KGI Daily Trading Ideas – 17 February 2021

IPO Watch

New Horizon Health Ltd (6606 HK): IPO priced at HK$26.66

- The company is the pioneer in China’s colorectal cancer screening market with ColoClear, its proprietary, non-invasive, multi-target, FIT-DNA test, being the first and only molecular cancer screening test in China approved by NMPA. ColoClear targets a 120 million high-risk colorectal cancer population in China, and enables users to collect stool samples at home and avoid invasive procedures while delivering high testing sensitivity and specificity.

- According to Frost & Sullivan, the colorectal cancer screening market in China has grown from RMB2.5bn in 2015 to RMB3.0bn in 2019, and is expected to further grow to RMB19.8bn in 2030, representing a CAGR of 18.7% from 2019 to 2030. The colorectal cancer screening market in China remains largely untapped with a penetration rate of 16.4% in 2019, compared with 60.1% in the US.

- Net loss decrease in FY19 was due to an increase in revenue generated from ColoClear provided as LDT services as a result of its broader market acceptance and continued efforts in marketing and expansion, and an increase in revenue generated from Pupu Tube, as it was selected by the government cancer early detection programs in multiple provinces in China. Net loss of RMB533.8mn in 9M20 was due mainly to losses from changes in fair value of preferred shares of RMB394.9mn.

| (RMB mn) | 2018 | 2019 | YoY growth | 9M20 | YoY growth |

| Revenue | 18.8 | 58.3 | 210.1% | 35.3 | -0.3% |

| Gross profit | 3.8 | 34.3 | 802.6% | 16.5 | -20.7% |

| Net loss | -224.9 | -106.5 | -52.6% | -533.8 | N.M. |

- Based on the IPO price of HK$26.66, the company’s market cap is at HK$11.1bn, and price-to-sale ratio (PSR) is at 191x. The PSR of the peers ranges from 150x to 300x.

- The subscription rate for public tranche is 4,133x. Goldman Sachs and UBS are the joint sponsors of the IPO. Cornerstone investors include Rock Springs Capital Master Fund, GIC Private Limited, LAV Amber Limited, Octagon Investments Master Fund, and etc. The stock will start trading on 18th February Thursday.

US Trading Ideas

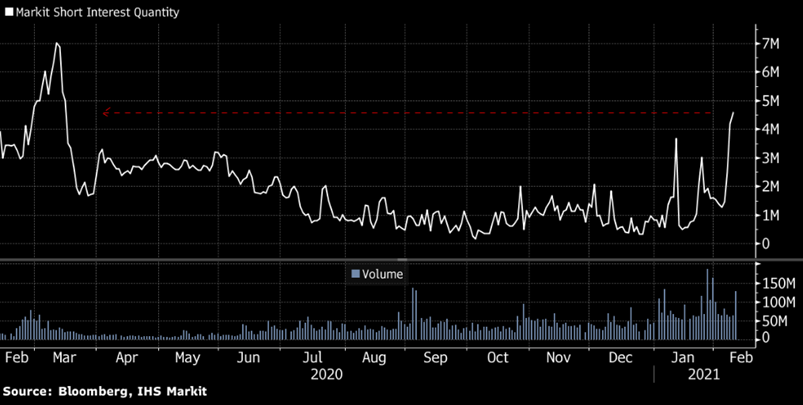

Volatility Index (VIX/UVXY/VXX): If short squeezes cause volatility, what happens to a volatility index short squeeze?

- VIX is a market index representing the expected volatility of the S&P 500 over the next 30 days, while UVXY and VXX are volatility ETFs derived from the VIX. The index profits from increased expected volatility, and typically moves explosively in the opposite direction to the S&P 500.

- The VIX is now at its lowest, closing below 20 last Friday for the first time since the COVID-19 pandemic spike as the S&P 500 marches on to new highs. Coincidentally, short interest in UVXY, the largest VIX ETF, is at the highest since March 2020.

- The volatility trade now mimics the Gamestop narrative with increasing retail interest on the long side of VIX, though we expect the short squeeze situation to be less likely than with individual stocks, given the nature of VIX products.

- We continue to recommend being long on a volatility product as we did 2 weeks ago, while current investors can augment existing positions by selling short term covered calls to reduce the downside cost of holding on to volatility products.

Advanced Micro Devices (AMD US): A surprising laggard amongst semiconductors

- BUY Entry – 92.1 Target – 103.9 Stop Loss – 86.9

- AMD is an American fabless semiconductor company known for their computer processors, and in recent years have taken significant market share over their longtime competitor Intel (INTC US).

- In the past 2.5 months, AMD has traded in a range while the Philadelphia Semiconductor Index (SOX US) carved a new high, as chip demand is red hot from the confluence of rising phone, console and automotive production. Production has been impeded from global chip shortage, a boon for chipmaking companies.

- While AMD’s share price tends to move inversely with INTC’s, both companies have gained in February from overall market and semiconductor sentiment. We prefer AMD over INTC as we expect the company to continue gaining market share, while INTC has short-term execution risk from the recent CEO change.

HK Trading Ideas

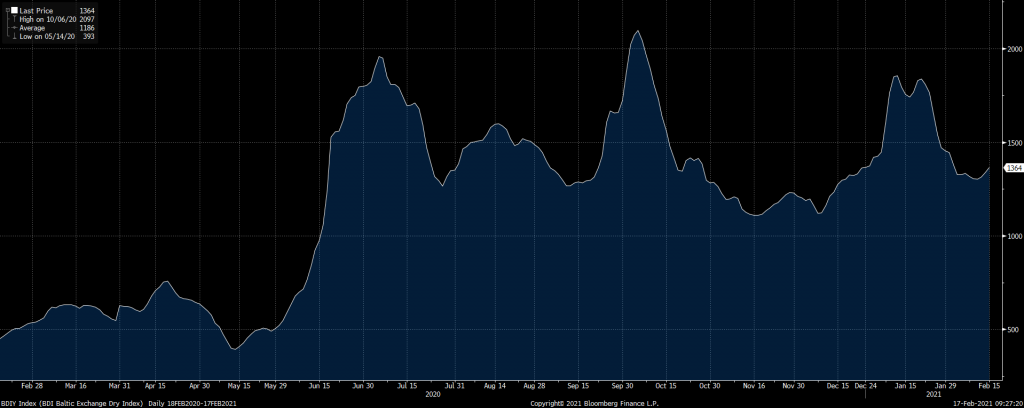

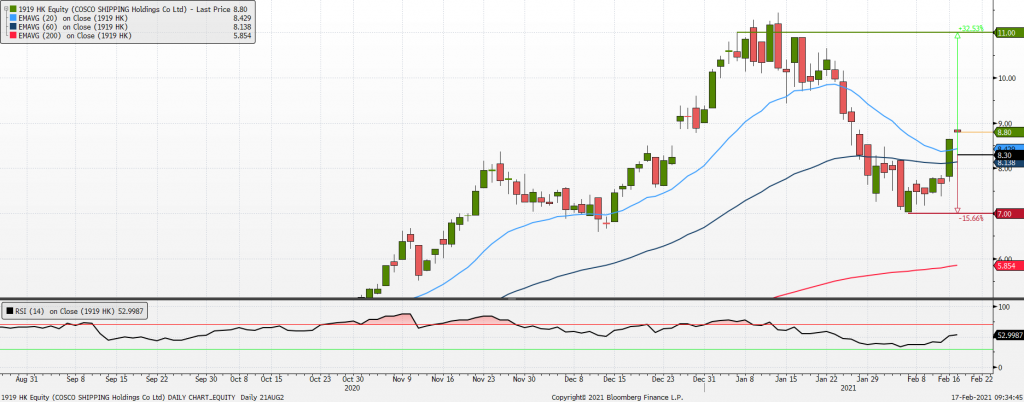

COSCO Shipping Holdings (1919 HK): Seasonal upswing

- BUY Entry – 8.3 Target –11 Stop Loss – 7.2

- COSCO Shipping Holdings is an investment holding company principally engaged in container shipping and related businesses. The Company is engaged in container shipping, dry bulk shipping, the management and operation of container terminals, container leasing and the provision of logistics services. The Company operates its business through two segments. The Container Shipping segment is engaged in the transportation of goods across the Pacific, Asia and Europe, and other international routes. The Terminal Operation and Investment segment is engaged in the operation and management of ports. The Company is also involved in the management and leasing of containers.

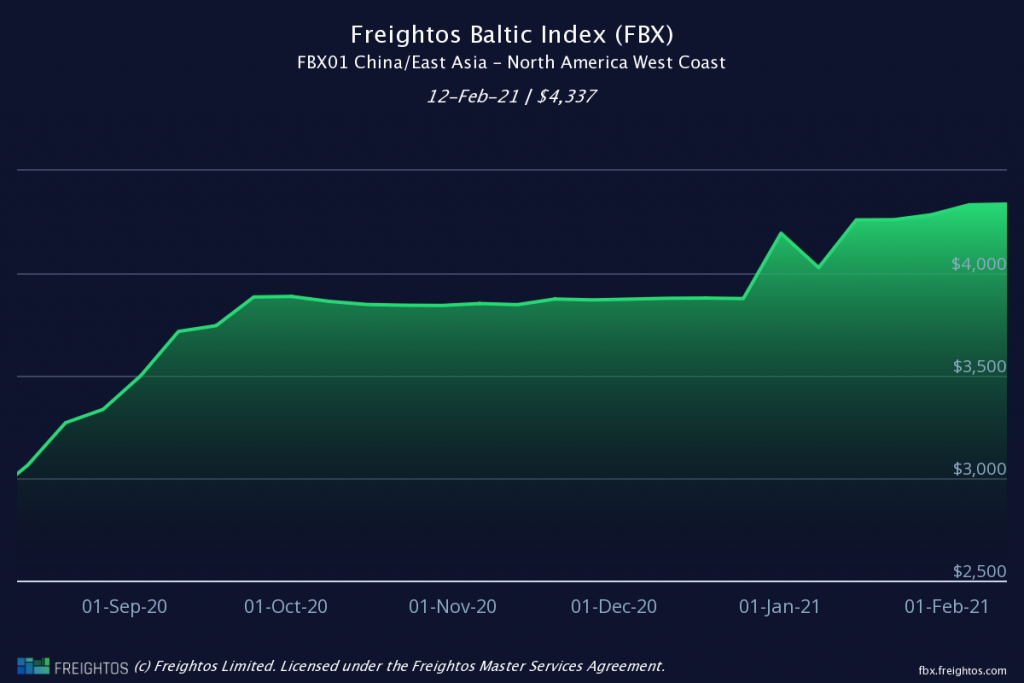

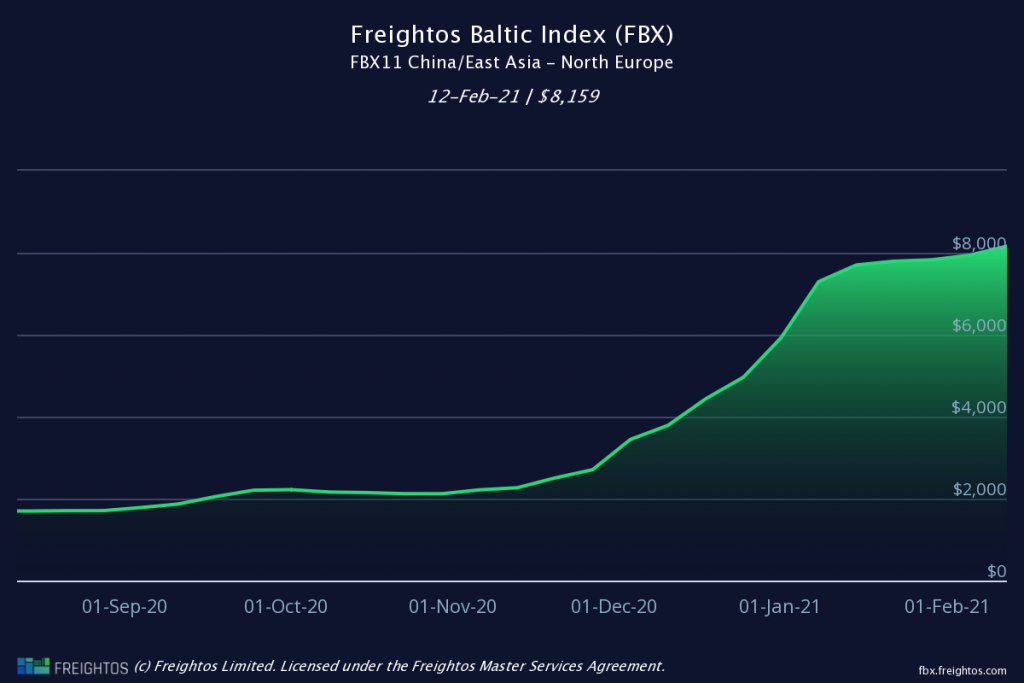

- Global container freight index rose above US$4,000 in February 2021. As of 16th February, the index reached a new high of US$4,275. Sub-index of the route from China/East Asia to North America and North Europe also recorded a new high of US$4,709 and US$8,455 respectively. The seaborne trade from China to the western hemisphere remains buoyant.

- Baltic Dry Index (BDI) started to turn after the correction in January 2021. With a bull run in hard commodities, BDI is expected to remain resilient.

- The company’s valuations based on price-to-earning ratio (PER) is still cheap. The forward 12-month PER is 7.1x, which compares favourably to the past five-years average of 22x. According to market consensus, net profit is expected to grow by 33.7% YoY in FY21.

Blue Moon Group Holdings Ltd (6993 HK): From twilight to new moon

- Re-iterate BUY Entry – 15.8 Target – 18.5 Stop Loss – 14.5

- Blue Moon Group Holdings Limited operates as a household care company. The company produces liquid laundry detergents, liquid soaps, concentrated liquid laundry detergents, and other products. Blue Moon Group Holdings markets its products throughout China.

- The company has been a market leader in hand wash and laundry detergent in China with a respective market share of 17% and 24% in China as of 2019. Revenue and net profit CAGRs are 12% and 254% respectively from 2017 to 2019. According to Bloomberg, revenue growth in FY21 and FY22 is estimated to be 33.7%YoY and 24.4% YoY, and net profit growth in FY21 and FY22 is estimated to be 45.7% YoY and 21.9% YoY.

- Although the house cleaning products market is highly competitive, branding and pricing are the keys to maintain or even expand market share. Blue Moon has both competitive advantages. The company has been upgrading its product series targeting different groups of users and launching new products each year.

- The current valuation is relatively cheap as the 12-month forward price-to-earnings ratio (PER) recently dropped to 45x, the lowest since IPO. We believe the fair PER is around 55x to 60x because of its dominant market status.

SG Trading Ideas

HPH Trust (HPHT SP): Past the storms of the sea

- BUY Entry (USD) – 0.22 Target – 0.32 Stop Loss – 0.17

- HPHT is reaping the rewards of surging China exports as the country remains the only fully operational factory in the world. HPHT’s outbound cargoes to the US and Europe increased by 33% YoY and 24% YoY in 4Q 2020 due to a surge in household and hospital PPE demand, airline freighter capacity cuts and efforts to catch up from pandemic disrupted supply chains.

- While HPHT’s management provided a more cautious view about the sustainability of the volume growth, we are of the more optimistic view that additional stimulus in the US and business reopenings elsewhere will result in global trade improvements going into 2021. The global economy is on the cusp of a new synchronised upcycle; increasing demand is already evident among industrial (copper and iron ore) and soft (palm oil and soybeans) commodities where prices are reaching 5-10 year highs.

- IHS Markit forecasts the real value of global trade to grow by 7.6% YoY in 2021 and 5.2% YoY in 2022, driven mainly by the recovery in global GDP and particularly strong growth expected in the second quarter of this year.

- HPHT goes ex-dividend today and will be paying out 7.7 HK cents for its 2H 2020 period. Valuations are attractive as it trades at a 40% discount to NAV and offers a 6-7% forward dividend yield.

Sembcorp Marine (SMM SP): Can it get any worse?

- BUY Entry – 0.155 Target – 0.19 Stop Loss – 0.14

- Offshore & Marine related stocks are moving after WTI crude rose above US$60 earlier this week due to the unusually cold weather that has disrupted oil production and pipelines in Texas. WTI prices are now at the highest level since January 2021.

- On a fundamental level, we believe that there is definitely a need for consolidation among Singapore’s shipyards given the challenging environment caused by the drop in capital expenditure among upstream companies, as well as fierce competition from the Chinese and South Korean yards.

- Therefore, we think an M&A is still possible for SMM even though talks of a merger between Keppel O&M have largely tapered off. M&A opportunities could include clean energy companies, which could potentially provide a re-rating to SMM’s disappointing share price performance following the demerger from parent company, Sembcorp Industries (SCI SP).

- SMM is due to report its full-year results before trading hours on Tuesday, 23 February.

Market Movers – What’s Hot

- The US 10-year yield went above 1.30% for the first time since February 2020 on optimism for an improving economy and expectations of higher inflation. The US Federal Reserve has said it will tolerate inflation above its 2.0% target.

United States

- Chinese emerging finance companies such as Futu Holdings (FUTU US), UP Fintech (TIGR US) and 360 DigiTech (QFIN US) extended gains on Tuesday. The three companies have month-to-date returns of at least 65%.

- EHang Holdings (EH US) -62.7% closing at US$46.3 after a short seller report from Wolfpack Research accuses the company of fictitious sales contracts and questionable claims of regulatory approvals.

- Churchill Capital Corp IV (CCIV US) +31.8% closing at US$52.7 after a Reuters report confirmed that a deal is nearing with Lucid Motors, at a US$12bn valuation. This implies a US$60bn valuation for Lucid Motors assuming the US$12bn deal is for a 20% stake, putting Lucid Motors above the 2 smaller Chinese EV players Li Auto (LI US) and Xpeng (XPEV US), and also above Rivian (RIVN US), a soon-to-be-listed US EV player with a rumoured valuation of US$50bn.

- Trading Dashboard: Adjust Meritage Home’s (MTH US) stop loss downwards from 82 to 80.1, given the lower entry price.

- Earnings watch: Wed 17 Feb – SHOP/RIO/BIDU/TWLO/ADI/HLT/IQ/FSLY/NVTA/SPWR/CAKE

Hong Kong

- HengTen Networks Group Ltd (136 HK) +46.26%, closing at a new high of HK$15.24. Alibaba Pictures Group Ltd (1060 HK) +34.58%, closing at HK$1.44. Ticket sales for the first five days of the Lunar New Year holidays touched RMB5.7bn, jumping by 33% compared to the same period in 2019. The filming and video entertainment sector had a big rally because of the news.

- ZhongAn Online P&C Insurance (6060 HK) +32.16%, closing at HK$73.35. Ark Fintech Innovation (ARKF) has been accumulating the stock, and as of 16th February, ARKF holds 13.87mn shares.

- The Materials sector continues to have a bull run, as prices of metals such as cobalt, lithium, copper, aluminium, tin reach multi year highs.China Molybdenum Co., Ltd. (3993 HK) +14.96%, closing at a new high of HK$6.54. Jiangxi Copper Co Ltd (358 HK) +13.2%, closing at HK$17.32. Ganfeng Lithium Co., Ltd. (1772 HK) +13.02%, closing at a new high of HK$145.

- PetroChina Co Ltd (857 HK) +13.17%, closing at HK$2.75. CNOOC Ltd (883 HK) +9.53%, closing at HK$9.54. China Petroleum & Chemical Corp (386 HK) +8.14%, closing at HK$4.12. International crude oil prices continue to rally while Chinese oil majors are still lagging compared to peers. The three counters’ share prices are catching up.

Singapore

- Sembcorp Marine (SMM SP) +3.9% to S$0.161 ahead of its full-year results to be announced before trading hours on Tuesday, 23 February. There was a media report published yesterday which highlighted the need for SMM to embark on M&A in order to achieve the scale to compete effectively against the Chinese and South Korean shipyards.

- Nanofilm (NANO SP) +1.2% to S$5.09 ahead of its maiden full-year results to be announced this/next week. As per Bloomberg consensus estimates, NANO is forecasted to grow earnings per share (EPS) by 18-43% per annum in FY2021 and FY2022.

- Delo Monte Pacific (DELM SP) +8.3% to S$0.26 after the company last week posted a net profit of S$22mn for 2Q FY2021, reversing from a loss of US$38mn in the prior year period. The company expects to return to profitability for its full-year FY2021, and has pared down its net debt to US$1.5bn from US$1.7bn, implying a reduction of gearing to 2.6x from 3.6x a year ago.

- Food Empire (FEH SP) +2.1% to S$0.98 after consensus estimates was upgraded to S$1.28 on expectations of another year of record earnings for the instant coffee manufacturer. FEH trades at 14/13x 2020/2021 P/E, which is among the cheapest consumer staple stock relative to local and regional peers who are trading at 20-30x P/E.

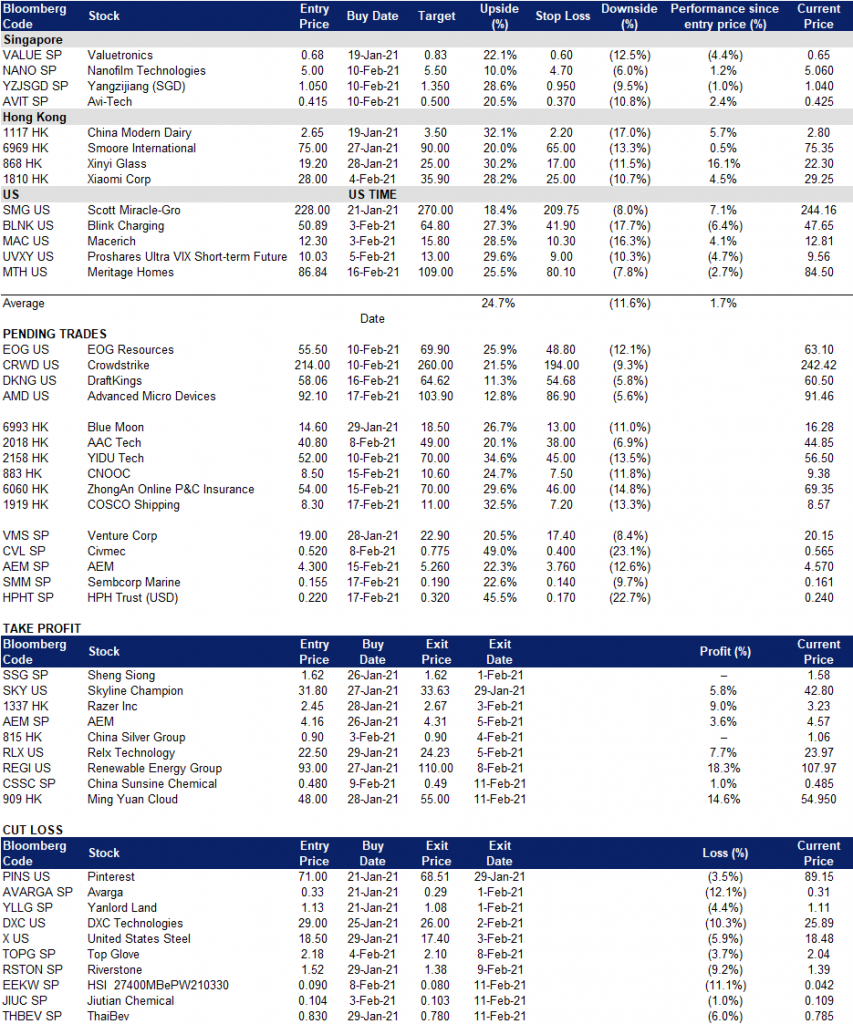

Trading Dashboard