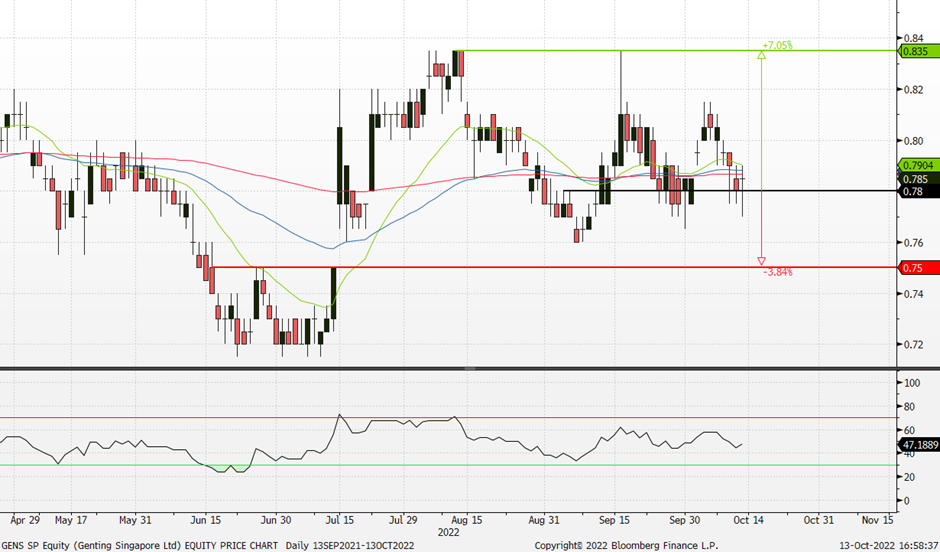

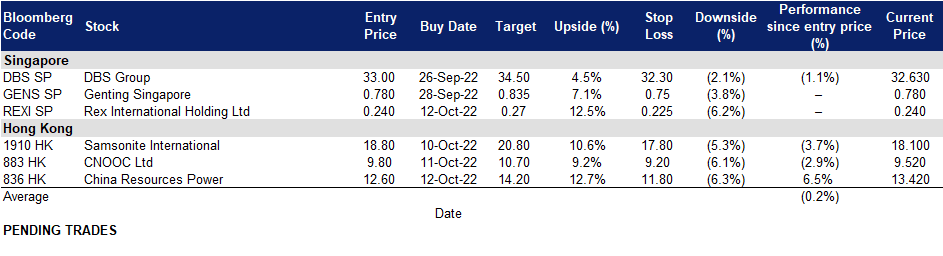

14 October 2022: Genting Singapore (GENS SP), China Resources Power Holdings Company Limited (836 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Genting Singapore (GENS SP): “Rooms” are hot

- RE-ITERATE BUY Entry – 0.780 Target – 0.835 Stop Loss – 0.750

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index.

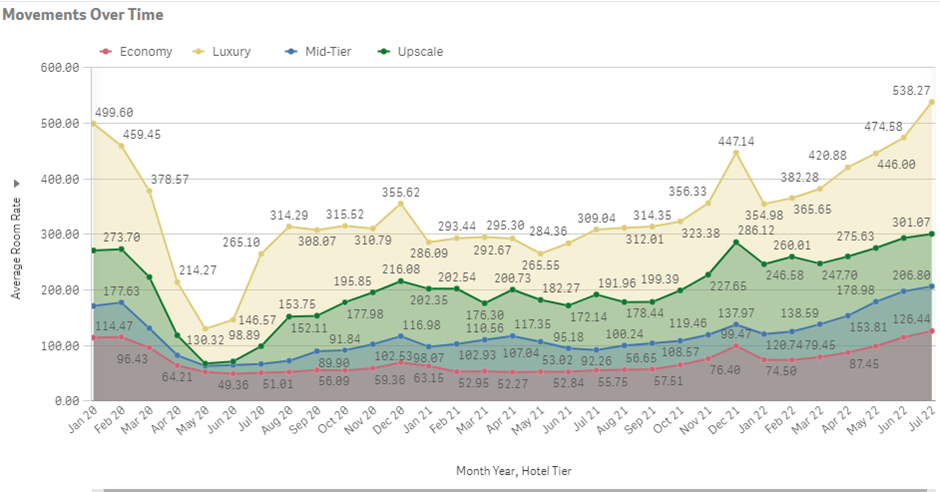

- Hotel prices hit a 10-year high. Singapore hotel room prices exceeded the pre-Covid level and hit a high in almost a decade in July 2022. As of July, the average room rate reached S$259/night, up c.70% YoY. The strong demand was driven by the increase in visitor arrivals amidst easing Covid-19 restrictions. Visitor arrivals in Singapore rose for the sixth straight month in July to 726,601, up from 543,733 in June, according to the tourism board.

Singapore hotel room price by tier

(Source: Singapore Tourism Analytics Network)

- Upcoming high-profile events pushing hotel prices higher. This week, hundreds of chief executives, crypto investors and innovators, and even a Bollywood star are flying in for a series of high-profile Mice events. The Singapore Tourism Board mentioned that nearly 90,000 delegates would be expected to attend about 25 Mice events around this period, similar to the number of events held pre-Covid-19. Some of the events held this week include the crypto conference – Token2049, the 20th Forbes Global CEO Conference, the ninth annual Milken Institute Asia Summit and the inaugural edition of the Time100 Leadership Forum. A number of these events will be held concurrently with the Formula One Grand Prix, taking place between Friday to Sunday. The entertainment lineup this weekend includes performances by Marshmello, Westlife and Green Day. Other big names in entertainment coming to Singapore later this year include Justin Bieber, Maroon Five, Guns N’ Roses and Jay Chou.

- Updated market consensus of the EPS growth in FY22/23 is 82.1%/60.7% YoY respectively, which translates to 28.2x/17.5x forward PE. Current PER is 53.1x. Bloomberg consensus average 12-month target price is S$0.95.

(Source: Bloomberg)

Rex International Holding Ltd (REXI SP): largest oil output cut since 2020

Rex International Holding Ltd (REXI SP): largest oil output cut since 2020

- RE-ITERATE Entry – 0.240 Target – 0.270 Stop Loss – 0.225

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Oil rebounded back to a three-week high. Oil prices gained after OPEC+ agreed to cut output by 2mn barrels/day from November. Brent went up 2.03% to US$93.6/bbl, and WTI went up 1.97% to US$88.06/bbl.

- Dollars pulled back and commodities rebounded. The US dollar index remains at below 112 after reaching a 20-year high of 115 last week. Commodities are inversely related to US dollars. The short-term correction of the dollar index provides relief rebound opportunities for global commodities.

- Ukraine War. Following the invasion of Ukraine, some countries have made the decision to stop buying Russian oil, imposed sanctions on Russia and G7 is planning to place a price cap on Russian oil purchases. Thus causing the price of oil sold by Russia to be significantly cheaper than oil from other sources, attracting more oil purchases from Asian countries such as India and China.

- Updated market consensus of the EPS growth in FY22/23 is -52.4%/368.4% YoY respectively, which translates to 9.0x/1.9x forward PE. Current PER is 4.6x. Bloomberg consensus average 12-month target price is S$0.47.

China Resources Power Holdings Company Limited (836 HK): A value stock in play

- Buy Entry – 12.6 Target – 14.2 Stop Loss – 11.8

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Power is a defensive sector. The downturn of the Hong Kong equity market persisted due mainly to the global rate hike cycle, China’s economy slowdown, and deteriorating China-US relations. The broad market selloff has yet ended, however, power sector is one of the few relatively outperforms. Not only does the sector provide consistent and positive cash flows, but also expand businesses into clean energy fields which are in line with global ESG theme and supported by the domestic policies.

- August operations update. Total net generation of subsidiary power plants in August-22 increased by 24.9% YoY to 19,734,839MWh, among which, subsidiary wind farms increased by 43.5% YoY to 2,753,235MWh, subsidiary photovoltaic plants increased by 6.7% YoY to 115,859MWh.

- 1H22 earnings review. Turnover grew by 17.78% YoY to HK$50.4bn. The increase was mainly attributable to a YoY increase of 23.9% in the average on-grid tariffs (tax exclusive) of subsidiary coal-fired power plants and a YoY increase of 19.9% in the average sales price of heat supply of subsidiary coal-fired power plants. Net profit attributable to shareholders of the company dropped by 22.46% YoY to HK$4.4bn. The fall in net profit was due to the increase in operating expenses resulted from higher raw material costs.

- The updated market consensus of the EPS growth in FY22/23 is 283.8%/27.9% YoY, respectively, translating to 6.7×/5.2x forward PE. The current PER is 72.0x. FY22F/23F dividend yield is 6.3%/8.2% respectively. Bloomberg consensus average 12-month target price is HK$20.85.

(Source: Bloomberg)

CNOOC Limited (883 HK): Recovery in oil prices

CNOOC Limited (883 HK): Recovery in oil prices

- RE-ITERATE Buy Entry – 9.7 Target – 10.7 Stop Loss – 9.2

- CNOOC Limited is a Hong Kong-based investment holding company principally engaged in the exploration, production and trading of oil and gas. Its businesses include conventional oil and gas businesses, shale oil and gas businesses, oil sands businesses and other unconventional oil and gas businesses. The company mainly operates businesses through three segments. The Exploration and Production segment is engaged in the exploration, development and production of crude oil, natural gas and other petroleum products. The Trading segment is engaged in the trading of crude oil, natural gas and other petroleum products. The company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, Indonesia and Brazil, among others.

- Largest crude oil prices weekly gain since February. During the China golden week holiday, crude oil prices enjoyed the second largest weekly gain YTD as OPEC+ agreed to cut its production targets for November by 2mn bbls/d; Brent and WTI jumped 15.34% and 16.89% respectively on the first week of October.

- First batch of 2023 crude oil import quotas released. The volume issued is about 20mn tonnes, equivalent to 146mn bbls. Last month, Beijing issued a third batch of quotas for 2022 that raised its non-state import quotas to 164.61mn tonnes this year.

- 1H22 results review. Revenue jumped by 84% YoY to RMB202.4bn. Net profit attributable to equity shareholders of the company jumped by 116% YoY to RMB71.9bn. Management declared an interim dividend of HK$0.7.

- The updated market consensus of the EPS growth in FY22/23 is 83.6%/-8.9% YoY, respectively, translating to 3.2×/3.5x forward PE. The current PER is 3.7x. The expected dividend yield in FY22/23 is 15.5%/11.9%. Bloomberg consensus average 12-month target price is HK$14.72.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Major Banks | +4.80% | Stock futures are flat ahead of Friday’s big bank earnings JPMorgan Chase & Co (JPM US) |

| Cable/Satellite TV | +4.56% | Comcast stock rises toward best day in 20 months as Citi sees ‘silver lining’ in beaten-down cable names Comcast Corp (CMCSA US) |

| Oil Refining/Marketing | +4.26% | Oil prices rise 2% on low diesel stocks ahead of winter Marathon Petroleum Corp (MPC US) |

Top Sector Losers

| Sector | Loss | Related News |

| Internet Retail | -0.64% | Why Amazon, Shopify, and MercadoLibre Stocks All Fell Today Amazon.com Inc (AMZN US) |

- Digital World Acquisition Corp (DWAC US) surged 14.7%, continuing its ascent on an announcement Wednesday that Google would allow the media company into its app store. The company was previously banned.

- Albertsons Companies Inc (ACI US) surged 11.5% on news that a potential buyout by rival supermarket operator Kroger could come as soon as Friday. Kroger shares rose 1.15% on the report.

- Revlon Inc (REV US) shot up 21.8% on reports that creditors of the company sent hundreds of millions of dollars by Citi on accident were denied a review of a ruling from an appeals court that they had to return the money.

- Otonomy Inc (OTIC US) shot down 53.5% to a 52-week low after the company said a drug for hearing loss showed “no clinically meaningful improvement.” It marks a turn from earlier phases that showed the drug had positive impact.

- Domino’s Pizza Inc (DPZ US) jumped 10.4% after third-quarter revenue came in at $1.07 billion, above the $1.06 billion expected by analysts, according to Refinitiv. That was helped by a 2% rise for U.S. same store sales. The company’s third-quarter earnings per share did come in lighter than expected $2.79. Analysts surveyed by Refinitiv were looking for $2.97 per share.

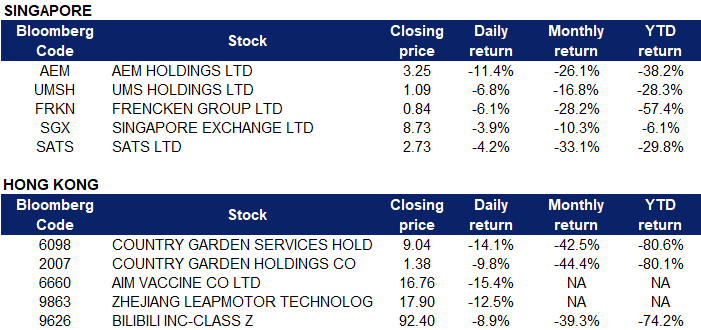

Singapore

- AEM Holdings Ltd (AEM SP), UMS Holdings Ltd (UMSH SP) and Frencken Group Ltd (FRKN SP) shares fell 11.4%, 6.8% and 6.1% yesterday respectively, tracking an overall decline among chipmakers worldwide. Taiwan Semiconductor Manufacturing Co slashed its 2022 capital spending target by roughly 10%, suggesting that the world’s most valuable chip company is bracing for a broader-than-anticipated downturn in the technology industry. Applied Materials Inc, a leading producer of chip-making equipment, slashed its forecast for the fourth quarter, while Intel Corp is said to be preparing to fire thousands. Furthermore, the Biden administration trade curbs limit the ability of companies that use US technology to sell products to China. They include restrictions on the export of some types of chips used in artificial intelligence and supercomputing, and also tighter rules on the sale of semiconductor equipment to any Chinese company.

- Singapore Exchange Ltd (SGX SP) shares tumbled 3.9% after Wall Street booked overnight losses amid inflationary pressures. Investors also fear a potential shock from U.S. inflation data, along with concerns over renewed lockdown measures in China due to the rising COVID-19 cases. The Straits Times Index headed down 1.39 percent to 3,040.45.

- SATS Ltd (SATS SP) declined 4.2% yesterday after Temasek Holdings’ subsidiary Fullerton Fund Management sold 1.2 million of its shares in Sats for some S$3.5 million or S$2.982 apiece on Oct 7. In a bourse filing on Wednesday (Oct 12), investment manager Tembusu Capital revealed the transaction would reduce its total stake in Sats from about 40 percent to 39.9 percent.

Hong Kong

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Electricity Supply |

+0.66% |

CLP Holdings Ltd (2 HK) |

|

Leisure & Recreation |

+1.12% |

Haichang Ocean Park Holdings Ltd (2255 HK) |

|

Alternative Energy |

+0.82% |

China faces headwinds in clean energy plans Xinyi Energy Holdings Ltd (3868 HK) |

Top Sector Losers

|

Sector |

Loss |

Related News |

|

Alcoholic Drinks & Tobacco |

-4.07% |

China’s income growth keeps pace with decade’s economic expansion Budweiser Brewing Company APAC Ltd (1876 HK) |

|

Semiconductors |

-2.56% |

U.S. scrambles to prevent export curbs on China chips from disrupting supply chain Semiconductor Manufacturing International Corp (981 HK) |

|

Property Management & Agency |

-2.41% |

China’s Bursting Housing Bubble Will Rock the Economy for Years KE Holdings Inc (2423 HK) |

- Country Garden Services Holdings Co Ltd (6098 HK) and Country Garden Holdings Co Ltd (2007 HK) Shares fell 14.1% and 9.8% respectively yesterday. Pacific Securities believes that the scale of bond issuance by private housing companies this year has dropped by more than 80% each month compared with the same period last year, and most private housing companies have virtually no ability to refinance. From the perspective of preventing systemic risks, if the sales recovery continues to be slow, more housing companies may have a second rollover. Investor confidence and panic have spread; macroeconomic pressure and repeated epidemics have forced the property service sector to enter a downward trend driven by the overall market.

- AIM Vaccine Co Ltd (6660 HK), Zhejiang Leapmotor Technology Co Ltd (9863 HK) and Bilibili Inc (9626 HK) Shares tumbled 15.4%, 12.5% and 8.9% respectively yesterday, as investors feared a potential shock from U.S. inflation data while rising COVID-19 cases in China drove concerns over renewed lockdown measures. China’s bluechip Shanghai Shenzhen CSI 300 index fell 0.7%, while the Shanghai Composite index shed 0.2%. Concerns over new COVID-related restrictions came back to the fore this week after infections in Shanghai hit a three-month high. Hong Kong’s Hang Seng index lost 1.2%, as investors feared more disruptions from new U.S. restrictions on semiconductor exports to China.

Trading Dashboard Update: Cut loss on Keppel Corp (KEP SP) at S$6.75.

(Source: Bloomberg)

(Source: Bloomberg)