KGI DAILY TRADING IDEAS – 15 September 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Rex International (REXI SP): Pure play on higher oil prices

- BUY Entry – 0.20 Target – 0.33 Stop Loss – 0.18

- Rex International Holding (Rex) is a pure-play oil & gas exploration and production company (Independent). It owns and operates an oil-producing field in Oman and has a portfolio of exploration licenses in Norway. This year, the company added the Brage oil field in Norway and was awarded two Production Sharing Contracts (PSCs) by Petroliam Nasional Berhad (PETRONAS), Malaysia’s national oil corporation.

- Expanding into Asia. Early this month, Rex made its first foray into Asia. The company was awarded two PSCs by PETRONAS. The two PSCs are related to the development and production of the Rhu-Ara and Diwangsa Clusters located in offshore Peninsular Malaysia. These previously discovered fields have a total estimated recoverables of 23.4 MMstb. The participating interests of Rex and Duta Marine Sdn Bhd (DMSB) are 95% and 5% respectively with Rex being the operator of the PSCs.

- Good start; even better second half. Rex International Holding (Rex) reported its highest semi-annual revenue since listing in 2013. Rex’s 1H2021 PATMI of US$24.0mn is a significant reversal from the US$20.1mn loss in 1H2020, driven by higher production and oil prices. We expect better performance ahead as the group grows organically and through acquisitions.

- Record free cash flows. Free cash flow generated by oil and gas companies are expected to break records this year with oil currently trading above US$70 per barrel. For Rex, the windfall will continue to strengthen its already strong balance sheet and give it opportunities to diversify.

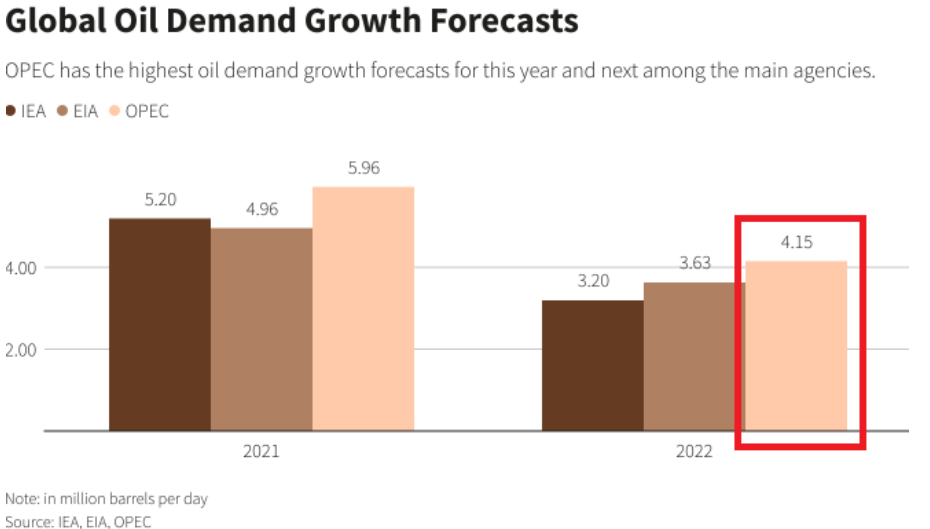

- Increasing oil demand going into 2022. While OPEC recently trimmed its oil demand forecast for 4Q2021 due to the Delta variant, the organisation has increased its 2022 oil demand growth forecast to 4.15mn barrels of oil per day, compared to 3.28mn in the previous month’s report. This basically means that oil demand will exceed pre-pandemic levels next year.

- We have an Outperform recommendation and a DCF-backed target price to S$0.33.

Singtel (ST SP): Finally turning around

- BUY Entry – 2.38 Target –2.60 Stop Loss – 2.28

- Singtel provides an extensive range of telecommunications and digital services to consumers and businesses across Asia, Australia, Africa and the US. It serves over 753 million mobile customers in 21 countries, including Singapore, Australia (via wholly-owned subsidiary Singtel Optus) and the emerging markets of India, Indonesia, the Philippines, Thailand and Africa.

- Five years of underperformance. Shares of Singtel have lost almost 50% from their 10-year peak of S$4.57 that they traded at in April 2015. The underperformance was due to the sequential underlying earnings decline over the past four years, mainly because of the drag from Bharti Airtel, its Indian associate.

- Improving outlook. Consensus anticipates an improving outlook for Bharti as the Indian wireless industry becomes a quasi-duopoly, which should drive revenue and earnings growth going forward. Bharti recently announced revisions to its prepaid and postpaid plans that could improve ARPU by 4-7%, according to estimates by JP Morgan. Meanwhile, its 100%-owned Australian subsidiary, Optus, is seeing a better competitive environment as operators remove discounts and are offering less bonus data.

- Longer-term driver. Beyond the next 12-24 months, a key driver will be Singtel’s digital banking plans together with its partner, Grab Holdings. The Singtel-Grab consortium will allow it to take deposits and offer banking services to retail and corporate customers. For now, we think Singtel’s share price has likely not factored in contribution from the digital bank business, and will likely be a positive boost to its shares when visibility emerges.

- Consensus estimates. Consensus has an overall positive outlook on Singtel, with 17 BUYS / 2 HOLDS / 0 SELL, and a 12m TP of S$2.94 (+23% upside potential). EPS is forecasted to finally grow 32% and 18% for FY2022 (YE March) and FY2023. The stock offers a decent dividend yield of 4.2% for FY2022 and 5.0% for FY2023.

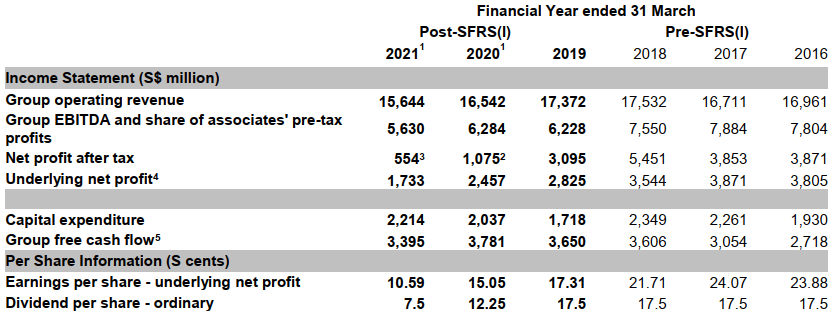

Singtel’s financial summary (2016-2021)

HONG KONG

Hua Hong Semiconductor Ltd (1347 HK): A quality semicon play amid weak market sentiment

- Buy Entry – 39 Target – 45 Stop Loss – 37

- Hua Hong Semiconductor Ltd is an investment holding company engaged in production and sales of semiconductor wafers. The company produces 200mm and 300mm-wafers. Its products are applied in general microcontroller (MCU), Type-C interface chips, image stabilization chips, touch control chips, and smart meter controller chips. The products also serve the Internet of Things (IoT), new energy vehicles, artificial intelligence and other markets.

- 1H21 results were better than market expectations. Revenue reached a record high of US$651mn, an increase of 52.0% YoY primarily due to increased wafer shipments and improved average selling price. Gross margin was 24.2%, an increase of 0.6ppts YoY, primarily driven by improved average selling price and capacity utilization, partially offset by increased depreciation expenses. Profit for the period attributable to owners of the parent was US$77.1 million, an increase of 102.3% YoY.

- 90nm eFlash, 90nm BCD, 55nm CIS, DT-SJ, and IGBT were mass produced in the 12-inch production lines, thereby better meeting the capacity needs of customers. The company is the first Pure Play Foundry in the world to mass produce advanced FS-Trench IGBT on both 8-inch and 12-inch production lines at the same time.

- The company’s simultaneous progress in its “8+12” production line technologies and its “IC + Discrete” technology platforms development strategy for the Embedded Non-Volatile Memory, Analog & Power Management, and Logic & RF IC device and Discrete device businesses will provide its customers with comprehensive and excellent technical support in foundry field.

- Consensus estimates per the 12-month target price at HK$54.4, implying a 26% upside potential. EPS is forecasted to grow at 74.1%/22.5%/19.2% for FY2021/22/23F, which would bring forward P/Es down to 41x/33x/28x FY2021/22/23F.

TRIP.COM (9961 HK): Seasonal trade based on the upcoming holiday

- Reiterate BUY Entry – 210 Target – 250 Stop Loss – 190

- Trip.com Group Limited, formerly Ctrip.com International, Ltd., is a travel service provider in China that provides accommodation booking, transportation ticketing, package tours and corporate travel management. The company aggregates hotel and transportation information to help leisure and business travellers make reservations. The company helps leisure travellers book travel packages and guided tours and helps corporate clients manage their travel needs. The company also offers a range of travel-related services to meet the different booking and travel needs of leisure and business travellers, including visitor reviews, attraction tickets, travel-related financial services, car services, travel insurance services and passport services. The company also offers package tours for independent leisure travellers, including tour groups, semi-tour groups and private groups, as well as package tours that require different transportation arrangements (such as cruise, buses or self-driving).

- The new wave of COVID-19 outbreak in China is under control. Though summer vacation was ruined, this was factored in the recent sell-down of the stock. The pent-up travelling demand could boost the seasonal sales for the upcoming golden week (Mid-autumn festival and national day Holiday) in late September.

- The company will announce 1H21 interim results on 24th September.

- The updated market consensus of the estimated net profit growth in FY22 and FY23 is 193.8% and 31.5% respectively, which translates to 22.1x and 16.8x forward PE. Bloomberg consensus average 12-month target price is HK$313.15.

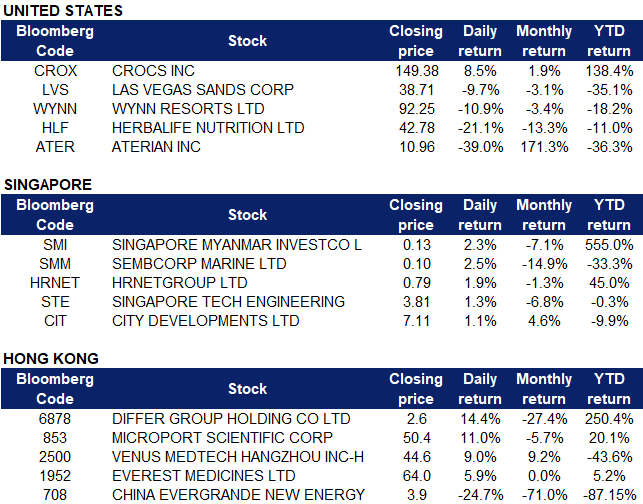

Market Movers

United States

- Crocs (CROX US) shares jumped as much as 14.6% after the footwear maker introduced a new shoe made of bio-based material as part of its goal to reduce its carbon footprint. The stock reached an all time high of $157.80, before closing 8.47% higher on Tuesday at $149.38. The company previously announced that they would achieve net zero emissions by 2030, armed with a tagline “comfort without carbon.” Additionally, the company’s second quarter earnings report recorded a record revenue that grew 93% YOY, and management predicts a 60% to 65% revenue increase for the full year compared to 2020.

- Casino stocks with presence in Macau Las Vegas Sands (LVS US) and Wynn Resorts (WYNN) fell as much as 13.9% and 13.8% respectively on Tuesday. This follows announcements by Macau’s government that COVID-19 cases are on the rise in the Chinese province of Fujian that could result in fewer visitors to Macau, and is giving the public until 29 October to give feedback on how to move forward with the region’s gambling business. Las Vegas Sands sold all its U.S. operations to focus on its business in Asia, and Wynn Resorts currently operates two casinos in Macau.

- Herbalife (HLF US) shares plunged 21.13% after the company revised its Q3 and FY21 guidance downwards. Herbalife blamed lower than expected levels of activity by its independent distributors for its decision to cut the guidance. The company expects full-year net sales to grow in the range of 4.5% to 8.5%, as compared to its previous forecast of 8.5% to 12.5% growth. Adjusted earnings per share is now at approximately $4.75 at midpoint, lower by 15 cents from the previous forecast.

- Aterian Inc (ATER US) shares crashed on Tuesday, plunging 39.04%. There was no company specific news. The stock recently saw its valuation surge on the heels of gaining traction as a meme stock and short squeeze candidate, but the push is now collapsing, possibly because of investors taking profit after the stock made a leap of over 50% on Monday. The company’s stock is still up roughly 171% over the last month and 42.5% over the last year.

Singapore

- Singapore Myanmar Investco (SMI SP) shares rose as much as 3.9% on Tuesday morning before closing 2.34% higher. The company previously announced last month that it had placed orders for up to 800 cryptocurrency mining machines which will be delivered to its facilities in Southeast Asia over the next few months. This follows SMI’s plan to venture into cryptocurrency, Software-as-a-Service (“SaaS”) and other high tech platforms as part of its new business direction. Mark Bedingham, president and CEO of SMI said “This is significant progress for SMI as we move towards technology-based SaaS businesses and help increase access to cryptocurrency mining for retail customers while generating substantial shareholder value.”

- Sembcorp Marine (SMM SP) shares rose 2.47% on Monday. The company recently secured a contract from Altera Infrastructure concerning the floating production, storage and offloading for the Dorada Project, which is located in the Bedout Sub-basin in West Australia. The project is expected to be completed by the second quarter of 2022, and is Sembcorp Marine’s third engineering, procurement and construction (EPC) project with Altera Infrastructure. Additionally, UOB Kay Hian recently upgraded the company’s rating to BUY, saying that the negatives surrounding the company are priced in at current levels and that post its S$1.5b rights issue, the company should be better equipped to weather conditions over the next year.

- HRnetGroup Ltd (HRNET SP). Shares rose 1.94% without any company specific news. CGS-CIMB Research Group released a report on 6 September, saying that they are turning more positive on the pace of the labour market recovery. CGS-CIMB are keeping “add” on HRnetGroup with an unchanged target price of $1.15 based on 17 times FY2022 price-to earnings. The Ministry of Manpower will release its Labour Market Report today (15 September), where the analysts expect positive data points to reaffirm their thesis that the labour market is on the mend.

- ST Engineering (STE SP) shares climbed 1.33% after UOB Kay Hian upgraded the company on Tuesday to “buy” with an unchanged target price of $4.25. Analyst K Ajith believes that now is an appropriate time to revisit the stock, given its price decline since its results were released. Ajith also remains optimistic on the stock in the medium-term in view of recently secured contracts and orders, which he thinks will lead to a gradual pick-up in aerospace earnings by mid-2022. Additionally, ST Engineering announced on Monday that its AGIL Smart Lift Monitoring solution will be installed in lifts in Singapore from 2021. Yao Shih Jih, head of smart utilities and infrastructure at ST Engineering said “The AGIL Smart Lift Monitoring solution is a great example of how our innovations are helping industries digitalise to create new value and seize new possibilities.”

- City Developments Limited (CIT SP) shares closed another 1.14% higher following its 5.4% climb on Monday. The company announced its plans to sell its stake in Chongqing Sincere Yuanchuang Industry Co. for US$1, ending its backing of the cash-strapped developer.

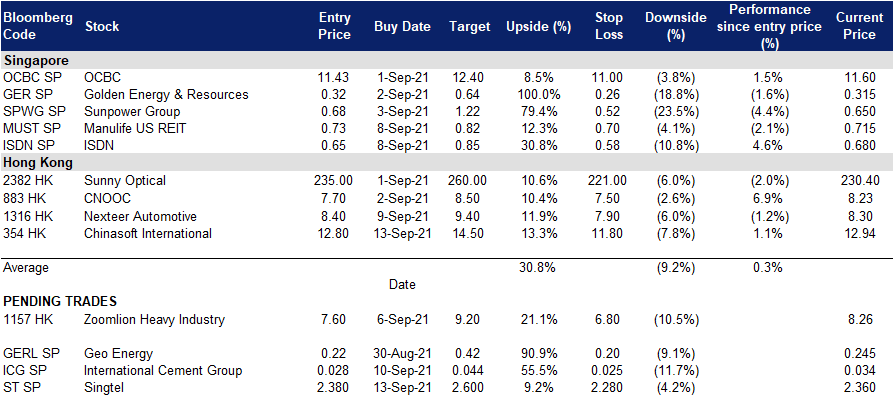

- Trading Dashboard: Add Singtel (ST SP) at S$2.38. Cut loss on Manulife US REIT (MUST SP) at S$0.71

Hong Kong

- Differ Group Holding Company Ltd (6878 HK) shares rose by 14.4% yesterday, with shares gaining a total of 38% over the last 6 trading days. The price rally followed the company’s announcement of it has been selected as a constituent stock of the FTSE Global Stock Index Series China Regional Index, effective after the market closes on 17 September. The board of directors believes that Differ’s inclusion in the index represents the capital market’s affirmation of the company’s value and performance. The company will continue to actively seek and grasp market opportunities so that its investment value can be realized.

- Microport Scientific Corporation Ltd (853 HK) shares rose by 11% yesterday after the company announced that its subsidiary, Shanghai Micro Creation will acquire a 45% equity stake in Fujian Kerui Pharmaceutical Co., Ltd. for approximately RMB 111mn. After the completion of the transaction, Shanghai MicroPort will become the single largest shareholder of Kerui Pharmaceutical. Shanghai MicroPort will obtain control of Kerui Pharmaceutical’s daily operations through an agreement arrangement.

- Venus MedTech Hangzhou Inc (2500 HK) shares rose by 9% yesterday, with shares gaining a total of 21.6% over the last 3 trading days. Shares closed at HK$44.60, slightly higher than its IPO price of HK$40 in December 2019. The shares rallied as it was announced that 2 long-term clinical studies on the transcatheter prosthetic pulmonary valve system VenusP-Valve, confirmed the long-term efficacy and effectiveness of the first domestic pulmonary valve developed by the company. In addition, the valve had some indicators which were better than similar international products. In March this year, VenusP-Valve also obtained a special license from the United Kingdom and entered the market in advance.

- Everest Medicines Ltd (1952 HK) shares rose by 5.9% yesterday, bringing total gains to approximately 42% since the company announced its results 2 weeks ago. Yesterday, Citi issued a research report and maintained a BUY rating on Everest Medicines with a TP of HK$135. Catalysts include the company’s acquisition of mRNA technology and the potential for future vaccine development, which can contribute to long-term growth. According to the report, the company has reached a comprehensive agreement with Canadian vaccine developer Providence Therapeutics to promote the development of mRNA vaccines and drugs including the new crown vaccine in the Asian market. Both parties will develop in a joint venture.

- China Evergrande New Vehicle Group Ltd (708 HK) shares declined by 24.7% yesterday and closed at a 3-year low. Shares have been on a downtrend since mid-April and as of yesterday, have lost approximately 94.4%. The company has been heavily battered ever since its parent, China Evergrande Group (3333 HK), announced liquidity and debt issues, leading to investors’ loss of confidence over the company’s ability to repay its bonds. Yesterday, Evergrande announced that it expects a “significant” continued decline in sales this month. The company has been trying to sell some assets to ease its liquidity crunch, but said those efforts haven’t yielded anything yet. Evergrande also warned its escalating troubles could also lead to broader default risks. Evergrande Property Group (6666 HK) and China Evergrande Group (3333 HK) shares dipped 12% and 11.9% respectively yesterday.

- Trading dashboard: KWG Living (3913 HK) cut loss at HK$5.8. TRIP.com (9961 HK) cut loss at HK$235. Add Chinasoft International (354 HK) at HK$12.8.

Trading Dashboard

Related Posts: