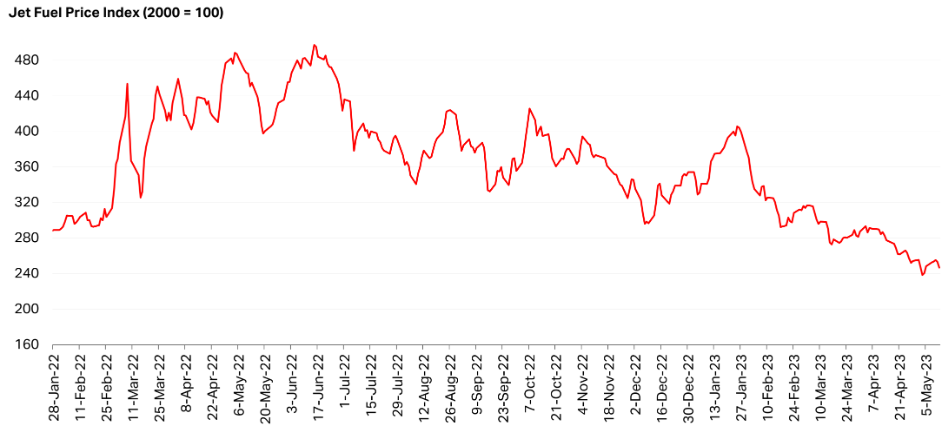

26 May 2023: Oversea-Chinese Banking Corp Ltd (OCBC SP), Alphabet Inc (GOOG US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Oversea-Chinese Banking Corp Ltd (OCBC SP): Benefiting from weakening USD

- BUY Entry 12.1 – Target – 12.5 Stop Loss – 11.9

- Oversea-Chinese Banking Corporation Limited offers a comprehensive range of financial services. The Company’s services include deposit-taking, corporate, enterprise and personal lending, international trade financing, investment banking, private banking, treasury, stockbroking, insurance, credit cards, cash management, asset management and other financial and related services.

- Distribution of first tokenised equity-linked structured note. In partnership with ADDX, OCBC has launched its first tokenised equity-linked structured note. These notes pay regular distributions at pre-defined intervals, subject to the terms of the notes and the absence of any extraordinary or trigger events. Fixed coupon notes provide an opportunity for investors to generate additional cash flow while gaining potential exposure to underlying securities or a basket of securities based on their specific market views, as stated by OCBC. This marks the debut of many upcoming equity-linked notes that OCBC intends to introduce.

- Benefit from rate cut expectations. Even though it is uncertain when rates will start to decline, Singapore banks will continue to thrive in this volatile environment as our local banking system is heavily regulated and conditioned under various stresses by the Monetary Authority of Singapore (MAS). MAS has also expressed its readiness to provide liquidity to maintain financial stability and orderly market functions. The overall market believes that the Feds will also attempt to decrease systemic risk in the financial sector by reducing interest-rate hikes and start to cut rates by 3Q23, with interest rates expected to peak at 5.25% to 5.5%. The expected decrease in interest rates could result in borrowers refinancing their loans, which were granted at higher rates.

- Growing wealth segment. Singapore is seeing an influx of wealthy individuals and family offices, which has led to a rise in assets under management at the country’s banks. The Monetary Authority of Singapore estimated there were about 700 family offices in 2021, but the current estimate is around 1,400, with mainland Chinese being the biggest drivers of growth. Although the family offices generate jobs indirectly through external finance, tax, and legal professionals, little of the money is being invested in funds or private equity firms. Despite this, the influx of wealth will still benefit banks in Singapore, particularly with the tax exemption programs for family offices, which have led to higher assets under management at banks in the country. Furthermore, with fear brewing due to the deteriorating US-China ties, the ultra-rich in Taiwan are considering setting up family offices in Singapore to protect their wealth. BDO Tax Advisory has reported an increase in inquiries from the ultra-rich in Taiwan. OCBC’s wealth management income contributed 33% to the Group’s total income in FY22. The group wealth management AUM was higher at S$258bn compared to S$257bn in FY21, driven by continued growth in net new money inflows which offset negative market valuation. As Singapore continues to attract a growing number of wealthy individuals, the country’s banks are expected to receive a boost in assets and deposits.

- Dividend yield and share buyback. OCBC’s dividend yield is expected to be 6.3% in FY23.It also has been buying back its share with a mandate.

- 1Q23 results review. Record net profit S$1.88bn for the first quarter, 39% YoY increase from S$1.36bn a year ago and rose 44% QoQ from S$1.31bn the previous quarter. Net interest income grew 56% YoY to S$2.34bn from S$1.50bn in 1Q22, a slight decline of 2% QoQ from 4Q22 S$2.39bn.

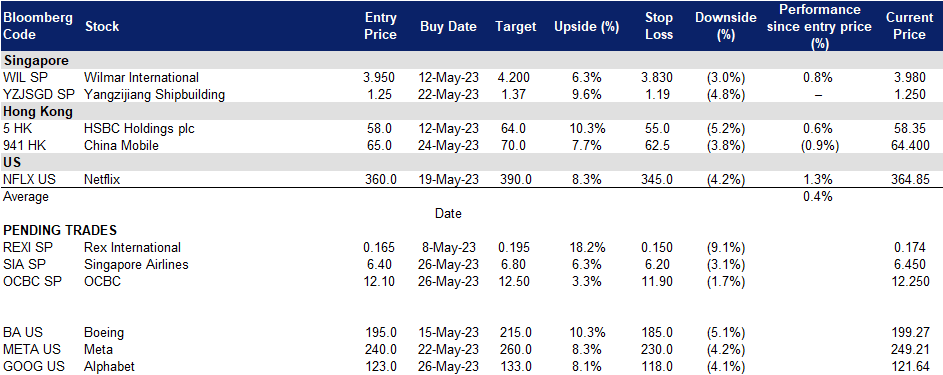

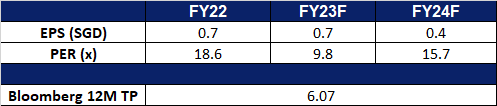

- Market consensus.

(Source: Bloomberg)

Singapore Airlines Ltd. (SIA SP): Recovering back to the pre-COVID level

- BUY Entry 6.40 – Target – 6.80 Stop Loss – 6.20

- The Singapore Airlines Group has over 20 subsidiaries, covering a range of airline-related services, from cargo to engine overhaul. Its subsidiaries also include SIA Engineering Company, Scoot, Tiger Airways, Singapore Flying College and Tradewinds Tours and Travel. Principal activities of the Group consist of air transportation, engineering services and other airline related activities.

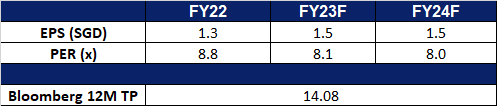

- Still more room for visitor arrivals recovery. In April, one year anniversary of Singapore’s full reopening of border, there were 1.13mn visitor arrivals to Singapore with 282.5% YoY growth. However, the number of arrivals is far below the pre-COVID level, compared to 1.69mn visitors in January 2020. The average monthly visitor arrivals in 2019 was above 1.5mn. Therefore, the normalisation of tourist visits is still on track.

Visitor arrivals trend

(Source: Singapore Tourism Analytics Network)

- To ride on the positive seasonality. The upcoming summer vacation (June to August) is the peak of the travelling season in a year. Meanwhile, this summer holiday is the first one after China’s full reopening. It is expected to see more visitors from China, as Singapore is a sweet spot of overseas traveling for families.

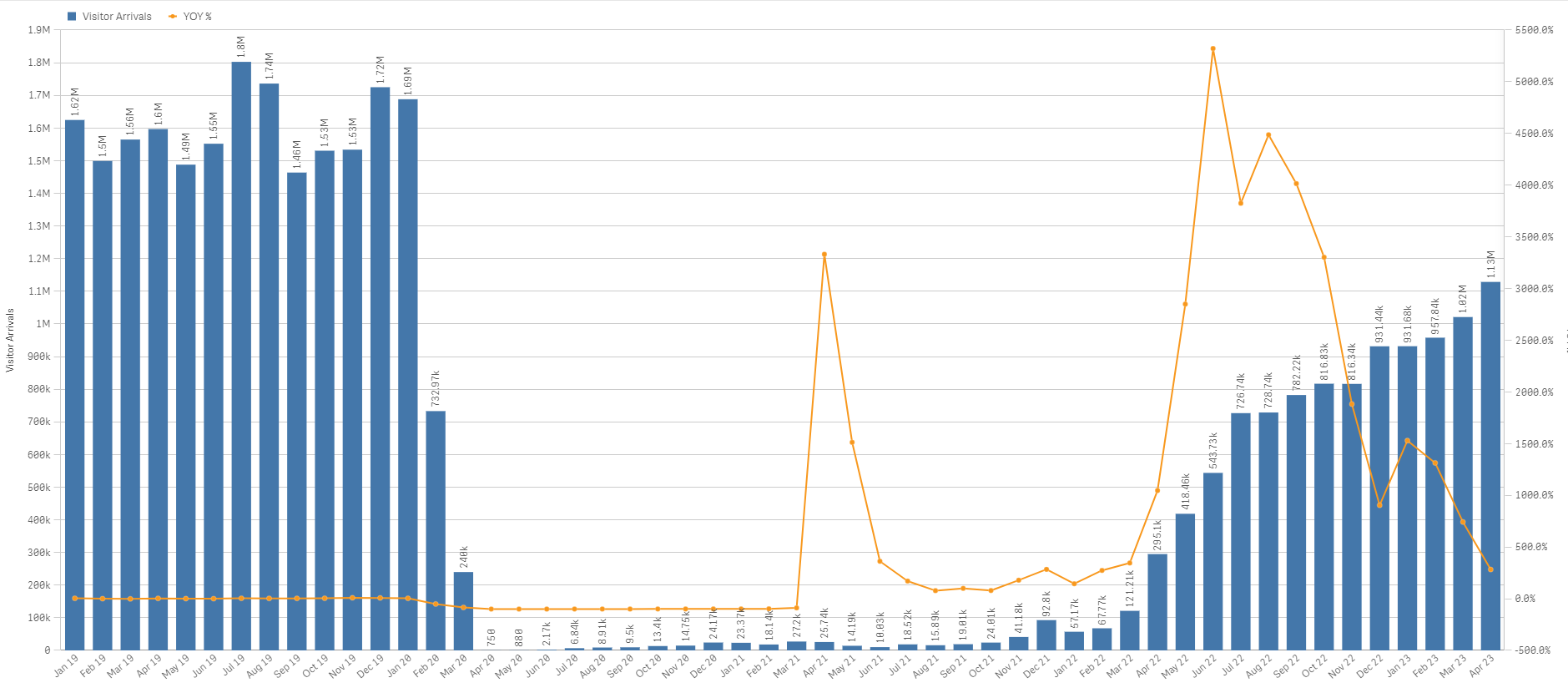

- Jet fuel prices trending down. Due to concerns over a slowdown of global economic growth and recession, international oil prices have been trending downward since mid-2022. Accordingly, prices of crude oil derivatives fall, benefiting airline companies as part of operating costs drops.

Jet fuel price trend

(Source: IATA, S&P Global)

- Record profit in FY23. Revenue more than doubled YoY from S$8.2bn to S$15.1bn as bookings soared and both SIA and Scoot substantially ramped up flights. The operating profit of S$2.7bn was a record for the group, reversing the S$610 mn operating loss in FY22. Net profit was S$2.16bn, the highest level achieved by the group since its inception 76 years ago in 1947.

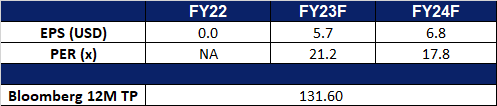

- Market consensus.

(Source: Bloomberg)

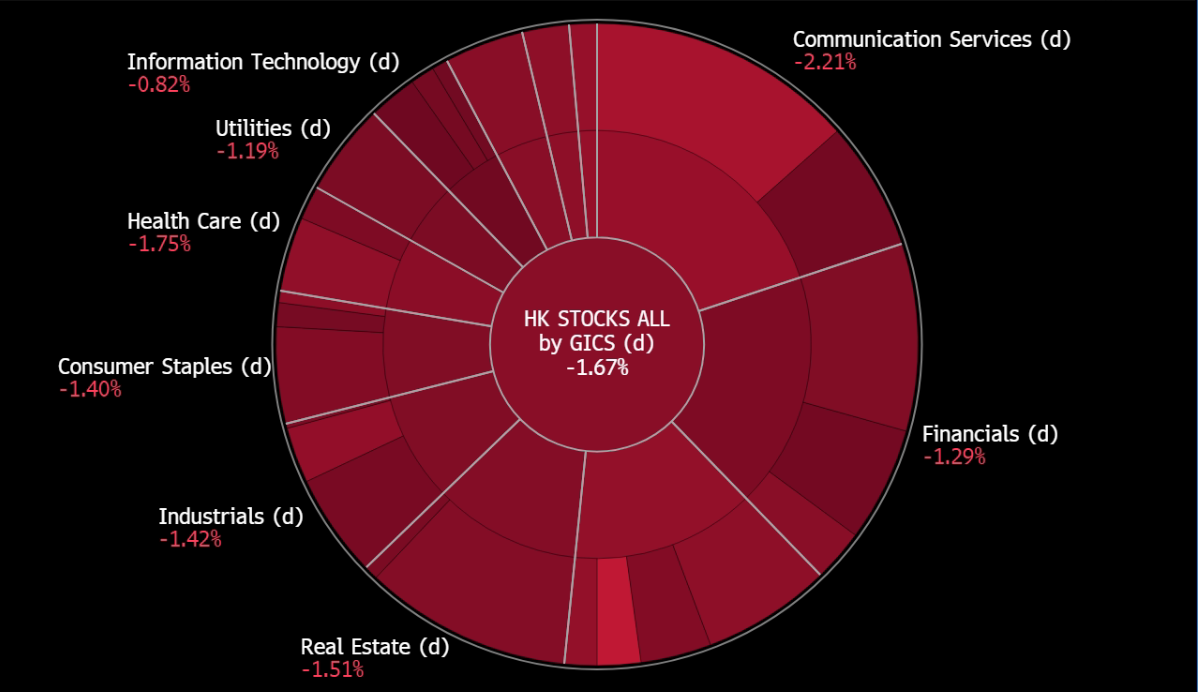

The Hong Kong market is closed today in observance of a public holiday (Buddha’s Birthday). Trading resumes on Monday, 29 May.

Alphabet Inc (GOOG US): Level the playing field

- BUY Entry – 123 Target – 133 Stop Loss –118

- Alphabet Inc. operates as a holding company. The Company, through its subsidiaries, provides web-based search, advertisements, maps, software applications, mobile operating systems, consumer content, enterprise solutions, commerce, and hardware products.

- Sprinkling in more Artificial intelligence. Google has announced its plan to incorporate AI technology into its search engine and other products. As part of this effort, the company will launch a new version of its search engine, called Search Generative Experience. This updated engine is designed to craft responses to open-ended questions and retain a recognizable list of links to the web, all using AI technology. Products such as Gmail will be able to draft messages while Google Photos will be equipped with more advanced image editing features that allow AI to modify users photos in various ways. Additionally, since Google wishes to prioritise accuracy and authenticity, its search engine will generate information citing reliable sources and will mark up its images that are generated with the help of AI.

- International Bard. Bard is a chatbot created by Google to rival OpenAI’s ChatGPT-4, which is accessible to users globally. Bard can be prompted with not only images but also text. Furthermore, Google has also announced the presence of a more powerful AI model it is working on, PaLM 1, which would be able to solve tougher problems and work on smartphones.

- 1Q23 earnings review. 1Q23 revenue grew by 2.6% YoY to US$69.79bn, beating estimates by US$950mn. 1Q23 GAAP EPS was US$1.17, beating estimates by US$0.10.

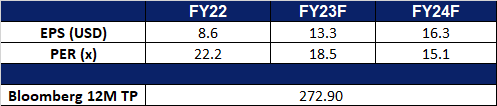

- Market consensus.

(Source: Bloomberg)

Meta Platforms (META US): Pulling back the curtains

Meta Platforms (META US): Pulling back the curtains

- RE-ITERATE BUY Entry – 240 Target – 260 Stop Loss – 230

- Meta Platforms, Inc. operates as a social technology company. The Company builds applications and technologies that help people connect, find communities, and grow businesses. Meta Platform is also involved in advertisements, augmented, and virtual reality.

- Unveil AI technology. As more mega caps are jumping on the AI bandwagon, Meta has also been developing its own cutting-edge AI chips. These chips will not only help Meta to improve the efficiency of its current operations but will also help to improve their AI capability further. In fact, the new inferencing chip that they have unveiled will be used to power some of Meta’s current recommendation algorithm. Furthermore, management has clearly stated that these chips are just the start and will eventually be used to power the metaverse. All of this, combined with the heavy cost-cutting policies that Meta has implemented to help improve profitability will undoubtedly lead to higher top and bottom lines for the firm in the coming quarters, and a high upside potential for the stock.

- Spinning out. Kustomer, an enterprise startup, which was purchased by Meta at the end 2020 for about US$1bn, has spun out and will operate as an independent company. Further supporting Meta’s intentions to reduce costs and its restructuring efforts.

- 1Q23 earnings review. 1Q23 revenue grew by 2.7% YoY to US$28.65bn, beating estimates by US$990mn. 1Q23 GAAP EPS was US$2.20, beating estimates by US$0.23. Average family daily active people grew by 5% YoY to US$3.02 bn for March 2023.

- Market consensus.

(Source: Bloomberg)

(Source: Bloomberg)

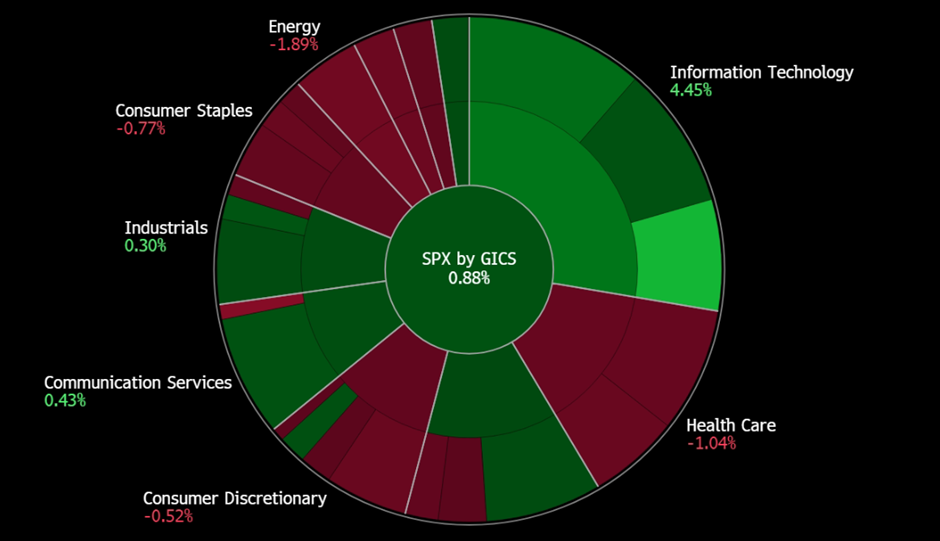

United States

Hong Kong

Trading Dashboard Update: Cut loss on Yankuang Energy Group (1171HK) at HK$24.7 and CRCC (1766 HK) at HK$4.6.