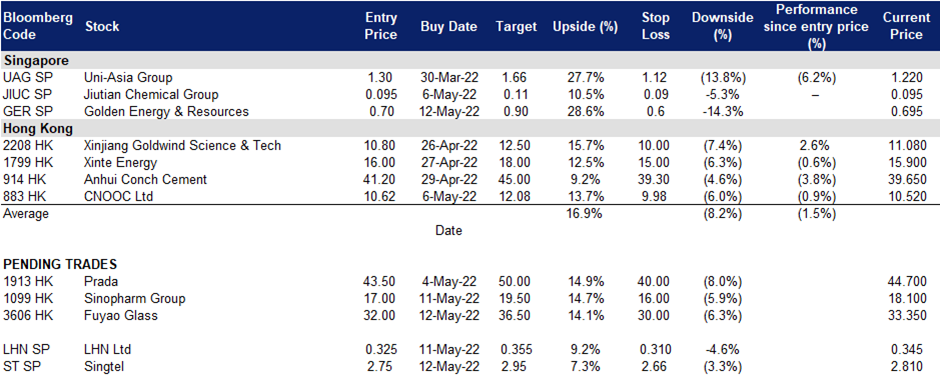

13 May 2022: Singtel Ltd (ST SP), Fuyao Glass Industry Group Co Ltd (3606 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

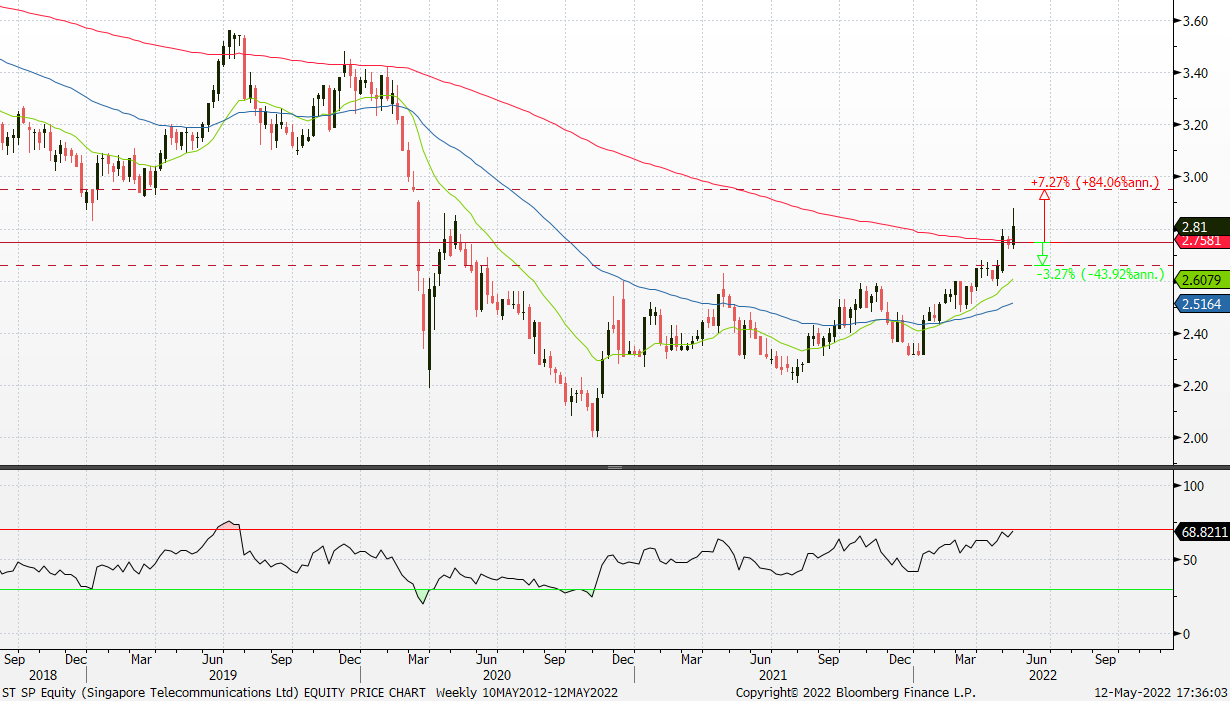

Singtel Ltd (ST SP): Breaking the 52-week high

- BUY Entry – 2.75 Target – 2.95 Stop Loss – 2.66

- Singtel provides an extensive range of telecommunications and digital services to consumers and businesses across Asia, Australia, Africa and the US. It serves over 753 million mobile customers in 21 countries, including Singapore, Australia (via wholly-owned subsidiary Singtel Optus) and the emerging markets of India, Indonesia, the Philippines, Thailand and Africa.

- Headwinds are easing. Singtel is forecasted to post mid-single digit EBITDA growth in FY2022, a turnaround from the 16% decline in the prior year financial period. Stabilising Singapore average revenue per user (ARPU) and higher Optus ARPU may drive EBITDA growth higher. Furthermore, dividends from associates, which make up more than 25% of operating cash flow, may finally be turning around, driven mainly by the easing of competition of associate Bharti Airtel.

- Defensive play against inflation. US consumer prices rose at an annual pace of 8.3% last month, more than economists’ expectations and staying at a four-decade high, underscoring the urgency of the Federal Reserve’s push to stamp out inflation. The Fed has increased its efforts to contain price pressures, implementing its first half-point rate rise in more than two decades this month. The Fed’s reduction of its $9tn balance sheet will also commence in June, the second of two levers it is using to cool the economy.

- Latest acquisition: Axicom. Earlier this month, Singtel announced that its associate, Australia Tower Network Pty Ltd (ATN), has completed the acquisition of Axicom, a provider of telecommunications tower infrastructure in Australia. Meanwhile, ATN owns mobile networks and rooftop sites in Australia, and also operates telecommunications towers for Singtel’s Australian telco subsidiary Optus. AustralianSuper head of infrastructure Nik Kemp said Axicom is complementary to its existing digital infrastructure portfolio and the combination of the 2 businesses will “result in the creation of a provider with a truly national footprint”.

- Earnings date. Singtel will be releasing its results for the second half and financial year ended 31 March 2022 on 27 May 2022, before trading hours.

- Positive street view and decent dividend yield. Consensus has an overall positive outlook on Singtel, with 16 BUYS, 2 HOLDS, 0 SELL, and a 12m TP of S$3.15. The stock offers a decent dividend yield of 3.5% for FY2022 and 4.3% for FY2023.

- Latest acquisition: Axicom. Earlier this month, Singtel announced that its associate, Australia Tower Network Pty Ltd (ATN), has completed the acquisition of Axicom, a provider of telecommunications tower infrastructure in Australia. Meanwhile, ATN owns mobile networks and rooftop sites in Australia, and also operates telecommunications towers for Singtel’s Australian telco subsidiary Optus. AustralianSuper head of infrastructure Nik Kemp said Axicom is complementary to its existing digital infrastructure portfolio and the combination of the 2 businesses will “result in the creation of a provider with a truly national footprint”.

- Earnings date. Singtel will be releasing its results for the second half and financial year ended 31 March 2022 on 27 May 2022, before trading hours.

- Positive street view and decent dividend yield. Consensus has an overall positive outlook on Singtel, with 16 BUYS, 2 HOLDS, 0 SELL, and a 12m TP of S$3.15. The stock offers a decent dividend yield of 3.5% for FY2022 and 4.3% for FY2023.

(Source: Bloomberg)

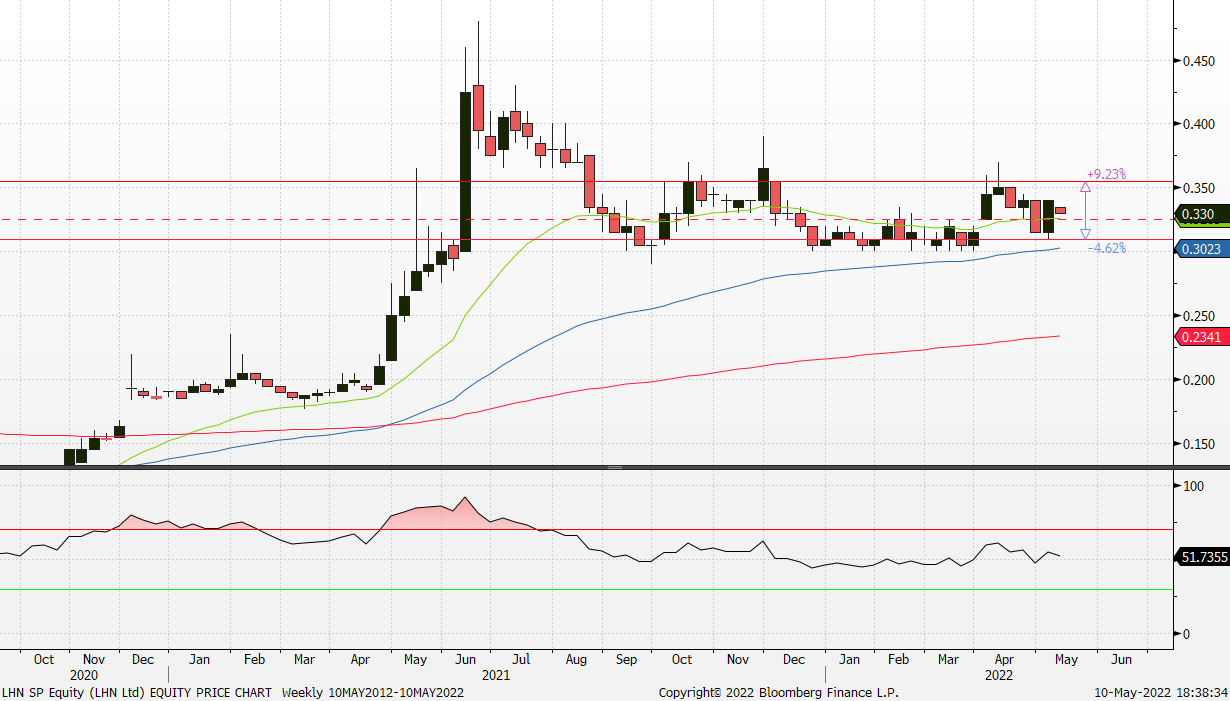

LHN Ltd (LHN SP): Positive profit guidance

- RE-ITERATE BUY Entry – 0.325 Target – 0.355 Stop Loss – 0.310

- LHN provides real estate management services through their expertise in space optimization. Under its Space Optimisation Business, the Group leases and manages a diverse portfolio of industrial, commercial and residential properties, which is complemented by its Facilities Management Business. The Group also provides logistics services under its Logistics Services Business.

- Positive profit alert guidance. Yesterday, LHN announced that the Group expects to record a higher net profit before tax for 1H22 of no less than approximately S$34 million as compared to the six months ended 31 March 2021 of approximately S$18.3 million. The higher net profit before tax for 1H22 arises mainly from the Space Optimisation Business due to (i) gains from subleases; (ii) higher fair value gains on the Group’s and joint ventures’ investment properties; and (iii) increase in profit from the Group’s co-living business under residential properties. LHN will be announcing its 1H22 results on 12 May 2022.

- Recent acquisitions. On 29 April, the Group announced that it had completed the acquisition of its River Valley Property, which was valued at S$8.5mn as of 20 April 2022. The 4 residential properties acquired in FY21 and 1 residential property acquired in 1Q22 are expected to commence operations in FY22. These 5 properties will add a total of approximately 204 keys to LHN’s Residential segment. In addition, full-year revenue contribution is expected from the 2 newly acquired JV properties under the Industrial segment.

- Further easing on Singapore’s borders to drive tourism. Singapore has reopened its borders to all fully vaccinated travellers, removing all existing vaccinated travel lanes (VTL) and unilateral opening arrangements from Apr 1. Travellers fully vaccinated against Covid-19 will no longer need to take any Covid-19 tests to enter Singapore from April 26.

- Incoming expats. As Hong Kong battles a worsening Covid-19 outbreak and surge in deaths, some expatriates there who plan to leave the city are moving to Singapore. In the past two months, several immigration service firms based in Singapore and international schools like Dulwich College (Singapore) have seen an uptick in inquiries from expatriates living in Hong Kong wanting to make a transfer.

- We currently have an OUTPERFORM recommendation on LHN, with a 12-month target price of S$0.44. Read the full report here.

(Source: Bloomberg)

Fuyao Glass Industry Group Co Ltd (3606 HK): Short–term headwinds are priced in

- Buy Entry – 32.0 Target – 36.5 Stop Loss – 30.0

- Fuyao Glass Industry Group Co Ltd is a China-based company, principally engaged in the manufacture and distribution of float glasses and automobile glasses. The company’s products portfolio consist of automobile glasses, such as coating glasses and others, which are applied in passenger cars, buses, limousines and others, and float glasses. The company distributes its products within domestic markets and to overseas markets.

- 1Q22 earnings review. Operating revenue grew by 14.75% YoY to RMB6.5bn. Net profit attributable to company shareholders grew by 1.86% YoY to RMB871.2mn. Three negatives resulted in mediocre results, including appreciation of RMB, high raw material costs, and high freight rates. The appreciation of RMB led to a decrease of RMB50.4mn in the gross profit. The high material costs and freight rates led to a decrease of RMB70.2mn and RMB53.1mn in total profit respectively. The company announced a final dividend of RMB10 (tax inclusive) (equivalent to HK$11.6) in cash per 10 shares.

- Headwinds are priced in. Rising covid cases and ensuing lockdowns of cities in China, rising materials costs resulting from Russia-Ukraine conflicts and ongoing supply chain disruptions have been factored in the previous sell-off. We believe the next catalysts such as lifting lockdown measures and reopening ports will provide a short-term relief rally as automobile sales are expected to rebound, and supply chain issues will be mitigated.

- Consensus estimates per the 12-month target price are at HK$42.3. EPS is forecasted to grow at 22.7%/23.4% for FY22F/23F, which would bring forward P/Es down to 19.1x/15.5x for FY22F/23F. The current PER is 23.5x.

(Source: Bloomberg)

Sinopharm Group Co., Ltd. (1099 HK): A defensive counter amidst sell-off

- BUY Entry – 17.0 Target – 19.5 Stop Loss – 16.0

- Sinopharm Group Co Ltd is a China-based company principally engaged in pharmaceutical and medical devices distribution business. The Company operates its business through four segments. Pharmaceutical Distribution segment is engaged in the distribution of pharmaceutical products to hospitals, other distributors, retail pharmacy stores and clinics. Medical Devices segment is engaged in the distribution of medical devices, as well as provides installation and maintenance services. Retail Pharmacy segment is engaged in the operation of chain pharmacy stores. Other Business segment is engaged in the distribution of laboratory supplies, manufacture and distribution of chemical reagents, production and sale of pharmaceutical products.

- 1Q22 earnings review. 1Q22 revenue grew by 6.86% YoY to RMB17.15bn. Net profit attributable to shareholders dropped by 23.25% YoY to RMB252.36mn. The decrease in profit was mainly attributable to the decline in the results of Sinopharm Accord’s associates due to the impact of the Covid-19 pandemic, which resulted in a corresponding decrease in investment income of Sinopharm Accord. At the same time, due to the impact of the pandemic, the retail sector has seen a decline in store traffic, and the new stores opened in 2021 cost large initial investment, the benefits of which have not yet emerged, resulting in a decrease in the margin levels.

- A defensive stock amidst market sell-off. The Hong Kong market has been hammered by both domestic crackdowns and unfavourable China-US tensions. Growth, value, and cyclical sectors, as well as other thematic stocks, have been sold off indiscriminately. However, this stock is relatively outperforming the rest as its business is largely immune to inflation and policy risks. The business driver is the distribution volume rather than profit margins. The growth in demand for medicines and medical devices is stable with low price sensitivity.

- The updated market consensus of the EPS growth in FY22/23 is 0.83%/10.5% YoY respectively, which translates to 5.6x/5.0x forward PE. The current PER is 8.1x. The FY22F/23F dividend yield is 5.3%/5.8%. Bloomberg consensus average 12-month target price is HK$24.07.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Biotechnology | +3.2% | BioNTech completes Phase II trial of COVID-19 vaccine in China BioNTech SE (BNTX US) |

| Specialty Stores | +2.5% | N/A Target Corp (TGT US) |

| Home Improvement Chains | +2.3% | N/A Home Depot Inc (HD US) |

Top Sector Losers

| Sector | Loss | Related News |

| Other Metals/Minerals | -2.6% | Why Did Freeport-McMoRan Stock Lose 30% In Value? Freeport Mc-Moran Inc (FCX US) |

| Telecommunications Equipment | -2.4% | Saudi Aramco overtakes Apple as world’s most valuable company Apple Inc (AAPL US) |

| Life/Health Insurance | -2.2% | Manulife (MFC) Q1 Earnings Lag Estimates, Asia Business Soft Manulife Financial Corp (MFC US) |

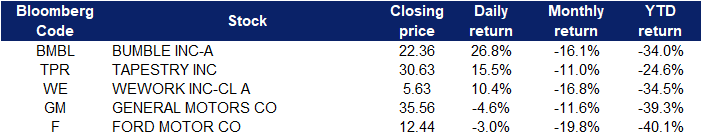

- Bumble Inc (BMBL US) shares jumped 26.8% after the company reported $211.2 million in revenue for the first quarter, which exceeded analysts’ estimates of $208.3 million, according to Refinitiv. The company also said it saw a 7.2% increase in paying users for the quarter.

- Tapestry Inc (TPR US) shares soared 15.5% after the luxury company behind Coach and Kate Spade reported that it expects Covid-related shutdowns in China to ease in June. Tapestry also reported an adjusted quarterly profit of 51 cents per share, which topped a consensus estimate from Refinitiv.

- WeWork Inc (WE US) shares jumped 10.4% after the coworking space company posted its first-quarter results. WeWork reported an adjusted earnings per share loss of 57 cents on revenue of $765 million. That loss was 37% lower than in the previous quarter.

- General Motors (GM US) and Ford (F US) shares lost 4.6% and 3% respectively yesterday, after Wells Fargo downgraded both to underweight from overweight, warning that the high costs of producing electric vehicles would hurt profits in the years ahead.

Singapore

- Rex International Holding Ltd (REXI SP) and RH Petrogas Ltd (RHP SP) shares lost 13.3% and 11.5% respectively yesterday. WTI crude futures fell more than 1% to below $105 per barrel on Thursday, giving back some gains after rallying 6% in the previous session, as economic uncertainties and recession fears outweighed supply concerns and geopolitical tensions in Europe. Oil and other riskier assets have come under constant pressure this week amid worries that aggressive interest rate hikes to rein in surging inflation would weigh on global demand and could lead to a possible recession. Meanwhile, Brent crude futures fell more than 1% to below $107 per barrel on Thursday.

- OIO Holdings Ltd (OIO SP) shares lost 10.9% yesterday. The global cryptocurrency market on Thursday, May 12, faced a brutal bloodbath with a 16.83% decrease in the market cap on the day. The global cryptocurrency market cap was standing at $1.14 trillion today, with major crypto coins like Bitcoin, Ethereum and Solana facing new lows in months. Investors have been extremely reluctant to invest in digital assets amid continued geopolitical tensions and rising inflation rates, resulting in an eventual crash in the cryptocurrency market.

- Geo Energy Resources Ltd (GERL SP) and Golden Energy & Resources Ltd (GER SP) shares lost 6.1% and 5.4% respectively yesterday. Newcastle coal futures, the benchmark for top consuming region Asia, consolidated above the $380-per-tonne mark and more than doubled in value since 2022, supported by continued robust demand against a tightening market backdrop. Still, soaring production from top consumers China and India should ease a global supply deficit and help cool down prices in the long term.

Hong Kong

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Infrastructure |

+2.52% |

Xinhua Headlines: China speeds up future-oriented infrastructure development China Railway Group Ltd (390 HK) |

|

Automobile Retailing, Maintenance & Repair |

+1.22% |

China auto sales plunge 48% but EVs strong as BYD comes out top China MeiDong Auto Holdings Ltd (2618 HK) |

|

Soft Drinks |

+0.98% |

China food prices soar as zero-COVID policy stokes inflation Nongfu Spring Co Ltd (9633 HK) |

Top Sector Losers

|

Sector |

Loss |

Related News |

|

Property Management & Agency |

-3.13% |

Cifi Ever Sunshine Services Group Ltd (1995 HK) |

|

Biotechnology |

-2.88% |

China Resources in talks to take Sihuan Pharma private at $3 billion valuation -sources Beigene Ltd (6160 HK) |

|

Semiconductors |

-2.67% |

China opposes semiconductor bill because it will give U.S. advantage -U.S. commerce chief Hua Hong Semiconductor Ltd (1347 HK) |

- Zai Lab Ltd (9688 HK) Shares fell by 20% yesterday and closed at a 52-week low. There was no company-specific news. Previously, the company announced its 1Q22 results. Revenue jumped by 132.4% YoY to US$46.7mn. Net loss attributable to the company shareholders narrowed by 64.6% YoY to US$82.4mn. The drop in losses was due mainly to no prepayment resulting from the new authorization of drugs.

- NIO Inc (9866 HK) shares fell 9.91% yesterday. Xpeng Inc (9868 HK) Shares fell 9.19% yesterday. Bilibili Inc (9626 HK) shares fell 8.03% yesterday. JD.com Inc (9618 HK) shares fell 7.78% yesterday. The broad market was sold off following the US market crash overnight. Hong Kong stocks fell to their lowest in two months, as the city’s monetary authority intervened to defend the local currency for the first time since 2019, fanning concerns of further liquidity outflows. The Hong Kong Monetary Authority bought about HK$1.59 billion (US$202 million) on Thursday to bolster the exchange rate after it weakened to HK$7.8500 per US dollar, the weak end of its HK$7.7500 to HK$7.8500 trading range. The HKMA’s first intervention in 18 months could add further pressure on interest rates, straining the economy already reeling from the impact of strict Covid measures.

Trading Dashboard Update: Add Golden Energy & Resources (GER SP) at S$0.70. Cut loss on Samudera Shipping Line (SAMU SP) at S$0.77.