13 April 2022: Sembcorp Marine (S51 SP), Ganfeng Lithium Co Ltd (1772 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Sembcorp Marine (S51 SP): Merger in sight

- BUY Entry – 0.106 Target – 0.115 Stop Loss – 0.101

- Sembcorp Marine (SMM) provides engineering solutions to the global offshore, marine and energy industries. The Group focuses on four key capabilities, mainly, Rigs & Floaters; Repairs & Upgrades; Offshore Platforms and Specialised Shipbuilding. The group operates shipyards in Singapore, Indonesia, the UK and Brazil. Its key clients include major energy companies, drilling contractors, shipping companies and owners/operators of floating production units.

- Merger mania. SMM is in the midst of merging with Keppel Corp’s offshore and marine (KOM) unit, thereby creating a much larger entity that will likely benefit from scale. The company on 31 March 2022 announced that negotiations were delayed but that both parties are committed to continue with the exclusive negotiations and work towards a definitive agreement by 30th April 2022.

- Benefiting from higher oil prices. Regardless of the merger with KOM, SMM is embarking on its business transformation to rebalance its product solutions portfolio by increasing its focus on renewables, cleaner energy and other green solutions. SMM’s sustainable solutions made up 30% of total revenue in 2021 and 43% of the group’s net order book as at end 2021. The higher oil prices are also set to give SMM’s future order book a boost given higher demand from clients to turn to sustainable solutions.

- Negative street estimates; waiting for re-rating catalyst. Street estimates are currently negative at the moment with only 1 BUY recommendation from UOB KayHian (TP S$0.11). There are 5 HOLD and 2 SELL ratings, with an average 12m price target of S$0.093, implying a negative return of 15% from the last close price. We may likely expect a re-rating of SMM’s shares upon the successful merger with KOM. The merger will help the company emerge as a stronger player that can seize more opportunities in the renewable and clean energy industries.

Sembcorp Marine (S51 SP) (Source: Bloomberg)

Yangzijiang Shipbuilding (BS6 SP): Enhancing shareholder value

- RE-ITERATE BUY Entry – 1.58 Target – 1.70 Stop Loss – 1.52

- China’s largest private shipbuilder. Yangzijiang is China’s largest private shipbuilder. The company builds a broad range of commercial vessels including containerships, bulk carriers and LNG vessels. Yangzijiang has been at the forefront of shipbuilding in China.

- Spin-off of investment business. The group will spin off its investment business into a separate entity, Yangzijiang Financial Holdings (YZJFH), and will list it on the Mainboard of the Singapore Exchange. YZJFH will place a strong focus on expansion into fund and wealth management, and diversify into fast-growing sectors and new asset classes including private debt and mezzanine financing. YZJFH will set up its headquarters in Singapore, with the aim of becoming a leading investment manager in Asia.

- A record year for orderbook. In 2021, the group secured record order wins for 124 vessels with a total contract value of US$7.41 billion. The group has focused on building containerships and clean energy vessels which typically demand higher margins given their higher value-add over dry bulkers and tankers. As at the end of 2021, Yangzijiang had an orderbook of US$8.5bn for 157 vessels, with containerships accounting for >US$7bn or 83% of total existing contract value.

- Positive consensus estimates. There are 7 BUYS and 2 HOLDs, with a 12m average TP of S$1.81, or an implied 13% total return from the last close price. Yangzijiang trades at an attractive 7.8x and 6.5x FY2022F and FY2023F P/E, and offers a dividend yield of around 3.0% per annum.

Yangzijiang Shipbuilding (BS6 SP) (Source: Bloomberg)

HONG KONG

Ganfeng Lithium Co Ltd (1772 HK): Range bound trade

- BUY Entry 90 – Target – 110 Stop Loss – 80

- GANFENG LITHIUM CO., LTD. is a China-based company principally engaged in the research, development, production and sales of deeply processed lithium products. The Company’s main products include lithium compounds, lithium metal and lithium batteries. The Company’s products are mainly used in electrical vehicles, chemicals and pharmaceuticals. The Company distributes its products in the domestic market and to overseas markets.

- Ramp-up in capacity. The company announced that it and its partner Mineral Resources Limited agreed to upgrade the ore processing capacity of Mt Marion spodumene project of the joint venture Reed Industrial Minerals Pty Ltd (RIM). According to the test work results, it is estimated that the spodumene concentrate capacity of Mt Marion spodumene project will increase from 450,000 tonnes per annum to 600,000 tonnes per annum by April 2022. Meanwhile, RIM is planning the second stage of capacity expansion, which plans to expand the current spodumene concentrate capacity to 900,000 tonnes per annum, which is expected to be completed by the end of 2022.

- Stellar FY21 earnings. FY21 Revenue jumped by 103.4% YoY to RMB11.1bn. Gross profit jumped by 282.5% YoY to RMB4.4bn. GPM jumped by 18.6ppts to 39.8%. Net profit attributable to the owners of the company jumped by 409.7% YoY to RMB5.4bn. NPM jumped by 21.6ppts to 49%. The stellar performance was due mainly to the 49% and 14.1% surge in the average selling price of the respective lithium series products and lithium batteries series products. Meanwhile, the company proposed a cash dividend of RMB3 for every 10 shares.

- Lithium carbonate price maintains at a record high. Lithium carbonate prices in China stayed at RMB496,500/tonne as of 11th April due to high global demand and tight supplies. Prices have jumped more than 85% YTD. China is expected to double the EV sales in 2022 to more than 5mn units. Meanwhile, battery producers rush to secure long-term supply contracts with lithium mining companies. The recent sanction on Russia pushed oil prices back to more than US$100/bbl. The outlook for oil is still very bullish. Accordingly, the demand for petroleum vehicles will be further suppressed. On the contrary, the demand for EVs, especially in Europe and the US will be further propelled. As a result, lithium, the main raw material for batteries, is expected to see stronger demands.

- The updated market consensus of the EPS growth in FY22/23 is 58.7%/16.0% YoY, respectively, translating to 13.4×/11.5x forward PE. The current PER is 21.4x. Bloomberg consensus average 12-month target price is HK$198.29.

Ganfeng Lithium Co Ltd (1772 HK) (Source: Bloomberg)

Metallurgical Corporation of China Ltd. (1618 HK): Infrastruct expansion to boost the economy

- RE-ITERATE BUY Entry 2.15 – Target – 2.50 Stop Loss – 2.00

- Metallurgical Corporation of China Ltd. is a China-based company principally engaged in the engineering construction related businesses. The Company’s businesses mainly include the engineering contracting, real estate development, resources development and equipment manufacturing. The Company’s engineering contracting businesses mainly include the metallurgical engineering, municipal engineering, transportation facilities and urban infrastructure construction, among others. Its real estate development businesses mainly include the development and construction of commercial and residential real estates. Its resource development businesses mainly include the mining and processing of iron, copper, nickel, lead and zinc, among others. Its equipment manufacturing businesses mainly include the manufacturing of metallurgical equipments and steel structures.

- Infrastructure expansion to bail out the weak economy. China’s Caixin general manufacturing PMI dropped to a 25-month low of 48.1 in March, and the Caixin general services PMI also plunged to a 25-month low of 42.0. The surge in covid cases and ensuing lockdowns of cities resulted in the economic contraction. Meanwhile, domestic consumption hardly recovers in the near term given the weak consumer confidence. The growth of international trade is expected to slow down as well, as Southeast Aisa countries gradually reopen, regaining some market shares of low-end manufacturing from China. Therefore, to revive the growth in the economy in the near term, the authority will probably resort to the old measure, infrastructure expansion. According to Bloomberg, the central government requested local government to draw up lists of projects. The planned investment in 2022 is expected to amount to at least RMB14.8tn.

- FY21 annual results review. Operating revenue grew by 25.1% YoY to RMB500.6bn. Net profit attributable to shareholders of the company grew by 6.5% YoY to RMB8.4bn. The value of newly signed contracts reached another record high of RMB1.2tn, up 18.2% YoY.

- The updated market consensus of the EPS growth in FY22/23 is 32.9%/10.8% YoY, respectively, translating to 3.8×/3.5x forward PE. The current PER is 4.9x. FY22F/23F dividend yield is 5.3%/5.6%. Bloomberg consensus average 12-month target price is HK$2.94.

Metallurgical Corporation of China Ltd. (1618 HK) (Source: Bloomberg)

MARKET MOVERS

Top Sector Gainers

| Sector | Gain | Related News |

| Coal | +8.6% | Moody’s raises coking coal prices assumptions amid supply issues Peabody Energy (BTU US) |

| Oil & Gas Production | +2.4% | High Prices Make Oil And Gas Much More Appealing To Big Banks Occidental Petroleum (OXY US) |

| Steel | +1.0% | Ukraine War Drives Shortage in Pig Iron, Pushing Steel Prices Higher Cleveland-Cliffs Inc (CLF US) |

Top Sector Losers

| Sector | Loss | Related News |

| Major Banks | -1.4% | Bank earnings expected to decline despite boost from Fed rate hikes JP Morgan Chase (JPM US) |

| Movies/Entertainment | -1.1% | How Rising Inflation and Mortgage Rates Could Affect the Stock Market AMC Entertainment (AMC US) |

| Internet Software / Services | -1.0% | Elon Musk deletes tweets critical of Twitter after weekend barrage Twitter (TWTR US) |

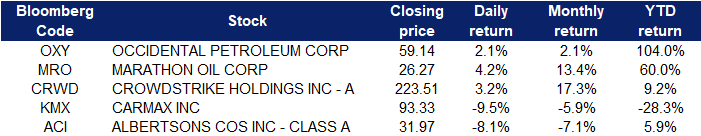

- Occidental Petroleum Corp (OXY US) and Marathon Oil Corp (MRO US) shares gained 2.1% and 4.2% respectively yesterday. WTI crude futures jumped more than 7% to above $100 per barrel on Tuesday, recovering from a 4% loss in the previous session, on relief about demand in China after Shanghai eased some virus restrictions. Also, OPEC warned it would be nearly impossible to replace Russian oil lost by a possible ban from the EU, while downwardly revising both global output and demand forecasts for this year. The EU is reportedly drafting proposals for an oil embargo on Russia although there was no agreement to ban Russian crude.

- Crowdstrike Holdings Inc (CRWD US) shares rose 3.2% after Goldman Sachs upgraded the stock to a “buy” from “neutral.” The firm said the strength of CrowdStrike’s business has been overlooked recently and that it’s “well positioned in the sweet spot of demand.”

- CarMax Inc (KMX US) shares plummeted 9.5% after reporting a beat on revenue but a miss on earnings for the latest quarter. The auto retailer earned 98 cents per share, below the $1.25 per share consensus estimate.

- Alberstons Companies Inc (ACI US) shares sank 8.1% after reporting earnings for the recent quarter. Albertsons beat on revenue and reported earnings of 75 cents per share, 11 cents above consensus estimates.

Singapore

- First Resources Ltd (FR SP) and Golden Agri Resources Ltd (GGR SP) shares rose 4% and 1.6% respectively yesterday. Malaysian palm oil futures climbed above the MYR 6,000-a-tonne level, a level not seen in two weeks, as investors assessed signs of more robust exports against a growing demand backdrop. Malaysia’s March palm oil exports were up 14.1% from a month earlier at 1.265 million tonnes, beating analysts’ estimates as shipments to China and India picked up. On top of that, the shortage of sunflower and rapeseed oils, in which conflicting countries Russia and Ukraine account for nearly 75% of the global exports, will make the European Union look for Malaysia and Indonesia to replace supplies.

- Sembcorp Marine Ltd (SMM SP) shares gained 2.8% yesterday. Sembmarine and Keppel Corporation said more time and deliberation were needed to advance the proposed combination of Keppel Offshore & Marine (Keppel O&M) and Sembmarine, although “significant progress” has been made. This came some 9 months after both parties first announced talks on potentially combining the entities. Both need to complete due diligence, reach a mutual agreement on the transaction terms and finalise definitive legal documentation.

- Singapore Post Ltd (SPOST SP) shares gained 2.3% yesterday. Singpost said in a bourse filing on Wednesday (Mar 30) evening that it will be issuing S$250 million in perpetual securities with an initial distribution rate of 4.35% per annum for the first 5 years. The money raised from the sale of these perpetual securities will be used for SingPost’s general corporate purposes, including the refinancing of its existing borrowings.

- RH Petrogas Ltd (RHP SP) shares rose 1.7% yesterday. WTI crude futures jumped more than 2.5% to above $96.5 per barrel on Tuesday, recovering from a 4% loss in the previous session, on relief about demand in China after Shanghai eased some virus restrictions despite most remaining confined. Also, OPEC warned it would be nearly impossible to replace Russian oil lost by a possible ban from the EU. The EU is reportedly drafting proposals for an oil embargo on Russia although there w as no agreement to ban Russian crude. Oil prices are now around levels before Russia’s invasion of Ukraine in late February, with IEA member states planning to release some 240 million barrels over the next six months in a bid to calm volatile oil markets.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Airline Services | +4.36% | China’s Goal in Covid Zero Pursuit Shifts Amid Omicron Outbreak Air China Limited (753 HK) |

| Travel & Tourism | +2.71% | US State Department orders non-essential staff to leave Shanghai over COVID-19 Trip.com Group Ltd (9961 HK) |

| Gamble | +1.56% | Half Macau operators may report 1Q negative EBITDA: MS Sands China Ltd. (1928 HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Fertilisers & Agricultural Chemicals | -3.29% | Protect China’s food security against geopolitical risks China XLX Fertiliser Lt (1866 HK) |

| Petroleum & Gases Equipment & Services | -2.69% | Column: China’s crude oil imports surge in March, but likely to fade amid COVID curbs China Oilfield Services Limited (2883 HK) |

| Semiconductors | -0.97% | Semiconductors: The end of China’s ‘longest bull market in history’ Hua Hong Semiconductor Ltd (1347 HK) |

- China Coal Energy Co Ltd (1898 HK) shares rose 14% yesterday after Citigroup released a research report saying that it reiterated its “buy” rating on China Coal Energy with a target price of HK$8.3, which corresponds to a PE ratio of about 7x in 2021. The company announced its first-quarter results forecast, which was better than expected. The company is expected to achieve a net profit of 6.45 billion yuan to 7.130 billion yuan in the first quarter, which represents a YoY increase of 83.80%-103.20%

- Jiumaojiu International Holdings Ltd (9922 HK), Haidilao International Holding Ltd (6862 HK). F&B stocks rose collectively yesterday after brokeragges gave an outlook which pointed to the recovery in the consumer sector. Jiumaojiu and Haidilao’s shares rose 9.9% yesterday. Huachuang Securities said on April 10 that from the second half of the year onwards, as the epidemic situation is better controlled and cost pressures ease, the consumer sector is expected to experience marginal improvement. Demand is poised to support further recovery of operations.

- NetEase Inc (9999 HK) and Tencent Holdings Ltd (700 HK) shares rose 4.2% and 3.6% respectively yesterday after regulators approved the country’s first batch of new titles in more than 8 months. “The resumption of game approval is a positive development to China’s games industry,” Citigroup analyst Alicia Yap wrote in a note. It “will help boost investor confidence that the government remains supportive of cultural and innovative aspects of the games industry and could signal resumption of a more regular approval process”.

Trading Dashboard

Trading Dashboard Update: Add Yangzijiang Shipbuilding (YZJSGD SP) at S$1.58. Cut loss on BYD Company (1211 HK) at HK$220 and OxPay Financial (OPFL SP) at S$0.174.