18 February 2022: The Hour Glass (HG SP), Jiangxi Copper Co Ltd. (358 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

The Hour Glass (HG SP): Time is money

- BUY Entry – 2.02 Target – 2.32 Stop Loss – 1.85

- The Hour Glass Limited is a specialty luxury watch retail group with multi-brand and standalone boutiques in the Asia Pacific Region. The group also owns Watches of Switzerland, a watch retail chain in Singapore that deals in mid-tier to high-end Swiss timepieces.

- 1H22 Financials: A strong start. Revenue rose 63% YoY to S$472mn for the half year ended 30 September 2021 (YE 31 March 2022) while net profit after tax surged 110% YoY to S$63.5mn in 1H22. This was mainly due to improved gross margins at 29.3% in 1H22 compared to the previous period at 26.2%. Bottom-line was boosted by an increase in share of results of associates which doubled to S$6.6mn in 1H22. As a results, basic and diluted EPS for 1H22 more than doubled to 8.95 Sing Cents compared to 4.22 Sing Cents in 1H21.

- The pure desire for luxury goods. With travel and social gatherings still limited in many parts of the world, the shift from spending on experiences to goods is likely to stick around for another year. After growing 4% between 2019 and 2021, Bain & Company estimates luxury goods sales will increase from €283 billion (S$428 billion) in 2021 to between €300 billion (S$454 billion) and €310 billion (S$469 billion) in 2022.

- Resilient industry shielded from inflation. The Hour Glass’s retail trade business has largely been resilient in the face of inflation running the hottest in almost 40 years. Rising costs are easily passed down to consumers as demand for luxury items continues to remain strong.

- We initiate The Hour Glass with an Outperform recommendation and a TP of S$2.32. Our TP is based on a discounted cash flow, taking into account a WACC rate of 10.5% and terminal growth rate of 2%.

ThaiBev (THBEV SP): Reopening and laggard play

- RE-ITERATE BUY Entry – 0.68 Target – 0.80 Stop Loss – 0.62

- ThaiBev is Thailand’s largest and one of Southeast Asia’s largest beverage companies. THBEV has a 28.5% stake in SGX-listed Fraser & Neave Ltd (FNN SP) and a 28.3% stake in Frasers Property Limited (FPL SP). It also has a 53.6% stake in Saigon Beer-Alcohol-Beverage Corporation (SABECO), Vietnam’s largest beer company. ThaiBev has a 90% market share of Thailand’s spirit market.

- Resilient 1QFY2022 performance. ThaiBev yesterday provided a 1QFY2022 (YE Sep) business update. Revenue in the quarter increased 7.4% YoY while EBITDA rose 1.6% YoY. The stronger growth was driven by the recovery in the beer (+10% YoY sales) and food (+21% YoY sales) segments. Balance sheet also improved with net gearing dropping to 0.75x as at end Dec-2021 vs 0.86x as at end Sep-2021.

- Lagging its peers in the STI. Despite the resilient financial performance, shares of ThaiBev have underperformed its fellow peers in the STI over the past one year. ThaiBev was the third worst performing component, declining 13% over the past one year and only outperforming Keppel DC REIT (-26%) and DairyFarm (-34%). In comparison, the STI increased 16% over the past one year.

- Positive consensus estimates. Consensus has 17 BUYS and 1 HOLD on ThaiBev, with an average TP of S$0.87, implying a 26% upside potential from the last close price. Earnings are expected to recover 7-11% per annum over the three two years, which would bring its forward P/E down to 15x/14x/13x FY2022/23/24F (YE Sep).

HONG KONG

Hua Hong Semiconductor Ltd (1347 HK): Rate hike impact is about done

- RE-ITERATE Buy Entry – 38 Target – 44 Stop Loss – 35

- Hua Hong Semiconductor Ltd is an investment holding company engaged in production and sales of semiconductor wafers. The Company produces 200mm and 300mm-wafers. Its products are applied in general microcontroller (MCU), Type-C interface chips, image stabilization chips, touch control chips, and smart meter controller chips. The products also serve Internet of Things (IoT), new energy vehicles, artificial intelligence and other markets. The Company operates its businesses through its subsidiaries.

- Another record high quarter in 4Q21. Revenue hit an all-time high of US$528.3 million, up 88.6% YoY and 17.0% QoQ. Gross margin was 29.3%, up 3.5 ppts YoY and 2.2 ppts QoQ. Net profit attributable to shareholders of the parent company was US$84.1 million, up 92.9% YoY and 65.6%. 1Q22 guidance remains upbeat. Revenue is expected to be approximately US$560 million. Gross margin is expected to be in the range of 28% to 29%.

- More or less priced in rate hike. Semiconductor sector performed poorly YTD due mainly to the expectations of rate hike and Fed balance sheet reduction. However, market leaders such as Taiwan Semiconductor Mfg. Co. Ltd. (TSM US) and Advanced Micro Devices, Inc. (AMD US) provided positive guidance for FY22 after they delivered strong 4Q21 results. The strong fundamentals are expected to offset the rate hike impact in the near term. Chip shortage will last longer than expected as demand growth outpaces the ramp-up in production.

- Consensus estimates. Updated market consensus of the estimated net profit growth in FY22/23 is 39.7%/12.3% respectively, which translates to 23.3x/20.7x forward PE. The current PE is 37.7x. Bloomberg consensus average 12-month target price is HK$53.08.

Jiangxi Copper Co Ltd. (358 HK): Breakout of copper prices

- Buy Entry – 14.1 Target – 16.0 Stop Loss – 13.2

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- Breakout signal has come. Copper prices have been consolidating after topping out in October 2021. The recent (core) CPI data in the US and Europe did not show any evident sign of inflation subsiding. Investors are still cautious of rising prices. Meanwhile, the ECB and Fed have pivoted to more hawkish moves to curb inflation. However, the expectation of declining liquidity has not pushed down commodity prices as the rise in prices is more attributable to supply chain issues. On 9th February, copper prices broke out in the consolidation channel. Although prices pulled back a bit, the uptrend has been formed. Moving forward, the seasonal inventory restocking in March could further drive prices higher.

- Infrastructure is the only way for China to maintain economic growth amidst a soft landing. China’s GDP growth dropped further to 4% YoY in 2021, down 90bps from 2020. The slowdown is not surprising as the second largest economy had been adopting the most draconian lockdown measures to maintain its zero-covid policy. Meanwhile, the authorities have aggressively demanded the real estate sector to de-leverage and have imposed a series of regulations upon the fast-growing sectors such as education and technology. Last year, the only driver that has prevented China from tipping into recession is its exports. However, Southeast Asia countries are expected to recover quickly in 2022, regaining market share of low-end production from China. Therefore, it is inevitable to see China’s export growth slow down this year. Given the weak domestic consumption which is difficult to be pushed by administrative measures, China has to resort to the old measure, fixed asset investment. And the recent loose monetary policies have paved the way for it to push infrastructure expansion to maintain economic growth.

- The updated market consensus of the EPS growth in FY22/23 is -0.87%/-8.37% YoY respectively, which translates to 7.3x/7.9x forward PE. Current PER is 7.8x. Bloomberg consensus average 12-month target price is HK$17.43.

MARKET MOVERS

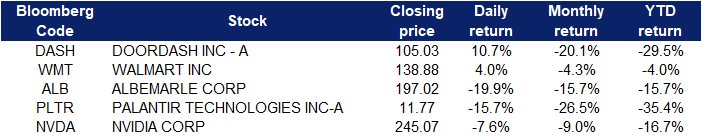

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Precious Metal | +4.0% | Gold tops $1,900/oz for first time since June as Ukraine tensions grow Barrick Gold (GOLD US) |

| Food Retail | +3.6% | Walmart, Kraft and Kroger look appetizing to investors amid market turmoil Walmart (WMT US) |

| Coal | +1.4% | Asia-Pacific coal prices slip, but supply still tight Peabody Energy (BTU US) |

Top Sector Losers

| Sector | Loss | Related News |

| Packaged Software | -4.2% | Nasdaq, S&P 500, Dow Jones plunge, bonds rally as Ukraine prompts safety trade Microsoft (MSFT US) |

| Semiconductor | -4.0% | Nvidia gives upbeat revenue forecast, Applied Materials sees supply-chain challenges Nvidia (NVDA US) |

| Internet Software / Services | -3.5% | Meta loses top-10 market value ranking amid worst month ever Meta Platforms (FB US) |

- DoorDash Inc (DASH US) shares rose 10.7% yesterday after the food-delivery company beat estimates for quarterly revenue. The company’s 34% revenue rise, although slower than the blistering pace recorded a year earlier, indicated that people still preferred getting their meals and other items such as groceries delivered to their doorstep. “This steady growth shows a heightened consumer interest and demand for delivery in non-restaurant categories, with DoorDash well positioned to take advantage of it,” Needham analysts said. However, food-delivery companies’ focus on chasing revenue growth through aggressive expansion is squeezing their margins. DoorDash reported a wider-than-expected loss, prompting some analysts to cut their price targets.

- Walmart Inc (WMT US) Shares rose 4% yesterday after the big-box retailer topped earnings expectations and reiterated its long-term forecast, which calls for adjusted earnings per share growth in the mid single-digits. Total revenue rose slightly to $152.87 billion from $152.08 billion a year earlier, above Wall Street’s expectations of $151.53 billion. Walmart posted net income of $3.56 billion, or $1.28 per share, compared with a loss of $2.09 billion, or 74 cents per share, a year earlier. Excluding items, the company earned $1.53 per share. Analysts were expecting Walmart would earn $1.50 per share, according to Refinitiv. Walmart is chasing new revenue streams, as it looks beyond retail. CEO Doug McMillon said those younger businesses, such as advertising, its third-party marketplace and online grocery delivery, are gaining momentum.

- Albemarle Corp (ALB US) shares plunged 19.9% yesterday. Sales of lithium, the company’s largest division, rose 13% to $404.7 million in the reported quarter. Excluding items, Albemarle earned $1.01 per share, beating analysts’ average estimate of 99 cents per share. The lithium producer forecasted its full-year earnings between $5.65 and $6.65 per share, the midpoint of which was slightly below estimates of $6.19, according to IBES data from Refinitiv. Given how lithium spot markets have been very strong over the past two months, investors were hoping for potentially a large beat, which did not happen, said Aleksey Yefremov, analyst at Keybanc Capital Markets.

- Palantir Technologies Inc. (PLTR US) shares plunged 15.7% yesterday after the company reported mixed earnings results for the fourth quarter. Revenue recorded was $433 million vs. $418 million estimated, according to Refinitiv, while EPS was 2 cents, adjusted vs. 4 cents estimated, according to a Refinitiv survey of analysts. Palantir expanded its commercial business throughout 2021, with revenue up 34% year over year to $645 million. U.S. commercial revenue alone soared 102% with the customer count jumping 4.7 times to 80. In 2021, government revenue gained 47% to $897 million.

- Nvidia Corp (NVDA US) shares lost 7.6% yesterday despite the company reporting strong quarterly results. Revenue recorded was $7.64 billion, versus $7.42 billion expected, up 53% year-over-year, while EPS was $1.32, versus $1.22 expected, up 69% year-over-year. Nvidia has gotten a boost as cloud providers and enterprises turn to its graphics processors that are used for artificial intelligence applications like speech recognition and recommendations. Nvidia reported $3.26 billion in sales from its data center business, up 71% annually. However, Nvidia’s automotive business was down 14% to $125 million. It’s not a primary focus for the company but represents a growth market for its chips. Nvidia said that car makers’ supply constraints were one reason that its automotive sales fell.

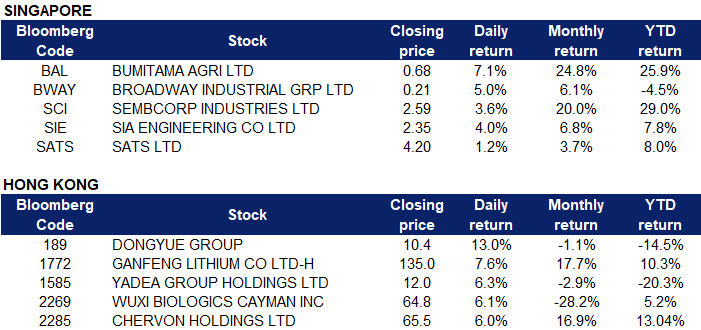

Singapore

- Bumitama Agri (BAL SP) surged 7% yesterday alongside rising palm oil prices and ahead of its full-year results that is scheduled to be announced on 22 Feb. Palm oil futures received a boost after soybean oil soared to the highest since May 2021 following a fire that halted operations at a top US biodiesel plant. Consensus has 3 buys and 1 hold recommendation on BAL and a 12m average TP of S$0.75 (+10% upside from last close price).

- Broadway Industrial (BWAY SP) shares rose 5% after the company reported that FY2021 sales and profit rose to a five-year high. FY2021 net profit rose 8% YoY to S$15mn as revenue increased 18% YoY to S$471mn. Core net profit would have been higher at S$18mn if not for a S$2.4mn charge for impairment of goodwill. The company has proposed a final dividend of 0.5 Sing cents and a special dividend of 0.5 Sing cents, which, together with the interim dividend of 0.5 Sing cents, brings the total dividend for FY2021 to 1.5 Sing cents.

- Sembcorp Industries (SCI SP). Shares of the green energy play rose 4% as it continued its upward momentum. SCI’s 17% return over the past month outperformed its STI peers, with Keppel Corp’s (KEP SP) 14% return trailing close behind. Earlier this month, CGS-CIMB raised its target price on SCI to S$2.96 from S$2.51 after changing its valuation methodology to the sum of parts from price to earnings in order to better reflect the group’s new segment reporting. SCI will report its full-year results before the market opens on 23 Feb.

- Singapore Airlines (SIA SP), SATS (SATS SP) and SIA Engineering (SIE SP) gained more than 1% after Singapore announced reopening plans that included relaxed pandemic restrictions and more vaccinated travel lanes with Hong Kong, Qatar, Saudi Arabia and the United Arab Emirates. DBS expects a swift rebound in both inbound and outbound tourism from the second quarter of 2022.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Alcoholic Drinks & Tobacco | +2.55% | Japanese beer giant Kirin sells 40% stake in China drinks company for US$994 million China Resources Beer (Holdings) Company Limited (291 HK) |

| Nonferrous Metal | +2.14% | Stocks of Chinese lithium suppliers soar as lithium price rally continues Ganfeng Lithium Co Ltd (1772 HK) |

| Alternative Energy | +1.76% | China government to help run coal power plants at full capacity China Datang Corp Renewable Power Co Ltd (1798 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Insurance | -0.96% | China state insurance head’s dubious dealings in Hong Kong China Taiping Insurance Holdings Company Limited (966 HK) |

| Investments & Assets Management | -0.77% | China’s ‘common prosperity’ drive positive for wealth management industry – UBS China Investment Fund Co Ltd (612 HK) |

| Construction Materials | -0.76% | China courts freeze US$157 million of Evergrande assets over missed construction payments China Resources Cement Holdings Limited (1313 HK) |

- Dongyue Group Limited (189 HK) PVDF sectors recently had several pieces of capacity ramp-up news. Lecron Industrial Development Grp Co Ltd (300343 CH) announced that it will build 50,000 tonnes p.a. PVDF production lines. Last month, the company announced a positive profit alert for FY21. Net profit attributable to its shareholders is expected to increase by approximately 260% to 359% YoY.

- Ganfeng Lithium Co Ltd (1772 HK) Lithium sector jumped after lithium carbonate spot price in China reached a new high of RMB402,500/tonne. Previously, CitiGroup resumed coverage on the company with a BUY rating and a TP of HK$187.5. The bank expects FY22 net profit to grow by 239% YoY to RMB15.9bn.

- Yadea Group Holdings Ltd (1585 HK) There was no company-specific news. The EV sector jumped due to the recovery of positive market sentiments.

- WuXi Biologics (Cayman) Inc (2269 HK) The CXO secor continued to rebound. Previously, The Capital Group Companies, Inc. increased its holdings of the company by 553.6mn shares with an average price of HK$56.1.

- Chervon Holdings Ltd (2285 HK) Shares closed at a new high, driven by the jump in the EV sector. CitiGroup initiated coverage with a BUY rating and a TP of HK$65. The bank expects the company’s respective 3-year CAGR of revenue and net profit to be 27% and 68%.

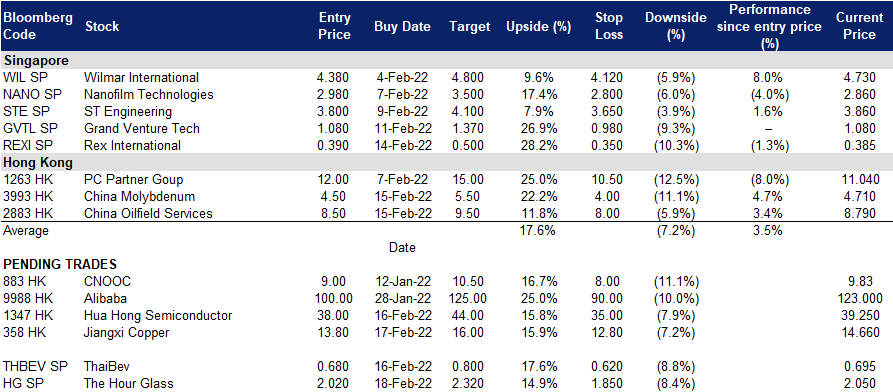

Trading Dashboard

Trading Dashboard Update: Take profit on China Resources Cement (1313 HK) at HK$7.1, Anta Sports Products (2020 HK) at HK$130, and Ganfeng Lithium (1772 HK) at HK$135.

(Click to enlarge image)