KGI DAILY TRADING IDEAS – 16 April 2021

IPO WATCH

TRIP.COM (TCOM US / 9961 HK): IPO pricing at HK$268

- The dual listing in Hong Kong is priced at HK$268, 19.52% discount to the initial price of HK$333.

- The public tranche subscription rate is 16x.

- Shares will start trading on Monday, 19 April.

UNITED STATES

Crowdstrike (CRWD US): Cybersecurity leader is coming back

- RE-ITERATE BUY Entry – 197 Target – 234 Stop Loss – 183

- Despite strong 4Q20 results which saw CRWD achieve its first quarterly net profit, CRWD fell around 30% from its peak during the March tech sell-off.

- CRWD trades at a staggering 50x Price/Sales, but has a strong operating leverage and has reached profitability unlike its other peer leader Zscaler (ZS US). Consensus target price for CRWD is at US$250.

- There continues to be positive momentum in high-growth stocks that have displayed signs of profitability. We re-iterate CRWD with a higher entry price.

United States Steel (X US): This steel coaster can still pick up passengers

- RE-ITERATE BUY Entry – 22.5 Target – 29.4 Stop Loss – 19

- Share price of X has rallied past the US$25 resistance on strong volume, but has now pulled back after a 5-day 35% gain.

- We expect additional momentum into US steelmakers, as iron ore prices stay near the all-time high, while X still trades some way off its 2018 average share price.

- We recommend buying slightly above the 20 EMA. Catalysts include further upwards guidance on their earnings during the 1Q21 earnings call later in the month.

SINGAPORE

Riverstone (RSTON SP): Potential for share price to recover ahead of ex-div on 30 April

- RE-ITERATE BUY Entry – 1.32 Target – 1.50 Stop Loss – 1.24

- The company will go ex-dividend on the last Friday of the month on 30 April. Share prices tend to rally ahead of big dividend payouts, and we think there is more room for Riverstone’s share to rally despite gaining 4% from our entry price of S$1.32.

- The company has declared a final and special dividend of RM 16 sen and RM 4 sen, respectively, which is equivalent to around 6.5 SG cents (based on MYR3.09 per SGD). This is an implied 4.7% dividend yield based on its last closing price of S$1.37.

- Furthemore, shares of glove makers listed in Singapore and Malaysia rallied yesterday on a combination of bargain hunting and short covering amid problems with Johnson & Johnson’s Covid-19 vaccine.

SingPost (SPOST SP): Hunting for the next GLC to embark on strategic review

- BUY Entry – 0.74 Target – 0.82 Stop Loss – 0.70

- SingPost is the national postal service provider in Singapore. The company provides domestic and international postal and courier service. SingTel is the largest shareholder with a 22% stake, followed by Alibaba Group with 15%.

- Expectations aren’t very high for SingPost given its underperformance over the last few years. Consensus has 2 BUYS, 3 HOLDS, 1 SELL, and an average target price of US$0.75. Its shares have a total 5-year return of -54%, or an annualised loss of 15%.

- However, we think SingPost’s shares at current levels provide an attractive risk-reward for a short-term trade amid the ongoing corporate actions undertaken by other government-linked companies. Most recently, shares of SPH (SPH SP) have gained 72% year-to-date, and was triggered by the strategic review it announced last month. Meanwhile, shares of Sembcorp Industries (SCI SP) have surged 144% year-on-year following the demerger of Sembcorp Marine (SMM SP), its offshore & marine business.

- On a fundamental level, SingPost is making strides toward growing its eCommerce-related business, and this segment is now estimated to make up around 65% of overall group revenues. CouriersPlease, Quantium Solutions and SP eCommerce experienced robust growth as a result of increased adoption of eCommerce activities in Asia-Pacific. In particular, CouriersPlease saw solid volume growth in Australia, with revenue rising 48% YoY for the half-year.

- Underlying net profit has also stabilised at around S$100mn over the last two financial years, after dropping from FY2015 (S$154mn), FY2016 (S$116mn) and FY2017 (S$106mn).

HONG KONG

CNOOC Limited (883 HK): Wait for a buying opportunity below $8

- Buy Entry – 7.8 Target – 9.4 Stop Loss – 7

- CNOOC Limited is a Hong Kong-based investment holding company principally engaged in the exploration, production and trading of oil and gas. Its businesses include conventional oil and gas businesses, shale oil and gas businesses, oil sands businesses and other unconventional oil and gas businesses. The Company mainly operates businesses through three segments. The Exploration and Production segment is engaged in the exploration, development and production of crude oil, natural gas and other petroleum products. The Trading segment is engaged in the trading of crude oil, natural gas and other petroleum products. The Corporate segment is engaged in corporate-related businesses. The Company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, Indonesia and Brazil, among others.

- The company has been underperforming the global oil majors due to the inclusion in the US blacklist of military-related enterprises. The company is out of favour for foreign investors. But we note that only 6% of its business is exposed to North America.

- The sell-down earlier this week could be due to the accident of V29 oil well on the 19-3WHPV platform. There are three staff members still missing.

- Updated market consensus of the estimated growth of net profit in FY21 and FY22 are 148.8% and 8.9% respectively, which translates to 5.2x and 4.8x forward PE. The current PE is 11.8x. The estimated respective dividend yield in FY21 and FY22 is around 9.3% to 10%. Bloomberg consensus average 12-month target price is HK$11.98.

Metallurgical Corporation of China Ltd. (1618 HK): Cannot ignore a metallurgy play

- BUY Entry – 2.0 Target – 2.5 Stop Loss 1.8

- Metallurgical Corporation of China Ltd. is a China-based company principally engaged in engineering construction related businesses. The company’s businesses mainly include engineering contracting, real estate development, resources development and equipment manufacturing. The company’s engineering contracting businesses mainly include the metallurgical engineering, municipal engineering, transportation facilities and urban infrastructure construction, among others. Its real estate development businesses mainly include the development and construction of commercial and residential real estates. Its resource development businesses mainly include the mining and processing of iron, copper, nickel, lead and zinc, among others. Its equipment manufacturing businesses mainly include the manufacturing of metallurgical equipment and steel structures.

- Previously, the company announced the FY20 full-year results. Operating revenue grew by 18.2% YoY to RMB40bn. Net profit grew by 23.8% YoY to RMB9.4bn. Net profit attributable to the shareholders grew by RMB19.1% YoY to RMB7.9bn. Management proposed a cash dividend of RMB0.75 for every 10 shares. Newly-signed contracts in FY20 exceeded RMB1tn with growth of 29.5% YoY for the first time.

- The company just announced that newly signed contracts in 1Q21 grew by 60.7% YoY to RMB280.57bn.

- The stock is another good exposure to the booming commodity cycle this year. Unlike the upstream raw materials suppliers like mining companies whose stock prices are sensitive to the underlying material prices, Metallurgical Corporation of China’s growth is more visible owing to the order book driven business model. Since the company has secured phenomenal growth in its order book due to strong demand, we believe its stocks price will gradually reflect the improving business performance.

Market Movers

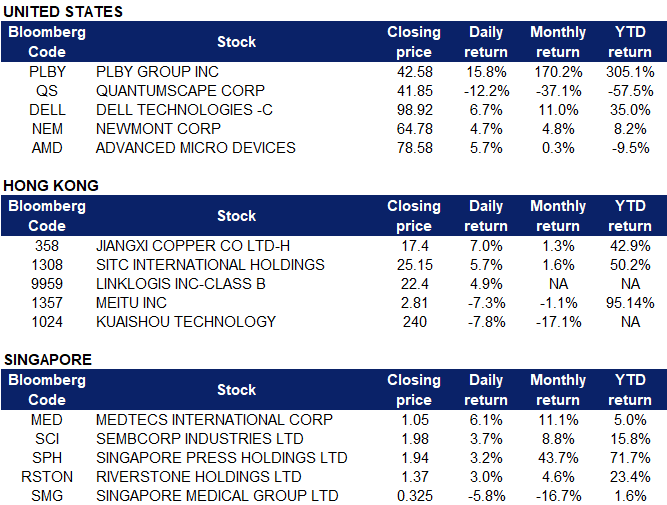

United States

- Playboy Group (PLBY US) continued hitting new highs on strong trading volume behind the potential monetization of its art and photography archive through Non-fungible Tokens (NFT). This stands in contrast with other NFT plays such as Dolphin Entertainment (DLPN US) and Takung Art (TKAT US) which have lost momentum in the market.

- Quantumscape (QS US) had a double-digit daily loss behind a short report by Scorpion Capital calling it a “Pump and Dump SPAC Scam”. Various other loss-making electric vehicle related stocks also saw substantial selling pressure today as investors re-assessed valuations on these loss-making EV players.

- Dell (DELL US) reached an all-time high, breaking out of its prior trading channel after announcing the spinoff of VMware (VMW US), its cloud computing software arm. The spinoff will provide cash to help offset Dell’s large debt load.

- Newmont Corporation (NEM US), Barrick Gold (GOLD US) and other gold miners gained along with gold spot and futures behind the announcement of US sanctions on Russia and the plunge in bond yields. The sanctions marked a steady comeback of geopolitical conflict after the calm during COVID-19 where countries had a united threat to deal with, and investors could be seeking the yellow metal as a hedge against political uncertainty.

- Advanced Micro Devices (AMD US) saw the largest daily % gain amongst large cap semiconductor stocks behind two analyst updates. Bank of America reiterated a Buy call with a US$100 target price, while Raymond James initiated coverage on AMD with a US$100 target price.

- Trading Dashboard: Take profit from Jazz Pharmaceuticals (JAZZ US) at US$168.39.

Earnings Watch: Ehang, Morgan Stanley (Friday)

Hong Kong

- Jiangxi Copper Company Limited (358 HK). Goldman Sachs raised its 12-month copper price target to US$11,000 and projected prices will hit $15,000 by 2025. Copper price was back to above US$9,000/tonne as of 15th April. Meanwhile, the investment bank also raised the TP to HK$24 from HK$19.6 and maintained a BUY rating.

- SITC International Holdings Company Limited (1308 HK). Balti Dry Index rose to a 3-week high of 2,178. Shipping and harbour sector jumped. HSBC raised the TP to HK$33 from HK$28 and maintained a BUY rating.

- Linklogis Inc (9959 HK). Shares closed at another new high since IPO. The market cap broke above HK$50bn. Investor sentiments were still positive in the SaaS sector.

- Meitu Inc (1357 HK). Shares were trading lower as Bitcoin prices corrected after it hit a new high of US$64,895. Investors viewed it as a partial proxy to Bitcoin trading.

- Kuaishou Technology (1024 HK). Shares closed at the lowest since IPO but still well above its public offering price of HK$115. However, its market cap dropped below HK$1tn for the first time.

Singapore

- Sembcorp Industries (SCI SP) after UOB KH earlier this week raised its target price to S$2.27 from S$2.00 and kept its BUY recommendation. The research house cited that SCI may benefit from efforts to ramp up its renewable energy portfolio with the recent win of two 82 megawatt solar projects in Singapore, making the company the solar energy market leader in the country.

- SPH gained another 3%, continuing its uptrend on high trading volumes amid its ongoing strategic review. Shares of SPH have gained almost 93% over the last six month, but still currently trades at a 15% discount to its book value.

- Riverstone (RSTON SP). Shares of Riverstone gained alongside SGX-listed Top Glove (+5%) and Bursa-listed glove makers including Supermax (+11%), Careplus (+14%), Ruberex (+13%) and Hartalega (+6%).

- Singapore Medical Group (SMG SP) resumed trading yesterday but announced that the potential transaction involving its shares will not be explored further. Shares have declined 17% from the start of the week, with most of the decline (around 12%) before the announcement was made.

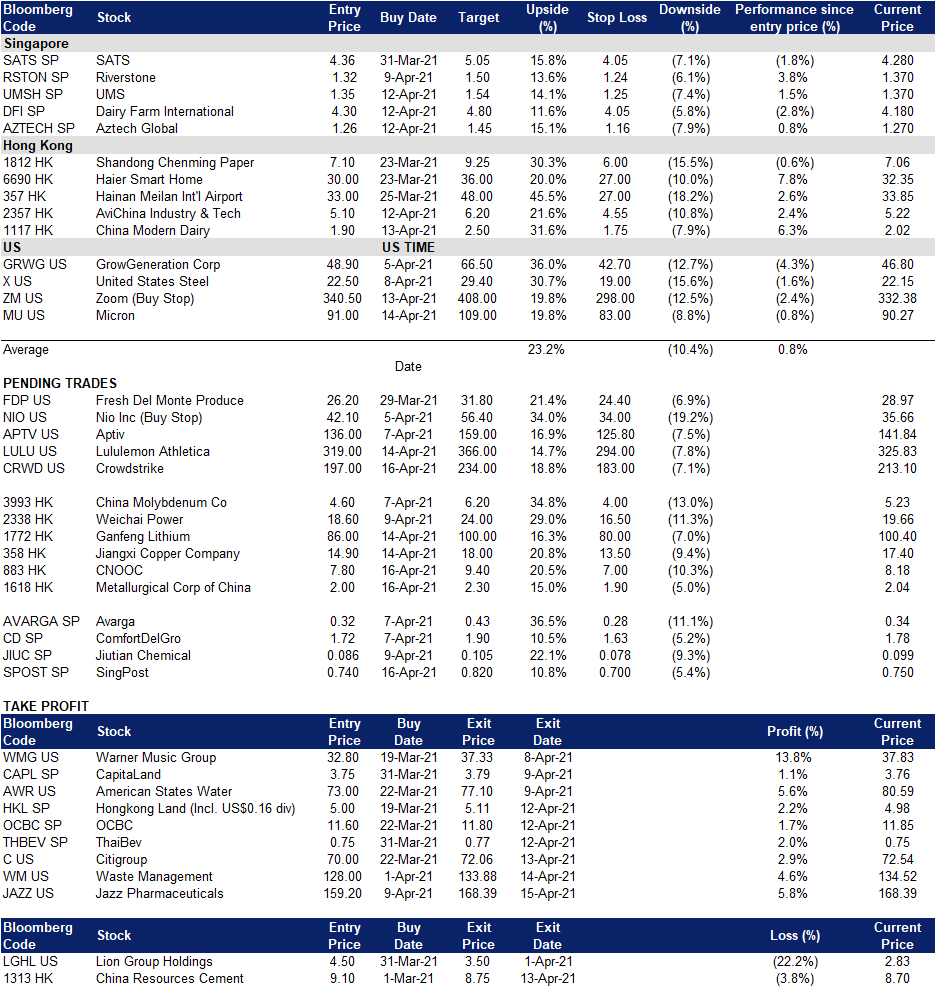

TRADING DASHBOARD