KGI DAILY TRADING IDEAS – 13 October 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

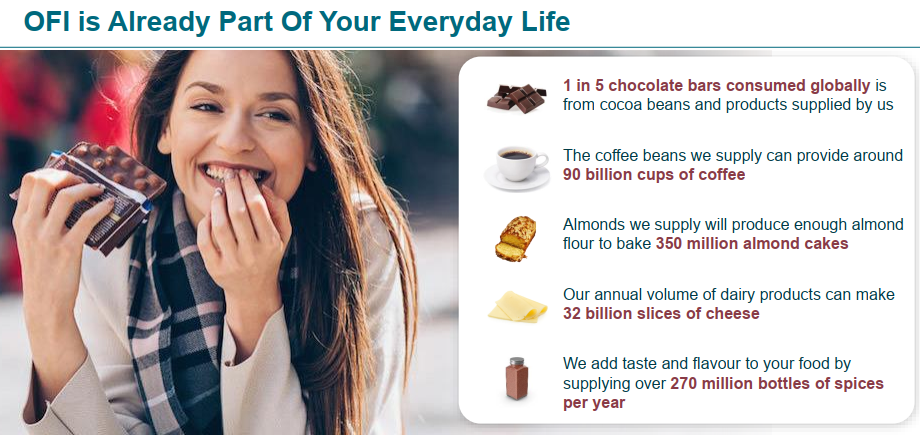

Olam International (SILV SP): Eating through your wallet

- BUY Entry – 1.70 Target – 1.90 Stop Loss – 1.60

- Olam is a leading food and agri-business operating across the value chain in more than 60 countries, supplying food, ingredients, feed and fibre to more than 17,300 customers worldwide. Listed on 11 February 2005 on the mainboard of SGX, Olam currently ranks among the top 30 largest listed companies in Singapore in terms of market capitalisation and is a Singapore constituent stock of the FT Global All Cap Ex US Index.

- Higher food prices. Food prices globally have risen in 13 of the past 15 months and are near their peak of 2011, owing to poor weather and pandemic-related disruptions. Earlier in October, The United Nations Reported that its Food Price Index (FFPI), which tracks the international price of a basket of food items, is already up 30% in 2021 from the 2020 annual average, the largest increase in 47 years. The escalating cost of producing fertilisers and transportation are exacerbating the surge in food prices.

- Catalyst from the listing of Olam Foods Ingredients (OFI). OFI intends to seek a primary listing on the London Stock Exchange and a concurrent secondary listing in Singapore in the first half of 2022. The London listing could raise about 2 bn pounds (US$2.8 bn). OFI reported a 29.5% YoY increase in 1H2021 EBIT and the company expects its strong business momentum to continue into the second half of 2021.

- Technical analysis. Olam share price has gained 36% from the recent low touched in July, and are currently testing the resistance of S$1.79. Since the rally from July, the 20 day EMA has provided firm support to its ongoing uptrend.

UN Food and Agriculture World Food Price Index

Silverlake Axis (SILV SP): The future is digital

- REITERATE BUY Entry – 0.30 Target – 0.36 Stop Loss – 0.27

- Silverlake Axis is a software company that provides banking solutions to banks in Asia. The company has been operating for more than 30 years. Of the top 20 largest banks in Southeast Asia, 40% of them use Silverlake’s core banking solutions.

- Parent’s new partner. Earlier in July 2021, The Edge reported that private equity firm Ikhlas Capital is investing US$40mn in Silverlake Group, the holding company of the SGX-listed Silverlake Axis Ltd. Silverlake Group is the largest shareholder of Silverlake Axis. In turn, Ikhlas Capital is partly owned by former banker Datuk Seri Nazir Razak, and the firm is one of the partners of a conglomerate comprising other firms including AirAsia’s Group e-wallet unit Big Pay and Malaysian Industrial Development Finance (MIDF) vying for one of the five digital banking licenses to be awarded by the first quarter of 2022.

- Digital banking is its future. Given Silverlake Axis’s experience and expertise in providing banking solutions over the past 30 years, combined with the recent news of the investment by Ikhlas Capital into its parent company, we think that the award of one of the five digital banking licenses could provide a much-need catalyst to Silverlake’s share price. Despite the >30% rally of its share price from the recent low, it is still near its 8-year low, partly due to a business slowdown over the years, and also due to a damaging short-seller report in 2015 which caused its market cap to almost halve in value.

- Still overlooked by consensus. Street expectations are not very high for the group, and may imply that many of the positive catalysts are not factored in yet into its current share price. There are 2 BUYS and 2 HOLDS and a 12m TP of S$0.38. Its valuations of 15x and 14x FY2022/23 P/E are relatively lower vs its software-related peers.

HONG KONG

The Hong Kong Observatory has decided to keep the Gale or Storm Signal No. 8 warning until 4pm.

As announced by HKEX, all trading sessions today will be cancelled if Typhoon No. 8 or above, or any announcement of Extreme Conditions, remains issued at 12:00 noon.

The Hong Kong market will be closed tomorrow Thursday, 14 October in view of the public holiday Chung Yeung Festival. Trading will resume on Friday, 15 October.

China Southern Airlines Company Limited (1055 HK): Slow but steady price uptrend

- Buy Entry – 4.5 Target – 5.0 Stop Loss – 4.3

- China Southern Airlines Company Limited is principally engaged in the operation of civil aviation, including the provision of passenger, cargo, mail delivery and other extended transportation services. The Company operates through two business segments, including Airline Transportation segment and Other segment. Airline Transportation segment consists of passenger and cargo and mail operations. Other segment includes hotel and tour operation, ground services, cargo handling and other miscellaneous services. The Company also provides services of general aviation and aircraft maintenance.

- Move on to post-COVID era. With more than 50% of the population vaccinated in major economies, and potential oral medicine of COVID treatment, countries are expected to fully open their borders in 2022. China has been insisting on a “zero infection” policy and adopting the most draconian quarantine measures on visitors. However, it has to normalise international travelling eventually when other countries open borders and adapt to coexist with the COVID virus. After all, isolation deters economic recovery and growth. The second largest economy with the largest population in the world cannot afford to maintain the absolute zero COVID patient at the price of reduction in travelling for a long term. The normalisation of travelling will be one of the main themes next year.

- High oil prices are another headwind but could correct for a while. The rally of oil price is expected to extend further. However, this is a secondary negative impact given that the air passenger volume is much lower compared to pre-COVID levels. The rally of oil prices is sharp and speedy. Hence, there could be some correction as oil is now becoming a crowded trade.

- Updated market consensus expects loss per share to narrow to RMB0.33 in FY21 from RMB0.77 in FY20, and eventually to turn profitable with an EPS of RMB0.176/0.267 in FY22/23. Bloomberg consensus average 12-month target price is HK$5.61.

Ganfeng Lithium Co Ltd (1772 HK): Victim of a sly deal, but likely priced in

- REITERATE Buy Entry – 130 Target – 150 Stop Loss – 120

- GANFENG LITHIUM CO., LTD. is a China-based company principally engaged in the research, development, production and sales of deeply processed lithium products. The company’s main products include lithium compounds, lithium metal and lithium batteries. The company’s products are mainly used in electrical vehicles, chemicals and pharmaceuticals. The company distributes its products in the domestic market and to overseas markets.

- Stellar 1H21 results. Revenue reached a record high of RMB4.0bn, an increase of 69.5% YoY primarily due to the increase in the unit selling prices and sales volume. Gross profit jumped by 204.3% YoY to RMB1.4bn. Gross margin was 34.9%, an increase of 15.4ppts YoY. Profit for the period attributable to owners of the parent was RMB1.4bn, an increase of 797.4% YoY.

- Price correction. The recent price drawdown was due mainly to the China-based battery-producer CATL acquiring Canada-based Millennial Lithium, topping an offer by Ganfeng Lithium of C$3.60/share. Millennial terminated the Ganfeng arrangement agreement in accordance with its terms and entered into the CATL arrangement agreement.

- Mark-up of selling prices. The company decided to raise the litimum product selling prices by RMB10,000/tonne and butyllithium products by 10% as a result of rising raw material prices and shortage of power supply, which resulted in higher production costs. The mark-up of prices will start from 10th October and last for one month.

- Consensus estimates per the 12-month target price is at HK$203.83, implying a 39.5% upside potential. EPS is forecasted to grow at 169.2%/49.8%/17.3% for FY2021/22/23F, which would bring forward P/Es down to 54x/36x/31x FY2021/22/23F.

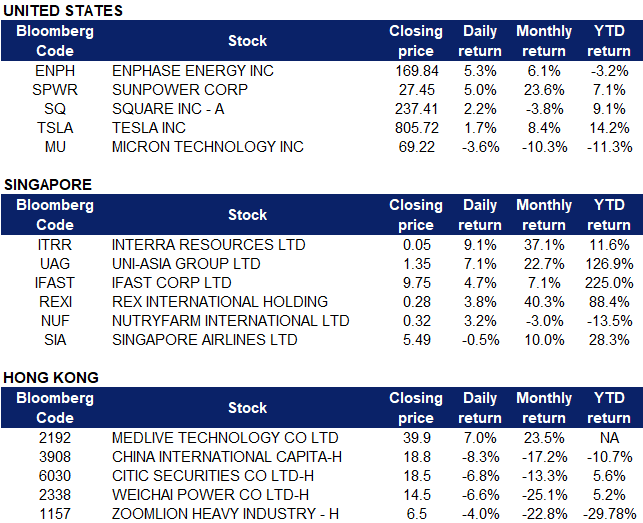

Market Movers

United States

- Solar energy stocks continued to rally as investors turn to alternative energy names while oil and natural gas prices surge due to threats of low supply and rising demand. Enphase Energy (ENPH US) and SunPower (SPWR US) shares rose 5.31% and 5.01% respectively on Tuesday.

- Square (SQ US) shares rose 2.19% on Tuesday after Atlantic Equities upgraded the stock from Neutral to Overweight and raised its target price to $300. Atlantic Equities analyst Kunaal Malde said that the company’s growth prospects “remain substantial” as it continues disrupting consumer and business banking through “strong execution against a digital-first strategy.” Square’s Cash App is a leading brand with network effects, innovates quickly and has “multiple monetization levers ahead,” says the analyst. The company’s second quarter results reported earnings per share of $0.40, swinging from a loss of $0.03 in the quarter a year earlier, and beat analyst expectations of $0.30. Revenue more than doubled to $4.68 billion.

- Tesla (TSLA US) shares moved 1.74% higher on Tuesday, after it was announced that the company sold more than 56,000 vehicles from its factory in China in September. Of these sales, only 3,853 were exported, according to a report by Reuters. Citing data from the China Passenger Car Association (CPCA), Reuters noted that overall passenger car sales in China dropped 17% in September compared to the prior-year period. Tesla’s impressive sales figures topped those of rival companies NIO and Xpeng, delivering over 10,000 vehicles each last month.

- Micron Technology (MU US) shares tumbled 3.61% after Trendforce published a report on Tuesday that called for a 3-8% dip in the price of dynamic random access memory (DRAM) computer memory for the fourth quarter compared to the third quarter’s typical prices. Trendforce also predicts a 17.9% increase in the industry’s total supply of DRAM memory in 2022, which should be sufficient to meet demand. Additionally, TrendForce analysts see a slowdown in the amount of DRAM being bought by purchasing managers of companies building computers and servers. Trendforce’s bearish expectations might have raised red flags for investors, as Micron currently generates 72% of its revenue from DRAM chips in fiscal 2021.

Singapore

- Shares of Singapore’s only pure-play profitable oil producer Rex International (REXI SP) rose another 3.77% yesterday, adding to its 8.2% gains on Monday, as Brent oil prices approached US$84 per barrel. Brent has risen more than 20% since mid-August, with Saudi Aramco estimating that the gas shortage in Europe has increased oil demand by around 500,000 barrels per day, while Citigroup estimates it could reach 1mn barrels per day in a bullish cash. We currently have an Outperform rating on Rex International and a 12m TP of S$0.33.

- Uni-Asia Group (UAG SP). The company which specialises in dry bulk carriers saw its shares rise 7.1% yesterday, driven mainly by charter rates that are near their 13-year peak. We have an OUTPERFORM recommendation on Uni-Asia and a 12m TP of S$1.56 (+16% potential upside from last close price).

- Interra Resource (ITRR SP) saw its shares rise 9.09% yesterday, likely in momentum with rising Brent oil prices. The company which engages in the business of petroleum exploration and production (E&P) announced last week that its joint venture entity Goldpetrol has commenced drilling development in the Chauk oil field in Myanmar. The well will be directionally drilled to a total measured depth of 5,100 feet with the primary objective of accelerating production from the oil reservoirs in this fault block, and a successful completion could lead to additional development opportunities.

- Nutryfarm International Ltd (NUF SP) shares rose 3.23% after the company announced on 11 October that it has secured a sales order for the delivery of 100 containers of durians from Thailand worth approximately RMB 65 million from Anhui Dingguan Supply Management, with the first shipment expected in November 2021. The company’s durian business was a strong contributor to its third quarter results for the financial period ended 30 June 2021, and it has announced various agreements since December 2020 to sell fresh durians from Thailand to Chinese fruit importers. The total contract value of these agreements has since exceeded RMB 1 billion.

- iFAST (IFAST SP) shares rose 4.73% after iFast Global Markets (the wealth advisory arm of iFast Financial, the Singapore subsidiary of iFast Corp) announced that its assets under administration grew 62% YoY to exceed $1 billion as at 30 September 2021. The company said in its press release that this achievement is significant, given that the division is only four years old.

- Aviation stock Singapore Airlines (SIA SP) jumped 7.6% on Monday trading after it was announced on Saturday that Singapore will launch eight Vaccinated Travels Lanes (VTLs) with countries in Europe and North America. The stock fell 0.54% on Tuesday, likely due to profit taking. Additionally, the company announced on Monday evening that it will be launching ‘seasonal flights’ to Vancouver and Seattle between 2 December 2021 and 15 February 2022. It will also be converting its daily direct flights from San Francisco to Vaccinated Travel Lane (VTL) services from next Wednesday, 20 October.

Hong Kong

- Medlive Technology Co Ltd (2192 HK). Shares rose 7% yesterday. The company announced on Monday that Yimai Intercommunication, which is controlled by the group through a contractual arrangement, intends to acquire 60% of the shares of Beijing Medicom Information Consulting for RMB 100mn. The latter is a well-known SaaS solution platform for academic conferences in China, focusing on medical conferences and is one of the leading professional technology suppliers in the field of conference management. The directors of the company believe that once the acquisition is implemented, it will bring good opportunities to the group and improve its business.

- China International Capital Corp Ltd (3908 HK), CITIC Securities Co Ltd (6030 HK). Chinese brokerage stocks fell collectively yesterday. Within the last 49 consecutive trading days on the Shanghai and Shenzhen Exchange, a turnover exceeding RMB 1tn was achieved. However, on the last day of September, both markets had a turnover of RMB 950.4bn, which was lower than RMB 1tn for the first time in more than two months. The three major A-Shares stock indexes fell more than 2% yesterday – Shanghai Composite Index fell 1.25%, Shenzhen Composite Index fell 1.62% and Chinext Composite Index fell 2.1%.

- Weichai Power Co Ltd (2338 HK), Zoomlion Heavy Industry Science and Technology (1157 HK). Construction machinery stocks fell collectively yesterday, Weichai Power’s shares fell 6.6% while Zoomlion’s shares fell 4% yesterday. JP Morgan issued a report commenting that the outlook for the demand of construction equipment and dump trucks in China is mixed. The liquidity impact of the real estate sector caused by the debt crisis of housing companies, increase in cost of goods caused by power curtailment, and the tightening of policies have led to a slow down in infrastructure activities this year. However, the economic slowdown also triggered policy adjustments. The bank noticed that mining activities accelerated to solve the power shortage, and infrastructure activities recovered after the issuance of special local government bonds. The bank expects demand for excavators and heavy-duty trucks to remain flat and fall by 17% YoY respectively next year. According to Bloomberg consensus, Weichai Power currently has a recommendation of 13 BUYS, 2 HOLDS and 1 SELL, with a 12M TP of HK$23.15, representing an upside potential of 59.2% as of yesterday’s closing price of HK$14.54. Zoomlion has a recommendation of 13 BUYS, 1 HOLD and 0 SELL, with a 12M TP of HK$12.03, representing an upside potential of 84.2% as of yesterday’s closing price of HK$6.53.

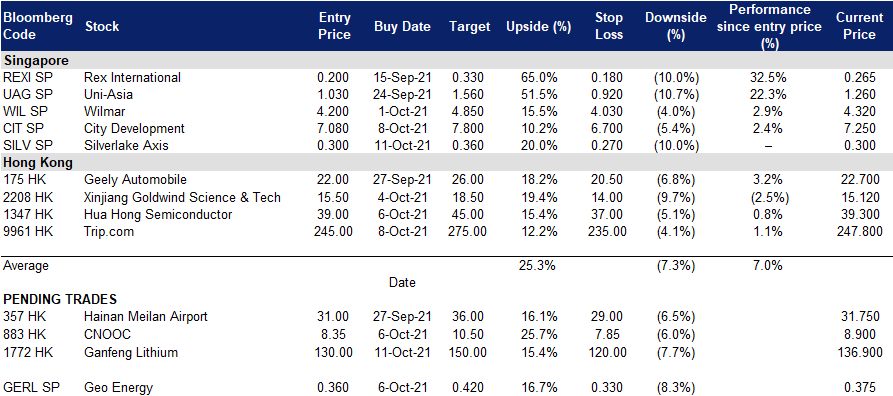

Trading Dashboard

Related Posts: