11 November 2022: Wilmar International Ltd (WIL SP), Dongfang Electric Corp Ltd. (1072 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Wilmar International Ltd (WIL SP): Sound fundamental and share buyback to uphold share prices

- BUY Entry – 3.90 Target – 4.10 Stop Loss – 3.80

- Wilmar International Ltd is a leading agribusiness group in Asia, one of 12 of the world’s biggest agricultural commodity companies. At the core of Wilmar’s strategy is an integrated agribusiness model that encompasses the entire value chain of the agricultural commodity business, from cultivation and milling of palm oil and sugarcane, to processing, branding and distribution of a wide range of edible food products in consumer, medium and bulk packaging, animal feeds and industrial agri-products such as oleochemicals and biodiesel. It has over 500 manufacturing plants and an extensive distribution network covering China, India, Indonesia and some 50 other countries and regions.

- Plans for emission reduction. Wilmar signed up for the Science Based Targets initiative (SBTi) in October 2022 with the aim of cementing their emission reduction targets while demonstrating the progress that reflects the significance of its commitments. Wilmar has expressed its climate ambitions towards a 1.5-degree Celsius pathway, with both Near-Term and Net Zero commitments outlined in its SBTi commitment. Over the next 24 months, they will develop time-bound plans delineating their strategy and approach to achieve their Near-Term and Net Zero emission reduction targets. The vast majority of their undertakings revolve around Scope 3 emissions, with efforts well underway to identify their Scope 3 footprint and formulate comprehensive plans to address and reduce them.

- Large market share. Wilmar International operates an integrated agribusiness model that encompasses the entire value chain of the agricultural commodity business. In the face of the commodity market volatility this year, the integrated and diversified business model of Wilmar International and its cautious approach to risk management when agri-commodities were at or near historical highs enabled the group to deliver record results this year. Even with the price volatility of different commodities, the company would still perform well due to its huge market share, allowing it to have better market information and formulate better sourcing strategies, thus achieving lower raw material costs.

- 3Q22 results. Wilmar’s core net profit surged by 38.2% YoY to US$796.7 million (S$1.13 billion), while revenue increased by 10.2% YoY to US$18.88 billion. The record quarterly results, the third straight quarter in a row, was driven by good performance across all of Wilmar’s core segments. Its 9M22 earnings increased by 49.2% YoY to US$19.5 billion while revenue increased by 17.9% YoY to US$55.01 billion.

- Share buyback. Between Nov 1 and 3, Wilmar’s chairman and chief executive officer increased deemed interest in the stock. The total consideration of three acquisitions was S$4,547,360 and increased his total interest in Wilmar International from 12.94 per cent to 12.96 per cent.

- Updated market consensus of the EPS growth in FY22/23 is 17.7%/-10.4% YoY respectively, which translates to 8.16x/9.11x forward PE. Current PER is 8.18x. Bloomberg consensus average 12-month target price is S$5.25.

(Source: Bloomberg)

Hongkong Land Holdings Ltd (HKL SP): Light at the end of the tunnel

- RE-ITERATE BUY Entry – 4.00 Target – 4.40 Stop Loss – 3.80

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages more than 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- China easing air travel. China is working on plans to scrap a system that penalises airlines for bringing virus cases into the country, a sign authorities are looking for ways to ease the impact of the Covid Zero policy. The State Council, which oversees China’s bureaucracy, recently asked government agencies including the civil aviation regulator to prepare for ending the so-called circuit-breaker mechanism. The system sees airlines banned temporarily from specific routes into China for one-to-two weeks, depending on how many Covid-positive passengers they bring into the country.

- Hope for reopening of borders in China. With news of China increasing international flights into the country, investors are hopeful that China will soon ease their strict Covid zero restrictions and allow for a gradual recovery of their economy. Furthermore, news of the Chinese government planning to ease the circuit breaker rule and drawing up a game plan to slowly open up their country has led to the rise in yuan and the Hong Kong market.

- Updated market consensus of the EPS growth in FY22/23 is -8.2%/12.9% YoY respectively, which translates to 10.9x/9.7x forward PE. Current PER is 11.9x. Bloomberg consensus average 12-month target price is S$5.67.

Dongfang Electric Corp Ltd. (1072 HK): Fuel cell and hydrogen energy themes in play

- Buy Entry – 12.0 Target –13.5 Stop Loss – 11.3

- Dongfang Electric Corp Ltd is a China-based company mainly engaged in the manufacturing and sales of power generation equipment. The Company operates five major reporting segments: Clean and High-Efficiency Energy Equipment segment, Renewable Energy Equipment segment, Engineering and Trade segment, Modern Manufacturing Service Industry segment, and Emerging Growth Industry segment. The Company’s main products include water turbine generator sets, steam turbine generators, wind turbine generator sets, power station steam turbines and power station boilers as well as gas turbines. he Company distributes its products within the domestic market and to overseas market.

- China to accelerate fuel cell vehicle deployments. By 2025, China will have about 50,000 hydrogen fuel-cell vehicles and its annual hydrogen production from renewable energy will reach 100,000 to 200,000 tonnes, according to the plan jointly released by the National Development and Reform Commission, and the National Energy Administration. Following the release of a national plan in March aimed at promoting the development of the hydrogen energy industry, local governments have made policies to strategize corresponding deployments.

- 3Q22 earnings review. Operating income grew by 18.4% YoY to RMB12.3bn. Net profit attributable to shareholders of the company jumped by 40.2% YoY to RMB725.9mn. In 9M22, the company manufactured power generation equipment with a capacity of 25,631.8MW, including hydro-electric turbine generating units (2,695.0MW), steam turbine generators (19,831.0MW), wind power generating units (3,105.8MW), power station steam turbines (19,318.0MW) and power station boilers (17,044.0MW). In 9M22, the company’s new effective orders amounted to RMB53.822 billion, among which 32.45% was attributable to high-efficiency clean energy equipment, 27.67% to renewable energy equipment, 12.98% to engineering and trade, 13.10% to modern manufacturing service business, and 13.81% to an emerging growth industry.

- The updated market consensus of the EPS growth in FY22/23 is 17.3%/29.4% YoY respectively, which translates to 14.0x/10.8x forward PE. The current PER is 12.8x. Bloomberg consensus average 12-month target price is HK$13.05.

(Source: Bloomberg)

Samsonite International S.A. (1910 HK): China to gradually reopen

Samsonite International S.A. (1910 HK): China to gradually reopen

- RE-ITERATE Buy Entry – 18.3 Target – 20.3 Stop Loss – 17.3

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- China easing air travel. China is working on plans to scrap a system that penalises airlines for bringing virus cases into the country, a sign authorities are looking for ways to ease the impact of the Covid Zero policy. The State Council, which oversees China’s bureaucracy, recently asked government agencies including the civil aviation regulator to prepare for ending the so-called circuit-breaker mechanism. The system sees airlines banned temporarily from specific routes into China for one-to-two weeks, depending on how many Covid-positive passengers they bring into the country.

- Global tourism to continue to recover in 2023. According to the Economist Intelligence Unit Tourism in 2023 report, the global tourism arrivals will increase by 30% YoY in 2023, following growth of 60% YoY in 2022, but will remain below pre-COVID levels. Meanwhile, EIU also expects international arrivals to recover back to 2019 levels in 2024.

- 1H22 results review. Net sales jumped by 58.9% (+66.9% constant currency) YoY to US$1,270.2mn. Operating profit arrived at US$159.9mn compared to a loss of US$86.4mn during the same period last year. Profit attributable to the equity shareholders arrived at US$56.3mn in 1H22 compared to a loss of US$142.5mn in 1H21. The turnaround of the business and financials was due mainly to the continued easing of COVID restrictions and the ensuing recovery of both domestic and overseas travel. North America, Latin America, and Europe saw a strong recovery. But the slowdown in China dragged the accelerated recovery in Asia.

- The updated market consensus of the EPS growth in FY22/23/24 is 1,222.2%/42.0%/20.2% YoY respectively, translating to 17.4×/12.2x/10.2x forward PE. The current PER is 15.5x. Bloomberg consensus average 12-month target price is HK$25.17.

United States

Top Sector Gainers

Sector | Loss | Related News |

| +11.34% | Dow pops 1,200 points, S&P 500 jumps 5% in biggest rally in two years after light inflation report |

Investment Managers | +10.65% | Wall St ends sharply higher as cooling inflation fuels hope of easing Fed |

Semiconductors | +10.31% | Shock Rally Sweeps Markets in Rebuke to Overconfident Bears |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Alcoholic Drinks & Tobacco | +3.42% | FIFA World Cup: Budweiser predicts record beer sales in Qatar Budweiser Brewing Co APAC Ltd (1876 HK) |

Telcomm Services | +0.40% | Tencent, China Unicom launch 5G time-critical remote control with Ericsson China Mobile Ltd (941 HK) |

Top Sector Losers

Sector | Loss | Related News |

Automobiles & Components | -3.08% | HK Autos Broadly Plummet as Tesla Further Slumps Over 7% to Hit 2-yr Low; Nio, Xpeng Crater 11% BYD Co Ltd (1211 HK) |

Gas Supply | -2.06% | China’s 2022 gas demand growth may be the lowest on record, says PetroChina executive Hong Kong & China Gas Co Ltd (3 HK) |

Environmental Energy Material | -1.98% | Coal Is Casting A Shadow Over China’s Remarkable Renewable Achievements Xinyi Solar Holdings Ltd (968 HK) |

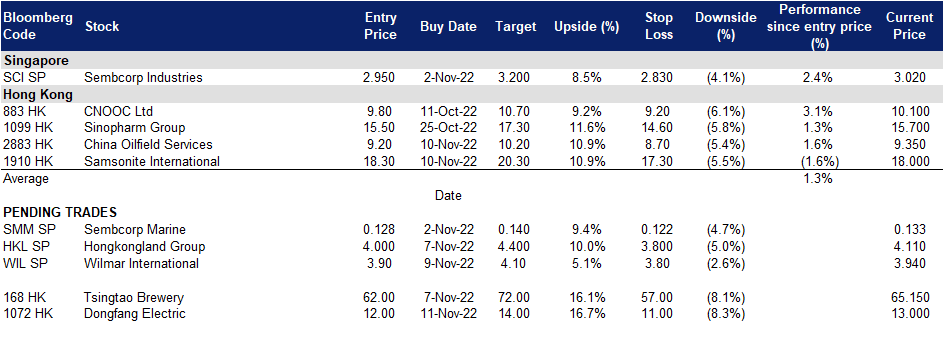

Trading Dashboard Update: Add China Oilfield Services (2883 HK) at HK$9.2 and Samsonite International (1910 HK) at HK$18.3.