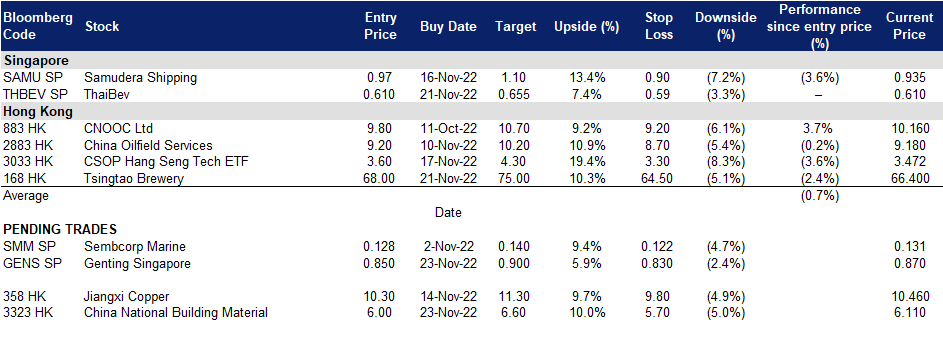

23 November 2022: Genting Singapore Ltd (GENS SP), China National Building Material Company Limited (3323 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Genting Singapore Ltd (GENS SP): The year-end holiday season coming

- BUY Entry – 0.85 Target – 0.90 Stop Loss – 0.83

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index. The principal activities of Genting Singapore and its subsidiaries are in developing, managing and operating integrated resort destinations including gaming, hospitality, MICE, leisure and entertainment facilities.

- Pent-up demand for travel. Singapore’s international visitor arrivals rose for the ninth straight month, since the start of the pandemic, hitting a record of 816,758 tourists in October, according to the Singapore Tourism Board’s latest figures. Genting Singapore owns and operates Resorts World Sentosa (RWS) Integrated Resort which comprises six luxury hotels, a world-class convention centre, Universal Studios Singapore, a casino, and the S.E.A Aquarium and Adventure Cove waterpark. With more tourists coming to Singapore, RWS is a location that they are sure to visit as it consists of some main attractions in Singapore.

- Loosening of restrictions. Additionally, with the relaxation of Covid restrictions, more locals are able to visit RWS for a day of fun or even stay for a weekend. Furthermore, large-scale events such as international conferences and Halloween Horror Nights can once again be held with the loosened safe management measures and increased operating capacity.

- RWS 2.0 expansion. Genting Singapore’s $4.5 billion mega expansion of RWS is proceeding expeditiously as planned. RWS will add two new zones to Universal Studios Singapore – Minion Park and Super Nintendo World – as well as a new oceanarium. The Oceanarium will be three times the size of the SEA Aquarium and encompass a research and learning centre. RWS will also refurbish the Hard Rock Hotel Singapore, Hotel Michael and Festive Hotel, which have around 1,200 rooms in all, in phases from the second quarter of 2022 through 2023. Festive Hotel will be refashioned into a business-leisure and work-vacation hotel, while the Resorts World Convention Centre will be refurbished.

- 3Q22 results. Genting reported a significant improvement in its 3Q results ended in September. For the period, earnings reached $135.8 million, versus $60.7 million in the year-earlier; revenue in the same quarter was $519.7 million, more than double $251.5 million in 3QFY2021, led by increases in both gaming and non-gaming revenue. Non-gaming revenue soared 144.3% YoY to S$137.3 million.

- Updated market consensus of the EPS growth in FY22/23 is 92.9%/58.9% YoY respectively, which translates to 30.0x/18.5x forward PE. Current PER is 58.5x. Bloomberg consensus average 12-month target price is S$0.96.

(Source: Bloomberg)

Thai Beverage PCL (THBEV SP): An SG-listed FIFA World Cup-themed stock

- RE-ITERATE BUY Entry – 0.610 Target – 0.655 Stop Loss – 0.590

- Thai Beverage Public Company Limited is Thailand’s largest and leading beverage producer and distributor. Its operation is considered among the leading distillers and brewers and in Southeast Asia. ThaiBev’s leading products include a variety of well-established spirits brands, including its famous brew Chang Beer. In the non-alcoholic beverage category, key products include water, tonic soda, energy drink, ready-to-drink coffee and green tea.

- FIFA World Cup. With the FIFA World Cup happening from 20 Nov to 18 Dec, many football fans will have their eyes on the 64 matches among 32 qualified national teams, streamed globally. Many fans enjoy drinking while watching the games streamed over live television. During this FIFA season, alcohol sales are expected to rise as fans go to various establishments to watch the matches.

- Relaxed Covid measures. With the relaxation of Covid-19 measures globally, there has been an increase in social activity, leading to an increase in the consumption of both alcoholic and non-alcoholic drinks. Nightlife has also resumed, contributing to the increase in the consumption of beverages.

- Consumer staple. Their extensive beverage range ensures that there is still demand for their products despite inflation. Consumers will still purchase their products but maybe in smaller quantities as compared to before.

- 3Q22 results. Their nine months sales revenue increased 8.2% YoY to BAHT207,922M and EBITDA rose 6.7% YoY to BAHT39,110M.

- Updated market consensus of the EPS growth in FY22/23 is 14.85%/6.23% YoY respectively, which translates to 14.5x/13.7x forward PE. Current PER is 15.4x. Bloomberg consensus average 12-month target price is S$0.83.

(Source: Bloomberg)

China National Building Material Company Limited (3323 HK): Infrastructure expansion to revive growth

- Buy Entry – 6.0 Target – 6.6 Stop Loss – 5.7

- China National Building Material Company Limited is an investment holding company. The Company operates its business through four segments. The Cement segment is mainly engaged in the production and sale New Suspension Preheater (NSP) cement and commercial concrete. The Lightweight Building Materials segment is mainly engaged in the production and sale of dry wall and ceiling system. The Glass Fiber and Composite Materials segment is engaged in the production and sale of rotor blades, glass fiber and composite materials. The Engineering Services segment is engaged in the provision of engineering services to glass and cement manufacturers, as well as equipment procurement business.

- Resort to the most effective growth driver to restart China’s economic growth. China is suffering from another wave of Covid cases spike right now. Even though the central government relaxed some of the Zero Covid measures, the restrictive lockdowns are back in the high-risk regions. Accordingly, the slowdown in economic growth is expected to extend throughout 4Q22. The softness in domestic consumption, fixed asset investment, and exports will not turn in the near term, and the last resort is government spending. Previously, the authority had announced 16 measures to support the property market. Once the winter season is gone and the Covid outbreak tapers, construction projects will resume. In a nutshell, infrastructure is the main driver for China to revive economic growth.

- 3Q22 earnings review. 9M22 total operating revenue decreased by 13.1% YoY to RMB171.3bn. Net profit attributable to the owners of the company decreased by 48.5% YoY to RMB7.0bn. The fall of performance reflected the slowdown in infrastructure development due mainly to lock-down measures.

- The updated market consensus of the EPS growth in FY22/23 is -34.1%/22.9% YoY, respectively, translating to 4.4×/3.6x forward PE. FY22F/23F dividend yield is 7.4%/9.6% respectively. The current PER is 3.44x. Bloomberg consensus average 12-month target price is HK$9.18.

(Source: Bloomberg)

Tsingtao Brewery Company Limited (168 HK): FIFA World Cup begins

- Buy Entry – 68.0 Target – 75.0 Stop Loss – 64.5

- Tsingtao Brewery Company Limited, together with its subsidiaries, engages in the production, distribution, wholesale, and retail sale of beer products worldwide. The company sells its beer products primarily under the Tsingtaoand and Laoshan brand names. It also provides wealth management, and agency collection and payment services; and financing, construction, and logistics services, as well as technology promotion and application services.

- FIFA World Cup Qatar 2022 kick started. The once in every four years FIFA World Cup is going to take place from November to December 2022. This is the largest global sports event after the Tokyo Olympic Games, and it is expected to attract a record high of spectators as most countries have eased COVID restrictions. Accordingly, it will stimulate sales of alcohol and other drinks. The beer feast will take place during the world cup period.

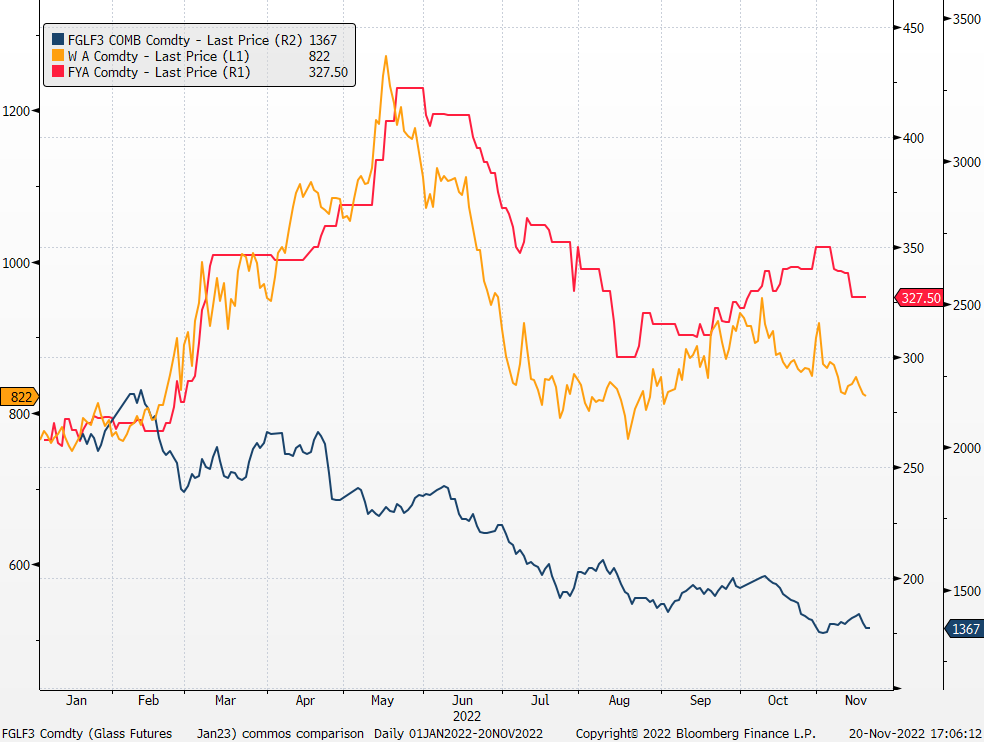

- Raw materials prices pulling back. After a short-term price rebound of beer’s key raw materials such as wheat and barley, both started to fall in November. So did the key packing material like glass. Moving forward, the company’s profit margins will gradually improve with inflation tapering.

Key raw materials prices performance

*Blue line: Glass (RMB/tonne), orange line: wheat (USD/bushel), red line: barley (AUD/tonne)

(Source: Bloomberg)

- 3Q22 earnings review. 3Q22 revenue grew by 16.0% YoY to RMB9.8bn. 3Q22 net profit attributable to shareholders of the company grew by 18.4% YoY to RMB1.4bn. 9M22 revenue grew by 8.7% YoY to RMB29.1bn. 9M22 net profit attributable to shareholders of the company grew by 18.2% YoY to RMB4.3bn.

- The updated market consensus of the EPS growth in FY22/23 is 19.7%/15.2% YoY, respectively, translating to 25.8×/22.4x forward PE. The current PER is 22.4x. Bloomberg consensus average 12-month target price is HK$86.69.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Precious Metals | +3.94% | Gold Price Forecast: XAU/USD steadily climbs to $1,750 level amid broad-based USD weakness Newmont Corp (NEM US) |

| Oil Refining/Marketing | +3.76% | Oil rises 1% as OPEC+ focus on supply cuts outweighs recession concerns Marathon Petroleum Corp (MPC US) |

| Apparel/Footwear Retail | +3.76% | S&P closes at more than two-month high on retail, energy lift TJX Companies Inc (TJX US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Coal | +6.86% | China coal output increases in October China Shenhua Energy Co Ltd (1088 HK) |

Infrastructure | +2.13% | World Cup venue, site of final match, built by China Railway Construction China Railway Group Ltd (390 HK) |

Telecomm. Services | +1.48% | China telecom giants win more subscribers China Mobile Ltd (941 HK) |

Top Sector Losers

Sector | Loss | Related News |

Biotechnology | -4.14% | Hong Kong stocks lead losses as China Covid cases rise; Asia markets mixed WuXi Biologics (Cayman) Inc (2269 HK) |

Medicine | -2.11% | JD Health International Inc (6618 HK) |

Property Management & Agency | -2.01% | KE Holdings Inc(2423 HK) |

Trading Dashboard Update: Take profit on Sembcorp Industries (SCI SP) at S$3.2. Cut loss on Bumitama Agri (BAL SP) at S$0.59.