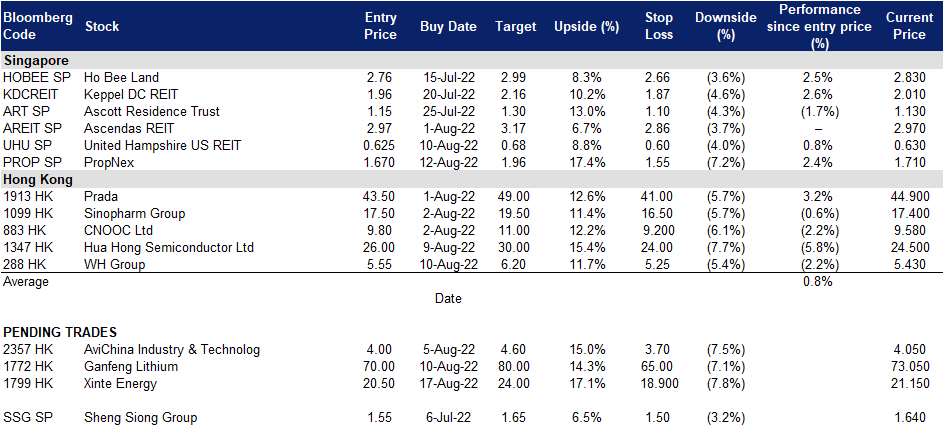

17 August 2022: Ascendas REIT (AREIT SP), China Tourism Group Duty Free Corp Ltd (1880)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Ascendas REIT (AREIT SP): 1H22 results to see positive rental reversions and inorganic growth

- RE-ITERATE BUY Entry 2.97 – Target – 3.17 Stop Loss – 2.86

- Ascendas Reit (AREIT) is Singapore’s first and largest listed Business Space and Industrial Real Estate Investment Trust (REIT). As at 31 March 2022, it owns 221 properties across three key segments, namely, 1) Business Space and Life Science, 2) Logistics and 3) Industrial and Data Centres. Ascendas Reit’s multi-asset portfolio is anchored by well-located quality properties across developed markets. 95 properties are located in Singapore, 36 properties in Australia, 41 properties in the United States and 49 properties in the United Kingdom/Europe. These properties host a customer base of more than 1,600 international and local companies from a wide range of industries and activities, including data centres, information technology, engineering, logistics & supply chain management, biomedical sciences, financial services (backroom office support), electronics, government and other manufacturing and services industries.

- JTC 2Q22 report implies continued strength in industrial rents. JTC’s 2Q22 market report showed that prices (+1.5% QoQ, +5.2% YoY) and rents (+1.5% QoQ, +3.4% YoY) of Singapore industrial spaces continued to climb for a 7th straight quarter. This was further supported by a creeping up in occupancy rates (+0.2ppt QoQ, -0.2ppt YoY) after dipping in 1Q22. JTC noted that the strong manufacturing performance, particularly in electronics and precision engineering segments, helped to drive demand for factories during the period.

- Stable rental reversions and acquisitions to mitigate divestments. AREIT’s 1H22 results should be boosted by inorganic growth after it acquired ~S$2.4bn of assets since 2021 (completed acquisition of 2 Australian properties in 1Q22). The completion of S$23m of AEIs during the year should also see an uplift to performance. AREIT had reported positive rental reversions of 4.5% in 2021 and 4.6% in 1Q22 and could see such a trend continue for the rest of the year. Notably, management had guided for positive low single-digit reversion in 2022 during its 1Q22 business update. Nonetheless, growth could be pared by S$248m worth of divestments, which were completed in 2021.

- Stable growth expected in FY22F financials, likely undervalued. The Street currently has 14/4/0 BUY/HOLD/SELL ratings and an average TP of S$3.23. Based on consensus estimates, FY22F gross revenue/NPI should pick up by 6.2%/6.2% YoY to S$1.3bn/S$977.8m respectively. In line with this, the street is expecting FY22F DPU to expand 3.9%YoY to 15.9¢ (FY21: 15.3¢) implying a fairly attractive yield of 5.4%. At current prices, AREIT would trade at 1.2x P/B almost 1sd away from its 2-year average of 1.3x.

(Source: Bloomberg)

PropNex (PROP SP): Position for bumper FY23F despite weaker 1H22 results; DPS offers strong safety net

- RE-ITERATE BUY Entry 1.67 – Target – 1.96 Stop Loss – 1.55

- PropNex is an integrated real estate services group. Its core business consists of four business segments namely; i) real estate brokerage, ii) training, iii) property management, and iv) real estate consultancy. Its primary business is in the provision of real estate brokerage services comprising real estate agency and project marketing services. PROP operates its real estate agency through PropNex Realty which is supported by PropNex International in project marketing.

- 1H22 results were fairly muted due mainly to fewer marketing launches. PROP reported weaker 1H22 NPAT of S$28.3m (-17.7% YoY) on relatively stable revenue of S$472.3m (-1.8% YoY) as the property cooling measures in Dec21 tamed price growth in the private residential market in 2Q2022 to a more sustainable pace. Transaction volumes softened in 1H22 as compared to the same period in 2021 as buyers held back on property purchases to monitor the impact of the fresh cooling measures introduced in Dec21. Despite fewer project launches at the start of the year, PROP’s performance was balanced by higher income from the other segments as more transactions were completed in 2Q2022.

- FY23F could see a bumper crop of launches. During its earnings brief, management maintained a sanguine outlook on private property prices for the rest of FY22F. It sees private property prices in the OCR and RCR to grow from 2021 in light of tight supply in those regions. Further afield in FY22F, PROP notes that the continued growth in GLS prices (OCR: +12.2% YoY, RCR: +18.4% YoY) implies that launch prices in FY23F will likely have another leg up to go. Additionally, the successful GLS and enbloc transactions would point to heightened launch activity in 2023.

- FY22F/23F yield of 6%/6.6% to provide strong support. The Street currently has 3/3/0 BUY/HOLD/SELL ratings and an average TP of S$1.96. Based on updated consensus estimates, FY23F revenue should slip by 3.4% YoY to S$742m, but margins may remain stable as PATMI holds pat at S$49.5m (-0.5% YoY). Nonetheless, FY23F DPU should expand by 10% YoY to S$0.11, implying a yield of 6.6%, higher than its 2-year average of 6%.

China Tourism Group Duty Free Corp Ltd (1880): A new largest IPO in Hong Kong YTD in 2022

- IPO overview:

- Sector: Consumer discretionary

- Issued price: HK$143.5 – 165.5

- Total new shares issued: 102.8mn

- Initial market cap: HK$294.18 – 340.1bn

- Sponsors: CICC, UBS

- IPO deadline: 18th August Thursday

- China Tourism Group Duty Free is the largest travel retail operator in the world focusing on sales of high-quality duty-free and duty-paid merchandise to travelers. Worldwide ranking by retail sales value has steadily over the past ten years, from the 19th in 2010 to the 12th in 2015, and further to the fourth in 2019 before reaching the first in 2020 and 2021, with 24.6% share of the global travel retail industry in 2021. The company is the only retail operator in China covering all duty-free sales channels (which include port stores, offshore stores, downtown stores, cruise stores, inflight stores and ship-supply stores). It has the most dutyfree stores in China. It operates 193 stores, including 184 stores in 100 cities across 28 provinces, municipalities and autonomous regions in China. It also operates 9 duty-free stores overseas in Hong Kong, Macau and Cambodia.

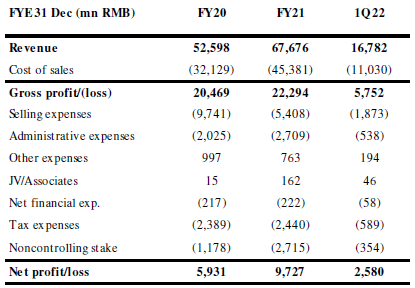

- Financials overview over the past three years.

- Use of proceeds. 48.8% of the proceed raised by China Tourism Group Duty Free’s H-share listing is to reinforce domestic channels, and 22.5% of which is to expand overseas channels. The remaining 13.5%/10.0%/3.7%/1.5% is for supply chain efficiency improvement/working captial/marketing/information technology system upgrade respectively.

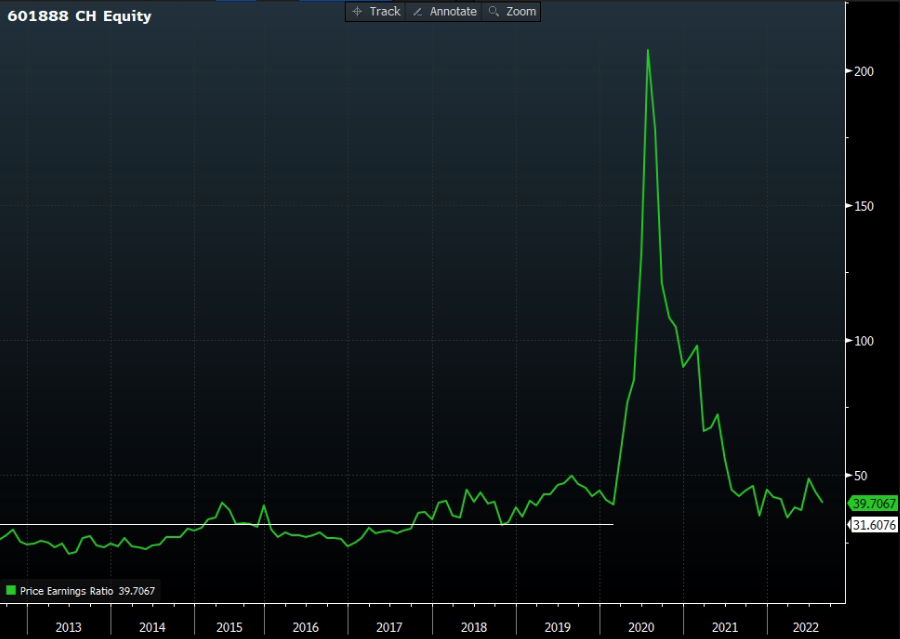

- Valuations. According to Bloomberg, the consensus estimates of FY22/23 EPS growth is -1.54%/49.73%, translating to 38.9x/26.1x. The long-term average PER before COVID-19 occurred was at 31.6x. Assuming FY22F net profit to be similar to the one in FY21. The fair valuation of the company will be RMB307.4bn, equivalent to HK$354.9bn based on the long term average PER, implying an upside potential of 4.4% if the IPO pricing is set at HK$165.5.

China Tourism Group Duty Free Corp Ltd (601888 CH) 10-year PER

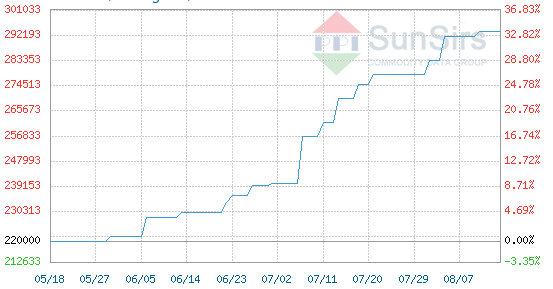

Xinte Energy Co Ltd (1799 HK): Polysilicon price reached a three-month high

- BUY Entry – 16 Target – 18 Stop Loss – 15

- Xinte Energy Co., Ltd. is an investment holding company principally engaged in the provision of solar energy and wind power solutions. The Company operates through seven segments. Polysilicon Production segment is engaged in the production and sales of polysilicon. Engineering and Construction Contracting (ECC) segment is engaged in the provision of ECC services for solar energy plants and wind power plants. Inverter Manufacturing segment is engaged in the manufacture of inverters. Sales of Electricity segment is engaged in the generation and sales of electricity. Photovoltaic (PV) Wafer and Module Manufacturing segment is engaged in the manufacture and sales of PV wafers and modules. Build-Own-Operate (BOO) segment is engaged in the building and operation of solar energy plants and wind power plants. Others segment is engaged in related trading businesses and the provision of design and logistics services.

- Downstream demand for silicon remains strong, upholding selling prices. According to the Silicon Industry of China Nonferrous Metals Industry Association, the domestic output of polysilicon is expected to grow by 13% MoM to 66,000 tonnes this month. Together with 7,000 tonnes of import, the total domestic supply is expected to be 73,000 tonnes in August. However, selling prices continue to edge even though the supply marginally improves as downstream demand remains strong.

China Polysilicon Spot Price (RMB/tonne), First-class and solar grade

- Positive 1H22 profit guidance. The unaudited net profit attributable to the shareholders is in the range of RMB5.5bn to RMB6.0bn in 1H22, representing a substantial increase over the corresponding period in 2021, due to an increase in both sales volume and average sales price of polysilicon products as well as an increase in profit from the construction and operation businesses of wind power and photovoltaic power plants.

- Updated market consensus of the EPS growth in FY22/23 is 71.1%/-15.7% YoY respectively, which translates to 2.8x/3.3x forward PE. Current PER is 4.9x. FY22F/23F dividend yield is 9.0%/7.4%. Bloomberg consensus average 12-month target price is HK$28.62.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Food Retail | +4.67% | Walmart sticks with second-half outlook after earnings beat expectations Walmart Inc (WMT US) |

| Home Improvement Chains | +3.63% | Home Depot beats second-quarter earnings expectations, stands by 2022 guidance Home Depot Inc (HD US) |

| Specialty Stores | +2.96% | Target Stock Gets a Boost From Walmart Earnings Target Corp (TGT US) |

Top Sector Losers

| Sector | Loss | Related News |

| Biotechnology | -1.72% | Why Moderna Stock Is Sliding Today Moderna Inc (MRNA US) |

| Semiconductors | -1.09% | Chipmakers’ Pandemic Boom Turns to Bust as Recession Looms Taiwan Semiconductor Manufacturing Co Ltd (TSM US) |

| Motor Vehicles | -0.71% | Tesla Pauses After Stock Rallies 50% From Its May Bottom Tesla Inc (TSLA US) |

- Bed Bath & Beyond Inc (BBBY US) skyrocketed about 29.1%. At its highest, shares added more than 70% to touch an intraday high of $28.60 Tuesday amid multiple trading halts due to volatility. The rally came as retail traders active on social media piled into the stock, encouraged by news that GameStop chair Ryan Cohen placed another bet on the struggling retailer.

- Nu Holdings Ltd (NU US) surged 17.9% after the firm reported quarterly revenue that rose 230% from a year earlier. Berkshire Hathaway owned $400 million of Nu Holdings shares at the end of the second quarter, unchanged from the prior quarter.

- Zoom Video Communications Inc (ZM US) fell 3.6% after Citi downgraded the company, saying growing competition from Microsoft Teams could push the stock down 20%. The bank said Zoom has too many post-pandemic challenges in addition to rising competition, including macro-related weakness hitting businesses and margin risk.

- Snowflake Inc (SNOW US) fell 1.8% after UBS downgraded them to neutral from buy amid mounting macro and competitive pressures. UBS also cited a slowdown in customer spending of cloud computing as well as rising competition.

- ThredUp Inc (TDUP US) rallied 17.4% after the company reported better-than-expected quarterly revenue, as well as a 29% increase in active buyers.

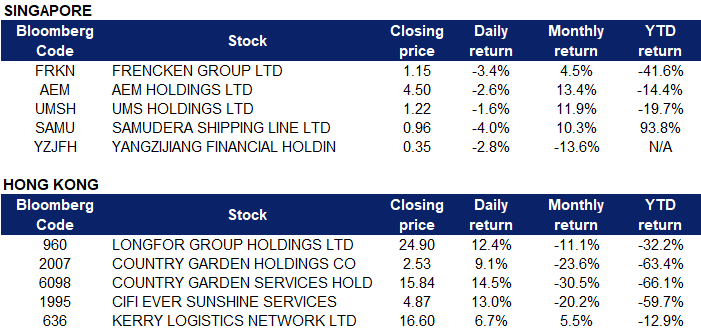

Singapore

- Frencken Group Ltd (FRKN SP), AEM Holdings Ltd (AEM SP) and UMS Holdings Ltd (UMSH SP) fell 3.4%, 2.6% and 1.6% respectively yesterday. Chipmakers are bracing for a particularly severe shift in coming months, when a record-setting sales surge is threatening to give way to the worst decline in a decade or more. The semiconductor market enjoyed a massive run-up in orders during the pandemic, sending sales and stock prices to new highs and triggering a global scramble to find enough supplies. There was hope in some circles that the boom could be sustained for several more years without a painful pullback, but chipmakers are now facing a familiar problem: growing inventory and shrinking demand. Now consumers are cutting down on big-ticket purchases, and chip buyers are following suit.

- Samudera Shipping Line Ltd (SAMU SP) fell 4.0% yesterday. Inflation is seen to ease, given how global supply-chain disruptions are beginning to unwind, shipping rates decline, port congestion eases and the backlog of orders is cleared, raising the prospect of lower core goods inflation ahead, says Fitch Ratings in its latest Economics Dashboard. According to the research firm, the cost of shipping freight has declined by as much as 70% on some routes since September 2021 while transporting cargo now takes around 90 days instead of 122 days in April 2022. On the other hand, consumers are slowing down their demand for big-ticket items and durables, further easing the strain on supply chains. This is because they got to put up with weaker purchasing power because of higher inflation. In addition, oil prices fell on Tuesday as bleak economic data from top crude buyer China renewed fears of a global recession.

- Yangzijiang Financial Holding Ltd (YZJFH SP) fell 2.8%, it had reported lower earnings for its maiden results announcement since its spin-off listing from Yangzijiang Shipbuilding in April. For the six months to June, the investment and fund management firm reported earnings of $136.4 million, down 30.6% y-o-y. Total income in the same period was down 27.3% to $173.8 million. YFH says that in view of the current macro uncertainty, it will adopt a more cautious approach in deploying its capital, preferring to diversify across different vintages. The company maintains it is on track to achieve its long-term target of allocating 50% of its AUM in Singapore for offshore investments, as it reduces its exposure in China.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Property Development | +1.40% | China property stocks rally on hopes of relief plan Longfor Group Holdings Ltd (960 HK) |

Gas Supply | +1.33% | Kunlun Energy Co Ltd (135 HK) |

Property Management & Agency | +1.07% | Chinese property developers surge in Hong Kong amid reports of government backing for onshore bonds Country Garden Services Holdings Co Ltd (6098 HK) |

Top Sector Losers

Sector | Loss | Related News |

Precious Metal | -1.35% | Gold Price Weakness to Persist on Failure to Defend August Opening Range Shandong Gold Mining Co Ltd (1787 HK) |

Biotechnology | -1.10% | Covid-19 in China: panic in Ikea as health authorities lock down store CARsgen Therapeutics Holdings Ltd (2171 HK) |

Automobiles & Components | -0.96% | Alibaba Cloud, Deloitte set up China facility to drive automotive applications Xpeng Inc (9868 HK) |

- Mainland property stocks broke out in early trading and property management stocks followed suit. Longfor Group Holdings Ltd (0960 HK), Country Garden Holdings Co Ltd (2007 HK), Country Garden Services Holdings Co Ltd (6098 HK), and CIFI Ever Sunshine Services Group Ltd (1995 HK) rose 12.4%, 9.1%, 14.5% and 13.0% respectively yesterday. According to media reports, Chinese regulators recently instructed China Bond Credit Enhancement Investment Corporation to carry out “full unconditional and irrevocable joint liability guarantee” for medium-term notes issued by real estate companies, including Longfor Group, CIFI Holdings, Country Garden, etc., model private housing enterprises. According to the latest news, a number of demonstration private housing enterprises confirmed that the supervision plan has given active support and is currently in communication. The regulator plans to provide liquidity support for these exemplary housing companies by guaranteeing newly issued bonds.

- Kerry Logistics Network Ltd (0636 HK) rose 6.7% yesterday. UBS’s latest report stated that the company’s current forecast price-earnings ratio has exceeded the freight adjustment, so the company’s rating was upgraded from “neutral” to “buy”, and the target price was raised from 18.5 Hong Kong dollars to 21 Hong Kong dollars. As of press time, Kerry Logistics rose 5.78% to HK$16.46, with a turnover of HK$10 million. UBS’s latest report said that Kerry Logistics’ stock price has fallen 36% from its record high in November 2021, and the market is worried that due to the ease of logistics bottleneck pressure, freight adjustment may drag down earnings.

Trading Dashboard Update: No stocks additions/deletions.