14 November 2022: Sunpower Group Ltd (SPWG SP), Jiangxi Copper Company Limited (358 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Sunpower Group Ltd (SPWG SP): China easing Covid measures

- BUY Entry – 0.250 Target – 0.280 Stop Loss – 0.235

- Sunpower invests, develops and operates centralised steam, heat and electricity generation plants. The group is strongly positioned to capitalise on the enormous market opportunities in the environmental protection sector in China and build a valuable portfolio of assets that generates attractive investment returns, as well as recurring, long-term and high-quality income and cash flows based on typically 30-year concession agreements.

- China recalibrating Covid Zero. With a detailed 20-point playbook regarding changes on the Covid Zero policy, China is easing its isolation from the world as well as the impact of the virus mitigation measures on the ground. China has announced the easing of quarantine measures for tourists and close contacts to a total of 8 days instead of 10 days and are pulling back on testing. Furthermore, the system that penalises airlines for bringing virus cases into the country will also be scrapped. China’s reopening process will likely remain slow and cautious, however, business will gradually start to pick up with the new measures implemented.

- Disposal of subsidiary. On 10 Nov, Sunpower announced that its indirectly wholly-owned subsidiary, Jiangsu Sunpower Machinery Manufacture Co. Ltd disposed of its 70% shareholding interest in Jiangsu Sunpower Energy-Saving Technology Co. Ltd, in October 2022, to streamline its corporate structure. The consideration for the disposal amounted to RMB2M (S$402,277). As at 30 September 2022, the net asset value represented by the disposed shares was approximately negative RMB6,662,447 (S$1,340,074). It is not expected to have any material impact on the group for the current financial year.

- 3Q22 results review. Sunpower’s quarterly revenue increased from RMB782.5M YoY to RMB868.6M, while GI recurring revenue increased by 46% YoY to RMB2,070M. The strong demand for clean industrial steam led to a 16% YoY rise in its total steam sales volume to 6.79M tons. Its 9M22 earnings increased by 19% YoY to RMB485M.

- Company shares are trading at 4.9x PE currently. The average PER of the China utilities sector ranges from 7x to 10x.

(Source: Bloomberg)

Wilmar International Ltd (WIL SP): Sound fundamental and share buyback to uphold share prices

- RE-ITERATE BUY Entry – 3.90 Target – 4.10 Stop Loss – 3.80

- Wilmar International Ltd is a leading agribusiness group in Asia, one of 12 of the world’s biggest agricultural commodity companies. At the core of Wilmar’s strategy is an integrated agribusiness model that encompasses the entire value chain of the agricultural commodity business, from cultivation and milling of palm oil and sugarcane, to processing, branding and distribution of a wide range of edible food products in consumer, medium and bulk packaging, animal feeds and industrial agri-products such as oleochemicals and biodiesel. It has over 500 manufacturing plants and an extensive distribution network covering China, India, Indonesia and some 50 other countries and regions.

- Plans for emission reduction. Wilmar signed up for the Science Based Targets initiative (SBTi) in October 2022 with the aim of cementing their emission reduction targets while demonstrating the progress that reflects the significance of its commitments. Wilmar has expressed its climate ambitions towards a 1.5-degree Celsius pathway, with both Near-Term and Net Zero commitments outlined in its SBTi commitment. Over the next 24 months, they will develop time-bound plans delineating their strategy and approach to achieve their Near-Term and Net Zero emission reduction targets. The vast majority of their undertakings revolve around Scope 3 emissions, with efforts well underway to identify their Scope 3 footprint and formulate comprehensive plans to address and reduce them.

- Large market share. Wilmar International operates an integrated agribusiness model that encompasses the entire value chain of the agricultural commodity business. In the face of the commodity market volatility this year, the integrated and diversified business model of Wilmar International and its cautious approach to risk management when agri-commodities were at or near historical highs enabled the group to deliver record results this year. Even with the price volatility of different commodities, the company would still perform well due to its huge market share, allowing it to have better market information and formulate better sourcing strategies, thus achieving lower raw material costs.

- 3Q22 results. Wilmar’s core net profit surged by 38.2% YoY to US$796.7 million (S$1.13 billion), while revenue increased by 10.2% YoY to US$18.88 billion. The record quarterly results, the third straight quarter in a row, was driven by good performance across all of Wilmar’s core segments. Its 9M22 earnings increased by 49.2% YoY to US$19.5 billion while revenue increased by 17.9% YoY to US$55.01 billion.

- Share buyback. Between Nov 1 and 3, Wilmar’s chairman and chief executive officer increased deemed interest in the stock. The total consideration of three acquisitions was S$4,547,360 and increased his total interest in Wilmar International from 12.94 per cent to 12.96 per cent.

- Updated market consensus of the EPS growth in FY22/23 is 17.7%/-10.4% YoY respectively, which translates to 8.16x/9.11x forward PE. Current PER is 8.18x. Bloomberg consensus average 12-month target price is S$5.25.

(Source: Bloomberg)

Jiangxi Copper Company Limited (358 HK): The turning point emergs

- BUY Entry – 10.3 Target – 11.3 Stop Loss – 9.80

- Jiangxi Copper Company Limited is a China-based company, principally engaged in the mining, smelting and processing of copper. The Company is also engaged in the extraction and processing of precious metals and dissipated metals, sulfur chemical industry business, and financial and trading businesses. The company’s products include cathode copper, gold, silver, sulfuric acid, copper rods, copper foils, selenium, tellurium, rhenium, bismuth and others. The Company mainly conducts its businesses within Mainland China and Hongkong.

- China to bail out property market. The People’s Bank of China and the China Banking and Insurance Regulatory Commission on Friday jointly issued a notice to financial institutions laying out plans to ensure the “stable and healthy development” of the property sector. The notice includes 16 measures that range from addressing the liquidity crisis faced by developers to loosening down-payment requirements for homebuyers. Meanwhile, developers’ outstanding bank loans and trust borrowings due within the next six months can be extended for a year, while repayment on their bonds can also be extended or swapped through negotiations. The authorities also told the nation’s second-tier banks to dole out another RMB 400bn (US$56bn) of financing for the property sector in the final two months of the year.

- Copper price rallied and dollar index fell. Last Friday, copper futures closed at US$391.35/pound, a six-month high, and the dollar index pulled back to 106.4, a mid-August level. US October inflation was better off, beating the market estimates. Meanwhile, China signalled a gradual reopening and a bailout of the property market. Both catalysts are a turning point for the commodities market as both positive pricing and demand factors are expected to uphold the near-term recovery of the metal market.

- 3Q22 earnings review. 3Q22 operating revenue grew by 2.2% YoY to RMB112.9bn. Net profit attributable to shareholders of the company dropped by 13.8% YoY to RMB1.3bn. 9M22 operating revenue grew by 9.2% YoY to RMB368.2bn. Net profit attributable to shareholders of the company increased by 4.9% YoY to RMB4.8bn.

- The updated market consensus of the EPS growth in FY22/23 is -3.8%/-23.8% YoY respectively, which translates to 6.2x/8.1x forward PE. The current PER is 5.7x. Bloomberg consensus average 12-month target price is HK$11.36.

(Source: Bloomberg)

Dongfang Electric Corp Ltd. (1072 HK): Fuel cell and hydrogen energy themes in play

- RE-ITERATE Buy Entry – 12.0 Target –13.5 Stop Loss – 11.3

- Dongfang Electric Corp Ltd is a China-based company mainly engaged in the manufacturing and sales of power generation equipment. The Company operates five major reporting segments: Clean and High-Efficiency Energy Equipment segment, Renewable Energy Equipment segment, Engineering and Trade segment, Modern Manufacturing Service Industry segment, and Emerging Growth Industry segment. The Company’s main products include water turbine generator sets, steam turbine generators, wind turbine generator sets, power station steam turbines and power station boilers as well as gas turbines. he Company distributes its products within the domestic market and to overseas market.

- China to accelerate fuel cell vehicle deployments. By 2025, China will have about 50,000 hydrogen fuel-cell vehicles and its annual hydrogen production from renewable energy will reach 100,000 to 200,000 tonnes, according to the plan jointly released by the National Development and Reform Commission, and the National Energy Administration. Following the release of a national plan in March aimed at promoting the development of the hydrogen energy industry, local governments have made policies to strategize corresponding deployments.

- 3Q22 earnings review. Operating income grew by 18.4% YoY to RMB12.3bn. Net profit attributable to shareholders of the company jumped by 40.2% YoY to RMB725.9mn. In 9M22, the company manufactured power generation equipment with a capacity of 25,631.8MW, including hydro-electric turbine generating units (2,695.0MW), steam turbine generators (19,831.0MW), wind power generating units (3,105.8MW), power station steam turbines (19,318.0MW) and power station boilers (17,044.0MW). In 9M22, the company’s new effective orders amounted to RMB53.822 billion, among which 32.45% was attributable to high-efficiency clean energy equipment, 27.67% to renewable energy equipment, 12.98% to engineering and trade, 13.10% to modern manufacturing service business, and 13.81% to an emerging growth industry.

- The updated market consensus of the EPS growth in FY22/23 is 17.3%/29.4% YoY respectively, which translates to 14.0x/10.8x forward PE. The current PER is 12.8x. Bloomberg consensus average 12-month target price is HK$13.05.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Apparel/Footwear | +6.38% | Why Nike Stock Was Climbing Today Nike Inc (NKE US) |

| Steel | +5.96% | Why BHP Group And Rio Tinto Stock Are Trading Higher BHP Group Ltd (BHP US) |

| Other Metals/Minerals | +5.18% | Iron ore price soars as China covid curbs eased despite surge in cases Rio Tinto PLC (RIO US) |

Top Sector Losers

| Sector | Loss | Related News |

| Managed Health Care | -4.54% | Stock Market Shifts To Growth Stocks From Health Care And Defensive UnitedHealth Group Inc (UNH US) |

| Aerospace & Defence | -3.47% | Fake tweets from ‘verified’ Twitter accounts spur real losses for Lilly and Lockheed stock Lockheed Martin Corp (LMT US) |

| Insurance Brokers/Services | -2.40% | Ryan Specialty Shares Drop 18% After 3Q Earnings Miss Marsh & McLennan Companies Inc (MMC US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Property Management & Agency | +7.71% | What China’s Covid Pivot Means for Its Beaten-Down Markets Ke Holdings Inc (2423 HK) |

Property Development | +7.58% | Foreign investors rush to buy Chinese property assets despite hype over real estate risks China Resources Land Limited (1109 HK) |

Travel & Tourism | +7.17% | China Eases Quarantine, Ends Flight Bans in Covid Zero Shift Trip.com Group Limited (9961 HK) |

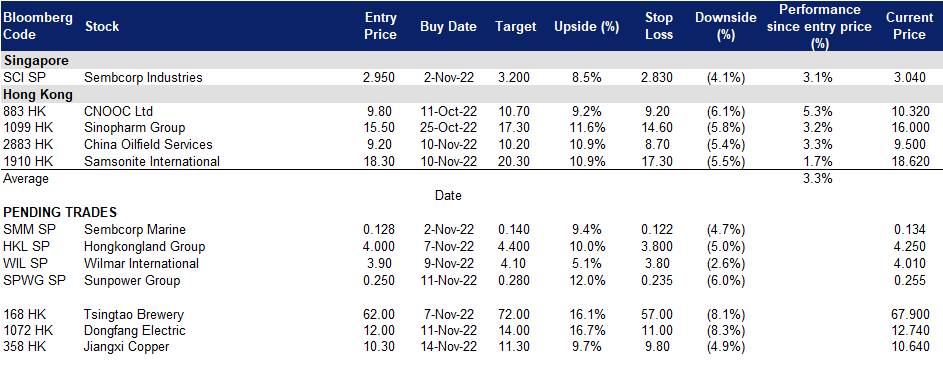

Trading Dashboard Update: No stocks additions/deletions.