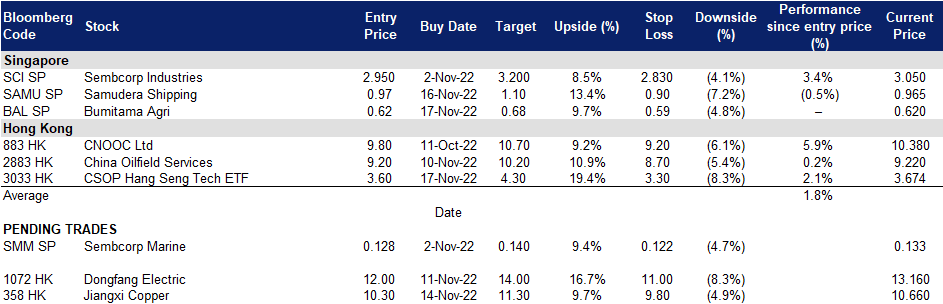

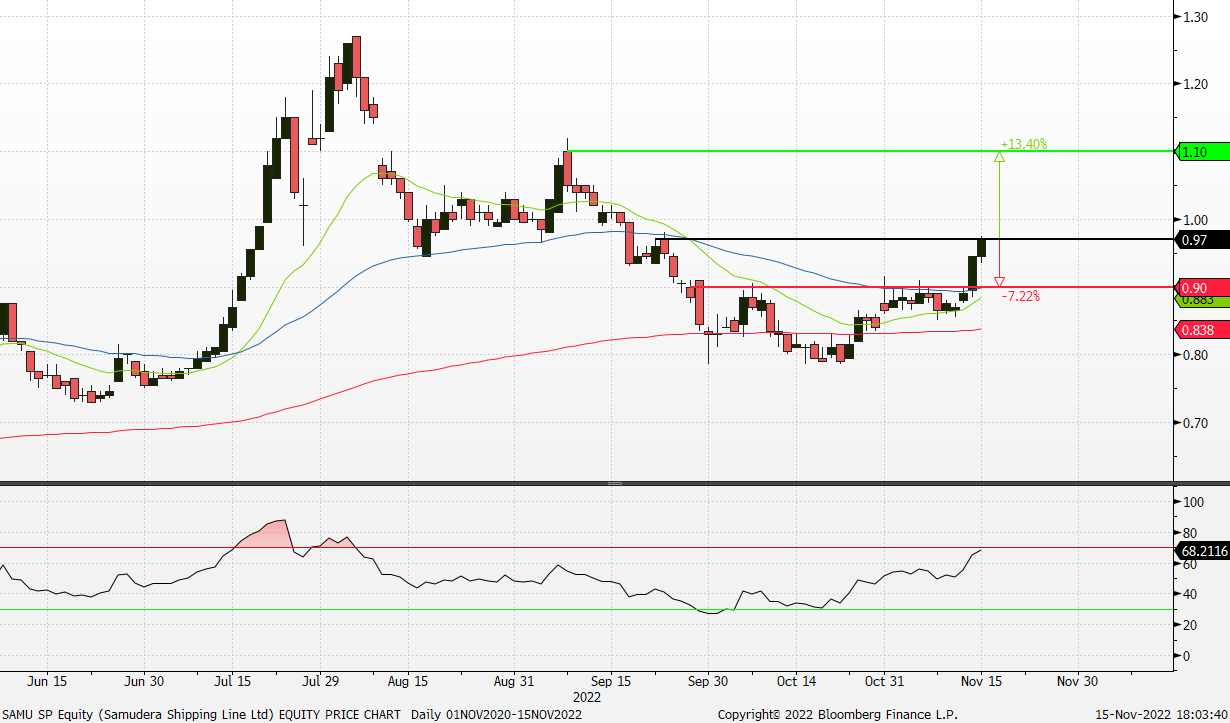

18 November 2022: Samudera Shipping Line Ltd (SAMU SP), CSOP Hang Seng TECH Index ETF (3033 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Samudera Shipping Line Ltd (SAMU SP): Shipping peak season comes

- BUY Entry – 0.97 Target – 1.10 Stop Loss – 0.90

- Samudera Shipping Line Ltd provides feeder services to Main Line Operators between the deep-harbor “hub” ports and the outlying “spoke” ports. It also provides inter-region and intra-region Container Shipping services to the end users. Singapore and Dubai are the main “hub” ports that the Company serves. Serving several major ports in China, Samudera’s Far East service acts as a bridge between South East Asia and China reflecting the growing intra-Asia trade. In addition to Container Shipping, the Group, through its wholly-owned subsidiary Foremost Maritime Pte Ltd, is engaged in Industrial Shipping. It positions itself as a reliable logistics partner to its industrial customers in distributing their bulk cargo – liquid, gas and dry.

- China recalibrating Covid Zero. With a detailed 20-point playbook regarding changes to the Covid Zero policy, China is easing its isolation from the world as well as the impact of the virus mitigation measures on the ground. China has announced the easing of quarantine measures for tourists and close contacts to a total of 8 days instead of 10 days and is pulling back on testing. Furthermore, the system that penalises airlines for bringing virus cases into the country will also be scrapped. China’s reopening process will likely remain slow and cautious, however, businesses will gradually start to pick up with the new measures implemented. This will also increase the shipments in and out of China as manufacturing output increases.

- Holiday sales. With the holiday season coming up, there will be a surge in demand for shipping as retailers and consumers order goods to stock up their shelves and to order gifts for the holidays. Indonesia-based Samudera Shipping is riding on a big pickup in shipping services in the wake of disruption to global supply chains triggered by the pandemic.

- 3Q22 profit guidance. Based on a preliminary assessment of the Financial Results, the Group has recorded a significant improvement in revenue and earnings for 9M2022 as compared to 9M2021. This was primarily due to an increase in container volume handled and higher freight rates in 2022. The Group’s performance for the full year ended 31 December 2022 is expected to be significantly better than its performance for the full year ended 31 December 2021.

- Updated market consensus of the EPS growth in FY22/23 is 101.31%/-38.12% YoY respectively, which translates to 3.29x/5.31x forward PE. Current PER is 1.45x. Bloomberg consensus average 12-month target price is S$0.83.

(Source: Bloomberg)

Bumitama Agri Ltd (BAL SP): Seasonally strong palm oil prices

- BUY Entry – 0.620 Target – 0.680 Stop Loss – 0.590

- Bumitama Agri Ltd produces Crude Palm Oil (CPO) and Palm Kernel (PK), with its oil palm plantations and mills located in Indonesia. The Company’s primary business activities are cultivating and harvesting oil palm trees, processing fresh palm fruit bunches from its oil palm plantations, plasma plantations and third parties into CPO and PK, and selling CPO and PK in Indonesia.

- Rising palm oil prices. Palm oil prices are likely to strengthen further as excessive rain in key producing countries curbs output, while demand increases for its use in food and biofuels. The increase in exports and decrease in production would help reduce the buildup of inventory for palm oil producers in Indonesia and Malaysia. Since the prices of palm oil as compared to other edible oils is lower, the demand of palm oil has been gradually increasing, which would also contribute to the rise in palm oil prices.

Palm oil futures price one-year performance

(Source: Bloomberg)

- Lower production quantities. Indonesia and Malaysia account for more than 80% of the global production of palm oil. From November, palm oil output is normally seen to taper off in the two countries. Furthermore, with the heavy rainfall across Southeast Asia, the floods and heavy rain make it difficult for workers to harvest the palm oil crop and move the fruit to factories for processing.

- 1H22 results review. On 12 August, Bumitama Agri Ltd reported IDR8,968.35 billion in revenue during 1H22, which translates to a 65% YoY. Sales contribution from CPO spiked during the period, attributable to 75% YoY growth in selling price, which averaged IDR 14,327/kg. Following the operational outperformance amidst good commodity pricing environment, Bumitama Agri has accumulated a considerable amount of cash liquidity in recent quarters. Both current and net gearing ratios have improved, from 1.49x and 0.50x in 1H21 to 3.02x and 0.20x in 1H22, respectively.

- Updated market consensus of the EPS growth in FY22/23 is 101.31%/-38.12% YoY respectively, which translates to 3.29x/5.31x forward PE. Current PER is 3.31x. Bloomberg consensus average 12-month target price is S$0.83.

(Source: Bloomberg)

CSOP Hang Seng TECH Index ETF (3033 HK): More positive confirmations of a turnaround

- BUY Entry – 3.6 Target – 4.3 Stop Loss – 3.3

- The investment objective of the Sub-Fund is to provide investment results that, before deduction of fees and expenses,closely correspond to the performance of the Hang Seng TECH Index.

- Positive signals of the China-US relations from the G20 summit. The first time face-to-face meeting of both China and the US top leaders since the COVID outbreak was held on Monday. Both leaders agreed to resume bilateral talks on climate change, economical stability, and health and food security. Though disputes remain, China and the US tensions are expected to relieve temporarily as both sides are back to conversations. The China-US relations are the bellwether of the Hong Kong equity market performance. The temporary shift from confrontation to cooperation sends positive sentiments to investors.

- Easing of restrictive measures. After the 20th National Congress of the Chinese Communist Party, the authority moderately unwound the Covid prevention and control measures. Meanwhile, the People’s Bank of China and the China Banking and Insurance Regulatory Commission jointly announced supportive policies for the real estate market which has been under a downturn. The central government starts to overhaul the economic development.

- Rebuilding confidence in the tech sector. HK-listing technology companies remain the most dynamic growth driver for China’s economy. China’s big techs are hammed more badly than the US ones are, and the sector has bottomed given the valuations and outlook.

(Source: Bloomberg)

Jiangxi Copper Company Limited (358 HK): The turning point emergs

Jiangxi Copper Company Limited (358 HK): The turning point emergs

- RE-ITERATE BUY Entry – 10.3 Target – 11.3 Stop Loss – 9.80

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- China to bail out property market. The People’s Bank of China and the China Banking and Insurance Regulatory Commission on Friday jointly issued a notice to financial institutions laying out plans to ensure the “stable and healthy development” of the property sector. The notice includes 16 measures that range from addressing the liquidity crisis faced by developers to loosening down-payment requirements for homebuyers. Meanwhile, developers’ outstanding bank loans and trust borrowings due within the next six months can be extended for a year, while repayment on their bonds can also be extended or swapped through negotiations. The authorities also told the nation’s second-tier banks to dole out another RMB 400bn (US$56bn) of financing for the property sector in the final two months of the year.

- Copper price rallied and dollar index fell. Last Friday, copper futures closed at US$391.35/pound, a six-month high, and the dollar index pulled back to 106.4, a mid-August level. US October inflation was better off, beating the market estimates. Meanwhile, China signalled a gradual reopening and a bailout of the property market. Both catalysts are a turning point for the commodities market as both positive pricing and demand factors are expected to uphold the near-term recovery of the metal market.

- 3Q22 earnings review. 3Q22 operating revenue grew by 2.2% YoY to RMB112.9bn. Net profit attributable to shareholders of the company dropped by 13.8% YoY to RMB1.3bn. 9M22 operating revenue grew by 9.2% YoY to RMB368.2bn. Net profit attributable to shareholders of the company increased by 4.9% YoY to RMB4.8bn.

- The updated market consensus of the EPS growth in FY22/23 is -3.8%/-23.8% YoY respectively, which translates to 6.2x/8.1x forward PE. The current PER is 5.7x. Bloomberg consensus average 12-month target price is HK$11.36.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Telecommunications Equipment | +1.48% | Cisco raises full-year outlook; announces restructuring Cisco Systems Inc (CSCO US) |

| Semiconductors | +1.19% | Why Buffett Just Invested Billions In Taiwan Semiconductor Taiwan Semiconductor Manufacturing Co Ltd (TSM US) |

| Oil Refining/Marketing | +0.86% | U.S. Diesel Inventories Hit Historic Lows At The Worst Possible Time Valero Energy Corp (VLO US) |

Top Sector Losers

| Sector | Loss | Related News |

| Other Consumer Services | -2.03% | S&P 500, Nasdaq close lower for a second day as investors weigh outlook for higher interest rates Booking Holdings Inc (BKNG US) |

| Home Improvement Chains | -1.70% | Dow futures fall slightly as investors assess the prospect of higher interest rates Home Depot Inc (HD US) |

| Investment Managers | -1.68% | Wall Street drops as hawkish Fed official comments weigh Blackstone Inc (BX US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Apparel | +1.40% | Dada Group sets new records for sales and delivery volume during 2022 Singles’ Day Grand Promotion Li Ning Co Ltd (2331 HK) |

Travel & Tourism | +1.31% | Trip.com Group Ltd (9961 HK) |

Other Support Services | +0.98% | Dada Group sets new records for sales and delivery volume during 2022 Singles’ Day Grand Promotion Koolearn Technology Holding Ltd (1797 HK) |

Top Sector Losers

Sector | Loss | Related News |

Alcoholic Drinks & Tobacco | -1.88% | Discounted Booze Pits JD.com Against One of China’s Largest Liquor-Makers Budweiser Brewing Co APAC Ltd (1876 HK) |

Precious Metals | -1.67% | Gold prices today: Yellow metal rates slide first time in one week as dollar remains firm Zijin Mining Group Co Ltd (2899 HK) |

Department Stores & Shopping Malls | -1.49% | China’s economy loses momentum as COVID curbs hit factories, consumers China Tourism Group Duty Free Corp Ltd (1880 HK) |

Trading Dashboard Update: Add Bumitama Agri (BAL SP) at S$0.62 and CSOP Hang Seng Tech ETF at HK$3.60.