KGI DAILY TRADING IDEAS – 26 FEBRUARY 2021

US Trading Ideas

JD.Com (JD US): Trade the upcoming IPO in HK

- BUY Entry – 89 Target – 110 Stop Loss – 80

- JD is an online direct sales company in China. The Company offers a wide selection of products through its website and mobile applications. JD sells appliances, computers, digital products, communication products, garments, books, and household items to consumers and vendors.

- The upcoming catalyst is the pending JD logistics IPO in HKEX. The spin-off of the sub-business segment is expected to increase the parent company’s valuation.

- Market consensus of net profit growths in FY21 and FY22 are 36.4x%YoY and 39.8% YoY, which implies forward PERs of 41.8x and 29.9x. Current PER is 57x.

- Big tech companies recently sold off due to rising interest rates, which has raised concerns of faster-than-expected inflation. However, we believe this is a short-term panic-sell down as Fed Chair Powell mentioned it could take three years for the US to reach the 2% inflation target, and that the Fed has multiple tools to rein in inflation. In the long-term, tech giants remain the key economic drivers, and their growth prospects are better off if inflation kicks in.

Relx Technology (RLX US): 47x Price/Sales for a super-growth stock; shares are now at post-IPO lows

- BUY Entry – 15 Target – 21 Stop Loss – 12

- We previously covered RLX’s IPO here, in which the IPO sentiment has cooled down and the shares have consolidated at the US$22-26 range until last week. Its shares underperformed the broader market this week, dropping to a post IPO low of US$16.85 last night.

- We see the correction as a good chance to accumulate positions in a high growth stock. Despite the 47x Price/Sales price tag, RLX is expected to double its sales next year, and potentially grow 5x in the next 4 years as the Chinese market warms up to e-vapor products.

HK Trading Ideas

Xinyi Glass Holdings Ltd. (868 HK): Why are you so hot? Solar industry driving strong glass demand

- BUY Entry – 20 Target –25 Stop Loss – 18

- Xinyi Glass Holdings Ltd engages in the manufacturing and sales of automobile, architectural, float, and other glass products for commercial and industrial applications. The company is also involved in the manufacture and sales of rubber and plastic products and the provision of logistics services.

- Float glass prices in China remain at high levels as the demand after Chinese New Year has resumed. The current average prices are close to RMB2,143/tonne, declining from the recent high of RMB2,350/tonne. It is expected that prices will stay around RMB2,000/tonne in 1H21.

- Because of the accelerating development of solar energy supported by the central government, domestic float glass capacity will shift to produce solar panels. Hence, float glass for construction is expected to be in short supply, keeping prices at 10-year highs. Market research estimates the average float glass prices will grow by 10% to 15% YoY in 2021.

- Market consensus of net profit growths in FY21 and FY22 are 28.6%YoY and 7% YoY, which implies forward PERs of 13.3x and 12.4x. Current PER is 23.7x.

CNOOC Limited (883 HK): High dividend yield stock with strong sector tailwinds

- Re-iterate BUY Entry – 9.1 Target – 10.6 Stop Loss – 8.3

- CNOOC is one of the global oil majors, substantially underperforming its peers even though global oil prices have rallied recently. This was mainly due to the company being included on the US blacklist of military-related enterprises. The company is under selling pressures from foreign funds.

- The company is one of China’s most important state-owned enterprises. Furthermore, only 6% of its business is exposed to North America.

- Updated market consensus of the estimated growth of net profit in FY21 and FY22 are 73% and 29% respectively, which translates to 7.7x and 6.0x forward PE. The current PE is 13.3x. The estimated respective dividend yield in FY21 and FY22 is around 6-7%.

- While shares of oil and gas stocks have rallied strongly year-to-date (CNOOC has gained 40% year-to-date), we think that there is further upside. The recent market sell-off is a buying opportunity for companies with strong fundamental outlook and high dividend yields.

SG Trading Ideas

Riverstone (RSTON SP): An earnings beat and a big Ang Bao for the new year

- BUY Entry – 1.36 Target – 1.64 Stop Loss – 1.25

- RSTON reported a blowout full-year results which beat consensus forecasts by 17% . Net profit surged almost 400% YoY to RM 647mn (vs RM 555mn consensus forecasts) driven by higher sales volume for both healthcare and cleanroom gloves. The group is aggressively ramping up production by 1.5 bn gloves each year to reach a total capacity of 15 bn gloves per year by end FY2023.

- Best of all, the company has declared a final and special dividend of RM 16 sen and RM 4 sen, respectively, which is equivalent to around 6.5 SG cents. This is higher than street estimates of 1RM 15.4 sen total dividend for FY2020.

- While RSTON has been associated with the out-of-favour Covid plays, its >50% ROEs and attractive 4-6% forward dividend yields should provide a much needed re-rating to its share price.

Yanlord Land Group (YLLG SP): Primed for a rebound as peers in HK rally

- BUY Entry – 1.12 Target – 1.27 Stop Loss – 1.05

- YLLG is a leading property developer in China with a focus on the luxury residential market in Tier 1 and Tier 2 cities such as Chengdu and Nanjing.

- YLLG offers a good short-term trading play following the rally of its peers listed in Hong Kong including Evergrande (3333 HK +6.6% to HK$16.58), Sunac (1918 HK +12% to HK$33.90), China Vanke ( 2202 HK +12% to HK$33.55), and China Resource Land (1109 HK +11% to HK$36.65).

- The jump among Chinese developers was spurred by new land sales rules that may benefit leading property developers. The new rules include limiting the number of land auctions this year instead of holding multiple smaller-scale events throughout the year, which could lead to higher requirements on land deposits and cash outlay, thus benefiting the larger developers with stronger balance sheets.

- We currently have a fundamental OUTPERFORM rating on the stock with a target price of S$1.52. The company earlier this month announced that its total pre-sales from residential and commercial units and car parks for the full year 2020 amounted to around RMB 79 bn (S$16 bn) on contracted gross floor area (GFA) of 2.1mn sqm, representing a surge of 41% YoY and 14% YoY respectively.

Market Movers – What’s Hot

Macro

- US 10-year Treasury yield jumped to a year high of 1.60%, a key indicator that investors now expect growth and inflation to move higher. The Bloomberg dollar index rallied 0.7% on Thursday, the most since last September, while most emerging market currencies declined.

United States

- Technology stocks bore most of the sell-off in overnight trading, with popular big-tech names like Amazon, Alphabet, Facebook and Apple dropping by 3-4%, while semiconductor companies Lam Research, Nvidia and Applied Materials fell by 7-8%.

- Twitter Inc (TWTR US) + 3.7% to US$74.59 was among the few of the technology stocks to close higher following an announcement from the company that it was setting new long-term targets. These included hitting at least 315mn users and doubling revenues by the end of 2023.

- Tesla (TSLA US) -8.0% to US$682.22, the worst performer among the megacap companies, closing below the US$695 level which was the day before it entered the S&P 500 index. TSLA is down 14% for the month. Earlier this week, it had to temporarily halt production at a Model 3 line in California, which according to media reports, is likely linked to chip shortages plaguing other automakers.

Hong Kong

- Seazen Group Limited (1030 HK) +16.46%, closing at HK$9.2. China Vanke Co Ltd (2202 HK) +12.21%,closing at HK$33.55. Sunac China Holdings Ltd (1918 HK) +12.44%, closing at HK$33.9. Shimao Property Holdings Limited (813 HK) +12.14%, closing at HK$25.4. China Resources Land Limited (1109 HK) +11.23%, closing at HK$36.65. The property sector were the top gainers as some research reports stated the valuation of the sector was at a historically low level. According to media reports, 22 key cities will limit the number of land auctions, and large developers are expected to snap up land and gain market shares from the new bidding regulations.

- GOME Retail Holdings Ltd (493 HK) +14.98%, closing at HK$2.38. Peer company Suning (002024 CH) announced a capital restructure plan where top shareholders including the founder look to sell as much as one-quarter of the company. Market is expecting the previous king of retailer GOME to be revived.

- Cansino Biologics Inc (6185 HK) +10.95%, closing at HK$393. The company announced that, on February 25, 2021, the National Medical Products Administration has granted conditional marketing authorization for the Recombinant COVID-19 Vaccine, Ad5-nCoV in mainland China.

- Aluminium Corporation of China (2600 HK) +16.95%, closing at HK$4.14. Aluminium futures hit a 10-year high in China. The re-inflation expectation continues to be reinforced, which is a tailwind for commodities.

Singapore

- SPH (SPH SP) +4.7% to S$1.34 in early morning trade this morning on media reports that it could potentially see strong returns from its investment in South Korean e-Commerce firm Coupang. SPH had invested in Coupang in mid-2014 when it was valued at US$5 bn, while valuations have now increased to US$50 bn, implying a tenfold return. Coupang had filed to list on the New York Stock Exchange, and at its current valuations, would make it the largest listing by a foreign firm in New York since Alibaba’s 2014 IPO.

- Thomson Medical (TMG SP) +9.2% to S$0.119 yesterday and +1.7% to S$0.121 in morning trading today as it continues to be a favourite momentum play among traders. TMG’s share price has gained 143% over the past month and now has a market cap of nearly S$3.1 bn. There has also been an increase in trading activity of TMG’s warrants (W220424) which have an exercise price of S$0.11.

- AEM (AEM SP) +1.0% to S$4.12 in trading this morning, bucking the overall sell-off in the broader market, after it reported record sales and earnings for FY2020. Full-year FY2020 earnings surged 85% to S$98mn on the back of record revenue of S$519mn, an increase of 61% YoY. The company has proposed a final dividend of 4.0 SG cents, bringing total full-year dividend to 9.0 SG cents, representing a 77% YoY increase.

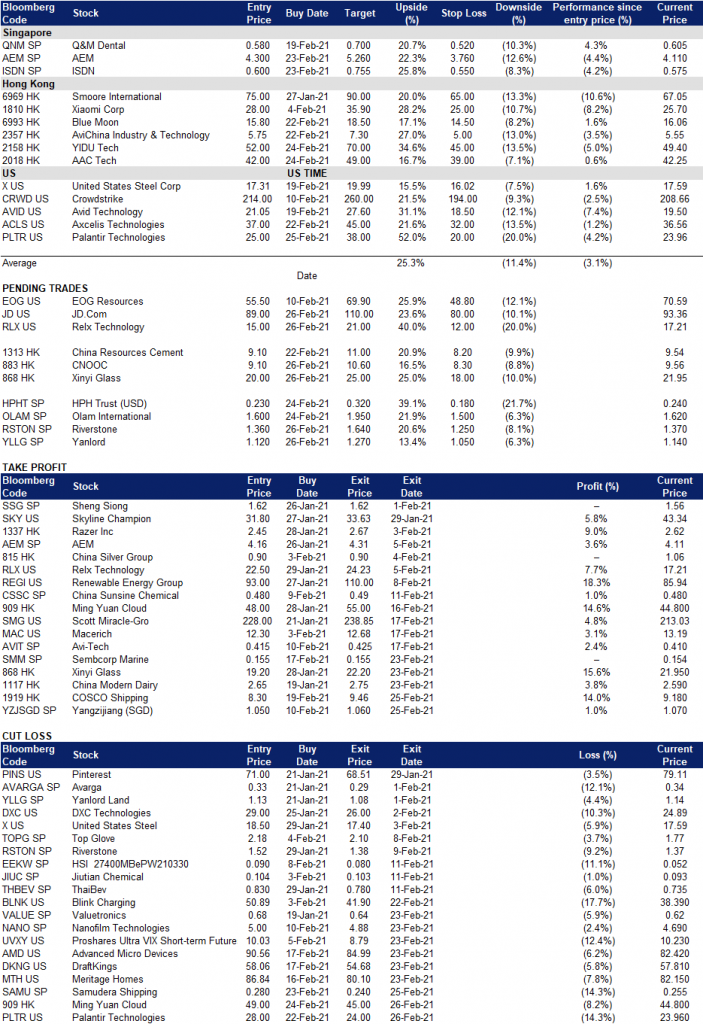

Trading Dashboard