22 April 2022: Bumitama Agri Ltd (BAL SP), Xinte Energy Co Ltd (1799 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Bumitama Agri Ltd (BAL SP): Palm oil prices on another run

- BUY Entry – 0.83 Target – 0.88 Stop Loss – 0.80

- Bumitama Agri Ltd is an Indonesia-based producer of crude palm oil and palm kernel with oil palm plantations and mills located in three provinces of Indonesia, namely Central Kalimantan, West Kalimantan and Riau. Its primary business activities are cultivating and harvesting oil palm trees, processing fresh palm fruit bunches from its oil palm plantations, plasma plantations and third parties into crude palm oil and palm kernel, and selling crude palm oil and palm kernel.

- Outstanding FY21 financials. Revenue rose 34.6% to IDR 12,248,630mn in FY21 while gross profit rose 36.8% to IDR 3,456,655mn. Gross profit margin improved marginally by 0.4ppts to 28.2% in FY21, compared to 27.8% in FY20. Overall bottom-line grew 53.4% to IDR 2,089,377mn in FY21.

- Russian-Ukraine war a push to commodity prices. Against an already turbulent backdrop of global inflationary pressures amid rising food and energy prices and disrupted supply chains following the coronavirus pandemic, the war between Russia and Ukraine is exacerbating supply and demand tensions, damaging consumer sentiment and is threatening global economic growth. Palm oil prices spiked to slightly above $8000 in the beginning of March 2022 and even though prices have corrected, they remain well above 2021 levels.

- Recent catalyst of palm oil prices. Cargill Inc., one of the world’s biggest agricultural traders, stopped buying palm oil products from Sime Darby Plantation Bhd. after the U.S. said it found indicators of forced labour in the Malaysian grower.

- Cargill has suspended all new sourcing of palm oil and derivative products from Sime Darby since Feb. 25, the world’s biggest oil palm planter by acreage said in an emailed response to questions. Positive consensus estimates. Bumitama Agri currently has a positive consensus estimate of 4 BUYS, 0 HOLD and 0 SELL, with a 12M TP of S$0.93.

Generic 1st Crude Palm Oil (K01 Comdty)

Bumitama Agri Ltd (BAL SP) (Source: Bloomberg)

Golden Energy and Resources (AUE SP): Higher highs

- RE-ITERATE BUY Entry – 0.68 Target – 0.75 Stop Loss – 0.64

- Disclaimer: KGI Securities (Singapore) was the placement agent for Golden Energy and Resources’ S$86.9mn private placement that was completed on 7 March 2022.

- Diversified resources play. GEAR is a diversified mining and natural resources investment company. Having its roots as one of Indonesia’s largest coal miners, the group is on track to become the dominant metallurgical coal player in Australia with the acquisition of Mitsui Coal Pty Ltd (BMC) from BHP Group (BHP AU). GEAR will further diversify into base metals that will be utilised for clean energy uses such as copper, cobalt, zinc and nickel.

- Transformational year. Golden Energy & Resources (GEAR) is on track to significantly expand its production capacity and profits with the acquisition of BHP Mitsui Coal Pty Ltd (BMC). The acquisition will cement GEAR, through its ASX-listed Stanmore subsidiary, as a major metallurgical coal (coking coal) provider in the region. Metallurgical coal is the key ingredient in the steel industry, whose demand is driven by China now and India in the future.

- Primary beneficiary of Russia coal ban. Last week, the European Union, UK and Japan announced plans to phase out imports of coal from Russia, leaving power utilities to source from other countries such as Indonesia and Australia. Russia is the world’s third largest exporter of thermal coal, with the EU, UK, Japan and South Korea taking about 55% of those deliveries in 2020, according to data provided by BloombergNEF.

- Technical TP of S$0.75; fundamental TP of S$1.29. While we have a Technical TP of S$0.75 based on short-term technical factors, we maintain our fundamentals-based TP of S$1.29. Our fundamental TP is based on the SOTP valuation of its majority stakes in Stanmore Resources (metallurgical coal), PT Golden Energy Mines (thermal coal) and Ravenswood Gold (gold). Stanmore will increasingly drive GEAR’s valuations, which currently makes up 48% of GEAR’s fair value, while GEMS drops to 42% of our fair value, down from 85% in our initiation report (25 Aug 2021). Read the full fundamentals-based report here.

Golden Energy and Resources (AUE SP) (Source: Bloomberg)

HONG KONG

Xinte Energy Co Ltd (1799 HK): A way to sustainable development

- BUY Entry – 16 Target – 18 Stop Loss – 15

- Xinte Energy Co., Ltd. is an investment holding company principally engaged in the provision of solar energy and wind power solutions. The Company operates through seven segments. Polysilicon Production segment is engaged in the production and sales of polysilicon. Engineering and Construction Contracting (ECC) segment is engaged in the provision of ECC services for solar energy plants and wind power plants. Inverter Manufacturing segment is engaged in the manufacture of inverters. Sales of Electricity segment is engaged in the generation and sales of electricity. Photovoltaic (PV) Wafer and Module Manufacturing segment is engaged in the manufacture and sales of PV wafers and modules. Build-Own-Operate (BOO) segment is engaged in the building and operation of solar energy plants and wind power plants. Others segment is engaged in related trading businesses and the provision of design and logistics services.

- High oil prices are tailwins for renewable energy. The Russia-Ukraine conflict results in unprecedented sanctions on Russia which is a main crude oil exporter. The unexpected widening supply gap of 4mn bbl/d boosted oil prices to 2014 highs. Europe and the US are rushing to secure alternative sources of supply and ramp up domestic oil output amidst the looming energy crisis. Meanwhile, the situation will also accelerate the deployment of renewable energy supply, especially solar. Photovoltaic sector is expected to revive after months of correction. The concerns over potential sanctions on China photovoltaic companies should be relieved as the US priorities reining in inflation by increasing energy supplies at the moment.

- Proposal of application and offering of infrastructure REITs. Previously, the company announced to consider to use the wind power and photovoltaic power generation operation projects owned by Hami Huafeng New Energy Power Generation Co., Ltd. and Hami Fengshang Power Generation Co., Ltd., which are wholly-owned subsidiaries of TBEA XINJIANG SUNOASIS CO., LTD., as the infrastructure assets for the application and offering of the Publicly Traded Infrastructure REITs.

- Positive FY21 earnings alert. Net profit attributable to shareholders of the company is expected to be no less than RMB5.0bn compared to RMB0.7bn in FY20. The increase in the Group’s profit is mainly due to the increase in sales volume of polysilicon products, the significant increase in the sales price of polysilicon products, as well as the increase in the scale and power generation volume of the group’s self-operated wind power and photovoltaic power plants. The company will be announcing 1Q22 earnings on 22th April Friday.

- Updated market consensus of the EPS growth in FY22/23 is 30.4%/-18.9% YoY respectively, which translates to 2.8x/3.4x forward PE. Current PER is 3.7x. FY22F/23F dividend yield is 9.2%/6.1%. Bloomberg consensus average 12-month target price is HK$27.08.

Xinte Energy Co Ltd (1799 HK) (Source: Bloomberg)

Samsonite International S.A. (1910 HK): Travelling spree this summer vacation

- RE-ITERATE BUY Entry 17 – Target – 19 Stop Loss – 16

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- Further recovery in the tourism sector. According to the IATA, the global economics air passenger traffic will continue to recover, indicating an enhancement in tourism. On average, the industry-wide air traffic volume will reach 83% of the 2019 level in 2022 compared to 47% of the pre-COVID level in 2021.

- Turned losses in profits in FY21. FY21 revenue jumped by 31.5% YoY to US$2.0bn. Gross profit jumped by 55.0% YoY to US$1.1bn. GMP reached 54.5% during the period (FY19 GPM: 55.4%). Net profit attributable to the company shareholders reached US$14.3mn compared to US$1.3bn losses in FY20.

- The updated market consensus of the EPS growth in FY22/23 is 1,230%/33.8% YoY, respectively, translating to 16.9×/12.6x forward PE. The current PER is 237.7x. Bloomberg consensus average 12-month target price is HK$22.34.

Samsonite International S.A. (1910 HK) (Source: Bloomberg)

MARKET MOVERS

Singapore

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) shares rose 10.2% and 4.5% respectively yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, moved to levels not seen in almost a month around the $320-per-tonne mark, supported by continued robust demand against a tightening market backdrop. Russia’s invasion of Ukraine and the unprecedented economic sanctions have thrown the global energy market into chaos, with top consumers scrambling to find alternative supplies to replace Russian coal.

- Jardine Cycle & Carriage Ltd (JCNC SP) shares rose 5.4% yesterday. There was no company specific news. The company’s annual AGM is to be held on 27 April and yesterday, the company responded to substantial and relevant questions.

- First Resources Ltd (FR SP) and Golden Agri-Resources Ltd (GGR SP) shares rose 3.7% and 2.9% respectively yesterday. Malaysian palm oil futures traded around MRY 6,350 per tonne, not far from a near five-week high of 6,546 hit on April 20th as stronger edible oil and crude futures supported buying of palm in spite of weak export data and prospects of higher production this month. In addition, Cargill Inc, one of the world’s biggest agricultural traders, stopped buying palm oil products from Sime Darby Plantation Bhd. after the U.S. said it found indicators of forced labour in the Malaysian grower.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| System Applications & IT Consulting | +1.09% | Op-ed: U.S. Democrats press Congress to pass China tech competition bill to create jobs and shore up supply chain GDS Holdings Ltd (9698 HK) |

| Infrastructure | +0.48% | For China investors, Covid lockdowns are the biggest threats Metallurgical Corp of China Ltd. (1618 HK) |

| Construction & Decoration | +0.38% | View: The infrastructure bull in China’s shop – The Great Wall syndrome China State Construction International Holdings Limited. (3311 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Gamble | -2.55% | Macau Legislative Assembly gives general approval to bill governing junkets, satellites on first reading Sands China Ltd. (1928 HK) |

| Airline Services | -2.46% | China plane crash investigators find no evidence of navigation instrument failure China Southern Airlines Company Limited (1055 HK) |

| Environmental Energy Material | -2.44% | GCL Technology to expand into semiconductor-related business with eye on US$1.9 billion joint venture in Inner Mongolia Xinyi Solar Holdings Limited (968 HK) |

- Seazen Group Ltd (1030 HK) and KWG Group Holdings Ltd (1813 HK) shares fell 7.1% and 9.5% respectively yesterday. CITIC Securities said in its industry commentary report on April 21 that real estate companies will continue to face profitability uncertainties. If the companies cannot replenish their land reserves after the fourth quarter of 2021, they may face problems such as the deterioration of the quality of marketable resources. JPMorgan Chase also said today that the weak performance of Chinese property stocks was mainly due to the continued weakness in property sales and the fact that since mid-March, Chinese property stocks have rebounded by 30%, with most investors taking profits already.

- Haidilao International Holding Ltd (6862 HK) and Pop Mart International Group Ltd (9992 HK) shares fell 7.1% and 6.9% respectively yesterday. Reopening themed Chinese stocks extended this week’s rout as traders fretted over the economic fallout from the nation’s Covid-Zero strategy, with lower-than-expected policy stimulus adding to their disappointment. President Xi Jinping defended China’s lockdown-dependent approach to fighting the pandemic in a speech at the opening ceremony of the Boao Forum for Asia.

- WuXi Biologics (Cayman) Inc (2269 HK) shares fell 6.8% yesterday on concerns that the demand for vaccines is faltering. Johnson & Johnson (JNJ US) said on Tuesday that it would no longer provide guidance for Covid-19 vaccine sales due to the global oversupply and demand uncertainty. In addition, recently, Pfizer’s (PFE US) Covid-19 revenue forecast was cut by brokerage Cantor Fitzgerald. The brokerage expects 1Q22 sales to only be about $1 billion, halving the earlier forecast of $2 billion. WuXi Biologics signed 9 Covid-19 vaccine contracts, which contributed nearly 30% of revenue last year.

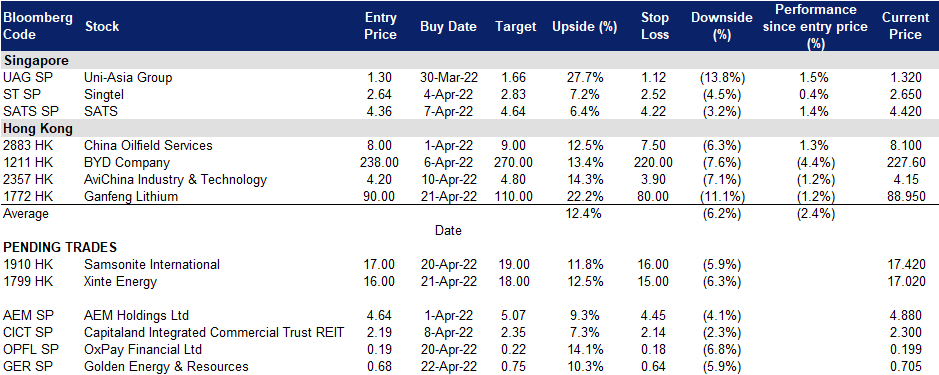

Trading Dashboard

Trading Dashboard Update: Take profit on ComfortDelGro (CD SP) at S$1.50. Cut loss on Yangzijiang (YZJSGD SP) at S$1.52. Cut loss on Ping An Insurance (2318 HK) at HK$54. Cut loss on MCC (1618 HK) at HK$2.0. Cut loss on China National Building Material (3323 HK) at HK$9.8. Add Ganfeng Lithium (1772 HK) at HK$90.