KGI DAILY TRADING IDEAS – 16 August 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

InnoTek (INNOT SP): EV is its future

- BUY Entry – 0.85 Target – 1.12 Stop Loss – 0.80

- InnoTek is a precision metal components manufacturer serving the consumer electronics, office automation and mobility device industries. The company has a strong and diversified base of Japanese and European end-customers. Management has communicated strong expectations for the automotive division, led by a strong push for electric vehicles in China.

- Mixed 1H2021 results. Net profit in the first half almost doubled to S$7.2mn, lifted by increased sales in automobile products and a recovery in the office automation (OA) sector. However, gross profit margins declined to 21% in 1H2021, from 21.4% in 1H2020 amid higher costs for raw materials and labour, as well as increased lease expenses.

- Recent weakness is a buying opportunity. Shares sold off last week after the release of results, mainly as the management expects customers’ demand to weaken as a result of the shortage of electronic components and chips. In addition, the group expects labour and raw materials to continue to rise while sales and production may still face supply chain issues which will lead to higher logistics-related costs.

- EV is a bright spot. On the bright side, the group’s EV business will be the key driver for the group going forward. The group is placing more emphasis on expanding its customer base in the EV space while growing business with its existing EV clients.

- OUTPERFORM and fundamental TP of S$1.12. Our 5.5x EV/EBITDA peg translates to around 14.3x FY22F P/E.

Civmec (CVL SP): Well prepared for the ongoing commodity supercycle

- REITERATE BUY Entry – 0.745 Target – 0.86 Stop Loss – 0.700

- Civmec is an integrated, multi-disciplinary construction and engineering service provider to the Oil & Gas, Metals & Minerals and Defence & Infrastructure sectors. The group provides services in Australia and its manufacturing facilities are located in Western Australia and New South Wales.

- Strong momentum. 9M2021 revenue and profit have already surpassed the full year 2020. We forecast FY2022F earnings to surpass the previous peak in 2013, during the last commodity supercycle. Civmec’s order book has now surpassed A$1bn this year, supported by strong cash flows and balance sheet, all underpinned by a superb management team.

- Short and mid-term catalysts. Favourable industry supply and demand dynamics driven by China’s appetite for iron ore.

- Long-term drivers. Likelihood of increased contract wins as the Australian government ramps up on defence and infrastructure spending. Civmec’s overall revenue is supported by approximately 20% recurring income from maintenance and upgrading works.

- Outperform. We initiate Civmec with an Outperform recommendation and a TP of S$0.86. Our TP is based on 12x P/E to its FY2022F EPS of S$0.72 (based on 0.9984 SGD/AUD). Read our full report here.

- Earnings to watch. Civmec is due to report its financial full-year results (YE June) either on 26 or 27 August.

HONG KONG

Hua Hong Semiconductor Ltd (1347 HK): Pull back to the previous consolidation range

- Buy Entry – 39 Target – 44 Stop Loss – 37

- Hua Hong Semiconductor Ltd is an investment holding company engaged in production and sales of semiconductor wafers. The company produces 200mm and 300mm-wafers. Its products are applied in general microcontroller (MCU), Type-C interface chips, image stabilization chips, touch control chips, and smart meter controller chips. The products also serve the Internet of Things (IoT), new energy vehicles, artificial intelligence and other markets.

- 1H21 results were better than market expectations. Revenue reached a record high of US$651mn, an increase of 52.0% YoY primarily due to increased wafer shipments and improved average selling price. Gross margin was 24.2%, an increase of 0.6ppts YoY, primarily driven by improved average selling price and capacity utilization, partially offset by increased depreciation expenses. Profit for the period attributable to owners of the parent was US$77.1 million, an increase of 102.3% YoY.

- 90nm eFlash, 90nm BCD, 55nm CIS, DT-SJ, and IGBT were mass produced in the 12-inch production lines, thereby better meeting the capacity needs of customers. The Company is the first Pure Play Foundry in the world to mass produce advanced

FS-Trench IGBT on both 8-inch and 12-inch production lines at the same time.

- The Company’s simultaneous progress in its “8+12” production line technologies and its “IC + Discrete” technology platforms development strategy for the Embedded Non-Volatile Memory, Analog & Power Management, and Logic & RF IC device and Discrete device businesses will provide its customers with comprehensive and excellent technical support in foundry field.

- Consensus estimates per the 12-month target price at HK$54.7, implying a 26% upside potential. EPS is forecasted to grow at 70%/25.6%/16.6% for FY2021/22/23F, which would bring forward P/Es down to 43x/34x/29x FY2021/22/23F.

Zoomlion Heavy Industry Science And Technology (1157 HK): Infrastructure sector regains momentum

- Buy Entry – 8 Target – 9.6 Stop Loss – 7.2

- Zoomlion Heavy Industry Science And Technology Co., Ltd. is principally engaged in the research, development, manufacture and sales of engineering equipment, environmental sanitation equipment and agricultural equipment. The company operates through four segments. The Engineering Equipment segment includes concrete equipment, lifting equipment, earthmoving equipment, foundation construction equipment, road construction equipment and forklifts, which mainly serve the construction of infrastructure and real estate. The Environmental Industry segment is engaged in the production of sanitation equipment, as well as environmental management investment and operating business. The Agricultural Equipment segment consists of farming machinery, harvesting machinery, drying machinery and agricultural machinery, among others. The Financial segment provides financial leasing and other financial services.

- According to the China Construction Machinery Association, a total of 17,345 excavators were sold in July, down 9.24% YoY. Domestic sales fell 24.1% YoY, compared with a fall of 21.9% YoY in June. But exports grew 75.6% YoY in July. July was the third consecutive month of decline. In May and June, excavator sales fell 14.3% YoY and 6.19% YoY respectively. In 1H21, 26 Chinese companies exported 30,133 excavators, up 107% YoY.

- The US Senate on Tuesday approved a $1tn bipartisan infrastructure bill after months of negotiations. It could boost the company’s overseas sales of machineries in the next couple of months.

- With the ongoing clamp-down on the technology sector, funds try to find safe harbours. Traditional sectors have been seeing consistent fund flows for weeks.

- Market consensus of net profit growth in FY21 and FY22 are 10.3% YoY and 12.9% YoY, which implies forward PERs of 6.2x and 5.5x. Current PER is 7.0x. Bloomberg consensus average 12-month target price is HK$12.9.

Market Movers

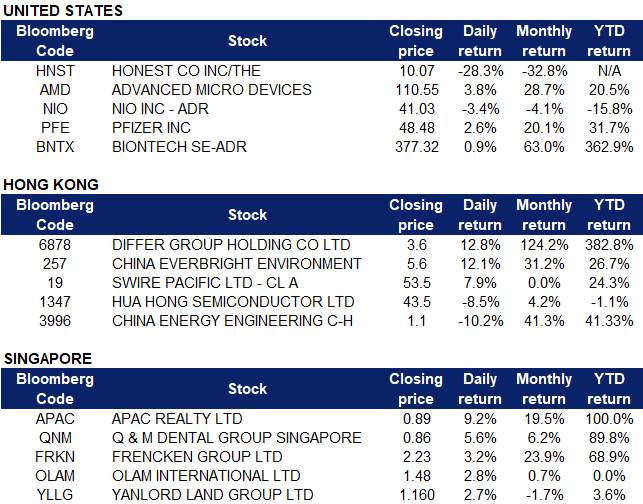

United States

- The Honest Company (HNST US) shares plunged 28% on Friday after the company reported worse than expected second quarter results. The baby and beauty product business reported a loss of 17 cents per share with revenue of $74.6 million, while analysts were expecting a loss of 14 cents per share on revenue of $78.8 million.

- Advanced Micro Devices (AMD US) shares closed 3.8% higher on Friday at $110.55 after Bloomberg released a report on the semiconductor industry that stated that the lag between a semiconductor company placing an order for a semiconductor and getting it delivered by a contract manufacturer now stands at 20.2 weeks. This could suggest that the chip shortage is getting worse, potentially raising the prices of CPUs and GPUs in the future.

- NIO (NIO US)’s shares closed 3.39% lower after Citigroup analyst Jeff Chung lowered their target price from $72 to $70, and reduced his estimates for the company’s average selling prices and gross margins over the next couple of years.

- COVID-19 stocks received a bump on Friday with Pfizer (PFE US) and BioNTech (BNTX US) rising 2.62% and 0.88% respectively. This follows the U.S. Food and Drug Administration (FDA) announcement on Thursday evening that they had expanded the Emergency Use Authorizations for the Pfizer-BioNTech COVID-19 vaccine to include a third booster dose for immunocompromised individuals.

Singapore

- APAC Realty Limited (APAC SP). Shares rose by 9.2% on Friday and closed at a 3-year high after the company announced positive 1H21 earnings results on 12 August. Revenue increased to S$358.4mn in 1H21, a YoY increase of 107.4%, while profit surged by 120.2% to S$17mn. Strong revenue growth was underpinned by the strong demand from local buyers in a buoyant Singapore residential property market, where the private residential resale market recorded sales of 10,090 units in 1H2021, an increase of 228.6% from 3,071 units in 1H2020, while the HDB resale market grew 57.1% to 14,644 units in 1H2021 from 9,319 units in 1H2020. In addition, the company declared an interim dividend of 3.5 Sing cents per share and a special dividend of 3.0 Sing cents per share. Read the full results here.

- Q&M Dental Group (Singapore) Limited (QNM SP). Shares rose by 5.6% as the company announced positive 2Q21 earnings results on Friday. Total revenue for 2Q21 doubled to S$50.8mn from S$24.9 mn in 2Q20, while adjusted PATMI from operations increased more than 10 times from S$0.7mn to S$8.2mn. In addition, the company announced a 2nd interim dividend of 1 Sing cent per share to be paid on 3 September and proposed a bonus issue of up to 157,461,725 new ordinary shares on the basis of 1 bonus share for every 5 existing ordinary shares. Read the full results here.

- Frencken Group Limited (FRKN SP). Shares rose by 3.2% and closed at an all-time high on Friday as the company announced positive 1H21 earnings results on 12 August. Revenue increased by 28.3% YoY to S$375.3mn in 1H21, while net profit rose by 69.7% to S$31.6mn. Read the full results here. DBS upgraded its TP on Frencken to S$2.65 and maintained a BUY rating.

- Olam International Limited (OLAM SP). Shares rose by 2.8% as the company announced positive 1H21 earnings results on Friday. Revenue increased by 33.7% YoY to S$22.8bn in 1H21, while operating PATMI surged by 116.0% YoY to S$436.6mn, its highest since inception. Read the full results here. The company also declared an interim dividend of 4.0 Sing cents per share, an increase from 1H20’s dividend of 3.5 Sing cents. In addition to the outstanding results, the company also announced that Olam Food Ingredients intends to seek primary listing on the London Stock Exchange, with concurrent listing in Singapore, and is on track for an IPO in 1H22.

- Yanlord Land Group Limited (YLLG SP). Shares rose by 2.7% on Friday as the company announced positive 1H21 earnings results on 12 August. Revenue was up by 44.7% YoY to RMB13.2mn in 1H21, while profit increased by 54.8% to RMB1.57bn. The increase in revenue for 1H21 was primarily attributable to the increase in gross floor area delivered to customers, which was partly offset by the decrease in average selling price (ASP) per square metre achieved by the group in 1H21 compared to 1H20. The decrease in ASP achieved by the group in 1H21 was mainly due to the change in the composition of product-mix delivered. Total rental and hotel income of the group increased by 40.9% to RMB692mn YoY, mainly attributable to the strong recovery of domestic business travel and tourism demand for hotels and serviced apartments in the PRC. Read the full results here.

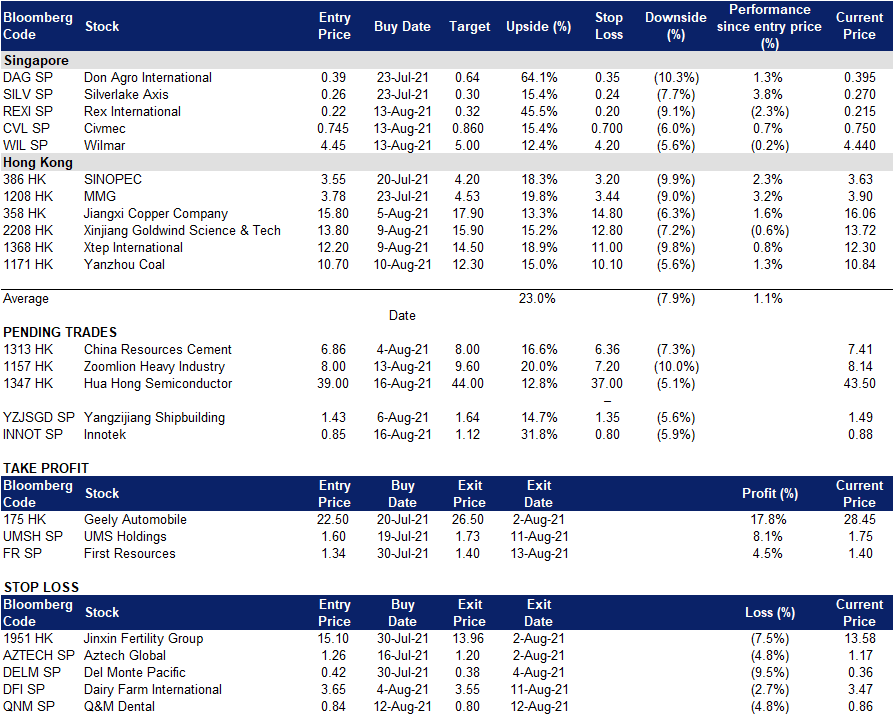

- Trading Dashboard: Add Rex International (REXI SP) at S$0.22, Civmec (CVL SP) at S$0.745 and WIlmar (WIL SP) at S$4.45. Take profit on First Resources (FR SP) at S$1.40.

Hong Kong

- Differ Group Holding Co Ltd (6878 HK). Shares closed at an all-time high. The company previously announced plans to acquire an online e-commerce platform in the automobile industry in the PRC for RMB53mn.The company also announced a positive profit guidance where net profit of the group was expected to increase by 125% – 150% YoY in 1H21earlier.

- China Everbright Environment Group Ltd(257 HK) Shares closed near the highs reached in January. The company announced 1H21 results. Revenue increased by 44% YoY to HK$26.5bn. EBITDA increased by 29% YoY to HK$8.2bn. Profit attributable to equity holders of the Company increased by 28% YoY to HK$3.9bn. The company declared an Interim dividend of HK19.0 cents per share.

- Swire Pacific Ltd (19 HK). Shares closed near a one-month high. The company announced 1H21 results. Revenue increased by 20% YoY to HK$46.7bn. Loss attributable to the company’s shareholders narrowed by 90% YoY to HK$792mn due to a significant increase in profits at Swire Coca-Cola, a strong performance from the Property Division in the Chinese Mainland and reduced losses from Cathay Pacific. The respective interim dividend for “A” share and “B” share was HK$1 and HK$0.2.

- Hua Hong Semiconductor Ltd (1347 HK). The company announced 1H21 results. Revenue reached a record high of US$651mn, an increase of 52.0% YoY primarily due to increased wafer s.hipments and improved average selling price. Gross margin was 24.2%, an increase of 0.6ppts YoY, primarily driven by improved average selling price and capacity utilization, partially offset by increased depreciation expenses. Profit for the period attributable to owners of the parent was US$77.1 million, an increase of 102.3% YoY. The share price could fall due to potential for selling on earnings movement.

- China Energy Engineering Corp Ltd (3996 HK) There was no company specific news. The plunge could be due to some profit-taking movement. The China Securities Regulatory Commission recenetly approved the absorption and merger of China Gezhouba Group Stock Company Limited. The company secured an EPC contract worth approximately RMB4,095mn earlier on.

Trading Dashboard

Related Posts: