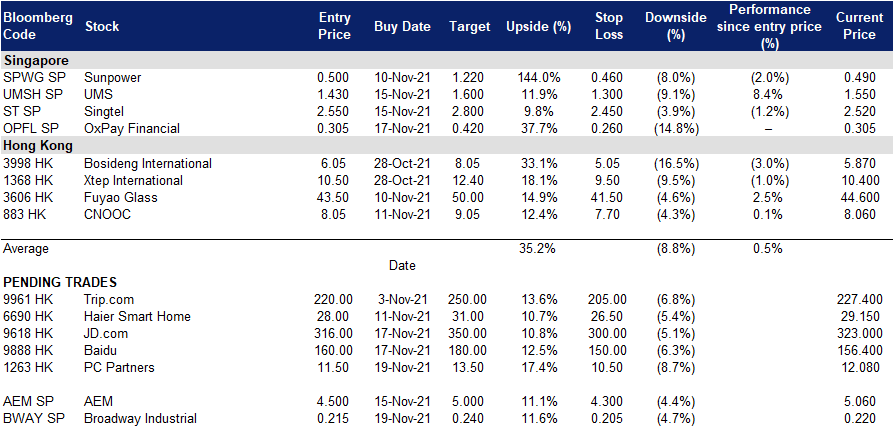

19 Nov 2021: Broadway Industrial (BWAY SP), PC Partner Group Limited (1263 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Broadway Industrial (BWAY SP): The need for space

- BUY Entry – 0.215 Target – 0.240 Stop Loss – 0.205

- Listed on the mainboard of SGX since 1994, the company is one of the leaders in the manufacture of precision components and assemblies. It is a key provider of actuator arms, assemblies and other related parts for the global hard disk drive (HDD) industry. Headquartered in Singapore, the company has 4 manufacturing facilities in China and Thailand and employs around 3,5000 people.

- Need for space. Total HDD sector revenue is expected to increase at a 10% CAGR from 2020 to 2025, reaching total sales of US$32.9bn by 2025, according to forecasts by TRENDFOCUS. Growth will mainly be driven by enterprise demand for more storage. While the growth of cloud-based solutions has been highlighted as a key driver of higher storage demand, the market may still be overlooking the increasing trend of data-localisation measures. The number of localisation measures around the world has more than doubled over the last four years, with China being the most data-restrictive country, followed by Indonesia, Russia, and South America.

- Strong outlook in 2H 2021. 1H2021 sales increased 11% YoY to S$211mn while net profit grew by 9% YoY to S$7mn. The better performance was driven primarily by higher shipment volume and higher average selling price of its HDD products as it shipped more high-performance enterprise products. Management commented that it expects demand for high-performance HDDs and personal storage HDDs to remain strong in 2H 2021. The company currently trades at an attractive 6.5x annualised 1H2021 P/E.

OxPay Financial (OPFL SP): Cash is no longer king

- REITERATE BUY Entry – 0.305 Target –0.42 Stop Loss – 0.27

- OxPay is an online-to-offline (O2O) financial services technology provider with a fully integrated platform that allows both online and offline merchants to run and grow their business easily.

- High entry barriers and growing market. The payment sector is highly regulated, serving as high entry barriers to the digital payment space. OxPay is one of the 19 non-bank companies in Singapore to be awarded the merchant acquisition license as of September this year. OxPay’s target market of SMEs, coupled with its highly accredited license, gives it an edge over other competitors in the SME space, with adequate market share for penetration.

- Initiate with Outperform and S$0.42 TP. OxPay is well-positioned to benefit from the growing e-commerce trend and the explosive use of e-money with its recent integration of GrabPay and Shopee Pay. The appointment of OxPay as exclusive payment provider for F&B Hive Ventures, which has over 4000 restaurants in Thailand, is expected to be a significant revenue contributor from FY22 onwards.

- Read our full initiation report here.

HONG KONG

PC Partner Group Limited (1263 HK): A metaverse-themed stock

- Entry – 11.5 Target – 13.5 Stop Loss – 10.5

- PC Partner Group Limited is an investment holding company principally engaged in the electronics and personal computer (PC) parts and accessories businesses. Its main business includes the design, development and manufacturing of video graphics cards for desktop PCs, the provision of electronics manufacturing services, as well as the manufacturing and trading of other PC related product components. The Company is also engaged in the provision of technical support services through its subsidiaries. Its primary products are video graphics cards, motherboards and mini-PCs. Its primary brands include ZOTAC, Inno3D and Manli. Its businesses are mainly conducted in Mainland China, Hong Kong, Macau, Korea and the US.

- Expecting 3Q21 to reach a new record. Prices of graphic cards continue to rise. The price hikes of RTX 3080 or lower, GTX 10 series, and RX 6000 series range from 3% to 7% in September. AMD (AMD US) announced its 3Q21 results. Its Computing and Graphics segment revenue jumped by 44% YoY or 7% QoQ to US$2.4bn. In 1H21, PC Partner’s graphic card revenue grew by 140.8% YoY to HK$6.0bn. The group’s gross profit margin increased to 27.2% from 9% during the same period. It is expected that PC Partner Group’s 3Q21 results will be stellar.

- Metaverse theme hype. Facebook (FB US) recently changed its name to META, announcing the metaverse as its core development for the next decade. Previously, Nvidia (NVDA US) also announced plans to develop the metaverse area. In the foreseeable future, the demand for graphic cards will have exponential growth. PC Partner can be viewed as one of the few metaverse-themed stocks listed in Hong Kong. AMD announced its next-gen Zen 4-based EPYC “Genoa” CPUs at its Accelerated Data Center event, as well as the world’s first MCM-based “Aldebaran” GPU that will power AMD’s new Instinct MI250X and MI250 accelerators. Meanwhile, they also announced that they have secured Meta, the company formerly known as Facebook, as a new customer. Meta will be using AMD EPYC CPUs inside of its data centres.

- Cryptocurrencies on the long-term bull trend. Another driver for sales growth is the positive uptrend of the crypto market. Both Bitcoin and Ethereum remained at a healthy uptrend. An increasing number of institutions have accepted cryptocurrencies as one part of their asset allocations. With higher crypto prices, mining activities remain buoyant globally, pushing higher demand for graphic cards.

- The company’s valuation is attractive. The stock is currently trading at only 4.1x PE.

TRIP.COM (9961 HK): Range bound trade

- REITERATE Buy Entry – 220 Target – 250 Stop Loss – 205

- Trip.com Group Limited, formerly Ctrip.com International, Ltd., is a travel service provider in China that provides accommodation booking, transportation ticketing, package tours and corporate travel management. The company aggregates hotel and transportation information to help leisure and business travellers make reservations. The company helps leisure travellers book travel packages and guided tours and helps corporate clients manage their travel needs. The company also offers a range of travel-related services to meet the different booking and travel needs of leisure and business travellers, including visitor reviews, attraction tickets, travel-related financial services, car services, travel insurance services and passport services. The company also offers package tours for independent leisure travellers, including tour groups, semi-tour groups and private groups, as well as package tours that require different transportation arrangements (such as cruise, buses or self-driving).

- Speed bump again. Tourism and recreation sector is on a tortuous path of recovery. Countries who have 60% to 70% of vaccination rates gradually open the borders. However, China still strictly adopts the zero-infection policy domestically. Recently, there were rising infection cases in China, and related cities and districts were locked down again. This led to the sell-down of the stock, breaking the recovery of price. However, it is a buying opportunity now as the past performance showed a resiliency to such kind of news.

- Promising recovery against COVID-19. Previously, the company announced 1H21 results. Total net revenue increased by 86% YoY and 43% QoQ to RMB10bn, driven by the strong recovery momentum of the China domestic market. Both domestic hotel and air-ticket GMV increased by about 150% YoY. Compared with the same pre-COVID period in 2019, both domestic hotel and air ticketing reservations achieved double-digit growth in 2Q21. Staycation travel continues to serve as a major driver of domestic recovery with local hotel reservations growing nearly 80% versus pre-COVID period in 2019. Revenues from corporate travel management grew 141% year over year and 26% compared with the pre-COVID period in 2019. In 1H21, the company reported a net profit of RMB 1bn compared to a net loss of RMB 5.8bn during the same period last year.

- Best performance among all the e-commerce large-cap Chinese companies. The crackdown of multiple sectors hammered share prices of technology stocks. Currently, there is no obvious sign of turnaround. However, tourism is one of the few sectors that are relatively immune to policy risks. The price performance of the company showed positive signs of turnaround amidst the recent bearish market sentiment.

- The updated market consensus of the estimated net profit growth in FY22 and FY23 is 383.1% and 51.6% respectively, which translates to 27.4x and 18.1x forward PE. Bloomberg consensus average 12-month target price is HK$286.36.

Market Movers

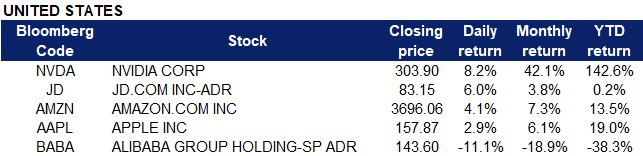

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Semiconductors | +3.2% | Here Are The Winners of Metaverse Buzz |

| Telecommunications Equipment | +2.6% | Apple Stock Sets New All-Time High Following Latest Apple Car Rumors |

| Home Improvement Chains | +2.1% | US Homebuilder Sentiment Increases to a Six-Month High |

Top Sector Losers

| Sector | Loss | Related News |

| Casinos/Gaming | -2.7% | Record high cases, more rules and partial lockdowns: A new Covid wave engulfs Europe |

| Airlines | -1.8% | |

| Information technology services | -1.6% | Cisco reports disappointing revenue and issues forecast that misses estimates |

- Alibaba (BABA US) shares tumbled 11% yesterday after it reported misses on both the top and bottom lines for its fiscal second quarter 2022. The Chinese tech company reported earnings per share of $1.74 with sales of $31.15 billion, while analysts were expecting earnings per share of $1.93 and sales of more than $32 billion. Alibaba explained that its profit slump was “mainly due to … increased investments in key strategic areas”.

- JD.com (JD US) shares gained 6% yesterday after it reported solid third quarter results, showing solid growth across its e-commerce and logistics businesses. Revenue was up 25.5% to $33.9 billion, matching estimates, and annual active customers rose 25% to 552.2 million. JD shares may also have benefited from a disappointing quarterly report from Alibaba, which issued weaker-than-expected guidance for fiscal 2022.

- Nvidia (NVDA US) shares jumped 8.5% in the premarket, before closing at a record high of $316.7 after beating Q3 earnings and offered bullish outlooks for both the current quarter and the revenue potential from the developing ‘metaverse’. Revenue rose 50% YOY to $7.1 billion, driven by a 55% surge in data center sales to $2.9 billion, and a 42% jump in gaming revenue to $3.22 billion. Additionally, CEO Jensen Huang shared his vision for Nvidia’s Omniverse platform for generating interactive AI-powered “avatars.” The avatars will serve as virtual robotics applications that provide assistance in a wide range of areas. Nvidia intends to charge each Omniverse Avatar user a licensing fee of $1,000 per year, which analysts peg at a staggering $100 billion per year.

- Apple (AAPL US) shares climbed 2.9% yesterday, hitting an all time high. Bloomberg reported that the company is “pushing to accelerate development of its electric car” and “refocusing the project around full self-driving capabilities.” The report follows speculation that Apple had visited automakers and suppliers in Asia, including Toyota Motor as part of its early-stage preparations.

- Amazon (AMZN US) shares popped 4.1% yesterday. Goldman Sachs named Amazon as its top stock pick for 2022 in the Internet space. Analyst Eric Sheridan explained that they saw Amazon as their top pick “as we view this recent earnings report as fully reflective of investor concerns on both revenue and profitability into 2022. AMZN is exposed to a multitude of broader secular growth themes, including e-commerce, advertising, cloud computing, media consumption and consumer subscription adoption.” Additionally, the company announced that it was partnering Starbucks on a concept store using Amazon’s “Just Walk Out” technology. The concept store “integrates the digital and physical retail experience, bringing together the connection and comfort of a Starbucks café and convenience of Amazon Go’s Just Walk Out shopping experience.”

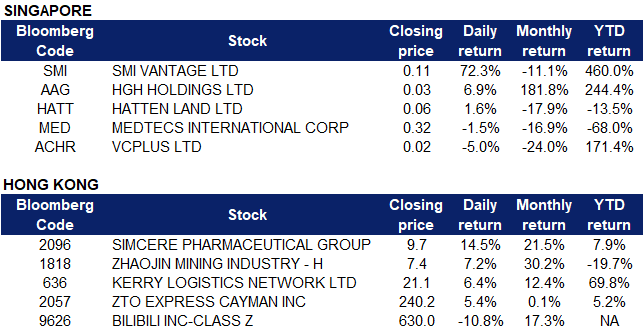

Singapore

- Medtecs (MED SP) shares declined 1.5% yesterday after the company warned that its third quarter earnings for FY2021 is “not expected to be strong”as the first half of the year. The company stated however, that it still expects to be profitable. The company said that this is largely attributed to “existing customers completing their stockpiling exercises in 2020, subsequent inventory adjustment attributable to certain customers, and the stabilization of the supply and prices of the PPE market globally.”

- SMI Vantage (SMI SP) shares surged 72.3% yesterday to close at $0.112 after the company said that it has signed a memorandum of understanding with The9 (a Nasdaq-listed substantial shareholder) to develop a non-fungible token (NFT) publishing business. President and chief executive of SMI Vantage, Mark Bedingham said, “SMI will aim to enable a wider range of contributors to create, mint and trade their digital content on NFT platforms.”

- Blockchain related stocks HGH Holdings (AAG SP), Hatten Land (HATT SP) and VCPlus (ACHR SP) jumped yesterday, likely in tandem with news of SMI Vantage’s NFT-publishing plans. Stocks of HGH and Hatten Land rose 6.9%, 1.6% respectively, while VCPlus shares surged as much as 5% before closing 5% lower. HGH Holdings previously announced that it has entered into a non-binding MOU with AAEX to explore developing a potential blockchain platform. Hatten Land shares surged in September and October after it announced plans to pivot towards digital and blockchain activities. VCPlus acquired Apec Solutions in October to further its fintech ambition.

- Trading Dashboard: Remove Bumitama Agri (BAL SP) at S$0.55

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Electric Equipment | +1.41% | China key player in green hydrogen energy push |

| Precious Metals | +1.29% | Gold rises as inflation unease boosts appeal |

| Securities | +1.27% | China to Ease Developer Funding Limits in $152 Billion Market |

Top Sector Losers

| Sector | Loss | Related News |

| Property Management & Agency | -2.1% | Embattled China developers rush to raise $3 billion in a day |

| Airline Services | -1.83% | From terminal to take off, China’s digital yuan changes payment methods across aviation sector |

| Consumer Electronics | -1.73% | Bluehole Publishes a Feature Story on Global Advocacy for Tobacco Harm Reduction Prior to WHO FCTC COP9 |

- Simcere Pharmaceutical Group Ltd (2096 HK). Shares rose 14.5% yesterday. The company announced yesterday that it would be cooperating with Shanghai Institute of Materia Medica on the development of a new anti-coronavirus (SARS‑CoV‑2) drug. The molecules have a strong inhibitory effect on a variety of new crown mutant strains, including Delta strain. According to the agreement, Simcere Pharmaceuticals has exclusive rights for production and commercialization of the new drug.

- Zhaojin Mining Industry Company Ltd (1818 HK). Shares rose 7.2% yesterday in tandem with rising gold prices. Gold firmed up above US$1,860 an ounce yesterday, after gaining 1% in the previous session as the dollar and US bond yields retreated from recent peaks, amidst a shift towards safe-haven assets driven by economic and policy uncertainties. Global inflation rates are hitting decade highs due to rising input prices and supply chain disruptions, putting pressure on major central banks to bring forward guidance on interest rate hikes.

- Kerry Logistics Network Ltd (636 HK). Shares rose 6.4% yesterday. Recently, the Ministry of Transport issued the “Fourteenth Five-Year Development Plan for Comprehensive Transportation Services”, with requirements that by 2025, domestic deliveries are within a day, deliveries to neighboring countries are within 2 days and deliveries to major cities around the world are within 3 days. The plan also highlighted that the integrated freight logistics service system and international logistics supply chain system would be continuously improved, and transportation structure would be further optimized.

- ZTO Express (Cayman) Inc Ltd (2057 HK). Shares rose 5.4% yesterday after the company announced its third quarter results. Even though net profit in the third quarter decreased 2.86% YoY to RMB1.167bn, total revenue was RMB7.391bn, an increase of 11.3% YoY. In addition, the group’s gross profit was RMB1.568bn, a YoY increase of 12.7%. Even though single ticket revenue was priced lower, the improvements in gross margin and sales was due to huge volume growth, which managed to offset the effects of cheaper tickets. According to Bloomberg consensus, the company currently has a rating of 7 BUYS, 1 HOLD and 1 SELL, with a 12M TP of HK$317.98, representing an upside potential of 32.4% as of yesterday’s closing price.

- Bilibili Inc (9626 HK). Shares declined 10.8% yesterday after the company announced its third quarter results. The company continued to see strong growth in its value-added services, such as premium memberships and live broadcasting services. Revenue in that segment jumped 95% to $296.3mn and was up sharply in advertising and e-commerce as well. However, mobile gaming revenue growth was sluggish at 9% to $216mn as the company has faced headwinds from a regulatory crackdown on video games. Gross margin declined due to an increase in revenue sharing, and on the bottom line, the company’s adjusted loss expanded from $0.40 per share to $0.65, which was slightly better than estimates at $0.67.

- Trading Dashboard Update: Take profit on Nexteer Automotive (1316 HK) at HK$10.50

Trading Dashboard

Related Posts: