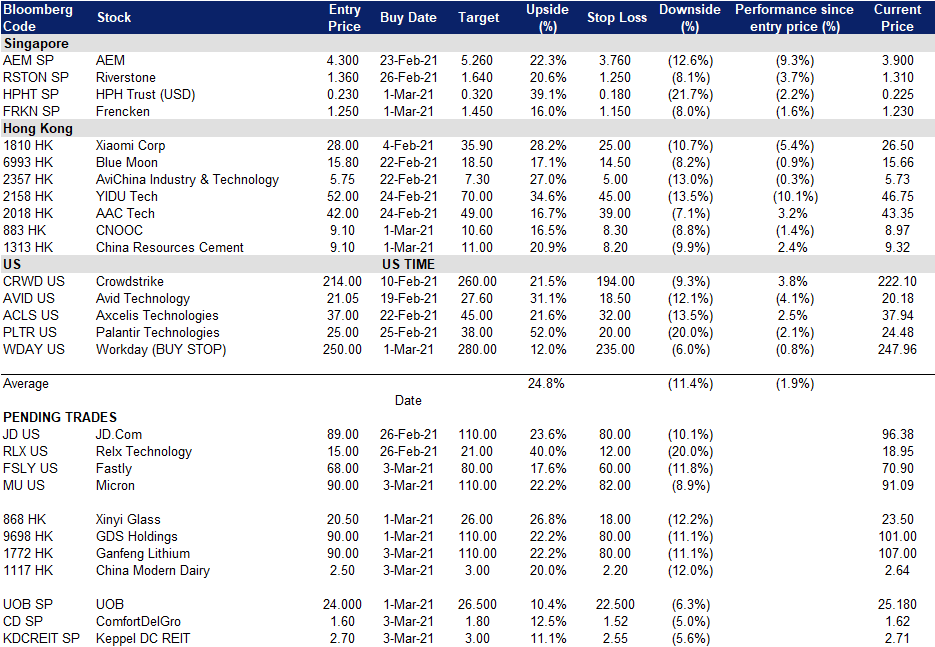

KGI DAILY TRADING IDEAS – 3 March 2021

US Trading Ideas

Micron (MU US): Warning, insufficient memory

- BUY Entry – 90 Target -110 Stop Loss – 82

- MU manufactures and markets Dynamic Random Access Memory chips (DRAMs), static random access memory chips (SRAMs), flash memory, semiconductor components and memory modules. It is one of the largest memory chip makers in the world, competing against the likes of Samsung and SK Hynix in DRAM and Kioxia and Western Digital in NAND.

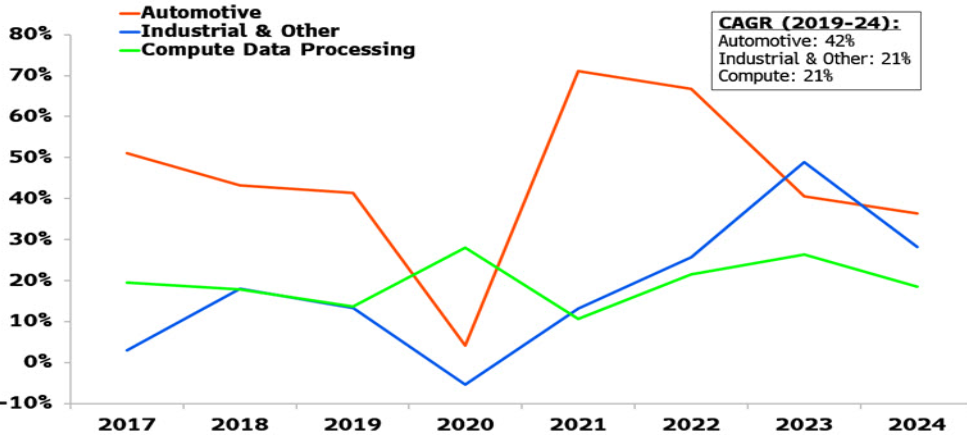

- MU is riding on strong demand for DRAM and NAND memory products driven by the auto-sector recovery, cloud growth, console gaming and strong 5G smartphone cycle. DRAM per device is also expanding amid AI and 5G use.

- Gartner has forecasted a 28% revenue growth for DRAM in 2021, after growing by 5% in 2020. Server and handset demand may push DRAM demand beyond supply in 1Q, driving prices higher. These two end-markets are among the heaviest consumers of DRAM, with almost 405GB per server and 5 GB in each phone.

- In the medium term (2-3 years), the auto sector will remain the fastest-growing segment for DRAM demand. In this area, MU’s strong auto portfolio may benefit the most as the auto sector recovers from the sharp slowdown in 2020.

- MU will report earnings at the end of this month.

Fastly, Inc. (FSLY US): Fastly down then fastly up

- BUY Entry – 68 Target – 80 Stop Loss – 60

- The company provides infrastructure software. The Company offers cloud computing, image optimization, security, edge computer technology, and streaming solutions. Fastly serves customers in the United States.

- The company is the leader in edge computing which is a key part of digital transformations for enterprises, especially improving the performance of web-based applications and allowing for videos to be transmitted at satisfactory speeds.

- The company recently announced a US$750mn convertible senior notes to 2026 in a private placement.

- 4Q losses were reported at US$0.09, compared to US$0.15 losses in 4Q19, while market expectation was US$0.10 losses. Revenue grew by 40.2% YoY to US$82.65. GPM increased by 2.5ppts to 59.2%. The company guided 32% YoY growth in revenue in FY21. The headwinds remain as revenue from Tik Tok which accounted for 13% of overall revenue for several quarters last year declined. But the company managed to find replacements for Tik Tok to fill the revenue gap.

- Revenue is expected to grow by 31.0% YoY and 27.7 YoY in FY21 and FY22. The Bloomberg average 12M TP is US$86.6.

HK Trading Ideas

Ganfeng Lithium (1772 HK): Correction is about done

- BUY Entry – 90 Target –110 Stop Loss – 80

- Ganfeng Lithium Co., Ltd is a China-based company principally engaged in the research, development, production and sales of deeply processed lithium products. The Company’s main products include lithium compounds, lithium metal and lithium batteries. The Company’s products are mainly used in electrical vehicles, chemicals and pharmaceuticals. The Company distributes its products in the domestic market and to overseas markets.

- The company announced FY20 full year results where revenues grew by 3.4% YoY to RMB5.5bn, and net profits grew by 175% YoY to RMB985mn. The phenomenal growth was due mainly to the increase in production and sales volume of the lithium salt products and gain on change in the fair value of financial assets.

- Electric vehicle hype has been tapering since February. However, the demand for raw materials of batteries remains robust. As the world largest limitium and related compounds producer, the company has a moat that provides the required raw materials to various EV makers. It is likely that only a few EV producers will survive in the future, but the ultimate winners will still be the litimium and related compounds providers. Ganfeng is expected to be the leader in the foreseeable future.

- Market consensus of net profit growth in FY21 and FY22 are 123.6%YoY and 57.5% YoY, which implies forward PERs of 67.7x and 43x. Current PER is 151.4x.

China Modern Dairy Holdings Ltd (1117 HK): Milk is getting more expensive

- BUY China Modern Dairy Entry – 2.5 Target – 3 Stop Loss – 2.2

- China Modern Dairy Holdings Ltd. is an industrialized agricultural company. The Company operates dairy farms and produces raw milk in China. China Modern Dairy Holdings Ltd focuses on large-scale industrialized free-stall dairy farming.

- The company announced a positive profit alert that its FY20 net profit will be more than RMB700mn (including a one-off disposal gain of RMB72mn) with growth of more than 100% YoY.

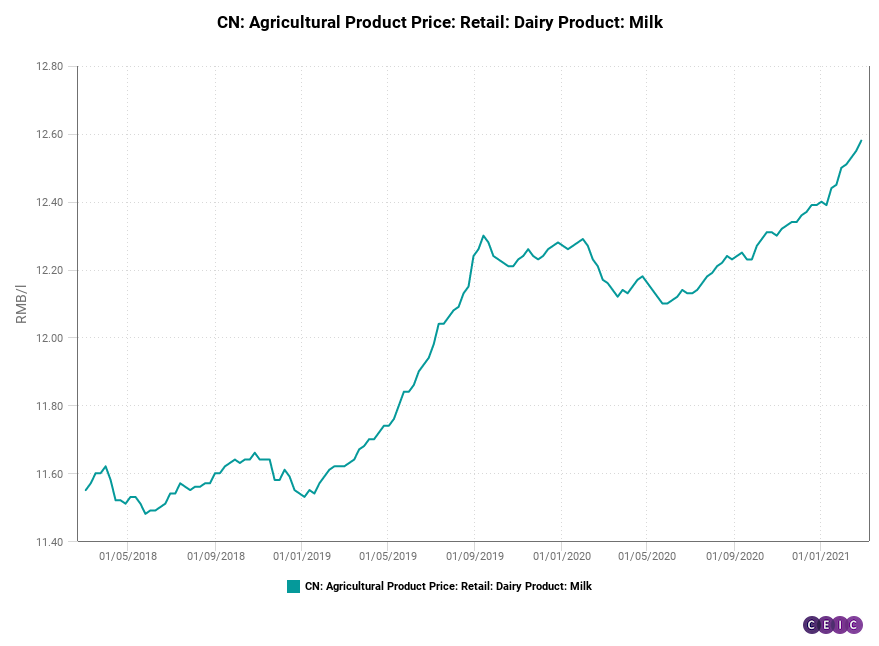

- Raw milk demand in China is estimated to be 450mn tonnes in 2020 and projected to grow to 500mn in 5 years. Domestic production of raw milk is estimated to be 33mn tonnes in 2020 and projected to grow to 35mn tonnes in 5 years time. Hence, demand growth will outpace supply growth.

- As of 26th February, the retail milk price in China reached a new high of RMB12.58/litre. The demand for milk is robust but supplies are tight.

- China Modern Dairy’s raw milk production is expected to be 1.6mn tonnes in 2020. The company has set a goal to achieve 3.6mn tonnes of raw milk production by 2025, equivalent to a CAGR of 17%. Furthermore, the company has also benefited from rising milk price.

SG Trading Ideas

ComfortDelGro (CD SP): Are we there yet? Traveling once again

- BUY Entry – 1.60 Target – 1.80 Stop Loss – 1.52

- CD is one of the largest land transport companies in the world, operating in seven countries and with a global network of over 40,000 vehicles. The company’s businesses include bus, taxi, rail, car rental and leasing, automotive engineering, inspection and testing services, drive centres and outdoor advertising.

- Singapore is the largest contributor of operating profits, making up 66% in FY2019, followed by Australia (19% of operating profits), UK/Ireland (10%) and China (5%).

- Net profit for FY2020 declined 77% YoY to S$62mn as ridership across all its business and regions were affected by the various lockdowns. It had to recognise impairments of almost S$50mn for the year.

- However, the worst may finally over. Management says that they are seeing a steady uptick in business activity especially in 4Q20, and the group has been doubling down on its digitalisation efforts to better prepare and take advantage of recovery opportunities.

- Valuations are currently attractive at 1.2x P/B, which is significantly below historical averages. CD has a very strong balance sheet (near net cash as at end 2020), a rarity for a transport company, thereby giving it flexibility to fund dividend payouts going forward. Dividend yields are expected to recover to 3.9% in FY2021E, and stablise at around 5-6% thereafter, based on street estimates.

Keppel DC REIT (KDCREIT SP): Surfing the data wave

- BUY Entry – 2.70 Target – 3.00 Stop Loss – 2.55

- KDCREIT is Asia’s first pure-play data centre REIT listed in Asia. Its current portfolio comprises of 19 data centres located in hubs across the Asia Pacific and Europe. As of end-2020, it had S$3.0bn of assets under management.

- DPU has consistently increased every year, recently growing to 9.17 Sing cents in FY2020 (vs 7.71 Sing cents in FY2019 and 6.51 Sing cents in FY2015). Meanwhile, balance sheet is healthy with a low aggregrate leverage of 36% and a very strong 13x interest coverage, giving it significant headroom for inorganic growth via acquisitions. Portfolio occupancy has remained resilient throughout the pandemic, and was at 98% at the end of 2020.

- KDCREIT currently trades at 2.2x forward P/B and offers a 3.7% div yield for FY2021E, rising to 3.9% in FY2022E and to 4.0% in FY2023E, as per Bloomberg consensus estimates.

- Its units are now trading at the lower end of the range since July 2020 (range of between S$2.70 to S$3.08), as the broader sell-off among technology stocks has hurt sentiments.

Market Movers – What’s Hot

United States

- Rocket Companies (RKT US) +71.2% to close at US$41.60. Shares of the online mortgage provider surged in a movement reminiscent of the GameStop and AMC Entertainment short squeeze that was triggered in January. Short interest on RKT was at US$1.2bn, or 46% of the float, making it the fifth-largest short in the US banking sector.

- TripAdvisor (TRIP US) +6.7% to close at US$52.64 following an upgrade by Citi to a Buy from Neutral and a higher target price of US$62, citing more optimism about the company’s new Plus subscription product.

- Cruise lines stocks such as Carnival Corp (CCL US;+5%; US$27.59) and Norwegian Cruise Line (NCLH US; +4%; US$31.18) outperformed the broader market on more analysts upgrades. Macquarie upgraded the cruise line sector to outperform from neutral, highlighting that the worst of the pandemic is likely in the rearview mirror and that government restrictions could be lifted in the coming months. Macquarie has called NCLH the best-positioned operator, and upgraded its target price to US$48 from US$18.

- Electric Vehicle stocks are among the worst performers last night with shares of Li Auto, XPeng and Nio dropping by 8-13%. The sell-off in the sector could partly be attributed to Tesla’s underperformance, as well as the global chip shortage that is likely be a short-term overhang for the Chinese auto sector.

- Earnings Watch: Trip.com (3 Mar), Broadcom (4 Mar), Costco (4 Mar), Kroger (4 Mar).

Hong Kong

- HengTen Networks Group Ltd (136 HK) -22.67%, closing at HK$9.28. Hong Kong finance minister Paul Chan yesterday presented the latest budget and mentioned not to rule out further hike of stamp duty but that there is no plans for now. The previous hotly traded China-Hong Kong connect stocks have been continuously sold off.

- GOME Retail Holdings Limited (493 HK) -18.79%, closing at HK$1.88. The company announced a 228mn shares placement at the price of HK$1.97.

- COSCO SHIPPING Holdings Co., Ltd (1919 HK) -10.39%, closing at HK$8.28, as the sell-down was due to overall weak market sentiments. However, the fundamentals of the stock remain sound, with several research houses upgrading their ratings and target prices. .

- China Youzan Ltd (8083 HK) -8.79%, closing at HK$3.01. SasS sector continued to be sold off due to weak market sentiments. The company announced that an application was made to the Stock Exchange for the listing of Youzan Technology Shares on the Main Board of the Stock Exchange by way of introduction.

- JS Global Lifestyle Co Ltd (1691 HK) +11.78 %, closing at HK$24.2. Joyoung Co., Ltd., a subsidiary of the company which is listed on the Shenzhen Stock Exchange (002242 SZ) announced positive preliminary FY20 results. In FY20, Joyoung reported a 20.44% YoY growth in operating revenue to RMB11.26bn and a 13.94% YoY growth in net profit to RMB939.0mn.

Singapore

- Penny cap panic. Penny stocks are selling off this morning as funds rotate into blue-chip names and re-opening plays. Jiutian Chemical (JIUC SP) -9% to S$0.079 this morning, as shares have been under selling-pressure after it missed analyst estimates. Other penny caps, which have been among the best performers in Singapore year-to-date, are down sharply this morning and they include Oceanus (OCNUS SP), which is down 35% this morning at S$0.041 and Thomson Medical (TMG SP), down 8% to S$0.108.

- Singapore Banks are getting a bid this morning on a brighter economic outlook and higher interest rates. Singapore’s economy is forecasted to grow 4% to 6% this year, bouncing back from a 5.4% contraction in 2020. Shares of DBS, UOB and OCBC are up between 0.8-1.5% is early morning trade today.

- Glovemakers were among the worst performers in Singapore yesterday, with shares of UG Healthcare, Riverstone and Top Glove dropping by 3 – 7%. The rotation out of Covid-19 plays been accelerating on more positive vaccine news, as Johnson & Johnson’s Covid-19 vaccine becomes the third authorised vaccine in the US.

Trading Dashboard