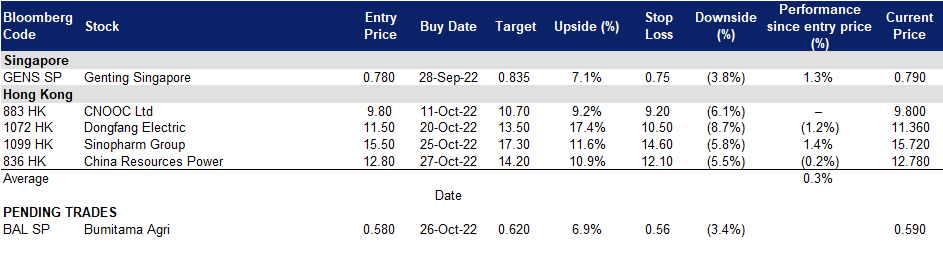

28 October 2022: Bumitama Agri Ltd (BAL SP), China Resources Power Holdings Company Limited (836 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Bumitama Agri Ltd (BAL SP): Seasonally strong palm oil prices

- BUY Entry – 0.580 Target – 0.620 Stop Loss – 0.560

- Bumitama Agri Ltd produces Crude Palm Oil (CPO) and Palm Kernel (PK), with its oil palm plantations and mills located in Indonesia. The Company’s primary business activities are cultivating and harvesting oil palm trees, processing fresh palm fruit bunches from its oil palm plantations, plasma plantations and third parties into CPO and PK, and selling CPO and PK in Indonesia.

- Rising palm oil prices. Palm oil prices are likely to strengthen further as excessive rain in key producing countries curbs output, while demand increases for its use in food and biofuels. The increase in exports and decrease in production would help reduce the buildup of inventory for palm oil producers in Indonesia and Malaysia. Since the prices of palm oil as compared to other edible oils is lower, the demand of palm oil has been gradually increasing, which would also contribute to the rise in palm oil prices.

Palm oil futures price one-year performance

(Source: Bloomberg)

- Lower production quantities. Indonesia and Malaysia account for more than 80% of the global production of palm oil. From November, palm oil output is normally seen to taper off in the two countries. Furthermore, with the heavy rainfall across Southeast Asia, the floods and heavy rain make it difficult for workers to harvest the palm oil crop and move the fruit to factories for processing.

- 1H22 results review. On 12 August, Bumitama Agri Ltd reported IDR8,968.35 billion in revenue during 1H22, which translates to a 65% YoY. Sales contribution from CPO spiked during the period, attributable to 75% YoY growth in selling price, which averaged IDR 14,327/kg. Following the operational outperformance amidst good commodity pricing environment, Bumitama Agri has accumulated a considerable amount of cash liquidity in recent quarters. Both current and net gearing ratios have improved, from 1.49x and 0.50x in 1H21 to 3.02x and 0.20x in 1H22, respectively.

- Updated market consensus of the EPS growth in FY22/23 is 101.31%/-38.12% YoY respectively, which translates to 3.29x/5.31x forward PE. Current PER is 3.31x. Bloomberg consensus average 12-month target price is S$0.83.

(Source: Bloomberg)

Genting Singapore (GENS SP): “Rooms” are hot

- RE-ITERATE BUY Entry – 0.780 Target – 0.835 Stop Loss – 0.750

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index.

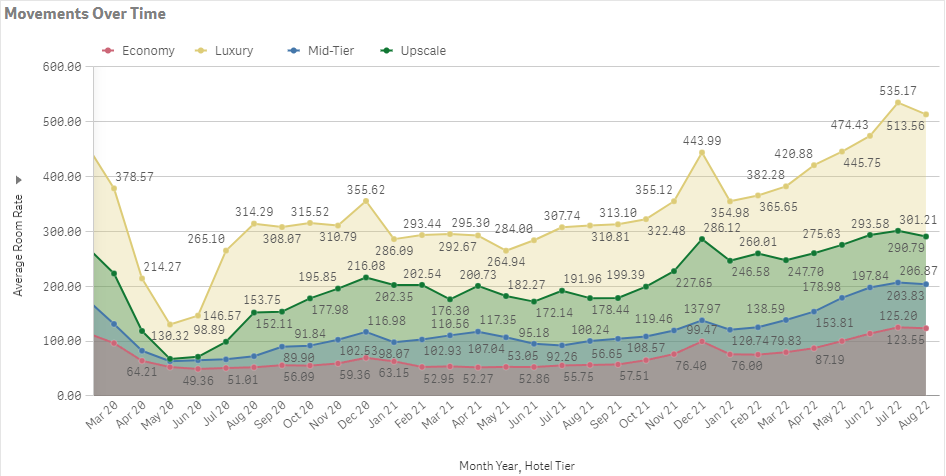

- Hotel prices hit a 10-year high. Singapore hotel room prices exceeded the pre-Covid level and hit a high in almost a decade in July 2022. As of July, the average room rate reached S$259/night, up c.70% YoY. The strong demand was driven by the increase in visitor arrivals amidst easing Covid-19 restrictions. Even though August figures showed mild corrections, the September figures will be another new highs as F1 and finance conferences were held in Singapore during the period, pushing hotel prices even higher. Visitor arrivals in Singapore rose for the eighth straight month in September to 726,140, up from 728,740 in August, according to the tourism board.

Singapore hotel room price by tier

(Source: Singapore Tourism Analytics Network)

- Upcoming high-profile events pushing hotel prices higher. For the rest of the year, a total of 28 Mice events have been lined up to be held in Singapore, some of the events include, the Singapore FinTech Festival, Future Travel Experience APEX Asia Expo, Bloomberg New Economy Forum and OSEA (Offshore Southeast Asia) 2022. With the Tour de France Prudential Singapore Criterium to be held this month, which will feature 32 riders from eight of the world’s most lauded professional cycling teams, this event is bound to get sports fans out of their seats. Furthermore, some Mice events to be hosted in Singapore next year are already on the timeline. Some key events such as Silmo Singapore, a leading eyewear and lifestyle trade show, and Vinexpo Asia, a major wine and spirits exhibition, will join Comexposium’s stable of existing events in Singapore, including Milipol Asia-Pacific, the Asia-Pacific’s largest homeland security event. Additionally, Italian Exhibition Group (IEG), a big meetings, incentives, conventions and exhibitions player, will establish its South-east Asia regional headquarters in Singapore by end-2023 and expand its business in the region under its three-year pact with STB. Additionally, well-known artists such as JJ Lin, Maroon 5 and Mayday will be performing in Singapore this year.

- Updates of bid for the gaming concession in Macau. According to GGRAsia, the Macau Special Administrative Region is said to have unconditionally accepted Genting Malaysia Bhd’s indirect subsidiary GMM SA’s bid for the award of a new 10-year gaming concession involving casino operations.

- Updated market consensus of the EPS growth in FY22/23 is 84.2%/57.4% YoY respectively, which translates to 28.2x/18.0x forward PE. Current PER is 53.1x. Bloomberg consensus average 12-month target price is S$0.95.

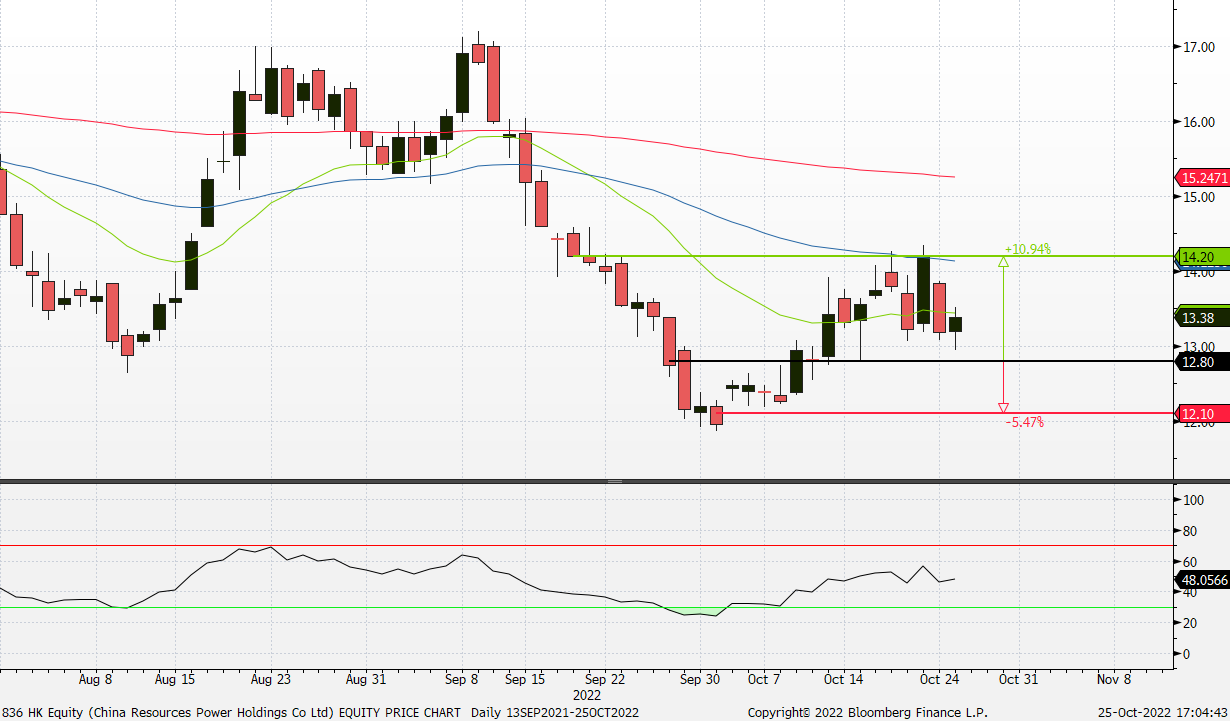

China Resources Power Holdings Company Limited (836 HK): A sound state-owned company with less selling pressures

- Buy Entry – 12.8 Target – 14.2 Stop Loss – 12.1

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Power is a defensive sector. The downturn of the Hong Kong equity market persisted due mainly to the global rate hike cycle, China’s economy slowdown, and deteriorating China-US relations. The broad market selloff has yet ended, however, power sector is one of the few relatively outperforms. Not only does the sector provide consistent and positive cash flows, but also expand businesses into clean energy fields which are in line with global ESG theme and supported by the domestic policies.

- September operations update. Total net generation of subsidiary power plants in September-22 increased by 5.9% YoY to 14,614,489MWh,subsidiary wind farms increased by 3.4% YoY to 2,244,858MWh, subsidiary photovoltaic plants increased by 4.9% YoY to 106,268MWh.

- 1H22 earnings review. Turnover grew by 17.78% YoY to HK$50.4bn. The increase was mainly attributable to a YoY increase of 23.9% in the average on-grid tariffs (tax exclusive) of subsidiary coal-fired power plants and a YoY increase of 19.9% in the average sales price of heat supply of subsidiary coal-fired power plants. Net profit attributable to shareholders of the company dropped by 22.46% YoY to HK$4.4bn. The fall in net profit was due to the increase in operating expenses resulted from higher raw material costs.

- The updated market consensus of the EPS growth in FY22/23 is 278.9%/29.9% YoY, respectively, translating to 7.0×/5.4x forward PE. The current PER is 74.1x. FY22F/23F dividend yield is 6.0%/8.0% respectively. Bloomberg consensus average 12-month target price is HK$20.86.

(Source: Bloomberg)

Dongfang Electric Corp Ltd. (1072 HK): 4Q22 more power-related projects to commence construction

Dongfang Electric Corp Ltd. (1072 HK): 4Q22 more power-related projects to commence construction

- RE-ITERATE Buy Entry – 11.5 Target –13.5 Stop Loss – 10.5

- Dongfang Electric Corp Ltd is a China-based company mainly engaged in the manufacturing and sales of power generation equipment. The Company operates five major reporting segments: Clean and High-Efficiency Energy Equipment segment, Renewable Energy Equipment segment, Engineering and Trade segment, Modern Manufacturing Service Industry segment, and Emerging Growth Industry segment. The Company’s main products include water turbine generator sets, steam turbine generators, wind turbine generator sets, power station steam turbines and power station boilers as well as gas turbines. he Company distributes its products within the domestic market and to overseas market.

- Ongoing investment in power grid and power source infrastructure. As of August, the cumulative investment of power grid and power source infrastructure in 8M22 grew by 10.7% and 18.7% YoY to RMB266.7bn and RMB320.9bn respectively. In August, China’s Power Grid announced that it planned to invest more than RMB150bn (US$22 billion) in the 2H22 in ultra-high voltage power transmission lines. Owing to the slowdown in economic growth in China, the central government has been pushing for infrastructure expansion. We expect more power projects to kickstart in 4Q22 as the authority tries to maintain full-year economic growth.

- 1H22 results review. Operating income grew by 23% YoY to RMB27.3bn, driven by the growth of thermal power, engineering contracting, international trade, wind power and other segments. Net profit attributable to shareholders of the company jumped by 31.6% YoY to RMB1.8bn. The new effective orders grew to RMB36.7bn. The company will announce its 3Q22 results on 28th October.

- The updated market consensus of the EPS growth in FY22/23 is 15.9%/22.7% YoY respectively, which translates to 13.0x/10.6x forward PE. The current PER is 12.7x. Bloomberg consensus average 12-month target price is HK$14.17.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Trucks/Construction/Farm Machinery | +3.04% | Caterpillar Surges Most in Two Years on Optimism Over Demand Caterpillar Inc (CAT US) |

| Industrial Conglomerates | +1.88% | Honeywell stock heads higher after earnings as company boosts profit outlook Honeywell International Inc (HON US) |

| Aerospace & Defence | +1.76% | Why Boeing Stock Is Bouncing Back on Thursday Boeing Co (BAUS) |

Top Sector Losers

| Sector | Loss | Related News |

| Internet Software/Services | -4.03% | Meta shares plunge 24% to the lowest price since 2016 Meta Platforms Inc (META US) |

| Internet Retail | -3.32% | Amazon Shares Plunge on Forecast for Sluggish Holiday Sales Amazon.com Inc (AMZN US) |

| Telecommunications Equipment | -2.66% | Apple earnings rise as economic gloom hits tech Apple Inc (AAPL US) |

- Meta Platforms Inc (META US) slumped 24.6% after issuing weak guidance for the current quarter and missing earnings estimates for the third quarter. Meta Platforms also shared its second consecutive quarterly revenue, with its Reality Labs unit losing more than $9 billion, and got hit by a slew of analyst downgrades.

- Caterpillar Inc (CAT US) jumped 7.7% following the company’s quarterly earnings report, which included beats on both the top and bottom lines. Earnings came in at $3.95 per share on revenue of $14.99 billion, compared to estimates of $3.16 per share on revenue of $14.33 billion, according to Refinitiv.

- Align Technology Inc (ALGN US) tumbled 18.1% after it posted disappointing earnings for the most recent quarter. Align reported $1.36 per share in earnings on revenue of $890 million. Analysts expected $2.18 per share on revenue of $953 million, according to Refinitiv.

- Credit Suisse Group AG (CS US) plummeted 20.0% after Credit Suisse posted a greater-than-expected loss for the third quarter. Credit Suisse also shared a restructuring plan to overhaul its struggling business.

- McDonald’s Corp (MCD US) shares got a 3.3% lift after the company beat earnings expectations for its most recent quarter. Traffic is growing in U.S. restaurants, McDonald’s reported, even after raising prices.

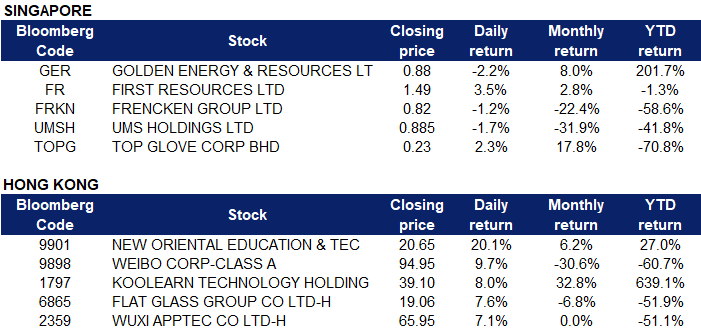

Singapore

- Golden Energy & Resources Ltd (GER SP) dropped 2.2% yesterday. Coal prices fell.

- First Resources Ltd (FR SP) Shares rose 3.5% yesterday. The international palm oil spot market price, having come down to a 15—month low in September 2022, has rebounded since. There has been a 9 percent increase in spot market prices in the last month, with the rally particularly sharp in the last week. Palm oil price currently hovers around 4,000 Malaysian Ringgit/ton – levels last seen in August 2022.

- Frencken Group Ltd (FRKN SP) and UMS Holdings Ltd (UMSH SP) fell 1.2% and 1.7% respectively yesterday. Microsoft on Tuesday reported a 14% drop in profit for the July-September quarter compared to the same time last year, reflecting a weak market for personal computers affecting its Windows business. Worldwide shipments of personal computers declined almost 20% in the quarter from the same time last year, according to market research firm Gartner, which said it was the steepest decline since it began tracking the PC market in the mid-1990s.

- Top Glove Corp Bhd (TOPG SP) rose 2.3% yesterday. Bursa Malaysia’s Health Care index rose more than 3% past 1,600 points to its highest in over two months, helped mainly by the rise in share prices of rubber glove manufacturers. After months of sell-off to below pre-pandemic lows, the sector has seen bargain hunting in recent days on investor perception towards the exporting sector as a beneficiary of a strengthening US dollar.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Precious Metal | +2.51% | Zijin Mining Plans $1.4 Billion Bond as It Buys Up Metal Used in Green Transition Zijin Mining Group Co Ltd (2899 HK) |

Other Support Services | +2.26% | Why New Oriental Education Stock Popped Today New Oriental Education & Technology Group Inc (9901 HK) |

Environmental Energy Material | +2.05% | China becomes global pioneer, leader in developing renewable clean energy Xinyi Solar Holdings Ltd (968 US) |

Top Sector Losers

Sector | Loss | Related News |

Electricity Supply | -3.72% | The World’s Biggest Source of Clean Energy Is Evaporating Fast CLP Holdings Ltd (0002 HK) |

Advertising | –1.35% | Chinese mobile advertising platforms increase global presence amid challenges Weimob Inc (2013 HK) |

IT Hardware | –0.89% | Microsoft profits down 14% as Windows hit by weak PC sales Lenovo Group Ltd (992 HK) |

- New Oriental Education & Technology Group Inc (9901 HK) Shares jumped 20.1% yesterday. Daiwa released a research report saying that it maintains the “buy” rating of New Oriental Group, and the profit of the live broadcast business Dongfang Selection (DFZX) in the first quarter of fiscal year 2023 exceeded expectations. According to the report, the operating profit margin of the STEAM business has exceeded 10% in the first quarter of fiscal 2023, which means that the group will usher in further profit potential.

- Weibo Corp (9898 HK) Shares climbed 9.7% yesterday. There was no company specific news. The Hang Seng index was up 0.71% in the final hour of trade after jumping more than 3% in early trade, boosted by tech stocks. The Hang Seng Tech index rose more than 4% early in the session and was last up 0.9%. Chinese onshore and offshore yuan strengthened sharply against the dollar in Asia’s afternoon on Wednesday.

- Koolearn Technology Holding Ltd (1797 HK) Shares popped 8.0% yesterday. On the evening of October 31, Yu Minhong will appear in the Taobao live broadcast room of the “New Oriental Xuncheng Education Store” to discuss with college students how to plan their college careers. In this regard, New Oriental said that making education live broadcasts on Taobao is a long-term plan with clear goals. According to the Southwest Securities Development Research Report, Koolearn Technology has performed outstandingly, with multiple vertical live broadcast rooms having expanded the product matrix. The total number of members is expected to reach 30 million by the end of 2022.

- Flat Glass Group Co Ltd (6865 HK) Shares rose 7.6% yesterday. Recently, Henan issued the “14th Five-Year Plan for High-Quality Development of Manufacturing Industry in Anyang City”. The “Planning” clearly defines the development goals of the new energy industry: focusing on the construction of national new energy demonstration cities, optimizing the wind power and photovoltaic industries, cultivating the biomass energy industry, promoting the agglomeration of new energy equipment manufacturing industries, and creating a new energy industry demonstration base in the central region. Focus on the development of photovoltaic glass, solar photovoltaic cells, battery components and key materials, encourage photovoltaic applications in characteristic industries, and promote photovoltaic building integration projects.

- WuXi AppTec Co Ltd (2359 HK) Shares climbed 7.1% yesterday. Daiwa issued a research report saying that WuXi AppTec was rated “buy”. The company raised its revenue growth target in 2022 from 68%-72% to 70%-72%; it also stated that due to the strong cash flow performance brought by large-scale projects, the H-share additional issuance plan was terminated.

Trading Dashboard Update: Add China Resources Power (836 HK).