KGI DAILY TRADING IDEAS – 15 October 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Broadway Industrial (BWAY SP): The need for space

- BUY Entry – 0.18 Target – 0.20 Stop Loss – 0.17

- Listed on the mainboard of SGX since 1994, the company is one of the leaders in the manufacture of precision components and assemblies. It is a key provider of actuator arms, assemblies and other related parts for the global hard disk drive (HDD) industry. Headquartered in Singapore, the company has 4 manufacturing facilities in China and Thailand and employs around 3,5000 people.

- Need for space. Total HDD sector revenue is expected to increase at a 10% CAGR from 2020 to 2025, reaching total sales of US$32.9bn by 2025, according to forecasts by TRENDFOCUS. Growth will mainly be driven by enterprise demand for more storage. While the growth of cloud-based solutions has been highlighted as a key driver of higher storage demand, the market may still be overlooking the increasing trend of data-localisation measures. The number of localisation measures around the world has more than doubled over the last four years, with China being the most data-restrictive country, followed by Indonesia, Russia, and South America.

- Strong outlook in 2H 2021. 1H2021 sales increased 11% YoY to S$211mn while net profit grew by 9% YoY to S$7mn. The better performance was driven primarily by higher shipment volume and higher average selling price of its HDD products as it shipped more high-performance enterprise products. Management commented that it expects demand for high-performance HDDs and personal storage HDDs to remain strong in 2H 2021. The company currently trades at an attractive 6x T12 P/E.

- Technical analysis and share buybacks. The uptrend momentum since 2Q2020 is well supported by the 200 day EMA. Furthermore, the company started buying back shares on 5 October, and has bought back more than 3.3mn shares over the past 2 weeks, at a price range of S$0.155 to S$0.173. The last time it bought back shares was more than 2 years ago.

Silverlake Axis (SILV SP): The future is digital

- REITERATE BUY Entry – 0.30 Target – 0.36 Stop Loss – 0.27

- Silverlake Axis is a software company that provides banking solutions to banks in Asia. The company has been operating for more than 30 years. Of the top 20 largest banks in Southeast Asia, 40% of them use Silverlake’s core banking solutions.

- Parent’s new partner. Earlier in July 2021, The Edge reported that private equity firm Ikhlas Capital is investing US$40mn in Silverlake Group, the holding company of the SGX-listed Silverlake Axis Ltd. Silverlake Group is the largest shareholder of Silverlake Axis. In turn, Ikhlas Capital is partly owned by former banker Datuk Seri Nazir Razak, and the firm is one of the partners of a conglomerate comprising other firms including AirAsia’s Group e-wallet unit Big Pay and Malaysian Industrial Development Finance (MIDF) vying for one of the five digital banking licenses to be awarded by the first quarter of 2022.

- Digital banking is its future. Given Silverlake Axis’s experience and expertise in providing banking solutions over the past 30 years, combined with the recent news of the investment by Ikhlas Capital into its parent company, we think that the award of one of the five digital banking licenses could provide a much-need catalyst to Silverlake’s share price. Despite the >30% rally of its share price from the recent low, it is still near its 8-year low, partly due to a business slowdown over the years, and also due to a damaging short-seller report in 2015 which caused its market cap to almost halve in value.

- Still overlooked by consensus. Street expectations are not very high for the group, and may imply that many of the positive catalysts are not factored in yet into its current share price. There are 2 BUYS and 2 HOLDS and a 12m TP of S$0.38. Its valuations of 15x and 14x FY2022/23 P/E are relatively lower vs its software-related peers.

HONG KONG

Fuyao Glass Industry Group Co Ltd (3606 HK): A-shares have bottomed out

- Buy Entry – 40 Target – 50 Stop Loss – 36

- Fuyao Glass Industry Group Co Ltd is a China-based company, principally engaged in the manufacture and distribution of float glasses and automobile glasses. The company’s products portfolio consist of automobile glasses, such as coating glasses and others, which are applied in passenger cars, buses, limousines and others, and float glasses. The company distributes its products within domestic markets and to overseas markets.

- Key financial highlights:

| (RMB mn) | 1H21 | 1H20 | YoY change |

| Revenue | 11,543.2 | 8,121.3 | 42.1% |

| Gross profit | 4,586.7 | 2,807.6 | 63.4% |

| GPM (%) | 39.7 | 34.6 | 5.1 ppt |

| Net profit | 1,766.7 | 962.5 | 83.6% |

| NPM (%) | 15.3 | 11.9 | 3.4 ppt |

- Chip shortage. Impacted by shortage of automobile chips, the automobile production recovery has slowed down even as demand for passenger vehicles continue to rise. Global automakers are forced to shut several plants due to insufficient chip supply. Automobile glass is one of the parts in a vehicle, and hence, its sales are highly correlated to the auto production volume.

- Power shortage. Due to extraditionarily high coal prices, China is facing a power outage which directly affects industrial production. Glass production demands a huge amount of electricity usage.

- Headwinds are transitory. Currently, shares are hammered due to the abovementioned unfavourable macro factors. However, unsustainable high coal prices are more impactful in the near term. Gradually, we believe that the negatives will be mitigated as China has resumed operations of some coal mines. Meanwhile, infections in Southeast Asia countries are decreasing, especially in Malaysia where most auto chip packaging is done. Hence, we could see some improvements in auto ship supply in 4Q21.

- A-share rebounded. The company’s A-share rose for 6 consecutive days, recording 19.4% gains from the recent low of RMB41.3 per share. H-share is still lagging.

- Consensus estimates per the 12-month target price is at HK$60.85, implying a 47.3% upside potential. EPS is forecasted to grow at 52.8%/25.3%/16.5% for FY2021/22/23F, which would bring forward P/Es down to 21.6x/17.2x/14.8x FY2021/22/23F.

China Southern Airlines Company Limited (1055 HK): Slow but steady price uptrend

- REITERATE Buy Entry – 4.5 Target – 5.0 Stop Loss – 4.3

- China Southern Airlines Company Limited is principally engaged in the operation of civil aviation, including the provision of passenger, cargo, mail delivery and other extended transportation services. The Company operates through two business segments, including Airline Transportation segment and Other segment. Airline Transportation segment consists of passenger and cargo and mail operations. Other segment includes hotel and tour operation, ground services, cargo handling and other miscellaneous services. The Company also provides services of general aviation and aircraft maintenance.

- Move on to post-COVID era. With more than 50% of the population vaccinated in major economies, and potential oral medicine of COVID treatment, countries are expected to fully open their borders in 2022. China has been insisting on a “zero infection” policy and adopting the most draconian quarantine measures on visitors. However, it has to normalise international travelling eventually when other countries open borders and adapt to coexist with the COVID virus. After all, isolation deters economic recovery and growth. The second largest economy with the largest population in the world cannot afford to maintain the absolute zero COVID patient at the price of reduction in travelling for a long term. The normalisation of travelling will be one of the main themes next year.

- High oil prices are another headwind but could correct for a while. The rally of oil price is expected to extend further. However, this is a secondary negative impact given that the air passenger volume is much lower compared to pre-COVID levels. The rally of oil prices is sharp and speedy. Hence, there could be some correction as oil is now becoming a crowded trade.

- Updated market consensus expects loss per share to narrow to RMB0.33 in FY21 from RMB0.77 in FY20, and eventually to turn profitable with an EPS of RMB0.176/0.267 in FY22/23. Bloomberg consensus average 12-month target price is HK$5.61.

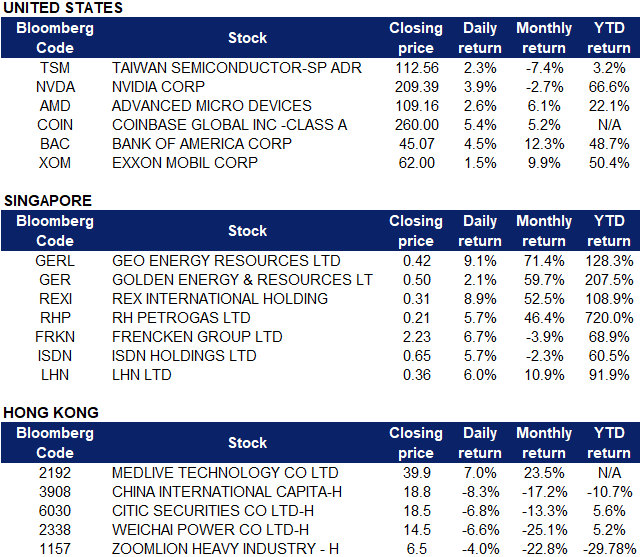

Market Movers

United States

- Taiwan Semiconductor Manufacturing Co Ltd (TSM), Nvidia Corp (NVDA US), Advanced Micro Devices Inc (AMD US). Semicon sector rose collectively yesterday due to a spillover effect from the announcement of TSM’s better-than-expected 3Q21 financial results. TSM shares gained 2.3% yesterday, while Nvidia and AMD gained 3.9% and 2.6% respectively. TSM reported quarterly earnings of US$1.08 per share, which beat estimates of US$1.04 per share, representing a 13.8% YoY increase. The company’s quarterly revenue was US$14.88bn, also beating estimates of US$14.83bn, representing a 16.3% YoY increase. 4Q21 revenue is expected to be in a range between US$15.4bn and US$15.7bn. Wendell Huang, Vice President and CFO, commented that moving into 4Q21, the company expects its business to be supported by the strong demand for its industry-leading 5nm technology.

- Coinbase Inc (COIN US). Shares rose 5.4% yesterday after the company announced that it plans to launch a marketplace that lets users mint, collect and trade NFTs, or non fungible tokens. NFTs are one-of-a-kind digital assets designed to represent ownership of online items like rare art or collectible trading cards. In addition, Russian president Putin announced yesterday that he recognises Crypto as a form of payment, which could have boosted crypto related shares. Bitcoin was trading around US$ 57,000 yesterday. Its last high was seen in May 2021. Fellow crypto peers, Square Inc (SQ US) gained 1.9% yesterday.

- Bank of America (BAC US) Shares rose 4.5% yesterday after the bank announced its 3Q21 results which exceeded analysts’ expectations, benefitting from better-than-expected loan losses and record advisory and asset management fees. Bank of America reported quarterly earnings of US$0.85 per share, beating estimates of US$0.71 per share. The company’s profit surged 58% to US$7.7bn while revenue climbed 12% to US$22.87bn. Bank peer, Citigroup Inc (C US) announced positive 3Q21 results as well, reporting US$2.15 in earnings per share on US$ 17.15bn in revenue. Wall Street was anticipating earnings per share of US$1.65 US$ 16.97bn in revenue. However, shares closed relatively flat, gaining only 0.8%.

- Exxon Mobil Crop (XOM US). Oil sector shares rose collectively yesterday. Exxon rose 1.5% yesterday. WTI crude futures rose above US$81 a barrel yesterday, while Brent crude futures traded above $84 per barrel. The previous high for WTI and Brent crude futures was last seen in October 2014 and October 2018 respectively. Concerns about supply tightness and shortages of natural gas in Europe and Asia are boosting the demand for oil. The EIA said on Wednesday that crude oil output in the US for 2021 would decline more than previously forecasted. Meanwhile, API data showed an overall increase in crude stockpiles, while gasoline and distillates inventory levels fell. Fellow oil peers BP Plc (BP US) and Chevron Corp (CVX US) were relatively flat yesterday, gaining 0.8% and 1% respectively.

Singapore

- Geo Energy Resources Ltd (GERL SP), Golden Energy & Resources Ltd (GER SP). Coal sector shares collectively rose yesterday, with Geo Energy leading the industry gaining 9.1%. Last week, coal prices eased to US$230 per metric ton after Beijing ordered coal miners to boost production in an effort to curb an ongoing energy crisis, while Russian President Vladimir Putin said Gazprom will send more gas to European countries via Ukraine. However, coal futures rebounded to above US$240 per metric ton yesterday as tight supply is expected to persist with floods hitting China’s Shanxi province, the largest coal mining hub in China, forcing the closure of 60 coal mines. China’s winter season and power crunch are further catalysts to rising coal prices. We currently have an OUTPERFORM rating for Geo Energy, which hit our 12M TP of S$0.42 as of yesterday’s closing price. We also have an OUTPERFORM rating for Golden Energy, with a 12M TP of S$0.64, representing an upside potential of 28% as of yesterday’s closing price.

- Rex International Holding Ltd (REXI SP), RH PetroGas Ltd (RHP). Oil sector shares rose collectively yesterday. Rex’s shares rose 8.9% while RH Petrogas’ shares rose 5.7%. WTI crude futures rose above US$81 a barrel yesterday, while Brent crude futures traded above $84 per barrel. The previous high for WTI and Brent crude futures was last seen in October 2014 and October 2018 respectively. Concerns about supply tightness and shortages of natural gas in Europe and Asia are boosting the demand for oil. The EIA said on Wednesday that crude oil output in the US for 2021 would decline more than previously forecasted. Meanwhile, API data showed an overall increase in crude stockpiles, while gasoline and distillates inventory levels fell. We currently have an OUTPERFORM rating for Rex International, with a 12M TP of S$0.33, representing an upside potential of 6.5%.

- Frencken Group Ltd (FRKN SP), ISDN Holdings Ltd (ISDN SP). Semicon related stocks collectively rose yesterday. Frencken rose 6.7% yesterday while ISDN rose 5.7%. The semicon industry rose as a result of a spillover effect from TSMC which announced a 13.8% rise in 3Q21 profit as global chip demand surge. The company mentioned that in the near-term, tight supplies will likely continue into 2022 amid booming demand during the Covid-19 pandemic.

- LHN Ltd (LHN SP). Shares rose 6% yesterday as the company’s residential segment is expected to benefit from Singapore’s reopening. Singapore recently announced that it would be opening vaccinated travel lanes to 8 more countries on Tuesday, namely Canada, Denmark, France, Italy, Netherlands, Spain, UK and US, on top of Brunei and Germany which were announced previously. There are now 11 countries under Singapore’s vaccinated travel lane scheme. The quarantine-free travel arrangement with South Korea will start on Nov 15. We currently have an OUTPERFORM rating for LHN, with a 12M TP of S$0.49, representing an upside potential of 36.1% as of yesterday’s closing price.

Hong Kong

The Hong Kong market was closed yesterday Thursday, 14 October in view of the public holiday Chung Yeung Festival. Trading will resume today Friday, 15 October.

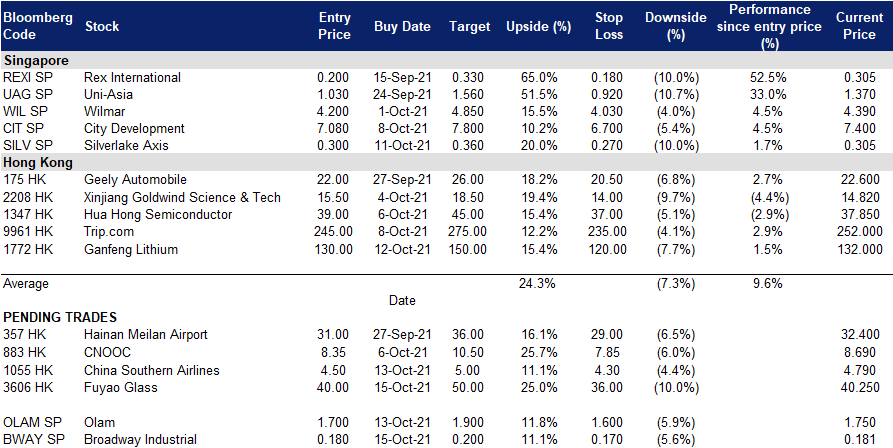

Trading Dashboard

Related Posts: