KGI Daily Trading Ideas – 19 February 2021

IPO Performance Review

New Horizon Health Ltd (6606 HK): No signs of easing for HK IPOs

- Shares opened at HK$76 and rose to a high of HK$85.9 in the debut session, from its IPO price of HK$26.66, helping the Chinese biotech firm raise US$263mn. The intraday low was HK$70. The stock closed at HK$84 which translated to a market cap of HK$35.1bn, and the price-to-sales ratio (PSR) based on RMB58.3mn FY19 revenue is at 60x.

- Given the average peers PSR of 16x, the current valuation is relatively high. However, it could price in future exponential growth. Assuming the top line grows by 100% in FY21 based on the RMB47mn (annualised 9M20 RMB35.3mn revenue), the forward 12-month PSR is estimated at 31x. Hence, we recommend building a position when forward PSR drops to around 20x which translates to a price of HK$55.

US Trading Ideas

United States Steel Corp (X US): Steel your resolve

- BUY Entry – 17.31 Target – 19.99 Stop Loss – 16.02

- We pitched X on 29 January after its 4Q20 earnings, in which the stock tumbled and hit our stop loss on 3rd February, in line with a sudden dip in iron ore futures.

- Since then, X has traded between US$16-17, forming multiple dojis, while iron ore prices have recovered.

- On 16 February, industry bellwether stocks such as Caterpillar (CAT US) and X saw strong gains, as BHP, the world’s largest miner, forecasted record iron ore output in 2021 during its 4Q20 earnings call.

- The 25% steel tariff remains in place, as the recent tariff challenge on 4th February has been dismissed, which remains a boon for X and other domestic steel producers. We expect both iron ore and steel prices to remain on a steady uptrend as Lunar New Year celebrations wind down and raw materials see resurfacing demand.

Avid Technology (AVID US): Rewarding recurring revenues; making fresh highs again

- BUY Entry – 21.05 Target – 27.6 Stop Loss – 18.5

- AVID provides hardware and software for creative video and audio professionals, competing against the likes of Adobe’s (ADBE US) Creative Cloud suite and Apple’s (AAPL US) Final Cut Pro. AVID’s products are catered towards enterprise users, with the likes of HBO, Disney and broadcasting companies as clients.

- AVID’s share price peaked around US$68 back in 2005, in which sales and net income peaked and have trended downwards since.

- In recent months, the share price saw strong upwards momentum as AVID has shown promising growth on its subscription business. Recurring revenue is now 71% of the business in 3Q20, up from 57% in 1Q19. 3Q20 sales are just -3.2% year-on-year despite the 20% fall in sales of hardware products.

- The company has also engaged in strong cost cutting initiatives, leading to a likely second year of profitability. As a result, 3Q20 net income has more than doubled year-on-year given the high margins of the SaaS business.

- AVID has broken past a multi-year fibonacci resistance near US$19 on strong volume on 3rd February, and we see the current share price pullback as a good opportunity to enter. We expect 4Q20 earnings call in March to be a catalyst for the share price to test the next fibonacci resistance.

HK Trading Ideas

AAC Technologies Holdings Inc (2018 HK): Accumulate when it dips

- BUY Entry – 42 Target – 49 Stop Loss – 39

- AAC Technologies Holdings is an investment holding company principally engaged in the manufacture and sale of miniaturized acoustic components. The company’s main products include speaker boxes, speakers, receivers and Micro Electro-Mechanical System (MEMS) microphones. The company’s products are used in smartphones, tablets, wearables and notebooks. The company also delivers integrated solutions, including haptics vibrators, Radio Frequency (RF) Mechanical and optical components. The company distributes its products in the domestic market and to overseas markets.

- The unpleasant 9M20 financial performance was due mainly to the overall slide of smartphone shipments during the COVID period. However, the smartphone market is expected to recover this year, especially Apple which delayed the launch of iPhone 12 to 4Q20. With the rollout of 5G, the smartphone market will embrace a new wave of upgrading and replacement. Hence, fundamentals will improve this year.

- The company has proposed the spin-off and separate listing of its optics business, which will be held through AAC Optics on a stock exchange in the PRC. This is expected to unlock shareholder value and potentially boost share price.

- Market consensus of the estimated growth of net profit in FY21 and FY22 are 65.6% and 21.2% respectively, which translates to 16.4x and 13.6x forward PE. The current PE is 23.6x.

Ming Yuan Cloud Group Hld (909 HK): Range bound trading

- RE-ITERATE BUY Ming Yuan Cloud Entry – 49.0 Target – 60.0 Stop Loss – 45.0

- Ming Yuan Cloud Group Holdings Limited develops software products. The Company provides enterprise resource planning, open platforms, software as a service products, platform as a service infrastructure products, and other products. Ming Yuan Cloud Group provides its services throughout China.

- The SaaS sector has been capturing investors’ attention recently, while Yidu Tech’s stellar IPO performance simply reinforces the positive sentiment in the sector.

- The stock has been consolidating at a range between the high 40s and high 50s recently.

- The company will be included as constituent stocks of the MSCI China Index and the MSCI China All Shares Index, with effect as of the market close of February 26, 2021

SG Trading Ideas

Q&M Dental (QNM SP): Even superheroes must go see their dentists

- BUY Entry – 0.58 Target – 0.70 Stop Loss – 0.52

- QNM has the widest network of well-recognized clinics at strategic locations in Singapore, serving 10% of the local population.

- Healthcare-related stocks in Singapore have been among the best performers year-to-date in the local bourse due to potential M&A activities and attractive valuations.

- QNM has remained resilient in its dental and medical services through Covid-19. While services was affected earlier in 2020, demand has quickly bounced back in the second half. As a result, its dental and healthcare services will continue to lend a greater level of stability to the business.

- We view upside potential from its timely investment into Acumen Diagnostics Pte Ltd. In 1H 2020, QNM invested in Acumen Diagnostics, which is involved in the manufacture, sale and distribution of diagnostic kits for Covid-19, in Singapore and internationally. We expect the business to contribute significantly to QNM in the short term.

- We have a fundamental fair value (read our initiation report here) of S$0.54 for QNM and will review it after the group reports full-year earnings next week. Meanwhile, given the positive sentiment among Singapore healthcare stocks, we believe this could be a good short-term play.

Samudera Shipping Line (SAMU SP): A smooth sea never made a skilled sailor

- BUY Entry – 0.28 Target – 0.35 Stop Loss – 0.245

- SAMU mainly operates containerships that service intra-Asian trade flows. The group services routes connecting ports in Southeast Asia, India, the Far East and the Middle East.

- SAMU has one of the strongest balance sheets we have ever come across for a publicly-listed shipping company. After years of challenges in the container shipping industry, SAMU is front and centre to ride Asia’s economic recovery.

- Additional stimulus in the US and business reopenings elsewhere would further result in global trade improvements going into 2021. The global economy is on the cusp of a new synchronised upcycle; increasing demand is already evident among industrial (copper and iron ore) and soft (palm oil and soybeans) commodities where prices are reaching 5-10 year highs.

- IHS Markit forecasts the real value of global trade to grow by 7.6% YoY in 2021 and 5.2% YoY in 2022, driven mainly by the recovery in global GDP and particularly strong growth expected in the second quarter of this year.

- Samu’s valuations are cheap as it trades at 0.57x P/B while in a strong net cash position of US$32mn as at end June 2020. It will report full-year results next week.

Market Movers – What’s Hot

United States

- US markets saw another choppy day of trading after jobless claims unexpectedly rose while housing starts were lower than expected. S&P500 -0.44%, DOW -0.38% and NASDAQ -0.72%.

- Post earnings disappointments include Walmart (WMT US, -6.5%), Fastly (FSLY US, -15.5%), Appian (APPN US, -6.8% after-hours), Tilray (TLRY US, -14%) and Dropbox (DBX US, -4.9% after-hours).

- Churchill Capital Corp IV (CCIV US) +3.2% closing at US$58.05 with an intra-day high of US$64.86, as investors continue to bid up the stock on the potential Lucid Motors deal.

- Trading Dashboard: Trim UVXY Target Price to US$11. Adjust AMD stop loss to US$84.99.

Hong Kong

- Yeahka Ltd (9923 HK) -11.32%, closing at HK$107.3. After reaching a record high of HK$122.7, the stock price pulled back substantially on the first day when China-Hong Kong connect resumed. This is likely due to some profit-taking as market sentiments turned berish.

- ZhongAn Online P & C Insurance Co Ltd (6060 HK) -10.15%, closing at HK$70.8. After more than 50% gains in three days, the stock price saw a correction due to profit-taking movements and as the hype over the stock cooled down. However, Ark Fintech Innovation ETF (ARKF US) continued to accumulate 284,200 shares yesterday. As of 18th February, ARKF held 15.6mn shares.

- China Literature Ltd (772 HK) -9.56%, closing at HK$82.5. The hype driven by the RMB1.8bn ticket sales of the new movie “Hi, Mom” during the lunar holiday as of 16th February was over. The company is one of the producers of the movie. Profit-taking movements and sharp turn of market sentiment caused the sell-down.

- Haidilao International Holding Ltd (6862 HK) -9.4%, closing at HK$75.7. The hype of Chinese New Year is over along with the end of the long holiday. Investors front ran the reopening of China-Hong Kong connect to lock in profits as the stock hit a record high of HK$85.8 on Tuesday, 16 February.

- Cansino Biologics Inc (6185 HK) -9.35%, closing at HK$393.6.The Capital Group Companies reduced its holdings by 555,000 shares at an average price of HK$404. However, JP Morgan increased holdings by 208,000 shares at an average price of HK$360.5 a week ago.

Singapore

- Medical-related companies were among the top gainers in Singapore yesterday on higher-than-average trading volumes. The outperformers are highlighted below.

- Sri Trang Agro (STA SP) +27.2% to S$1.87 on earnings beat and a higher-than-expected dividend of 1.75 baht per share, equivalent to 7.658 Sing cents. Net profit in 4Q FY2020 surged to 5.5 billion baht, from just 74mn baht in the prior year period. While the Thai-based rubber producer posted strong earnings, it is still considered a pandemic play and as such, likely to be subjected to profit taking on positive headlines from vaccine developments.

- Thomson Medical (TMG SP) +10.2% to S$0.097 as a favourite momentum play among traders and as it rides on the positive sentiment in the local healthcare sector. The stock is among Singapore’s best performing stock this year, having almost doubled over the past two trading weeks and now has a market cap of S$2.6 bn.

- Medtecs (MED SP) +9.6% to S$1.14 ahead of its full-year results to be announced next week. Trading volume for the medical supply copmany surged to the highest in almost a month.

- Rex International (REXI SP) +2.2% to S$0.186 as oil prices continue to rise on concerns that the extremely cold weather in the US may hamper US crude production. REXI is Singapore’s only listed oil producing company with plans to ramp up production this year.

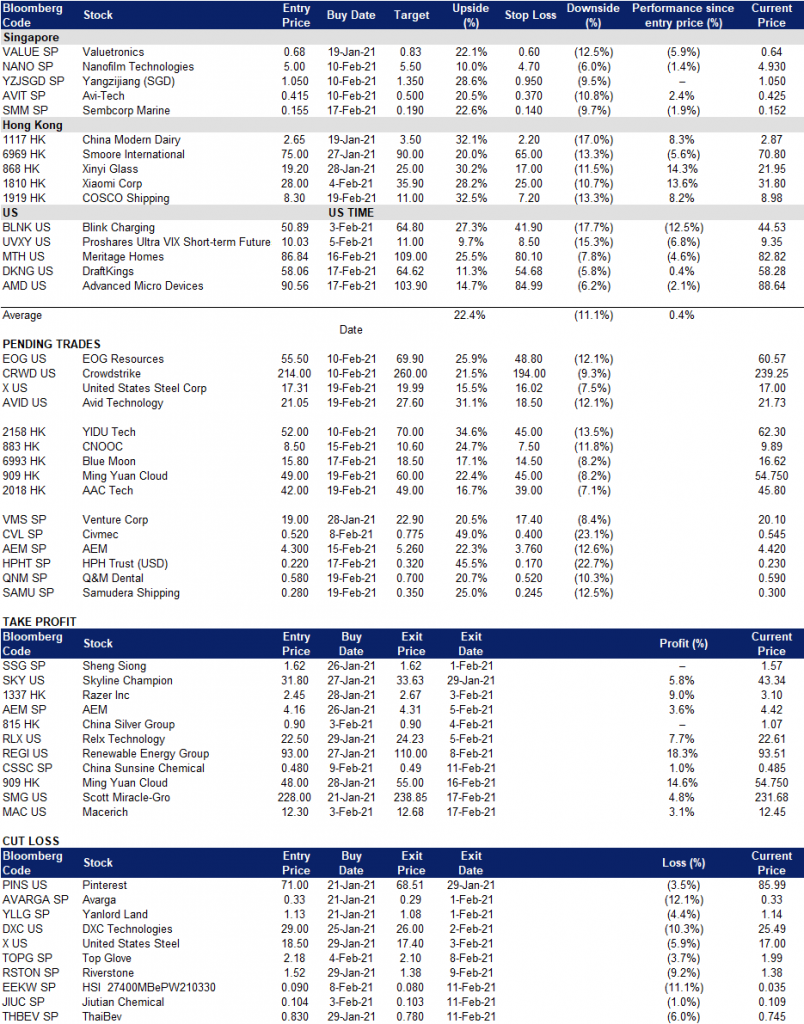

Trading Dashboard

One thought on “KGI Daily Trading Ideas – 19 February 2021”

Comments are closed.