil, natural gas and other petroleum products. The company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, Indonesia and Brazil, among others.

- Stellar results. Previously, the company announced 1H21 results. Revenue jumped by 47.8% YoY to RMB 110.2bn. Net profit attributable to the shareholders of the company jumped by 221% YoY to RMB 33.3bn. The company declared an interim dividend of HK$0.3 per share.

- International oil price rebound. As of 27th August, WTI closed at US$68.65/bbl, representing a 10.86% weekly gain, and Brent closed at US$72.56/bbl, representing a 11.7% weekly gain. The main driver of the recovery was due to the weakening US dollar (Dollar Index dropped by 0.83% last week) as Powell kept a dovish view at the Jackson Hole Symposium.

- The new wave of COVID-19 outbreak in China is under control. The recent oil price correction was partly due to concerns over the delta variant outbreak in China, which could result in weaker demand for petroleum. However, after China adopted draconian measures to control the outbreak, the new wave has been contained. The recovery in oil demand is expected to resume for the rest of 2021.

- Updated market consensus of the estimated net profit growth in FY21 and FY22 are 195.3% and 4.8% respectively, which translates to 4.3x and 4.1x forward PE. The current PE is 6.0x. The FY21F/22F dividend yield is expected to be 10.3% and 10.7% respectively. Bloomberg consensus average 12-month target price is HK$11.89.

Nexteer Automotive Group Limited (1316 HK): A value stock for a weak market

- BUY Entry – 8.4 Target – 9.4 Stop Loss – 7.9

- Nexteer Automotive Group Limited is an investment holding company principally engaged in the development, manufacturing, and provision of steering and driveline systems. Along with subsidiaries, the company operates its business through four segments: the North America segment, Asia Pacific segment, the Europe & South America segment, and the Others segment. The company’s products include electric power steering, hydraulic power steering (HPS), steering columns and intermediate shafts (CISs), driveline systems (DL), advanced driver assistance systems and automated driving (AD) products, among others.

- Impacted by shortage of automobile chips, the whole vehicle manufacturing industry has slowed down production even as demand for passenger vehicles is rising. The company’s product is one of the key components in a vehicle, and hence, its business is highly correlated to the sector’s prospects.

- Previously, the company announced the 1H21 results. Revenue grew by 43% YoY to US$1.7bn. Gross profit jumped by 85.5% YoY to US$226.5mn. Profit attributable to equity holders of the company jumped by 6300% YoY to US$83.1mn.

- The current price has factored in the less favourable earnings. Although the recovery of the business has slowed due to the headwinds of the auto chip shortage which has resulted in a slower than expected recovery in the overall auto sector, this is transitory rather than permanent. In the coming months, we expect more positive sector news to emerge, such as the resumption of auto production or production target hikes for 2022. It is likely that good news will have more impact on the stock price rather than negative news, given the substantial price correction of its share price.

- Updated market consensus of the estimated net profit growth in FY21 and FY22 are 57.0% and 43.6% respectively, which translates to 13.1x and 9.2x forward PE. The current PE is 13.9x. Bloomberg consensus average 12-month target price is HK$13.9.

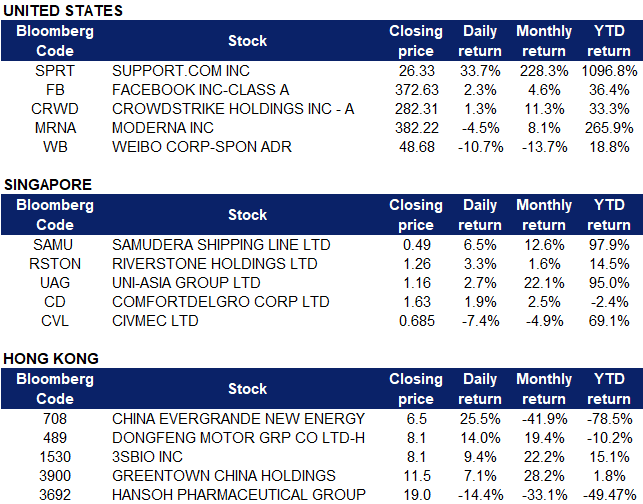

Market Movers

United States

- Support.com (SPRT US) became the latest company to become a “meme” stock when the company’s shares soared 33.65% after surging as much as 203% on Friday. The stock caught the attention of retail investors ahead of the company’s special meeting for stockholders on 10 September 2021. According to data analytics company S3 Partners, about 60% of Support.com’s float is held short. The surge in its share price has forced many short-sellers to close out or reduce their positions.

- Facebook (FB US) shares were up 2.26% on Friday, after a feature article in London’s The Telegraph described the social media company’s latest project, Horizons Workroom, an “online space for virtual reality meetings that has been developed by a group at the company’s London offices”. Facebook users who own the Oculus virtual reality (VR) glasses can use Horizons to meet together in cyberspace. Facebook CEO Mark Zuckerberg said that Horizons could well be the first step toward’s the company’s transformation from a mere social media company into a “metaverse company”.

- Crowdstrike (CRWD US) continued to rise another 1.27% on Friday after Nasdaq announced on Thursday that it would add the company to the Nasdaq-100 Index. It will also be added to the Nasdaq-100 Equal Weighted Index and the Nasdaq-100 Technology Index. The cloud security company will replace Maxim Integrated Products (MXIM US) on all three indexes. Crowdstrike is set to release second quarter financial results on 31 August 2021.

- Moderna (MRNA US) shares closed 4.52% lower on Friday despite news of the European Union allowing the company’s partner in Spain, Rovi, to continue the production of a COVID-19 vaccines. The stock likely dropped due to contamination in some doses of the vaccine shipped to Japan, linked to a potential manufacturing issue at Rovi’s facility. Investors could be worried that more problems might arise that could potentially disrupt the production of the SpikeVax vaccine.

- Weibo (WB US) plunged as much as 13% on Friday before closing 10.71% lower at $48.68. The chinese social media company removed a major fan site for Vicky Zhao, one of the country’s largest celebrities from numerous platforms including Tencent, Youku and iQiyi. This follows Beijing’s recent regulatory crackdowns on tech stocks.

Singapore

- Samudera Shipping (SAMU SP) Shares rose by 6.5% on Friday, after gains of 4.5% on Thursday and closed at its previous high since July 2007. The rise in share price was likely lifted by record high trans-pacific liner rates ahead of the seasonal peak season. The Drewry Hong Kong-Los Angeles container-rate benchmark rose 2.6% sequentially to a record of US$7,961 per 40-foot container in the week ended Aug 25. Current rates are 164% above their five-year average, driven by supply chain dislocations and port congestion in both China and the US.

- Riverstone Holdings (RSTON SP) Shares rose by 3.3% on Friday, even though there was no company specific news. Investors are likely buying ahead to enjoy the dividend payout of MYR0.1 per share (around 3.2 Sing cents) by the company. Ex-dividend date is on 20 September and payout date is on 6 October. As of Friday’s closing price, shares have gained 4.7% since Tuesday’s closing price of S$1.20.

- Uni-Asia Group (UAG SP) Shares rose by 2.7% on Friday and closed at a 2-year high. Investors are likely buying ahead to enjoy the dividend payout of 2 Sing Cents per share by the company. Ex-dividend date is expected to be on 20 September and payout date on 30 September. We have raised Uni-Asia’s TP to S$1.56, from S$1.42, which represents an upside of 34.5% from Friday’s closing price of S$1.16. UAG reported a 1H2021 profit of US$7.0mn, reversing from the US$3.9mn loss in 1H2020. The reversal was mainly on the back of the 49% YoY surge in charter income.Valuations are attractive amid the stronger-than-expected bulk carrier upcycle. Our TP implies a 0.7x FY2021F P/B, which is still a conservative 30% discount to international peers who are trading above 1.0x P/B. Read our 1H2021 update on the company here.

- Comfortdelgro Corporation (CD SP) Shares rose by 1.9% on Friday, after the company announced that it has clinched a S$1.13bn deal to operate rail services in Auckland. Comfortdelgro has formed a 50:50 joint venture with Auckland One Rail (AOR) and will start operating the Auckland metro from January 16 next year. The contract is for eight years, with the possibility of extensions. This marks the group’s first foray into the New Zealand land transport market, and its first move overseas as a rail operator. Read the full article published by The Straits Times here. ComfortDelGro offers a forecasted dividend yield of 3% and 5% for 2021 and 2022, while consensus has an overall positive outlook with 12 BUYS and an average TP of S$1.91 (+17% upside potential).

- Civmec Limited (CIV SP) Shares declined by 7.4% yesterday after the company announced its full year 2021 results. The company delivered strong earnings, as revenue increased by 72% YoY to A$674.2mn in FY21 and net profit after tax increased by 97% to A$36.6mn. Dividend payout for FY21 has also increased 100% to 2 Australian Cents. Despite outstanding results, investors could have a gloomier outlook on Civmec moving forward as management commented that due to the ongoing border restrictions due to Covid-19, the company would be taking a “measured approach” to tendering activities with a focus on securing projects that they are confident of having the resources for. Read for the company’s full results here and the article published by The Edge here.

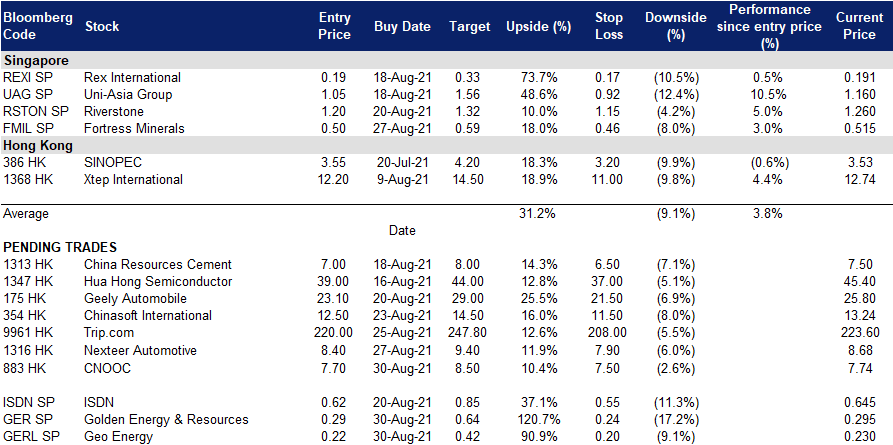

- Trading dashboard update: Add Fortress Minerals (FMIL SP) at S$0.50 and cut loss on Civmec (CVL SP) at S$0.70.

Hong Kong

- China Evergrande New Energy Vehicle Group Ltd (708 HK) The automobile sector jumped as related companies gradually reported 1H21 earnings. The company shares reached a 52-week low of HK$5 last Thursday. The rebound last Friday was due mainly to short-covering movement. The stock was one of the most heavily shorted stocks in HKEX. The company will be releasing 1H21 results on 30th August, and previously it announced a profit warning that the net loss expanded to RMB4.8bn, compared to a net loss of RMB2.45bn in 1H20.

- Dongfeng Motor Group Co Ltd (489 HK) The company announced 1H21 results. Revenue grew by 38.1% YoY to RMB69.9bn. Gross profit grew by 30.5% YoY to RMB10.2bn. Profit attributable to equity holders of the company jumped by 136.9% YoY to RMB8.6bn. The company declared a special dividend of RMB0.4 per share. Credit Suisse upgraded the TP to HK$13 from HK$12.8 and maintained an OVERWEIGHT rating.

- 3SBio Inc (1530 HK) Shares closed at a one-month high. Previously, the company announced 1H21 results. Revenue grew by 15.3% YoY to RMB3.1bn. Gross profit grew by 16.7% YoY to RMB2.6bn. Gross profit margin increased by 1ppt to 83.3%. Net profit attributable to owners of the parent grew by 28% YoY to RMB196.4mn.

- Greentown China Holdings Limited (3900 HK) Shares closed at a one-month high. Previously, the company announced 1H21 results. Total contracted sales achieved RMB 171.7bn, representing an increase of 88% YoY. 67 projects were newly-added, with a total GFA of approximately 11.86mn sqm and estimated saleable amount of RMB214bn, representing an increase of 22% YoY. Revenue grew by 51.2% YoY to RMB36.1bn. Profit attributable to owners of the company grew by 15.4% YoY to RMB2.4bn. Management expects the full year contracted sales to exceed the RMB310bn target.

- Hansoh Pharmaceutical Group Company Ltd (3692 HK) The company announced 1H21 results. Revenue grew by 10.6% YoY to RMB4.4bn. R&D expenditure jumped by 44.2% YoY to RMB687mn. Net profit grew by 5.6% YoY to RMB1.3bn. CitiGroup downgraded TP to HK$50 from HK$60 as its gross profit margin dropped 45bps to 90.6% due to a centralised drug procurement programme.

Trading Dashboard

Related Posts: