KGI DAILY TRADING IDEAS – 25 October 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Mermaid Maritime (MMT SP): Oil price winner

- BUY Entry – 0.09 Target – 0.12 Stop Loss – 0.08

- MMT is a Thailand-based but SGX-listed company that provides drilling and sub-sea engineering services for the offshore & marine industry. The company’s subsea engineering segment services clients mainly in Southeast Asia and the Middle East. MMT is a 58% owned subsidiary of Thailand-listed Thorsen Thai Agencies.

- Dismal performance from 2014-2020. MMT’s share price has significantly underperformed the broader market since 2014 when oil prices collapsed due to oversupply from US shale production. This underperformance is not specific to MMT but cuts through the whole O&G sector, as investors have severely underweighted exposure to the sector.

- Oil’s on a roll. Ironically, the global push towards renewables is helping to lift oil prices higher. The decline in capex to replenish depleting oil wells, combined with massive stimulus policies to prop up the global economy, are creating a favourable environment for oil prices going into 2022. WTI crude futures are now trading above US$80 a barrel, the highest since 2014.

- New contracts are finally coming in. The company announced on 19 October that it had won contracts in Thailand, Angola and Saudi Arabia worth a total of US$120mn. The contracts consist of subsea construction, IRM, subsea wellhead cutting and removal in Thailand and Survey in Angola and multiple Cable Lay scopes and Sat Diving interventions with long standing clients in Saudi Arabia. We expect the company to win more such contracts on the back of the favourable oil price environment.

ThaiBev (THBEV SP): Reopening play #1

- REITERATE BUY Entry – 0.70 Target – 0.80 Stop Loss – 0.65

- ThaiBev is Thailand’s largest and one of Southeast Asia’s largest beverage companies. THBEV has a 28.5% stake in SGX-listed Fraser & Neave Ltd (FNN SP) and a 28.3% stake in Frasers Property Limited (FPL SP). It also has a 53.6% stake in Saigon Beer-Alcohol-Beverage Corporation (SABECO), Vietnam’s largest beer company. ThaiBev has a 90% market share of Thailand’s spirit market.

- Resilient. Despite the impact from Covid-19, ThaiBev still managed to eke out earnings growth of 9% YoY in 1H FY2021. This was mainly due to a combination of resilient spirits/beer sales and tight cost control measures. The company even raised 1H2021 interim dividend to 0.15 Bhat from 0.10 Bhat in the prior-year period, indicating management’s positive outlook.

- Thailand reopening. As ThaiBev derives 75% of FY2020 revenue from Thailand, the recently announced plans to open up the country to travellers should be taken as a positive sign. It is estimated that Thailand lost about US$50bn in tourism revenue in 2020, with the economy suffering its deepest contraction in more than 20 years. There were only 70,000 visitors in the first 8 months of 2021, compared to 40mn visitors for the full year 2019.

- Positive consensus estimates. Consensus has 19 BUYS and 1 HOLD on ThaiBev, with an average TP of S$0.82, implying a 30% upside potential from the last close price. Earnings are expected to recover 7-8% per annum over the next two years, which would bring its forward P/E down to 17x/15x/14x FY2021/22/23F. The resumption to list its BeerCo could provide a short-term upside catalyst.

HONG KONG

China Molybdenum Co., Ltd. (3993 HK): Fall in metals stockpile could be a buying opportunity

- Buy Entry – 5.1 Target – 6.0 Stop Loss – 4.6

- China Molybdenum Co., Ltd. is a China-based company, principally engaged in the mining, smelting, processing and trading of metals, such as molybdenum, tungsten and copper. The company operates its businesses through five segments. Its Molybdenum, Tungsten and Related Products segment is mainly engaged in the mining of molybdenum and tungsten. Its Copper, Gold and Related Products segment is mainly engaged in the mining of copper and gold. The Niobium and Related Products segment is engaged in the niobium manufacturing business. The Phosphorus segment is engaged in phosphate manufacturing business. The Copper and Cobalt segment is engaged in the production of Copper and Cobalt. The Company conducts its businesses mainly in China, Australia, Brazil and Congo.

- 1H21 operating revenue jumped by 81.45% YoY to RMB84.8bn. Net profit attributable to shareholders jumped by 139.0% YoY to RMB10bn. The stellar performance was due to the increases in both sales volumes and ASPs.

- Production guidance as of June 2021:

| Principal products | Production volume (tonnes) | |

| FY21F | 1H21 | |

| TFM copper metal | 187,300 – 228,900 | 98,149 |

| Cobalt metal | 16,500 – 20,100 | 7,010 |

| Molybdenum metal | 13,800 – 16,900 | 7,999 |

| Tungsten metal (excluding Yulu Mining) | 6,900 – 8,400 | 4,272 |

| Iron concentrates (65%) | NA | 144,950 |

| Niobium metal | 8,700 – 10,600 | 3,947 |

| Phosphate fertilizer (HA+LA) | 999,000 – 1,221,000 | 520,506 |

| NPM copper metal (80% equity interest of NPM) | 24,100 – 29,400 | 11,656 |

| NPM gold (80% equity interest of NPM) | 21,300 – 26,000 (ounces) | 9,643 (ounces) |

| IXM metal trading (sales volume) | ||

| Concentrate products | 4,790,000 – 5,850,000 | 1,303,955 |

| Refined metal products | NA | 1,844,022 |

- Ongoing economic recovery benefits the industrial sector. Industrial metals market remained buoyant after topping out over the past few months. The price rally was due mainly to the supply chain issues. With the gradual reopening of borders among major economies from 4Q21 onwards, the disruptions on the global supply chain are expected to be mitigated. In FY22, we expect to see normalization of production activities, and which will be positive for the supply and demand dynamics. However, inflation will still be the main theme in 2022. As long as basic metal prices stay afloat, the growth in production will help the extension of growth till next year.

- Short-term catalyst. As of 22th October Friday, the copper inventory in the mainstream Chinese markets dipped by 14,400 mt from Monday to 94,700 mt. The impact from the previous power shortage started to spill over to the stockpile of industrial metals. With the slowdown of production during winter in China, the metal shortage could result in a year-end rally in industrial metal prices.

- The consensus estimate per the 12-month target price is HK$7.16. EPS is forecasted to grow at 4.6%/7.4%/51.1% for FY2022/23/24F, which would bring forward FY2022/23/24F P/Es down to 17.2x/16.4x/15.3x.

Ping An Insurance (Group) Company of China, Ltd. (2318 HK): Opportunities in a crisis

- REITERATE BUY Entry – 60.4 Target – 66.5 Stop Loss – 57.7

- Ping An Insurance (Group) Company of China, Ltd. is a personal financial services provider. The Company provides insurance, banking, investment, and Internet finance products and services. The Company operates its businesses through four segments. The Insurance segment provides life insurance and property insurance, including term, whole-life, endowment, annuity, automobile and health insurance. The Banking segment is engaged in loan and intermediary businesses with corporate customers and retail business. The Assets management segment is engaged in security, trust and other assets management businesses, including investment, brokerage, trading and asset management services. The Internet Financing segment is engaged in the provision of Internet finance products and services.

- Systematic risks are controllable and avoidable. As one of the largest blue chip stocks in HKEX, Ping An shares have halved from the peak of HK$99.7 in January. Recently it bottomed out from the low of HK$48.05. The sell-off was due to the concerns over China’s real estate industry crisis as the authorities tightened the sector in every means from sales to financing. As of June, the company had RMB47bn in real estate investments. On 17th October, People’s Bank of China (PBOC) governor Yi Gang said the authorities can contain risks posed to the Chinese economy and financial system from the struggles of China Evergrande Group. Although the central government will not bail out Evergrande Group, it will contain the spillover towards banking and other financial sectors, according to the signals hinted by the top governors.

- Crisis is not over but sentiment has started to turn positive. The latest news was that Evergrande has won a more than three-month extension to the maturity of a US$260mn bond beyond 3rd October after agreeing to provide extra collateral. Ping An’s shares had high trading volumes at the price level of the low 50s, implying institutional investors could have collected cheap shares. Meanwhile, the company will be announcing its 3Q21 results on 27th October. Investors are expecting the management to address the issues of its real estate investments.

- Ping An is experiencing the HSBC moment. Investors should focus on the core business fundamentals of Ping An. Similar to HSBC whose shares were hammered during China-US trade tensions, Ping An’s shares once plunged to below book value, which had never happened since its listing. Negative sentiment pushed prices down to oversold levels. Ping An’s core business remains intact once the company writes off the impairments in poor real estate investments.

- Updated market consensus of the estimated net profit growth in FY21/22/23 is -11.7%/21.9%/11.7% respectively, which translates to 7.2x/5.9x/5.3x forward PE. The current PE is 6.7x. Bloomberg consensus average 12-month target price is HK$91.02.

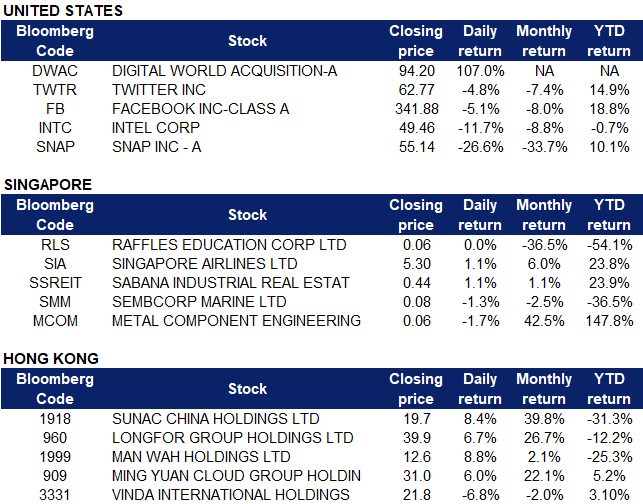

Market Movers

United States

- Shares of Snap Inc (SNAP US) plunged 26.59% after it reported quarterly results, with adjusted earnings per share at $0.17 vs. estimates of $0.08; revenue at $1.07 billion vs. $1.10 billion forecast; daily active users (DAUs) at 306 million vs. 301.8 million and average revenue per user (ARPU) at $3.49 vs. estimates of $3.67. CEO Evan Spiegel said that the iPhone’s privacy settings impacted Snap’s advertising business more than anticipated, “making it more difficult for our advertising partners to measure and manage their ad campaigns for iOS.” Snap CFO Derek Andersen also warned that between Apple’s privacy changes, supply chain interruptions and labor shortages, the company expects its 4Q revenue to come in between $1.16 billion and $1.20 billion, short of the $1.36 billion in revenue that analysts were expecting for the fourth quarter.

- Social Media stocks Facebook (FB US) and Twitter (TWTR US) fell 5.05% and 4.83% respectively following Snap’s remarks on the impact of Apple’s privacy changes. Technology companies have raised concerns over the privacy change known as ATT or App Tracking Transparency, which asks users through a pop-up if they want to opt-in for tracking. ATT was first introduced as a new feature in Apple’s iOS 14.5 updates in April 2021; when users open any app that wants to access a device ID called the Identifier for Advertisers, or IDFA, they will see a pop-up. The pop-up will ask if they want to be tracked and give them an opportunity to opt in. Critics say it will make it much harder for advertisers to track the effectiveness and profitability of targeted ads and possibly roil the online advertising business.

- Digital World (DWAC US), the SPAC through which Trump Media & Technology Group is going public, first made its gains on Thursdays following news of the former president forming a social-media company. Shares soared as much as 216% before closing 107.03% higher on Friday trading. The Trump entity will seek to “create a rival to the liberal media consortium” and to “fight back against the ‘Big Tech’ companies of Silicon Valley,” according to a press release circulating on Twitter. Within hours of the announcement, the site was defaced and knocked offline, according to reports.

- Intel (INTC US) shares declined 11.68% after the company announced third quarter results. Earnings per share were at $1.71 on sales of $18.1 billion compared to estimates of $1.11 a share on sales of $18.24 billion. Earnings rose 59% YOY while sales climbed 5%. The company cited weakness in the computing group that offset gains in its data center division for its decline in sales. Intel also said that its newer, faster chips would be less profitable in the early phase of their release, adding that profit margins would fall to between 51% and 53% over the next three years. CEO Pat Gelsinger told investors on a conference call that “we think all of our aggressive lean-ins right now are going to be handsomely rewarded in the marketplace, to our customers and to our shareholders over time.”

Singapore

- Raffles Education (RLS SP) shares soared as much as 19.7% after a three day trading halt was lifted on the stock. The company previously announced on Thursday that the Monetary Authority of Singapore (MAS) and the Commercial Affairs Department (CAD) have requested documents relating to loan facilities extended to its subsidiaries. The stock plummeted 26% on Monday trading, and tycoon Oei Hong Leong previously submitted a letter to the company asking why REC’s chief executive and founder Chew Hua Seng had caused the company to hire all “adult members of his family at high salaries”. Raffles Education provided exact figures on compensation to refute these allegations made by Oei. The stock closed 18.03% higher on Friday.

- Metal Component Engineering Ltd (MCOM SP) shares closed 1.72% lower on Friday, likely on profit taking. It was previously announced that the company’s subsidiary Gainhealth has signed a joint venture agreement (JVA) with MNR Food to establish a business developing and distributing clinical nutrition products through direct-to-consumer platform. The joint venture entity, Gain Foods, will be 60% owned by Gainhealth, with the remaining 40% owned by MNR. Gain Foods will be the marketer and distributor of products related to kids’ nutrition, seniors and weight wellness sub-segments products in various countries in Asia.

- Singapore Airlines (SIA SP) shares rose 1.15% to close at $5.30 on Friday. The company announced that the Airbus A380 will resume flying to Sydney from 1 December, as the carrier increases its capacity to the Sydney market ahead of the Christmas holiday period. Additionally, Australia is in the final stages of concluding a quarantine-free travel bubble with Singapore that could be established within next week.

- Sabana REIT (SSREIT SP) rose 1.15% on Friday. It was announced in a quarterly business update on Thursday that the Reit logged a portfolio occupancy of 85.3% as of 30 September, the highest level since 2018. The three-year high on occupancy was largely attributed to the Reit’s multi-tenanted properties with an occupancy of 90.7%, the highest in almost eight years. The Reit has also signed 90,600 sqft of new leases including with MNCs in the healthcare sector and cold chain logistics. Overall, rental reversion averaged at 11% for the first nine months of 2021.

- Sembcorp Marine (SMM SP) shares continued its losing streak, declining another 1.25% on Friday after the company issued a profit warning, saying that it expects to incur further losses in its 2HFY2021 ending 31st Dec, in addition to the $647 million loss it reported in its 1HFY2021 results. Despite making some progress in managing project completion delays, Sembcorp Marine said in its announcement that shareholders should note that COVID-19 related measures continue to have a serious impact on the Group’s performance.

- Notable share buybacks for the week: SGX, Hongkong Land, Jardine Matheson, Broadway Industrial, ST Engineering, UOB

Hong Kong

- Sunac China Holdings Ltd (1918 HK), Longfor Group Holdings Ltd (960 HK). Sunac’s shares gained 8.4% on Friday, extending its price rally since Thursday, while Longfor’s shares rose 6.7%. Chinese property stocks rallied following a surprise interest payment announced by debt-ridden property developer China Evergrande Group on Friday. In addition, China sought to allay fears of contagion of the property market, which spooked global markets earlier. The People’s Bank of China has said more than once that Evergrande is an individual, controllable case. In addition, central bank governor Yi Gang said on Wednesday that the first measure of response is to prevent Evergrande’s risks from spreading to other real estate companies. China Evergrande Group Ltd (3333 HK) rose 4.3% on Friday.

- Man Wah Holdings Ltd (1999 HK). Shares rose 8.8% yesterday. Man Wah Holdings is a leading manufacturer of upholstered furniture.From January to September, the cumulative floor space of houses completed increased 23.4% YoY and the cumulative floor space of commercial housing sold increased 11.3% YoY. During the period, household consumption maintained a relatively high growth under the influence of a low base and software online retail sales increased significantly. The company’s revenue from sofas and ancillary products accounted for more than 70%. From the perspective of recent policies, Q4 real estate credit may improve marginally, driving the industry’s prosperity. In the medium and long term, as the sales of new homes slow down, the demand for subsequent stock renovations will continue to increase in the proportion of furniture C-end consumption.

- Ming Yuan Cloud Group Holdings Ltd (909 HK). Shares rose 6% on Friday, in tandem with the property sector. Mingyuan Cloud is the largest real estate developer software solution provider in China. Its main business includes SaaS products and ERP solutions. The company has achieved stable cooperation with 96 of the top 100 real estate companies, and the total number of cooperative developers has reached 5,200. From 2017 to 2020, the company’s total revenue has shown a rapid growth trend, with a CAGR of 43.3%, and a gross profit margin of around 80%. In the first half of this year, the company achieved revenue of RMB 974mn, representing a YoY increase of 45.2% and adjusted net profit of RMB 194mn, representing a YoY increase of 32.7%.

- Vinda International Holdings Ltd (3331 HK). Shares declined 6.8% on Friday after the company announced its earnings on Thursday after hours. Even though in the first three quarters of 2021, the company’s total revenue increased 15.1%YoY to HK$ 13.2bn, gross profit margin fell by 1.4 percentage points to 36.6%. Operating profit narrowed by 13.1% to RMB 1.565bn, and operating profit margin fell by 3.8 percentage points to 11.9%.

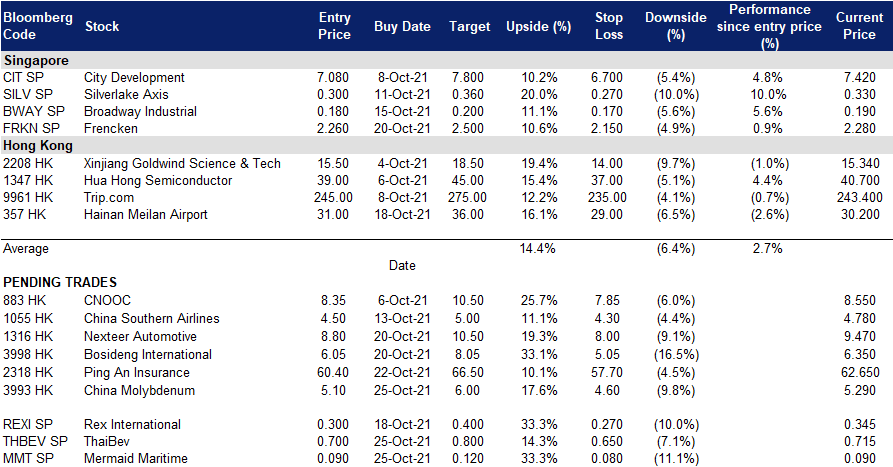

Trading Dashboard

Related Posts: