25 February 2022: Rex International Holdings Ltd (REXI SP), China Oilfield Services Limited (2883 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Rex International Holdings Ltd (REXI SP): Brent finally above US$100

- RE-ITERATE BUY Entry – 0.39 Target – 0.50 Stop Loss – 0.35

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

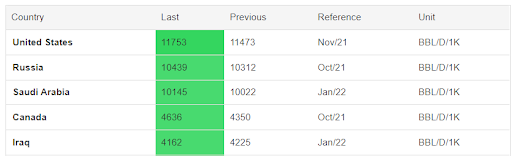

- Oil prices to the moon. Brent rose above US$100 per barrel after Putin ordered an attack on Ukraine. The introduction of sanctions by the US and Europe will complicate matters given that Russia is the largest provider of gas in Europe, and about a third of which usually travels through pipelines across Ukraine. More importantly, based on the latest production figures, Russia is the second largest oil producer in the world after Russia.

- Tightening an even together market. Even without the prospect of war, oil supply challenges among exporting countries still threaten to increase the tightness in oil markets and may continue to push prices higher, according to the International Energy Agency.

- Earnings watch. Rex is due to report its full year results on Friday, 25 February 2022. This set of earnings will be closely watched as it will include contributions from the Brage Field in Norway that Rex acquired in 2021.

Oil production by country, Top 5 producers (‘000 barrels per day)

First Resources (FR SP): Palm oil prices are also on a hot streak

- RE-ITERATE BUY Entry – 1.74 Target – 1.90 Stop Loss – 1.66

- Established in 1992 and listed on the SGX since 2007, First Resources is one of the leading palm oil producers in the region, managing over 200,000 hectares of oil palm plantations across the Riau, East Kalimantan and West Kalimantan provinces of Indonesia. The group’s core business activities include cultivating oil palms, harvesting, and milling them into crude palm oil (CPO) and palm kernel (PK). In addition, the group through its refinery, fractionation, biodiesel and kernel crushing plants, processes its CPO and PK production into higher value palm-based products such as biodiesel, refined, bleached and deodorised (RBD) olein and RBD stearin, palm kernel oil and palm kernel expeller.

- Palm oil prices are at all-time highs, again. Malaysian palm oil futures exceeded RM7,000 to trade at all-time highs again on Thursday, as concerns over the tensions in Ukraine spilled over into the broader commodity market. On a fundamental level, palm oil supply-demand dynamics remains favourable going into 2022. In addition to supply constraints in Indonesia and Malaysia, the two largest producers, palm oil prices have been buoyed by higher prices of alternatives such as soybean due to yield losses in drought-hit South America.

- Strong 4Q2021 earnings. FR reported its FY2021 results today. FY2021 net profit surged 62% YoY to S$161mn on the back of a 56% increase in sales, driven by a combination of higher average selling prices and stronger sales volume. Balance sheet is rock solid with net gearing ratio at 0.02x and cash & bank balances at US$382mn as at end Dec-2021.

- Higher dividend. The group declared a final dividend of 5.10 Sing cents, bringing full-year ordinary dividend to 6.45 Sing cents, representing 50% of underlying net profit.

- Positive outlook. The group expects the global vegetable oil supplies to remain tight in the tearn-term due to negative impact of weather and the shortages of labour at the Malaysian palm oil plantations. Furthermore, supply is also impacted by the Domestic Market Obligation (DMO) policy by Indonesia requiring palm oil exporters to sell 20% of their export volumes domestically at a stipulated price.

PALM OIL FUTURES (KO1)

HONG KONG

China Oilfield Services Limited (2883 HK): Three-digit oil prices finally came

- BUY Entry – 8.5 Target – 9.5 Stop Loss –8.0

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- The Black Swan event eventually happened. Russian forces attacked targets across Ukraine after President Vladimir Putin ordered an operation to “demilitarize” the country. Oil prices surged to the high back in August 2014. Brent and WTI arrived at above US$100/bbl. Beforehand, the US and the allies imposed sanctions on Russia, pushing commodities prices (crude oil and agricultural products) to new highs.

- Inflation shall go higher in the near term. The US, Europe, and China released their inflation data recently, showing that inflation pressure is still high. Oil and gas is a good hedging against inflation or stagflation amidst the rate hike cycle. The soaring oil price will gradually pull some investments back in the sector given clean energy investment is overheated at the moment.

- The updated market consensus of the EPS growth in FY22/23 is 34.6%/19.3% YoY respectively, which translates to 10.6x/8.9x forward PE. Current PER is 17.1x. Bloomberg consensus average 12-month target price is HK$9.93.

Alibaba Group Holding Ltd (9988 HK): Unfavourable 3Q21 results

- RE-ITERATE BUY Entry – 100 Target – 125 Stop Loss – 90

- Alibaba Group Holding Ltd is a holding company that provides the technology infrastructure and marketing reach to help merchants, brands and other businesses to leverage the power of new technology to engage with users and customers to operate. The Company operates four business segments. The Core Commerce segment provides China retail, China wholesale, International retail, International wholesale, Cainiao logistics services and local consumer services through Taobao Marketplace and Tmall. The Cloud Computing segment provides complete suite of cloud services, including database, storage, network virtualization services, big data analytics and others. The Digital Media and Entertainment segment provides consumer services beyond the core business operations. The Innovation Initiatives and Others segment is to innovate and deliver new services and products.

- Headwinds or noises. The recent negative news for the e-commerce giant was a fresh round of checks on state-owned companies and banks regarding the financial exposure to Ant Group. As Alibaba owns about one-third of Ant, the shares were sold down again owing to the concerns of another new round of crackdown which could result in some headwinds.

- Technology re-rating amidst the rate hike cycle. The worst start of 2022 for the US market was driven by the Federal Reserve’s more aggressive than expected rate hike and balance sheet reduction. Technology companies’ shares have been hammered and under selling pressure. However, Chinese technology peers have already re-rated due to policy and geopolitical risks. Comparatively, Chinese companies are less impacted by the sell-off given that downside is limited. YTD, China has recorded more ETF fund inflows than the US.

- Growth is the anchor for valuation. Investors have been averaging down into BABA’s shares since its downturn in 2021 given cheap valuations. We use PEG as a simple valuation metric. Based on Bloomberg estimates, BABA EPS is expected to drop by 20.64% YoY in FY22 and rebound by 13.0% YoY in FY23. Its FY23F PER is at 12.35x. The PEG is about 0.95x, which is lower than the US big tech giants’ averages of between 1.0x and 2.0x.

- 3Q22 earnings showed mixed signals. 3Q22 Non-GAAP EPS of RMB16.87 beat by RMB0.82. Revenue of RMB242.58bn grew by 9.7% YoY, missing by RMB3.21B. The top-line growth was the lowest in 8 years. The updated market consensus of the EPS growth in FY22/23 is -21.23%/12.4% YoY respectively, which translates to 12.9x/11.6x forward PE. The current PER is 14.6x. Bloomberg consensus average 12-month target price is HK$188.89.

MARKET MOVERS

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Packaged Software | +5.5% | Why megacap stocks rallied after Russia invaded Ukraine Microsoft (MSFT US) |

| Homebuilding | +4.8% | Homebuilding Market Flourishing Despite All Odds: 4 Winners D.R. Horton (DHI US) |

| Semiconductors | +2.8% | AMD, Nvidia to benefit as GPU market ‘still early in upgrade cycle’: BofA Nvidia (NVDA) |

Top Sector Losers

| Sector | Loss | Related News |

| Coal | -6.9% | Energy prices fall back to earth as Russian sanctions make room for exports Peabody (BTU US) |

| Major Banks | -3.3% | 10-year Treasury yield cuts losses but still below 2% JP Morgan (JMP US) |

| Precious Metals | -2.3% | XAU/USD pullback to $1910, opportunity to buy? Barrick Gold (GOLD US) |

- Moderna Inc (MRNA US) shares surged 15.1% yesterday after reporting better-than-expected results for the fourth quarter. The biotech company earned an adjusted $11.29 per share on $7.2 billion of revenue. Analysts surveyed by Refinitiv were expecting $9.90 in earnings per share on $6.78 billion of revenue. Bancel told CNBC on Thursday that the world may be moving out of the pandemic phase as the omicron wave subsides in the U.S. and around the world. However, Bancel said people will need booster shots in the fall, particularly individuals over 50 and those with underlying conditions.

- Salesforce.com Inc (CRM US), Microsoft Corp (MSFT US), Advanced Micro Devices (AMD US). Tech sector shares rebounded yesterday as investors shook off Russia’s invasion of Ukraine. Stocks rose broadly on Thursday, staging a massive comeback from steep declines seen earlier in the day, as investors looked past Russia’s attack on Ukraine. The S&P 500 rose 1.5% to 4,288.70 after dropping more than 2.6% earlier in the session. Despite the stunning reversal, the S&P 500 remains in correction territory — more than 10% off its Jan. 3 record close. The Nasdaq Composite opened in bear market territory on Thursday, down more than 20% from its record high in November, before bouncing off those levels. The Nasdaq still sits about 16% from its all-time high, however.

- Booking Holdings Inc (BKNG US) shares lost 7.1% yesterday after the company warned that there will be periods this year when the pandemic negatively impacts travel demand. Its warning came as Booking Holdings reported adjusted quarterly earnings of $15.83 per share, well above the $13.64 consensus estimate, according to Refinitiv. Its revenue also topped Wall Street forecasts.

Singapore

- RH Petrogas Ltd (RHP SP) and Rex International Holding Ltd (REXI SP) shares rose 11.7% and 4.8% respectively yesterday. WTI crude futures jumped more than 8% to above $100 per barrel yesterday, a level not seen since 2014, while Brent crude futures hit $100 per barrel for the first time since September 2014. President Vladimir Putin announced that Russia would launch a military operation in Ukraine, with explosions being reported in Kyiv. Markets have been wary of escalating tensions in Eastern Europe for weeks now, amid fears that a major conflict could disrupt energy flows and provoke crippling sanctions.

- MM2 Asia Ltd (MM2 SP) shares surged 10.9% yesterday after announcing that it will be raising $19.5 million from two prominent businessmen, Sam Goi Seng Hui and Oei Hong Leong. The company is placing 390 million new shares at 5 cents each, with Goi and Oei each taking up half the shares. Upon completion of the placement, they will each hold 7.18% of the company. The placement will help improve the company’s net tangible asset value per share from a negative 3.39 cents per share, as at March 31 2021, to a pro forma basis of negative 2.18 cents per share.

- Bumitama Agri Ltd (BAL SP) shares extended their rally and gained 2.9% yesterday. Malaysian palm oil futures skyrocketed to an all-time high of MYR 6,354 a tonne in the last week of February and are now up more than 30% since the beginning of 2022. Robust demand and supply constraints have been driving prices higher, while the Russia- Ukraine war lifted crude oil prices and boosted the appeal of vegetable oils. The Malaysian Palm Oil Board estimated the country’s production in February fell 1.79% from the previous month, with exports rising faster than its output. Meanwhile, Indonesia, the world’s top producer, started requiring producers to sell 20% of their planned exports to the domestic market.

- Oversea-Chinese Banking Corp Ltd (OCBC SP) shares extended their losses and declined 4.5% yesterday after missing earnings expectations. OCBC’s net profit fell to S$973 million in October to December last year from S$1.13 billion a year earlier, versus the S$1.18 billion average of four analyst estimates compiled by Refinitiv. OCBC said last month that a total of S$13.7 million was lost in a phishing scam involving the bank, up from the S$8.5 million reported in December 2021. “Looking ahead, we are cautiously optimistic that the operating environment will improve,” Group CEO Helen Wong said in a statement.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Precious Metal | +1.55% | Breaking: Gold Price soars to $1,974, its highest since September 2020 Shandong Gold Mining Co Ltd (1787 HK) |

| Petroleum & Gases Equipment & Services | +0.59% | Oil tops $105 after Russia attacks Ukraine China Oilfield Services Limited (2883 HK) |

| Alcoholic Drinks & Tobacco | +0.28% | NA Budweiser Brewing Company APAC Ltd (1876 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Software | -4.40% | Russian forces invade Ukraine with strikes on major cities SenseTime Group Inc. (20 HK) |

| E-Commerce & Internet Services | -3.54% | Alibaba Group Holding Ltd (9988 HK) |

| Biotechnology | -3.48% | Sirnaomics Ltd (2257 HK) |

- United Energy Group Ltd (467 HK) and Petrochina Co Ltd (857 HK) shares rose 5.4% and 3.4% respectively yesterday. WTI crude futures jumped more than 8% to above $100 per barrel yesterday, a level not seen since 2014, while Brent crude futures hit $100 per barrel for the first time since September 2014. In addition, natural gas futures rose more than 5% to a three-week high of $4.9 per million British thermal units yesterday. President Vladimir Putin announced that Russia would launch a military operation in Ukraine, with explosions being reported in Kyiv. Markets have been wary of escalating tensions in Eastern Europe for weeks now, amid fears that a major conflict could disrupt energy flows and provoke crippling sanctions. Meanwhile, frigid weather continued to move across most of the US, boosting gas demand for heating.

- Budweiser Brewing Company APAC Ltd (1876 HK) shares rose 4.8% yesterday, after the company announced its financial results. In 2021, the company reported revenue of US$6.788 billion, a YoY increase of 14.9%, while normalised profit before interest, tax, depreciation and amortisation was US$2.139 billion, a YoY increase of 27.3%. Budweiser’s market share expanded by 80 basis points in FY2021 and 24 basis points from FY2019. Budweiser Asia Pacific said that this is primarily due to the drive of Budweiser and Budweiser Gold, which has achieved double-digit growth in both existing and expanding markets. Secondly, Harbin Beer has achieved a consumption upgrade from core and affordable brands to core + brands, bringing high single-digit sales growth to the brand.

- Shandong Gold Mining Co Ltd (1787 HK) and Zhaojin Mining Industry Company Limited (1818 HK) shares rose 4.4% and 2.4% respectively. Gold broke through $1,970 yesterday, a level not seen since September 2020, as safe-haven demand for the metal jumped after President Putin launched a military operation in Ukraine. Putin warned other countries that any attempt to interfere with the Russian action would lead to “consequences they have never seen.” Meanwhile, investors are also kept an eye on accelerating inflation and ensuing rate hikes from the Federal Reserve. Fed governor Michelle Bowman said she would assess incoming data to decide whether a half percentage point increase at the March meeting is needed.

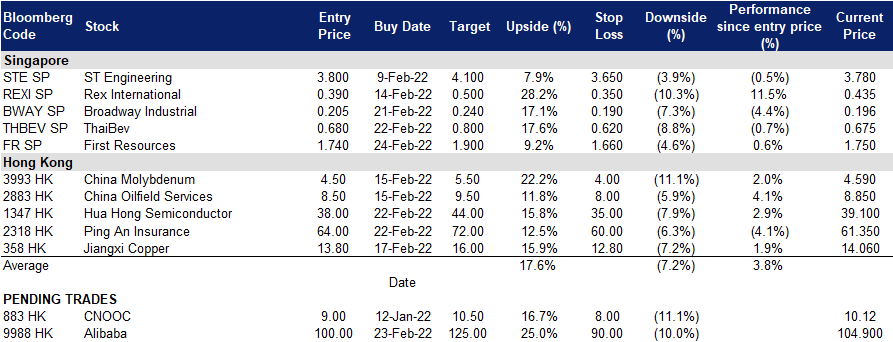

Trading Dashboard

Trading Dashboard Update: Added First Resources (FR SP) at S$1.74. Cut loss on The Hour Glass (HG SP) at S$1.94.

(Click to enlarge image)