KGI DAILY TRADING IDEAS – 11 October 2021

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Silverlake Axis (SILV SP): The future is digital

- BUY Entry – 0.30 Target – 0.36 Stop Loss – 0.27

- Silverlake Axis is a software company that provides banking solutions to banks in Asia. The company has been operating for more than 30 years. Of the top 20 largest banks in Southeast Asia, 40% of them use Silverlake’s core banking solutions.

- Parent’s new partner. Earlier in July 2021, The Edge reported that private equity firm Ikhlas Capital is investing US$40mn in Silverlake Group, the holding company of the SGX-listed Silverlake Axis Ltd. Silverlake Group is the largest shareholder of Silverlake Axis. In turn, Ikhlas Capital is partly owned by former banker Datuk Seri Nazir Razak, and the firm is one of the partners of a conglomerate comprising other firms including AirAsia’s Group e-wallet unit Big Pay and Malaysian Industrial Development Finance (MIDF) vying for one of the five digital banking licenses to be awarded by the first quarter of 2022.

- Digital banking is its future. Given Silverlake Axis’s experience and expertise in providing banking solutions over the past 30 years, combined with the recent news of the investment by Ikhlas Capital into its parent company, we think that the award of one of the five digital banking licenses could provide a much-need catalyst to Silverlake’s share price. Despite the >30% rally of its share price from the recent low, it is still near its 8-year low, partly due to a business slowdown over the years, and also due to a damaging short-seller report in 2015 which caused its market cap to almost halve in value.

- Still overlooked by consensus. Street expectations are not very high for the group, and may imply that many of the positive catalysts are not factored in yet into its current share price. There are 2 BUYS and 2 HOLDS and a 12m TP of S$0.38. Its valuations of 15x and 14x FY2022/23 P/E are relatively lower vs its software-related peers.

City Development (CIT SP): It hurts to let go, but sometimes it hurts more to hold on

- RE-ITERATE BUY Entry – 7.08 Target – 7.80 Stop Loss – 6.70

- City Dev is one of the largest property developers in Singapore. The company has a portfolio of income-producing and geographically diverse properties comprising residences, offices, hotels, serviced apartments, shopping malls and integrated developments. City Dev is also developing a fund management business and targets to achieve US$5bn in assets under management (AUM) by 2023.

- Leaving the past behind. Shares of City Dev reacted positively to the announcement on 10 Sep that it was divesting its interest in China-based developer Chongqing Sincere Yuanchuang Industry (Sincere) for US$1.0. As a recap, City Dev had taken almost S$2 billion of impairments on its investment in Sincere. The complete divestment of Sincere finally removed a heavy overhang on City Dev’s share price. Had City Dev remained the major shareholder of Sincere, it was likely to engage in a possibly long drawn bankruptcy reorganisation of the Chinese developer.

- Restructuring and M&A; short-term catalysts. To optimise property returns, the company is currently undergoing a strategic review of assets. The company has around S$24bn worth of assets it can play around with. A short-term catalyst for City Dev could be the potential listing of its UK-focused office REIT that should help lift its fee income, as well as unlocking capital for recycling. This is in addition to the current strategic review of M&C’s hotel portfolio.

- Following in the footsteps of CapitaLand. Fellow property developer CapitaLand was able to unlock value from the separation of its property management business into the newly listed CapitaLand Investment (CLI SP). CLI’s share price has performed very well since its debut last month, gaining more than 25%. We think that City Dev will likely follow a similar strategy of building up fee income from fund management activities, and potentially listing that entity in the future.

- Positive consensus rating. Bloomberg consensus indicates 16 BUYS and 1 HOLD, with a 12m average TP of S$9.23 (+30% upside potential from the last close price). City Dev currently trades at a 26% discount to its 10-year historical P/B average.

HONG KONG

Ganfeng Lithium Co Ltd (1772 HK): Victim of a sly deal, but likely priced in

- Buy Entry – 130 Target – 150 Stop Loss – 120

- GANFENG LITHIUM CO., LTD. is a China-based company principally engaged in the research, development, production and sales of deeply processed lithium products. The company’s main products include lithium compounds, lithium metal and lithium batteries. The company’s products are mainly used in electrical vehicles, chemicals and pharmaceuticals. The company distributes its products in the domestic market and to overseas markets.

- Stellar 1H21 results. Revenue reached a record high of RMB4.0bn, an increase of 69.5% YoY primarily due to the increase in the unit selling prices and sales volume. Gross profit jumped by 204.3% YoY to RMB1.4bn. Gross margin was 34.9%, an increase of 15.4ppts YoY. Profit for the period attributable to owners of the parent was RMB1.4bn, an increase of 797.4% YoY.

- Price correction. The recent price drawdown was due mainly to the China-based battery-producer CATL acquiring Canada-based Millennial Lithium, topping an offer by Ganfeng Lithium of C$3.60/share. Millennial terminated the Ganfeng arrangement agreement in accordance with its terms and entered into the CATL arrangement agreement.

- Mark-up of selling prices. The company decided to raise the litimum product selling prices by RMB10,000/tonne and butyllithium products by 10% as a result of rising raw material prices and shortage of power supply, which resulted in higher production costs. The mark-up of prices will start from 10th October and last for one month.

- Consensus estimates per the 12-month target price is at HK$203.83, implying a 39.5% upside potential. EPS is forecasted to grow at 169.2%/49.8%/17.3% for FY2021/22/23F, which would bring forward P/Es down to 54x/36x/31x FY2021/22/23F.

TRIP.COM (9961 HK): On-track recovery

- REITERATE Buy Entry – 245 Target – 275 Stop Loss – 235

- Trip.com Group Limited, formerly Ctrip.com International, Ltd., is a travel service provider in China that provides accommodation booking, transportation ticketing, package tours and corporate travel management. The company aggregates hotel and transportation information to help leisure and business travellers make reservations. The company helps leisure travellers book travel packages and guided tours and helps corporate clients manage their travel needs. The company also offers a range of travel-related services to meet the different booking and travel needs of leisure and business travellers, including visitor reviews, attraction tickets, travel-related financial services, car services, travel insurance services and passport services. The company also offers package tours for independent leisure travellers, including tour groups, semi-tour groups and private groups, as well as package tours that require different transportation arrangements (such as cruise, buses or self-driving).

- Promising recovery against COVID-19. Previously, the company announced 1H21 results. Total net revenue increased by 86% YoY and 43% QoQ to RMB10bn, driven by the strong recovery momentum of the China domestic market. Both domestic hotel and air-ticket GMV increased by about 150% YoY. Compared with the same pre-COVID period in 2019, both domestic hotel and air ticketing reservations achieved double-digit growth in 2Q21. Staycation travel continues to serve as a major driver of domestic recovery with local hotel reservations growing nearly 80% versus pre-COVID period in 2019. Revenues from corporate travel management grew 141% year over year and 26% compared with the pre-COVID period in 2019. In 1H21, the company reported a net profit of RMB 1bn compared to a net loss of RMB 5.8bn during the same period last year.

- Pent-up travelling demand during the golden week holiday. The company published a report regarding domestic tourism during the National Day Holiday. The average single-trip air ticket price increased by 7% YoY to RMB821. Net air ticket booking volume increased by 161% WOW one week before the golden week. The average passenger-kilometer increased by 3% YoY to 1,286km.

- Best performance among all the e-commerce large-cap Chinese companies. The crackdown of multiple sectors hammered share prices of technology stocks. Currently, there is no obvious sign of turnaround. However, tourism is one of the few sectors that are relatively immune to policy risks. The price performance of the company showed positive signs of turnaround amidst the recent bearish market sentiment.

- The updated market consensus of the estimated net profit growth in FY22 and FY23 is 383.1% and 51.6% respectively, which translates to 27.4x and 18.1x forward PE. Bloomberg consensus average 12-month target price is HK$286.36.

Market Movers

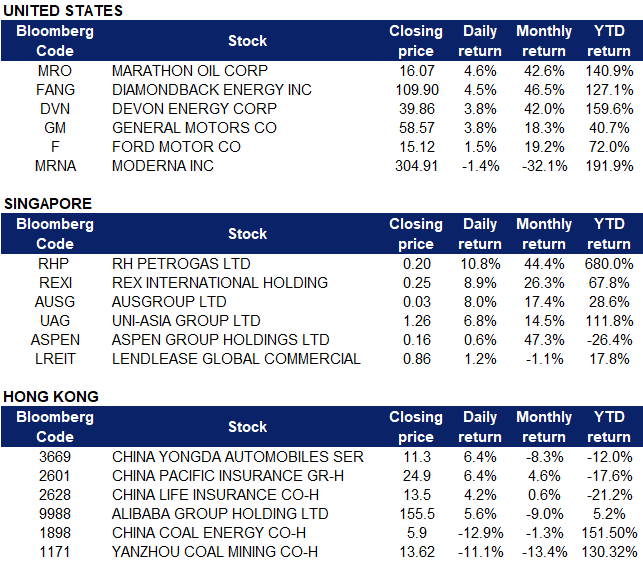

United States

- Energy stocks dominated the top performing spots on the S&P500 on Friday as crude oil prices hit $80 per barrel, the highest it has been since 2014. Shares of Marathon Oil (MRO US), Diamondback Energy (FANG US) and Devon Energy (DVN US) climbed 4.62%, 4.55% and 3.8% respectively. Marathon Oil’s shares also hit a 52-week high of $16.08.

- Moderna (MRNA US) stocks traded 1.44% lower on Friday after Finland, Denmark and Sweden announced that they would limit the use of Moderna’’s COVID-19 vaccine in young people over concerns of rare cardiovascular side effects. Finland’s national health authority, THL, announced that it would pause the use of Moderna’s Covid vaccine in young men, and all men aged 30 or younger would be offered the Pfizer-BioNTech vaccine instead. In Sweden, the use of the vaccine will be stopped in people born in 1991 or later, while Denmark is pausing the Moderna shot in everyone under the age of 18.

- General Motors (GM US) shares surged 3.77% on Friday following the continued momentum from the company’s investor day earlier last week. The company has a target of doubling its annual revenue to $280 billion and growing its operational profit margin of 12 – 14 % by 2030. Additionally, Credit Suisse analysts reiterated its ‘OUTPERFORM’ rating on the company, saying that General Motors has a “compelling cause” for multiple expansion. Ford Motor Company (F US) shares rose as much as 5.9% before closing 1.54% higher at $15.12 in momentum with General Motors’ gains as well.

Singapore

- RH Petrogas Ltd (RHP SP); Rex International Holding Ltd (REXI SP) shares continued their rally on Friday trading, rising 10.80% and 8.89% respectively. Oil sector shares have been making gains last week in tandem with rising oil prices. WTI crude oil futures and Brent crude futures are currently trading at new highs since November 2014 and October 2018 respectively. Additionally, RH Petrogas previously announced on Thursday that it has entered into a conditional capitalisation deed to allot and issue 90 million new shares at S$0.172 per share to Surreyville, an entity within the Tiong family group that holds around 28.6% direct shareholding interest in RH Petrogas.

- AusGroup Limited (AUSG SP) shares rose 8% on Friday, after the company announced that it has been awarded several contracts across Western Australia’s resources and mineral sectors worth a total of A$32 million or S$31.7 million. CEO and managing director of AusGroup said that the contracts “will allow AusGroup to further solidify our presence in these sectors within our core services. Our order book is also strengthened, providing the group with greater revenue visibility and confidence into 2022”.

- Uni-Asia Group (UAG SP). The company that specialises in dry bulk carriers saw its share rise 6.8% on Friday, driven mainly by charter rates that are near their 13-year peak. The Baltic Dry Index booked a gain of more than 6% for the week, its fourth straight weekly rise. We have an OUTPERFORM recommendation on Uni-Asia and a 12m TP of S$1.56 (+24% potential upside from last close price).

- Aspen Group Holdings (ASPEN SP) announced on Thursday that its subsidiaries Aspen Vision Land and Aspen Vision City had filed a defence and counterclaim in response to a claim initiated by Penang Development Corporation. The counterclaim is made for damages amounting to RM 161.6 million in relation to losses incurred as a result of breaches of agreements and/or misinterpretations between the parties. Aspen clarified that the suit is not expected to have a financial impact on the company’s net tangible assets or earnings per share for the current financial year. The stock rose as much as 1.88% before closing 0.62% higher on Friday.

- Lendlease Global Commercial Reit (LREIT SP) rose 1.18% on Friday after the Sydney-based Lendlease, manager of the Reit, announced that it is commencing construction on a large-scale vaccine facility in late 2021, in support of Singapore’s biopharmaceutical sector. Lendlease has built the majority of Singapore’s major pharmaceutical facilities and over 90% of the biotechnology facilities in Singapore’s Tuas Biomedical Park.

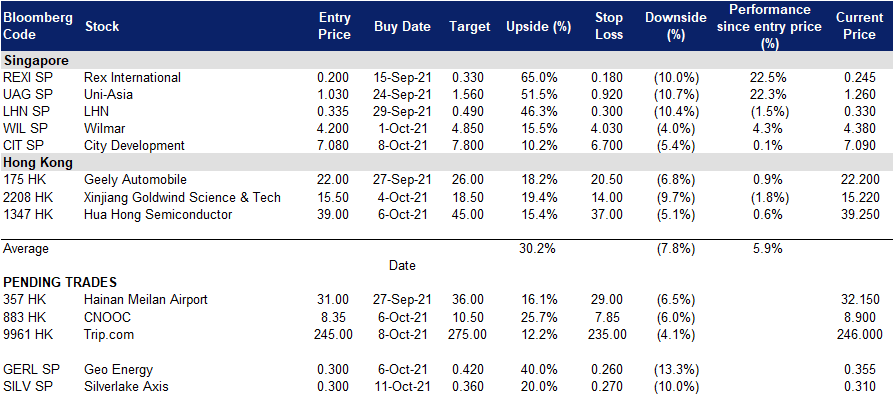

- Trading Dashboard: Remove Yangzijiang (YZJSGD SP) at S$1.39. Add City Development (CIT SP) at S$7.08

Hong Kong

- China Yongda Automobile Services Hldg (3669 HK) shares rose 6.4% on Friday, even though there was no company specific news. As of Friday closing, shares have declined a total of approximately 33% since its all-time high in July 2021 and are trading at a 6-month low. The rise in share price was likely due to a technical rebound. The company has recently been aggressively buying back shares. On 24 September, the company announced that it will repurchase 500,000 shares for approximately HK$5,748,100 at HK$11.20 to HK$11.74 per share. The total number of shares repurchased by the company under the repurchase authorization for nine consecutive trading days reached a total of 6.629 mn, with a cumulative purchase price paid about HK$77,824,300.

- China Pacific Insurance Group Co Ltd (2601 HK), China Life Insurance Co Ltd (2628 HK). Insurance sector shares rose collectively on Friday. China Pacific’s shares rose 6.4% while China Life’s shares rose 4.2%. CITIC’s Investment Research Report stated that negative market sentiment on the insurance sector has eased and there is now renewed optimism. The firm believes that as the monetary policy continues to adhere to the prudent target, long-term interest rates are expected to continue to rise, which would alleviate the pressure on the investment side of insurance companies. In terms of policies, the pension and health insurance sectors continue to receive encouragement and support, which could provide more adequate business space for insurance companies.

- Alibaba Group Holding Ltd (9988 HK) shares rose 5.6% yesterday, extending its price rally to 3 days. Despite the short-term rally, shares have declined a total of approximately 49% since its all-time high in October 2020. Recently, major domestic platforms are gradually lifting restrictions. According to the latest reports, Taote (formerly Taobao Special Edition) merchants have recently begun to sign contracts to open diversified payment agreements in batches and could access WeChat Pay within a month. At the end of last month, Ali’s Ele.me, Youku, Damai, Koala, Shuqi and other applications have successfully connected to WeChat Pay. Apps such as Taote, Xianyu, and Hema are currently waiting for WeChat’s review.

- China Coal Energy Co Ltd (1898 HK), Yanzhou Coal Mining Co Ltd (1171 HK). Coal sector shares collectively plunged on Friday on declining coal prices. China Coal’s shares declined 12.9% while Yanzhou Coal’s shares declined 11.1%. On Friday, coal futures fell to US$230 per metric ton from a record of US$269.5 hit on October 5th, following news that China called for a huge boost in coal output to fight power crunch. In addition, the energy crisis eased after Russian President Putin said Gazprom will send more gas to Europe via Ukraine and as domestic production and inventories of oil and gasoline in the US increased.

Trading Dashboard

Related Posts: