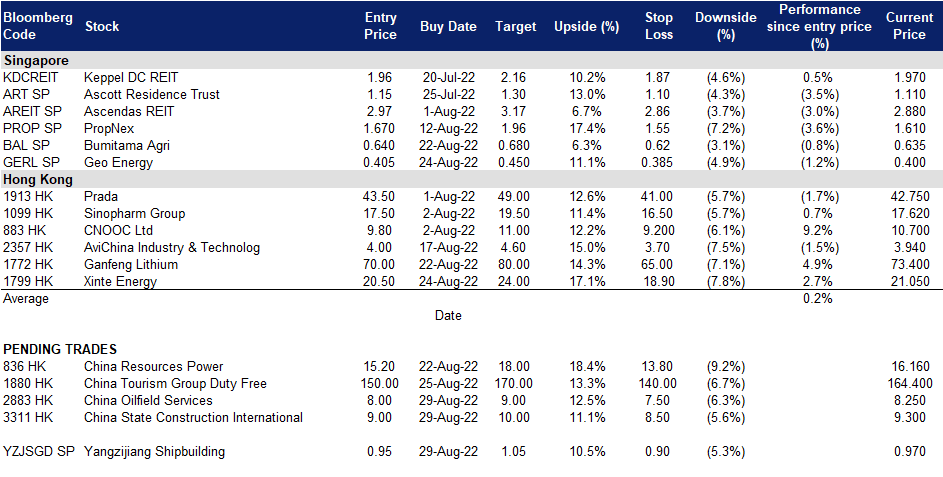

29 August 2022: Yangzijiang Shipbuilding (YZJSGD SP), China Oilfield Services Limited (2883 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Yangzijiang Shipbuilding (YZJSGD SP): Solid fundamentals to buffer impacts from a volatile market

- BUY Entry 0.95 – Target – 1.05 Stop Loss – 0.90

- Yangzijiang (YZJ) produces a range of commercial vessels, including mini bulk carriers, bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels and lifting vessels. It operates two shipyards, with the older yard located in Jiangyin city. The yard spans about 800 m of deep-water coastline and covers an area of about 200,000 sqm (excluding the coastal area). YZJ’s newer yard is located in Jingjiang city. The yard has 1,940 m of deep-water coastline, production area of 1,508,857 sqm, a drydock that can accommodate two 100,000 dwt vessels and two half 100,000 dwt vessels at one time.

- FY22 (YE June) earnings review. 4Q22 revenue grew by 14.8% YoY to S$22.0mn, and FY22 revenue grew by 11.8% YoY to S$82.5mn. 4Q22 gross profit grew by 9.6% YoY to S$11.3mn, and FY22 gross profit grew by S$44.0mn. 4Q22 Net profit grew by 22.7% to S$5.9mn. FY22 new profit grew by 9.7% YoY to S$19.8mn. The company proposed a final dividend of 6 SG cents and a special dividend of 2 SG cents.

- Secures additional orders for green vessels. YZJ announced that it clinched orders for four 8,000 TEU LNG dual-fuel containerships by repeat customer PIL and will be progressively delivered in 2025. The vessels will be equipped with a membrane containment tank system that was co-developed in-house, and demonstrates its focus on moving up the value chain to more complex LNG vessels. The orders bring total new orders secured YTD to USD990m for 16 vessels. As at writing, YZJ has a total order book value of US$8.15bn for 137 vessels, which is expected to keep its yard facilities at a healthy utilisation rate till mid-2025.

- Undemanding valuations with a decent DPS. The Street is fairly bullish on YZJ’s prospects with 7 BUY, and only 1 HOLD ratings, and an average 12M TP of S$1.30. The street expects FY23F/24F EPS growths to be 11.9%/12.6%. YZJ is currently trading at an undemanding 6.5x and 5.8x FY23F/24F P/E and 5.2%/6.6% FY23F/24F dividend yield respectively.

(Source: Bloomberg)

Geo Energy Resources Ltd (GERL SP): Unexpected tailwind to uphold coal prices

Geo Energy Resources Ltd (GERL SP): Unexpected tailwind to uphold coal prices

- RE-ITERATE BUY Entry – 0.405 Target – 0.450 Stop Loss – 0.385

- Geo Energy is a coal mining group that commenced business operations in 2008 and has an established track record in the operation of coal mining sites for the purpose of coal production and coal sale in Indonesia. Its coal production operations are primarily located in Kalimantan, Indonesia. Its main businesses include 1. owning and operating its own coal mine. 2. offering mine contracting services to third party mine owners. 3. selling coal to both coal traders and coal export companies.

- Tailwinds for thermal coal prices. China’s Southwest regions are under a heatwave. State weather forecasters issued a heat “red alert” for the 11th consecutive day on Monday, as extreme weather continues to play havoc with power supplies and damage crops. China’s scorched southwestern regions extended curbs on power consumption on Monday as they deal with dwindling hydropower output and surging household electricity demand during a long drought and heatwave. The supply shortage of hydropower will put thermal power plants under pressure. It is expected that thermal coal prices to rebound in the near term as urgent demand resumes.

- Record-high 1H22 earnings. Revenue jumped by 67% YoY to US$368.3mn. Gross profit surged by 117% YoY to US$151.5mn. GPM was 31.7% compared to 11.0% during the same period last year. Profit attributable to owners of the company soared by 118% YoY to US$105.0mn. The stellar performance was mainly driven by the skyrocketing coal prices. The average ICI4 in 1H2022 was US$85.89/tonne, compared to US$47.78/tonne in 1H2021. The total coal sales volume dropped 3.7% YoY to 5.18mn tonnes.

- High dividends and cheap valuations. GERL declared a second interim dividend of S$0.02 per share. Along with the first interim dividend of S$0.02 per share paid on 27 May 2022, this represents 39% pay-out ratio on the Group’s 1H22 net earnings. GERL currently trades at only 2.3x FY21 P/E.

SGX IHS McCloskey Indonesian 4200kc GAR FOB Thermal Coal Futures

(Source: Bloomberg)

China Oilfield Services Limited (2883 HK): Near-term tailwinds to boost oil prices

- Buy Entry – 8.0 Target – 9.0 Stop Loss – 7.5

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- Possible OPEC output cut. Oil prices closed slightly higher amid the overall market sold-off, driven by signals from Saudi Arabia that OPEC could cut output. Brent crude futures rose US$0.98 to settle at US$100.79/bbl. U.S. West Texas Intermediate (WTI) crude futures dropped 4 US cents to settle at US$92.95/bbl.

- Upcoming US$1tn China infrastructure expansion. To turn the downturn of the economy, China’s central government announced an allocation of RMB6.8tn (US$1tn) of government funds for construction projects. The key sectors to be benefited are renewable energy (solar and wind), water, urban infrastructure, and data centers. The fiscal spending will indirectly boost the demand for oil, pushing oil prices to edge higher. The long-lasting high oil prices help positive sentiment and activities of the upstream exploration and production.

- 1H22 earnings review. Revenue increased by 19.5% YoY to RMB15.1bn. Profit attributable to owners of the company grew by 37.6% YoY to RMB1.1bn. The growth was driven by the gradual recovery of the offshore oil and gas industry and the demand for drilling rigs. As of 30 June 2022, the company operated and managed a total of 57 drilling rigs, including 44 jackup drilling rigs and 13 semi-submersible drilling rigs. In 1H22, the operating days for the company’s drilling rigs amounted to 8,017 days, representing an increase of 1,439 days or 21.9% compared with the same period of last year. The calendar day utilisation rate of drilling rigs was 77.4%, representing an increase of 12.1 percentage points compared with the same period of last year.

- Updated market consensus of the EPS growth in FY22/23 is 827.0%/23.5% YoY respectively, which translates to 11.8x/9.6x forward PE. Current PER is 56.1x. Bloomberg consensus average 12-month target price is HK$10.4.

(Source: Bloomberg)

China State Construction International Holdings Limited (3311 HK): Infrastructure theme to turn around

China State Construction International Holdings Limited (3311 HK): Infrastructure theme to turn around

- Buy Entry – 9.0 Target – 10.0 Stop Loss – 8.5

- China State Construction International Holdings Limited is an investment holding company principally engaged in construction contracts business. The Company is also engaged in infrastructure project investments, facade contracting business and infrastructure operation. The Company operates its business through four segments: Hong Kong, Mainland China, Macau and Overseas. Through its subsidiaries, the Company is also engaged in building construction, civil and foundation engineering works.

- Upcoming US$1tn China infrastructure expansion. To turn the downturn of the economy, China’s central government announced an allocation of RMB6.8tn (US$1tn) of government funds for construction projects. The key sectors to be benefited are renewable energy (solar and wind), water, urban infrastructure, and data centers.

- 1H22 results review. Revenue jumped by 47.9% YoY to RMB53.8bn. Gross profit grew by 20.0% YoY to RMB 7.2bn. Profit attributable to owners of the company grew by 20.1% YoY to RMB4.2bn. The company declared an interim dividend of HK$0.24. As of 30 June 2022, the company registered a steady growth with newly signed contracts amounting to HK$90.48bn, representing a YoY increase of 28.3%.

- Updated market consensus of the EPS growth in FY22/23 is 22.8%/14.7% YoY respectively, which translates to 6.0x/5.2x forward PE. Current PER is 6.2x. FY22F/23F dividend yield is 5.1%/5.8%. Bloomberg consensus average 12-month target price is HK$12.06.

(Source: Bloomberg)

United States

Top Sector Losers

| Sector | Loss | Related News |

| Semiconductors | -5.59% | Why Nvidia, AMD, and Applied Materials Stocks Dropped Today NVIDIA Corp (NVDA US) |

| Industrial Conglomerates | -5.01% | 3M Can’t Use Bankruptcy to Halt Lawsuits Over Combat Earplugs, Judge Rules 3M Company (MMM US) |

| Internet Software/Services | -4.95% | Powell warns of ‘some pain’ ahead as the Fed fights to bring down inflation Alphabet Class A (GOOGL US) |

- Affirm Holdings Inc (AFRM US) tanked 21.3% after the company reported a larger-than-expected quarterly loss. Affirm also issued a disappointing outlook, but it did post quarterly revenue that topped Wall Street estimates.

- Peloton Interactive Inc (PTON US) continued to decline, shedding 3.6% Friday. The connected fitness equipment maker closed down 20% on Thursday after reporting slumping sales and widening losses for its fiscal fourth quarter. The latest stock moves came after Peloton rallied 20% on Wednesday on the news of its partnership with Amazon.

- Farfetch Ltd (FTCH US) jumped 26.1% after the company reported quarterly earnings that beat analyst expectations. Farfetch posted a smaller-than-expected loss and more revenue than estimated.

- Everbridge Inc (EVBG US) gained 17.4% on a Bloomberg report that the software company is exploring a potential sale.

- Dell Technologies Inc (DELL US) sank 13.5% after revenue in the recent quarter fell short of analysts’ expectations as the PC market shows signs of weakness. The company topped earnings estimates by 4 cents a share.

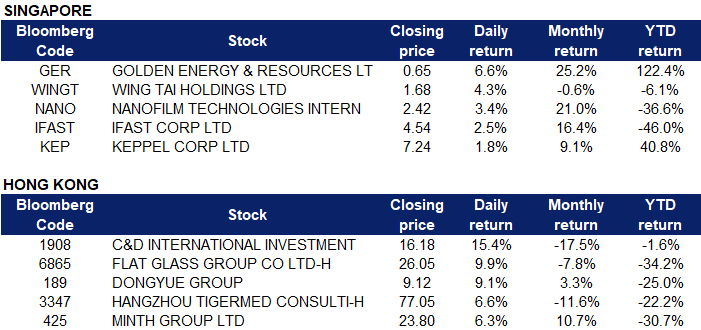

Singapore

- Golden Energy & Resources Ltd (GER SP) rose 6.6% on Friday. Russian coal exports were effectively halted by a European Union ban on entities within the 27-nation bloc servicing shipments of the fuel to anywhere in the world. The International Energy Agency sees coal consumption in Europe rising by 7% in 2022 on top of last year’s 14% surge, with the continent now turning to seaborne coal from South Africa, Indonesia, and even as far away as Australia as it halts imports from Russia.

- Wing Tai Holdings Ltd (WINGT SP) rose 4.3% on Friday. Property and retail company Wing Tai Holdings on Thursday (Aug 25) reported full-year net profit of $140.2 million for financial year 2022, a jump of 222 percent from $43.6 million profit in the previous year. Revenue for the full year ended June 30 came in at $514.6 million, a 12 per cent increase from $461.4 million a year ago. Earnings per share for FY2022 was 16.6 cents, compared with 3.99 cents in FY2021. The company said the jump in net profit was largely due to higher contributions from its associated and joint-venture companies, Wing Tai Properties in Hong Kong, as well as Uniqlo in Singapore and Malaysia.

- Nanofilm Technologies International Ltd (NANO SP) rose 3.4%. The Singapore market ticked marginally higher on Friday as most global indices traded up ahead of US Federal Reserve chair Jerome Powell’s speech at the Jackson Hole Symposium.

- iFAST Corp Ltd (IFAST SP) rose 2.5% on Friday. Standard Chartered and iFAST Singapore have recently launched iFAST’s first authorised Variable Capital Companies (VCC) fund. The CNH Fund, one of the first retail VCC funds to be launched in Singapore, will be the first to offer a T+0 settlement for investors. The cash management solution will offer investors a yield above CNH term deposits as well as same-day liquidity.

- Keppel Corp Ltd (KEP SP) rose 1.8% on Friday. On August 24, it announced it would acquire a majority stake in local environmental services firm 800 Super Holdings through a consortium in a deal that values the business at S$380 million. The consortium will pay S$304 million to buy 80% stake in 800 Super, one of the three public waste collectors in the city-state. The group will hold the stake via Keppel Asia Infrastructure Fund and Keppel Infrastructure. “The acquisition of a strategic interest in 800 Super complements and broadens the range of environmental services that Keppel Infrastructure offers,” said Cindy Lim, CEO of Keppel Infrastructure.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Machinery & Equipment | +3.94% | Economic Watch: Soaring China-Europe freight trains facilitate international trade Haitian International Holdings Limited (1882 HK) |

Environmental Energy Material | +2.87% | Top-notch clean energy equipment showcased in China’s Sichuan Flat Glass Group Co Ltd (6865 HK) |

Biotechnology | +2.77% | Gilead hits back at Bristol Myers’ Supreme Court petition in CAR-T patent feud WuXi Biologics (Cayman) Inc (2269 HK) |

Top Sector Losers

Sector | Loss | Related News |

Telecomm. Services | -2.95% | China’s telecom sector sees stable growth in Jan.-July PCCW Limited Common Stock (8 HK) |

Coal | -0.81% | China’s record drought is feeding its coal habit, with link to climate change China Coal Energy Company Limited (1898 HK) |

Semiconductors | -0.74% | Chinese chip foundry SMIC to invest $7.5 bln in new fab in Tianjin Semiconductor Manufacturing International Corporation (981 HK) |

- C&D International Investment Group Ltd (1908 HK) rose 15.4% on Friday. On August 26, C&D International Group announced that Zhuang Yuekai had resigned as the company’s executive director and chairman of the board of directors for personal reasons. The company also announced that Zhao Chengmin has been appointed as the chairman of the board of directors, effective from the 25th.

- Flat Glass Group Co Ltd (6865 HK) rose 9.9% on Friday. The company’s comprehensive profit margin in the second quarter increased to 23.7%, which Goldman Sachs believes is mainly due to the increase in solar glass prices and the increase in domestic supply of quartz. In addition, as of the end of June, the daily smelting volume of Flat Glass reached 15,800 tons, and it is predicted that it will further increase to 20,000 tons by the end of the year. The rapid expansion of production capacity will drive its growth.

- Dongyue Group Ltd (0189 HK) rose 9.1% on Friday. Shanghai recently issued several policies to support the development of hydrogen energy, mentioning the exploration of the construction of a hydrogen trading platform, accelerating the application of photovoltaic hydrogen production, and exploring the development of offshore wind power hydrogen production. It is reported that many provinces during the year have introduced policies to support the hydrogen energy industry.

- Hangzhou Tigermed Consulting Co Ltd (3347 HK) shares rose 6.6% after announcing its interim results on the evening of August 25. In 22H1, the company achieved revenue of 3.594 billion yuan, a year-on-year increase of 74.78%; net profit attributable to the parent was 1.192 billion yuan, a year-on-year decrease of 5.02%; non-returned to the parent net profit was 771 million yuan, a year-on-year increase of 42.12%. China Merchants Securities commented that the company’s resilience manifested in its high growth seen throughout the year, and it is expected to improve its international competitiveness in the long run under the four-prong approach of business expansion, transformation, customer expansion and strategic investment.

- Minth Group Ltd (0425 HK) shares rose 6.3% on Friday. The group recently released its interim results. UBS released a research report saying that it maintained Minth Group’s “buy” rating, its performance in the first half of the year was better than market expectations, raised its 2022-24 profit forecast by 1% to 3%, and its target price rose from HK$27 to HK$28.8. The company’s management has provided guidance for a 30% year-on-year increase in revenue and net profit in the second half of the year, as the battery box business is expected to reach 1 billion to 1.5 billion yuan in the second half of the year with new orders.

Trading Dashboard Update: No stocks additions/deletions.