12 October 2022: Keppel Corp Ltd (KEP SP), China Resources Power Holdings Company Limited (836 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Keppel Corp Ltd (KEP SP): Expansion amidst a market downturn

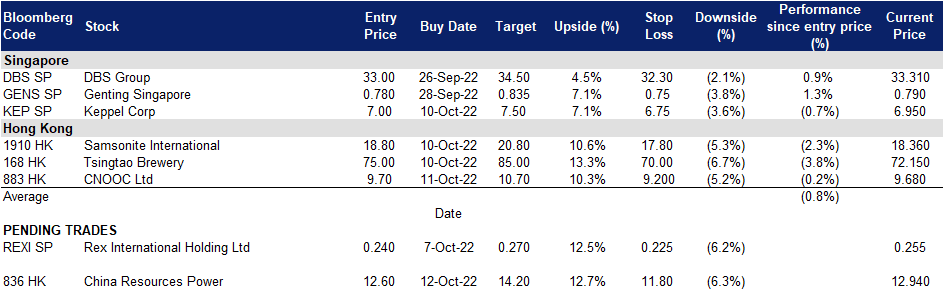

- RE-ITERATE Entry – 7.00 Target – 7.50 Stop Loss – 6.75

- Keppel Corporation is a Singaporean conglomerate headquartered in Keppel Bay Tower, HarbourFront. The company consists of several affiliated businesses that specialises in offshore & marine, property, infrastructure and asset management businesses.

- Delivery in 4Q22. Keppel Shipyard won the third contract from a fully-owned subsidiary of Royal Boskalis Westminster NV for the overhaul and jumboisation of two trailing suction hopper dredgers (TSHD). The second TSHD has been scheduled to be delivered to the shipyard in 4Q22.

- New FPSO contract. Keppel Offshore & Marine won a US$2.8 billion ($4.0 billion) newbuild floating production storage and offloading (FPSO) contract from Petrobras for the deployment at the Buzios field offshore Brazil. The new order, P-83 is scheduled for delivery in 1H27 and is a repeat order from the previous P-80 secured in August 2022.

- KIT portfolio expansion. Keppel Infrastructure Trust (KIT) has expanded its portfolio in Europe – co-investing €160 million (S$226 million) in the European onshore wind energy portfolio, and ventured into Saudi Arabia – invested US$250 million (S$336 million) to acquire stakes in Aramco Gas Pipelines Company, and South Korea – bought Eco Management Korea Holdings for 626.1 billion won (S$666.1 million) in cash. The company has plans to grow the trust’s portfolio to $18 billion within the next decade.

- Updated market consensus of the EPS growth in FY22/23 is -12.5%/7.8% YoY respectively, which translates to 14.4x/13.4x forward PE. Current PER is 11.1x. Bloomberg consensus average 12-month target price is S$8.79.

(Source: Bloomberg)

Rex International Holding Ltd (REXI SP): largest oil output cut since 2020

Rex International Holding Ltd (REXI SP): largest oil output cut since 2020

- RE-ITERATE Entry – 0.240 Target – 0.270 Stop Loss – 0.225

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Oil rebounded back to a three-week high. Oil prices gained after OPEC+ agreed to cut output by 2mn barrels/day from November. Brent went up 2.03% to US$93.6/bbl, and WTI went up 1.97% to US$88.06/bbl.

- Dollars pulled back and commodities rebounded. The US dollar index remains at below 112 after reaching a 20-year high of 115 last week. Commodities are inversely related to US dollars. The short-term correction of the dollar index provides relief rebound opportunities for global commodities.

- Ukraine War. Following the invasion of Ukraine, some countries have made the decision to stop buying Russian oil, imposed sanctions on Russia and G7 is planning to place a price cap on Russian oil purchases. Thus causing the price of oil sold by Russia to be significantly cheaper than oil from other sources, attracting more oil purchases from Asian countries such as India and China.

- Updated market consensus of the EPS growth in FY22/23 is -52.4%/368.4% YoY respectively, which translates to 9.0x/1.9x forward PE. Current PER is 4.6x. Bloomberg consensus average 12-month target price is S$0.47.

China Resources Power Holdings Company Limited (836 HK): A value stock in play

- Buy Entry – 12.6 Target – 14.2 Stop Loss – 11.8

- China Resources Power Holdings Company Limited is a Hong Kong-based investment holding company principally engaged in the investment, development and operation of power plants. The Company operates through three segments. Thermal Power segment is engaged in the investment, development, operation and management of coal-fired power plants and gas-fired power plants, as well as the sales of heat and electricity. Renewable Energy segment is engaged in wind power generation, hydroelectric power generation and photovoltaic power generation, as well as the sales of electricity. Coal Mining segment is engaged in the mining of coal mines, as well as the sales of coal. The Company mainly operates businesses in China.

- Power is a defensive sector. The downturn of the Hong Kong equity market persisted due mainly to the global rate hike cycle, China’s economy slowdown, and deteriorating China-US relations. The broad market selloff has yet ended, however, power sector is one of the few relatively outperforms. Not only does the sector provide consistent and positive cash flows, but also expand businesses into clean energy fields which are in line with global ESG theme and supported by the domestic policies.

- August operations update. Total net generation of subsidiary power plants in August-22 increased by 24.9% YoY to 19,734,839MWh, among which, subsidiary wind farms increased by 43.5% YoY to 2,753,235MWh, subsidiary photovoltaic plants increased by 6.7% YoY to 115,859MWh.

- 1H22 earnings review. Turnover grew by 17.78% YoY to HK$50.4bn. The increase was mainly attributable to a YoY increase of 23.9% in the average on-grid tariffs (tax exclusive) of subsidiary coal-fired power plants and a YoY increase of 19.9% in the average sales price of heat supply of subsidiary coal-fired power plants. Net profit attributable to shareholders of the company dropped by 22.46% YoY to HK$4.4bn. The fall in net profit was due to the increase in operating expenses resulted from higher raw material costs.

- The updated market consensus of the EPS growth in FY22/23 is 283.8%/27.9% YoY, respectively, translating to 6.7×/5.2x forward PE. The current PER is 72.0x. FY22F/23F dividend yield is 6.3%/8.2% respectively. Bloomberg consensus average 12-month target price is HK$20.85.

(Source: Bloomberg)

CNOOC Limited (883 HK): Recovery in oil prices

CNOOC Limited (883 HK): Recovery in oil prices

- RE-ITERATE Buy Entry – 9.7 Target – 10.7 Stop Loss – 9.2

- CNOOC Limited is a Hong Kong-based investment holding company principally engaged in the exploration, production and trading of oil and gas. Its businesses include conventional oil and gas businesses, shale oil and gas businesses, oil sands businesses and other unconventional oil and gas businesses. The company mainly operates businesses through three segments. The Exploration and Production segment is engaged in the exploration, development and production of crude oil, natural gas and other petroleum products. The Trading segment is engaged in the trading of crude oil, natural gas and other petroleum products. The company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, Indonesia and Brazil, among others.

- Largest crude oil prices weekly gain since February. During the China golden week holiday, crude oil prices enjoyed the second largest weekly gain YTD as OPEC+ agreed to cut its production targets for November by 2mn bbls/d; Brent and WTI jumped 15.34% and 16.89% respectively on the first week of October.

- First batch of 2023 crude oil import quotas released. The volume issued is about 20mn tonnes, equivalent to 146mn bbls. Last month, Beijing issued a third batch of quotas for 2022 that raised its non-state import quotas to 164.61mn tonnes this year.

- 1H22 results review. Revenue jumped by 84% YoY to RMB202.4bn. Net profit attributable to equity shareholders of the company jumped by 116% YoY to RMB71.9bn. Management declared an interim dividend of HK$0.7.

- The updated market consensus of the EPS growth in FY22/23 is 83.6%/-8.9% YoY, respectively, translating to 3.2×/3.5x forward PE. The current PER is 3.7x. The expected dividend yield in FY22/23 is 15.5%/11.9%. Bloomberg consensus average 12-month target price is HK$14.72.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Specialty Stores | +1.79% | PwC Finds Millennials Likely to Lead Spending This Holiday Season Walmart Inc (WMT US) |

| Apparel/Footwear | +1.54% | PwC Finds Millennials Likely to Lead Spending This Holiday Season Nike Inc (NKE US) |

| Real Estate Investment Trusts | +1.42% | A Warning for the World Economy: ‘The Worst Is Yet to Come’ Prologis Inc (PLD US) |

Top Sector Losers

| Sector | Loss | Related News |

| Semiconductors | -2.72% | TSMC shares fall 8.3% after U.S. steps up China chip curbs Taiwan Semiconductor Manufacturing Co Ltd (TSM US) |

| Other Consumer Services | -2.28% | Why Travel Stocks Tanked Today Airbnb Inc (ABNB US) |

| Major Banks | -2.15% | JPMorgan Says Too-Hot CPI Would Put Stocks at Risk of 5% Tumble JPMorgan Chase & Co (JPM US) |

- Uber Technologies Inc (UBER US) and Lyft Inc (LYFT US) dropped 10.4% and 12.0%, respectively, after the Labour Department proposed a new rule that could pave the way for gig workers to be reclassified as employees rather than independent contractors. The proposal could raise costs for the companies, who rely on contract workers to drive on their own schedules.

- Amgen Inc (AMGN US) jumped 5.7% after Morgan Stanley upgraded Amgen to overweight from equal weight, saying Amgen is “largely derisked” and provides defensiveness for investors.

- Leggett & Platt Inc (LEG US) dropped 7.2% after the industrial manufacturer cut its full-year sales and earnings guidance, citing rising inflation and challenging economic conditions.

- Bilibili Inc (BILI US) dropped 7.2% after Bernstein downgraded the stock to underperform from market perform, citing balance sheet risk.

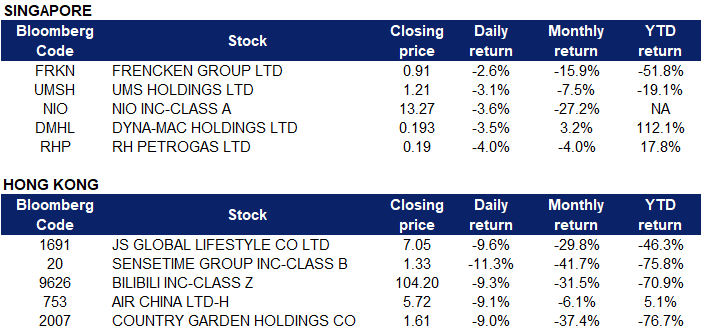

Singapore

- Frencken Group Ltd (FRKN SP) and UMS Holdings Ltd (UMSH SP) shares fell 2.6% and 3.1% yesterday respectively. Asia’s top chip stocks tumbled Tuesday, ensnared in an escalating US-China tech race that has erased more than $240 billion from the sector’s global market value. The Biden administration measures will erect barriers of entry to China’s market by limiting the ability of US firms to sell equipment and tech to their Chinese counterparts.

- NIO Inc (NIO SP) shares dropped 3.6%, on news that fellow EV maker Rivian issued a significant recall of most of its vehicles. It was also affected by recession fears and the flare-up in COVID-19 cases in China.

- Dyna-Mac Holdings Ltd (DMHL SP) and RH PetroGas Ltd (RHP SP) shares tumbled by 3.5% and 4.0% yesterday respectively. Oil prices fell on Tuesday (Oct 11), extending nearly 2 per cent losses in the previous session, as a stronger US dollar and a flare-up in COVID-19 cases in China increased fears of slowing global demand.

Hong Kong

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Electricity Supply |

+2.64% |

Does China really need that much more coal-fired electricity? CLP Holdings Ltd (2 HK) |

|

Precious Metal |

+1.63% |

China battery makers actively expanding capacities for energy storage systems Zijin Mining Group Co Ltd (2899 HK) |

|

Investments & Assets Management |

+1.22% |

Macro bets help hedge funds ride rough Chinese markets ESR Group Ltd (1821 HK) |

Top Sector Losers

|

Sector |

Loss |

Related News |

|

Airline Services |

-4.91% |

China rushes to control new Covid cases across the country Cathay Pacific Airways Ltd (293 HK) |

|

Software |

-2.93% |

HK stocks at 11-year lows as China vows to stick to zero-Covid policy SenseTime Group Inc (20 HK) |

|

Alcoholic Drinks & Tobacco |

-2.79% |

China Liquor Stocks Pare Losses as Drinking Ban Speculation Swirls Budweiser Brewing Co APAC Ltd (1876 HK) |

- JS Global Lifestyle Co Ltd (1691 HK) Shares fell 9.6% yesterday. The National Energy Administration recently issued a letter responding to the proposal of the fifth meeting of the 13th National Committee of the Chinese People’s Political Consultative Conference No. 01691 (No. 110 of the Economic Development Category). Following that, the National Energy Administration will cooperate with the Ministry of Ecology and Environment and other departments to connect green electricity trading, green certificate trading and carbon emission trading, and study the inclusion of household photovoltaics in the carbon emissions trading market.

- SenseTime Group Inc (20 HK) and Bilibili Inc (9626 HK) Shares plummeted 11.3% and 9.3% respectively yesterday. Hong Kong’s stock benchmark on Tuesday (Oct 11) fell below 17,000 points for the first time in 11 years, after China vowed to stick to its zero-Covid policy, adding to slowdown concerns amid heightened US tech crackdowns and aggressive overseas rate hikes. Tech giants listed in Hong Kong tumbled 3%. The US measures include restrictions on the export of some types of chips used in artificial intelligence and supercomputing, and also tighter rules on the sale of semiconductor equipment to any Chinese company.

- Air China Ltd (753 HK) and Country Garden Holdings Co Ltd (2007 HK) Shares dropped 9.1% and 9.0% respectively yesterday, after concerns about China’s economic slowdown deepened as Beijing squashed hopes for an imminent reversal of its zero-Covid policy. Shanghai has doubled down on Covid tightening measures, requiring all arrivals to take three nucleic acid tests within three days, as China’s biggest commercial city with about 25 million residents reported one new infection outside quarantine on Monday. The flare-up in the pandemic and a slumping property market will make it harder for the economy to rebound this time.

Trading Dashboard Update: Cut loss on TRIP.com (9961 HK) at HK$210. Add CNOOC (883 HK) at HK$9.7.

(Source: Bloomberg)

(Source: Bloomberg)