11 April 2022: Yangzijiang Shipbuilding (YZJSGD SP), Metallurgical Corporation of China Ltd. (1618 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

Yangzijiang Shipbuilding (YZJSGD SP): Enhancing shareholder value

- BUY Entry – 1.58 Target – 1.70 Stop Loss – 1.52

- China’s largest private shipbuilder. Yangzijiang is China’s largest private shipbuilder. The company builds a broad range of commercial vessels including containerships, bulk carriers and LNG vessels. Yangzijiang has been at the forefront of shipbuilding in China.

- Spin-off of investment business. The group will spin off its investment business into a separate entity, Yangzijiang Financial Holdings (YZJFH), and will list it on the Mainboard of the Singapore Exchange. YZJFH will place a strong focus on expansion into fund and wealth management, and diversify into fast-growing sectors and new asset classes including private debt and mezzanine financing. YZJFH will set up its headquarters in Singapore, with the aim of becoming a leading investment manager in Asia.

- A record year for orderbook. In 2021, the group secured record order wins for 124 vessels with a total contract value of US$7.41 billion. The group has focused on building containerships and clean energy vessels which typically demand higher margins given their higher value-add over dry bulkers and tankers. As at the end of 2021, Yangzijiang had an orderbook of US$8.5bn for 157 vessels, with containerships accounting for >US$7bn or 83% of total existing contract value.

- Positive consensus estimates. There are 7 BUYS and 2 HOLDs, with a 12m average TP of S$1.81, or an implied 13% total return from the last close price. Yangzijiang trades at an attractive 7.8x and 6.5x FY2022F and FY2023F P/E, and offers a dividend yield of around 3.0% per annum.

Yangzijiang Shipbuilding (YZJSGD SP) (Source: Bloomberg)

Capitaland Integrated Commercial Trust (CICT SP): A reopening play amidst an inflationary environment

- RE-ITERATE BUY Entry – 2.19 Target – 2.35 Stop Loss – 2.14

- CapitaLand Integrated Commercial Trust (CICT) is the first and largest real estate investment trust (REIT) listed on Singapore Exchange Securities Trading Limited (SGX-ST). CICT owns and invests in quality income-producing assets primarily used for commercial (including retail and/ or office) purposes, located predominantly in Singapore.

- A strong set of FY21 financials. CICT recorded gross revenue of S$1.3bn and distributable income of S$687.4mn in FY2021, an increase of 75.1% and 83% YoY respectively. DPU stood at 10.4 SG Cents in FY21, up 19.7% YoY from 8.69 SG Cents. As of 31 December 2021, CICT’s aggregate leverage was 37.2%, well below MAS’ regulatory limit of 45% to 50%. The average cost of debt was stable at 2.3% per annum.

- Reopening play. The Singapore government announced on 25 March 2022 that all vaccinated travellers can enter Singapore without quarantine from the first of April. Travellers will no longer be required to take only designated flights to enter Singapore quarantine-free, and will not have to take the antigen rapid test (ART) within 24 hours of arrival. This latest round of easing will make travelling as seamless as it was before the pandemic. Out of CICT’s Retail REIT portfolio, Clarke Quay’s occupancy was the lowest at 73.5% as of 31 December 2021. The recent easing of regulations which includes alcohol after 1030pm and the upcoming reopening of all nightlife activities, such as clubs and discos starting 19 April is expected to boost the laggard retail mall. As for CICT’s Office REIT portfolio, the occupancy rate is currently at 91.5% and further upside is driven by the relaxation to 75% of workers being able to return to office, compared to 50% previously.

- Inflationary hedge. Out of CICT’s total borrowings of S$8.6bn as of 31 December 2021, 83% are on fixed interest rates, which is able to shield the impact of upcoming interest rate hikes. In addition, because rents and property value tend to increase amidst the increase in overall prices, the REITs whose properties are able to capitalise on that can provide an inflation hedge.

- Recent acquisitions. On Friday (Mar 25), CICT and CapitaLand Open End Real Estate Fund (Coref) announced that they had entered into an agreement to acquire 79 Robinson Road with a respective 70% and 30% ownership.

- Positive consensus estimates. Currently, CICT has a consensus rating of 17 BUYS, 3 HOLDS and 0 SELL, and a 12M TP of S$2.44.The FY22F/23F dividend yield is 5.1%/5.3%.

Capitaland Integrated Commercial Trust (CICT SP) (Source: Bloomberg)

HONG KONG

Metallurgical Corporation of China Ltd. (1618 HK): Infrastruct expansion to boost the economy

- BUY Entry 2.15 – Target – 2.50 Stop Loss – 2.00

- Metallurgical Corporation of China Ltd. is a China-based company principally engaged in the engineering construction related businesses. The Company’s businesses mainly include the engineering contracting, real estate development, resources development and equipment manufacturing. The Company’s engineering contracting businesses mainly include the metallurgical engineering, municipal engineering, transportation facilities and urban infrastructure construction, among others. Its real estate development businesses mainly include the development and construction of commercial and residential real estates. Its resource development businesses mainly include the mining and processing of iron, copper, nickel, lead and zinc, among others. Its equipment manufacturing businesses mainly include the manufacturing of metallurgical equipments and steel structures.

- Infrastructure expansion to bail out the weak economy. China’s Caixin general manufacturing PMI dropped to a 25-month low of 48.1 in March, and the Caixin general services PMI also plunged to a 25-month low of 42.0. The surge in covid cases and ensuing lockdowns of cities resulted in the economic contraction. Meanwhile, domestic consumption hardly recovers in the near term given the weak consumer confidence. The growth of international trade is expected to slow down as well, as Southeast Aisa countries gradually reopen, regaining some market shares of low-end manufacturing from China. Therefore, to revive the growth in the economy in the near term, the authority will probably resort to the old measure, infrastructure expansion. According to Bloomberg, the central government requested local government to draw up lists of projects. The planned investment in 2022 is expected to amount to at least RMB14.8tn.

- FY21 annual results review. Operating revenue grew by 25.1% YoY to RMB500.6bn. Net profit attributable to shareholders of the company grew by 6.5% YoY to RMB8.4bn. The value of newly signed contracts reached another record high of RMB1.2tn, up 18.2% YoY.

- The updated market consensus of the EPS growth in FY22/23 is 32.9%/10.8% YoY, respectively, translating to 3.8×/3.5x forward PE. The current PER is 4.9x. FY22F/23F dividend yield is 5.3%/5.6%. Bloomberg consensus average 12-month target price is HK$2.94.

Metallurgical Corporation of China Ltd. (1618 HK) (Source: Bloomberg)

Ping An Insurance (Group) Company of China, Ltd. (2318 HK): Expecting loosening policies soon

- RE-ITERATE BUY Entry – 57.0 Target – 63.5 Stop Loss – 54.0

- Ping An Insurance (Group) Company of China, Ltd. is a personal financial services provider. The Company provides insurance, banking, investment, and Internet finance products and services. The Company operates its businesses through four segments. The Insurance segment provides life insurance and property insurance, including term, whole-life, endowment, annuity, automobile and health insurance. The Banking segment is engaged in loan and intermediary businesses with corporate customers and retail business. The Assets management segment is engaged in security, trust and other assets management businesses, including investment, brokerage, trading and asset management services. The Internet Financing segment is engaged in the provision of Internet finance products and services.

- Expecting monetary and fiscal stimulus soon. China’s Caixin general manufacturing PMI dropped to a 25-month low of 48.1 in March, and the Caixin general services PMI also plunged to a 25-month low of 42.0. This was due mainly to the surge in widespread COVID infections and multiple cities lockdowns. Hence, 1Q22 GDP growth could be negative. The implication is that China’s government will probably further lower key rates and propose a fiscal stimulus plan to avoid a recession in 2Q22. The real estate market is the pillar to uphold the economy. Some local governments have started to overturn the old restrictive rules to revive property sales. In the near term, we could see further relief in the domestic housing market.

- A Proxy of a property developer fund. Given Ping An’s large exposures to property developers, including equities and bonds, its share price performance closely relates to the HK-listed property developer sector price movements. Currently, the sentiment toward the sector started to turn positive.

- The updated market consensus of the EPS growth in FY22/23 is 27.9%/15.2% YoY respectively, which translates to 6.3x/5.5x forward PE. The current PER is 8.1x. .The FY22F/23F dividend yield is 5.3%/5.8%. Bloomberg consensus average 12-month target price is HK$77.87.

Ping An Insurance (Group) Company of China, Ltd. (2318 HK) (Source: Bloomberg)

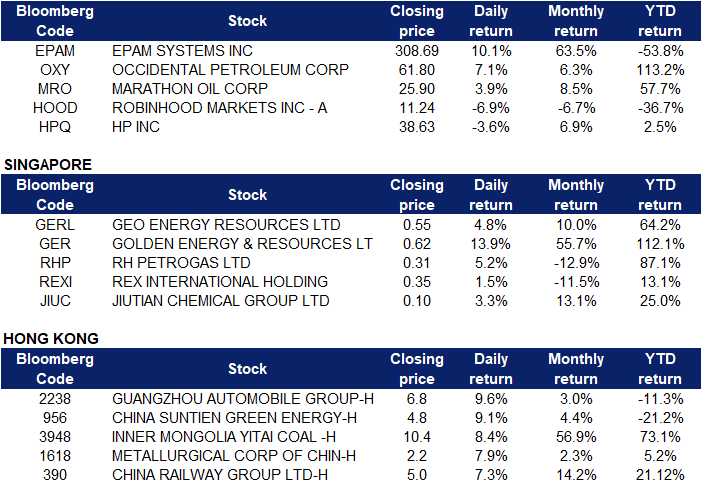

MARKET MOVERS

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oilfield Services / Equipment | +4.3% | Nigeria Says OPEC Is Out of Spare Capacity Halliburton (HAL US) |

| Oil & Gas Production | +3.8% | Crude oil futures mostly steady, outlook remains bullish EOG Resources (EOG US) |

| Precious Metals | +2.3% | Gold Price Technical Outlook: Can’t Stay Stagnant Forever, Move Coming Barrick Gold (GOLD US) |

Top Sector Losers

| Sector | Loss | Related News |

| Semiconductors | -2.6% | Nvidia, AMD lead chip decline as Truist finds ‘hard evidence of order cuts’ Nvidia (NVDA US) |

| Motor Vehicles | -2.3% | China’s EV maker Nio suspends production due to halted supply chain Tesla (TSLA US) |

| Internet Retail | -1.7% | Chinese Tech Stocks Fall as Tencent Shuts Game Streaming Site JD.com (JD US) |

- EPAM Systems (EPAM US) shares surged 10.1% on Friday after EPAM Systems said it would terminate its operations in Russia. Stifel analysts said in a late Thursday note that they interpreted the decision as “positive as it removes the most visible overhang.”

- Occidental Petroleum Corp (OXY US) and Marathon Oil Corp (MRO US) shares rose 7.1% and 3.9% respectively on Friday. WTI crude futures steadied around $96 per barrel on Friday and headed for their second straight weekly decline, amid plans for a massive reserve release and demand concerns in top importer China. However, investors are also closely monitoring sanctions against Russian energy after the EU banned coal imports from Russia while preparing an embargo on oil, gas, and nuclear fuel.

- Robinhood (HOOD US) shares lost 6.9% on Friday after Goldman Sachs downgraded the stock to sell from neutral. The Wall Street firm cited softening retail engagement levels, continued weakness in account growth and a limited path to near-term profitability for its updated outlook.

- HP (HPQ US) shares declined 3.6% on Friday after UBS downgraded the stock to neutral from buy. UBS believes high valuations and weak consumer sentiment will limit upside for HP. The call comes after Warren Buffett’s Berkshire Hathaway purchased a major stake in the company this week.

Singapore

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) shares rose 13.9% and 4.8% respectively on Friday. Coal prices in Asia jumped as Europe’s move to ban Russian imports of the fuel threatened to deliver a new global supply challenge. Rising electricity demand and a lack of new coal supply should keep prices elevated, said David Lennox, a resources analyst at Fat Prophets in Sydney.

- RH Petrogas Ltd (RHP SP) and Rex International Holding Ltd (REXI SP) shares rose 5.2% and 1.5% respectively yesterday. WTI crude futures steadied around $96 per barrel on Friday and headed for their second straight weekly decline, amid plans for a massive reserve release and demand concerns in top importer China. The US benchmark is down about 3% so far this week, losing the bulk of the gains seen since Russia’s invasion of Ukraine started in late February. IEA member states agreed this week to tap 60 million barrels of oil from strategic reserves, on top of a 180 million barrel release announced by the US last week, aimed at cooling energy prices. Investors are also closely monitoring sanctions against Russian energy after the EU banned coal imports from Russia while preparing an embargo on oil, gas, and nuclear fuel.

- Jiutian Chemical (JIUC SP) shares rose 3.3% on Friday. In an April 5 note, Ho is maintaining “buy” on Jiutian with a raised target price of 16.8 cents, up from 13.8 cents previously. High average selling prices (ASPs), slower rise in raw material costs make for a widening of gross profitability for Jiutian Chemical Group, says UOB Kay Hian Research analyst Clement Ho. Product ASPs will continue to trend upwards in 1Q2022, says Ho. “The average price for DMF recorded a 74.5% y-o-y spike in 2M2022 to RMB16,350 ($3,485.43)/tonne. This compares with our initial estimate of RMB10,500/tonne in 2022 for Jiutian.”

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Precious Metal | 2.96% | Russia’s central bank says it will stop buying gold at a fixed price Shandong Gold Mining Co Ltd (1787 HK) |

| Agricultural, Poultry & Fishing Production | 1.86% | Shanghai vows to improve food deliveries as discontent grows over COVID curbs WH Group Ltd (288 HK) |

| Electricity Supply | 1.50% | China’s Wind Turbine Prices Have Hit Bottom, Goldwind Says Xinjiang Goldwind Science & Tech Co Ltd (2208HK) |

Top Sector Losers

| Sector | Loss | Related News |

| Electronic Component | -2.00% | China’s smartphone market could plunge 20% as Covid cases spike — but Apple may see growth Aac Technologies Holdings Inc (2018 HK) |

| Software | -0.73% | China uses AI software to improve its surveillance capabilities Kingsoft Corporation Limited (3888 HK) |

| Semiconductors | -0.58% | Chinese telecoms giant Huawei pushes semiconductor packaging innovation to ease disruptions caused by US chip sanctions Shanghai Fudan Microelectronics Company (1385 HK) |

- Guangzhou Automobile Group Co Ltd (2238 HK) shares rose 9.6% on Friday. GAC Group recently announced that the cumulative output since the beginning of this year was 598,100 units, a year-on-year increase of 24.96%. Cumulative sales since the beginning of this year was 608,200, a year-on-year increase of 22.48%. At present, the auto industry is still facing headwinds such as the chip shortages, the sharp fluctuation of raw material prices and the decline of subsidies for new energy vehicles. However, Zeng Qinghong, chairman of GAC Group said that the Group is still confident to challenge the goal of 15% increase in annual vehicle production and sales.

- China Suntien Green Energy Corp Ltd (956 HK) shares rose 9.1% on Friday. Shenwan Hongyuan released a research report saying that it gave Xintian Green Energy a “buy” rating, and net profit in 2022-24 is expected to be 23.01/29.94/3.618 billion yuan, corresponding to the current share price PE of 7x /5x/4x. The bank is also optimistic about the development of two clean energy businesses, natural gas and new energy power generation.

- Inner Mongolia Yitai Coal Company Ltd (3948 HK) shares rose 8.4% on Friday. Coal prices in Asia jumped as Europe’s move to ban Russian imports of the fuel threatened to deliver a new global supply challenge. Rising electricity demand and a lack of new coal supply should keep prices elevated, said David Lennox, a resources analyst at Fat Prophets in Sydney.

- Metallurgical Corporation of China Ltd (1618 HK) and China Railway Group Ltd (390 HK) shares rose 7.9% and 7.3% respectively on Friday. At Beijing’s behest, local governments have drawn up lists of thousands of “major projects,” which they’re being put under intense pressure to see through. Planned investment this year amounts to at least 14.8 trillion yuan ($2.3 trillion), according to a Bloomberg analysis. That’s more than double the new spending in the infrastructure package the U.S. Congress approved last year, which totals $1.1 trillion spread over five years.

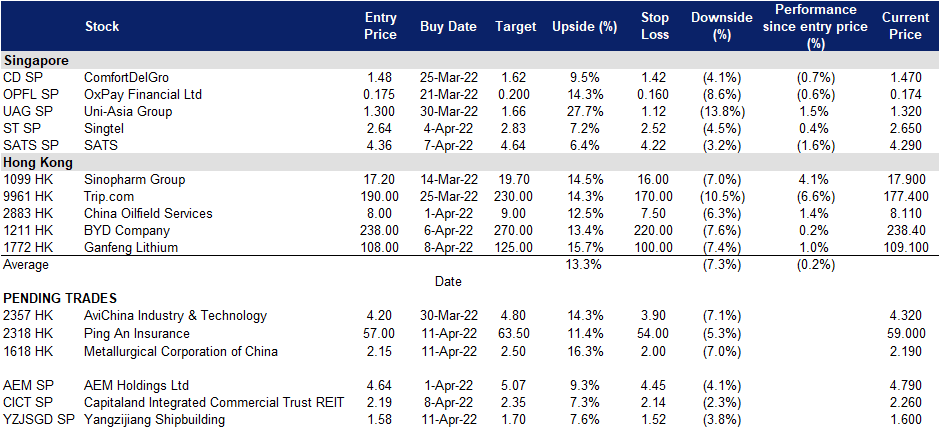

Trading Dashboard

Trading Dashboard Update: No additions or deletions to trading dashboard.