10 October 2022: Keppel Corp Ltd (KEP SP), CNOOC Limited (883 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Keppel Corp Ltd (KEP SP): Expansion amidst a market downturn

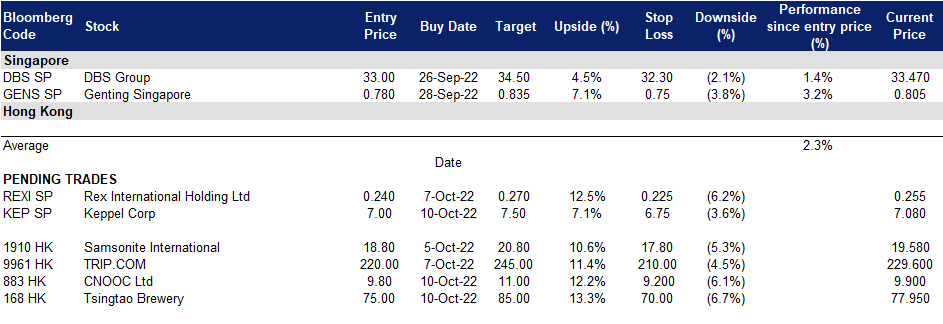

- Entry – 7.00 Target – 7.50 Stop Loss – 6.75

- Keppel Corporation is a Singaporean conglomerate headquartered in Keppel Bay Tower, HarbourFront. The company consists of several affiliated businesses that specialises in offshore & marine, property, infrastructure and asset management businesses.

- Delivery in 4Q22. Keppel Shipyard won the third contract from a fully-owned subsidiary of Royal Boskalis Westminster NV for the overhaul and jumboisation of two trailing suction hopper dredgers (TSHD). The second TSHD has been scheduled to be delivered to the shipyard in 4Q22.

- New FPSO contract. Keppel Offshore & Marine won a US$2.8 billion ($4.0 billion) newbuild floating production storage and offloading (FPSO) contract from Petrobras for the deployment at the Buzios field offshore Brazil. The new order, P-83 is scheduled for delivery in 1H27 and is a repeat order from the previous P-80 secured in August 2022.

- KIT portfolio expansion. Keppel Infrastructure Trust (KIT) has expanded its portfolio in Europe – co-investing €160 million (S$226 million) in the European onshore wind energy portfolio, and ventured into Saudi Arabia – invested US$250 million (S$336 million) to acquire stakes in Aramco Gas Pipelines Company, and South Korea – bought Eco Management Korea Holdings for 626.1 billion won (S$666.1 million) in cash. The company has plans to grow the trust’s portfolio to $18 billion within the next decade.

- Updated market consensus of the EPS growth in FY22/23 is -12.5%/7.8% YoY respectively, which translates to 14.4x/13.4x forward PE. Current PER is 11.1x. Bloomberg consensus average 12-month target price is S$8.79.

(Source: Bloomberg)

Rex International Holding Ltd (REXI SP): largest oil output cut since 2020

Rex International Holding Ltd (REXI SP): largest oil output cut since 2020

- RE-ITERATE Entry – 0.240 Target – 0.270 Stop Loss – 0.225

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Oil rebounded back to a three-week high. Oil prices gained after OPEC+ agreed to cut output by 2mn barrels/day from November. Brent went up 2.03% to US$93.6/bbl, and WTI went up 1.97% to US$88.06/bbl.

- Dollars pulled back and commodities rebounded. The US dollar index remains at below 112 after reaching a 20-year high of 115 last week. Commodities are inversely related to US dollars. The short-term correction of the dollar index provides relief rebound opportunities for global commodities.

- Ukraine War. Following the invasion of Ukraine, some countries have made the decision to stop buying Russian oil, imposed sanctions on Russia and G7 is planning to place a price cap on Russian oil purchases. Thus causing the price of oil sold by Russia to be significantly cheaper than oil from other sources, attracting more oil purchases from Asian countries such as India and China.

- Updated market consensus of the EPS growth in FY22/23 is -52.4%/368.4% YoY respectively, which translates to 9.0x/1.9x forward PE. Current PER is 4.6x. Bloomberg consensus average 12-month target price is S$0.47.

(Source: Bloomberg)

CNOOC Limited (883 HK): Recovery in oil prices

- Buy Entry – 9.7 Target – 10.7 Stop Loss – 9.2

- CNOOC Limited is a Hong Kong-based investment holding company principally engaged in the exploration, production and trading of oil and gas. Its businesses include conventional oil and gas businesses, shale oil and gas businesses, oil sands businesses and other unconventional oil and gas businesses. The company mainly operates businesses through three segments. The Exploration and Production segment is engaged in the exploration, development and production of crude oil, natural gas and other petroleum products. The Trading segment is engaged in the trading of crude oil, natural gas and other petroleum products. The company mainly operates businesses in China, Canada, the United Kingdom, Nigeria, Indonesia and Brazil, among others.

- Largest crude oil prices weekly gain since February. During the China golden week holiday, crude oil prices enjoyed the second largest weekly gain YTD as OPEC+ agreed to cut its production targets for November by 2mn bbls/d; Brent and WTI jumped 15.34% and 16.89% respectively on the first week of October.

- First batch of 2023 crude oil import quotas released. The volume issued is about 20mn tonnes, equivalent to 146mn bbls. Last month, Beijing issued a third batch of quotas for 2022 that raised its non-state import quotas to 164.61mn tonnes this year.

- 1H22 results review. Revenue jumped by 84% YoY to RMB202.4bn. Net profit attributable to equity shareholders of the company jumped by 116% YoY to RMB71.9bn. Management declared an interim dividend of HK$0.7.

- The updated market consensus of the EPS growth in FY22/23 is 83.6%/-8.9% YoY, respectively, translating to 3.2×/3.5x forward PE. The current PER is 3.7x. The expected dividend yield in FY22/23 is 15.5%/11.9%. Bloomberg consensus average 12-month target price is HK$14.72.

Tsingtao Brewery Company Limited (168 HK): A FIFA World Cup themed play

- RE-ITEREATE Buy Entry – 75 Target – 85 Stop Loss – 70

- Tsingtao Brewery Company Limited, together with its subsidiaries, engages in the production, distribution, wholesale, and retail sale of beer products worldwide. The company sells its beer products primarily under the Tsingtaoand and Laoshan brand names. It also provides wealth management, and agency collection and payment services; and financing, construction, and logistics services, as well as technology promotion and application services.

- FIFA World Cup Qatar 2022 in one month. The once in every four years FIFA World Cup is going to take place from November to December 2022. This is the global largest sports event after the Tokyo Olympic Games, and it is expected to attract a record high of spectators as most countries have eased COVID restrictions. Accordingly, it will stimulate sales of alcohol and other drinks. The beer feast will take place during the world cup period.

- 1H22 earnings review. Revenue grew by 5.4% YoY to RMB19.3bn. Gross profit dropped by 9.6% YoY to RMB7.3bn. GPM dropped by 6.3ppts to 38.1%. Net profit attributable to shareholders of the company grew by 18.1% YoY to RMB2.9bn. NPM increased by 1.3ppts to 14.8%. The growth of the bottom line was due mainly to the upgrade of the product mix and improvement of cost control.

- The updated market consensus of the EPS growth in FY22/23 is -9.0%/17.0% YoY, respectively, translating to 29.8×/25.5x forward PE. The current PER is 26.7x. Bloomberg consensus average 12-month target price is HK$90.18.

United States

Top Sector Losers

| Sector | Loss | Related News |

| Semiconductors | -5.81% | Chip stocks slide as Samsung, AMD expect steep fall in demand NVIDIA Corp (NVDA US) |

| Motor Vehicles | -4.69% | Tesla stock had its worst week since March 2020 during a ‘very intense 7 days’ for Elon Musk Tesla Inc (TSLA US) |

| Packaged Software | -4.48% | Why Microsoft Fell Today Microsoft Corp (MSFT US) |

- Ambac Financial Group Inc (AMBC US) shot up 15.6% on news of settlements with Bank of America that would bring Ambac $1.84 billion. The settlements come out of lawsuits related to the bond insurance policies Ambac used for Bank of America prior to the 2008 financial crisis. Bank of America was down about 2.4%.

- Levi Strauss & Co (LEVI US) dropped 11.7% to a 52-week low after cutting its full-year sales and profit outlook Thursday, as the clothing maker cited issues stemming from the supply chain and the stronger U.S. dollar.

- Advanced Micro Devices Inc (AMD US) plummeted 13.9% after the semiconductor company issued disappointing preliminary results for the third quarter and said it expects revenue to fall short of its previous $6.7 billion dollar forecast. AMD blamed the shortfall on weakening PC demand and supply chain constraints. Shares of other chip companies including Intel and Nvidia fell on the news.

- CVS Health Corp (CVS US) dropped 10.5% following a report that the health care giant is in “exclusive talks” to buy Cano Health. The company had already been falling after the Centres for Medicare and Medicaid Services downgraded one of its Aetna Medicare Advantage plans in its annual ratings. Shares of Cano gained 9%.

- Credit Suisse Group AG (CS US) was up 13.1% after offering to buy back $3 billion in debt securities Friday and sell a famous hotel it owns. It marks another day of tumult for shares of the stock — which hit an all-time low earlier in the week — as market observers questioned the bank’s health.

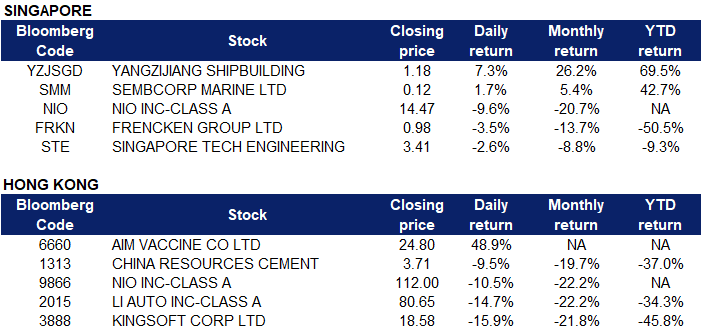

Singapore

- Yangzijiang Shipbuilding Holdings Ltd (YZJSGD SP) shares rose 7.3% on Friday. Yangzijiang Shipbuilding has secured new orders for another 22 vessels, raising its total order book value to date to a record high of US$10.27 billion (S$14.67 billion) and extending its top-line visibility to mid-2025.

- Sembcorp Marine Ltd (SMM SP) shares rose 1.7% on Friday. Sembcorp Marine recently announced that its wholly-owned subsidiary, Sembcorp Marine Rigs & Floaters, has been awarded a US$3.05 billion ($4.25 billion) contract for the P-82 Floating, Production, Storage and Offloading vessel through an international tender from Brazilian state-owned oil and gas producer, Petroleo Brasileiro S.A. (Petrobras).

- NIO Inc (NIO SP) shares slid 9.6%. NIO has been on a downward trajectory, with the counter sliding 9.6 per cent to US$14.47 on Friday. With its market value cut by S$9.2 billion in September, Nio would need to reinvigorate its shares for investors to stay the course.

- Frencken Group Ltd (FRKN SP) and Singapore Technologies Engineering Ltd (STE SP) shares fell 3.5% and 2.6% on Friday respectively. There was no company-specific news. Singapore shares finished lower, with the Straits Times Index (STI) falling 5.75 points or 0.2 per cent to 3,145.81. With the US non-farm payroll data out on Friday night (Singapore time), investors have been staying on the sidelines as the keenly watched economic numbers could have an impact on the Federal Reserve’s hawkish rate hike stance.

Hong Kong

Top Sector Gainers

|

Sector |

Gain |

Related News |

|

Textile & Apparels |

+0.34% |

CPC steers China toward prosperity ANTA Sports Products Ltd (2020 HK) |

|

Electronic Component |

+0.33% |

Biden tightens China chip rules on chaotic day for industry Sunny Optical Technology (Group) Co. Ltd (2382 HK) |

|

Telecomm. & Networking Equipment |

+0.23% |

Gulf states go digital with China ZTE Corporation (863 HK) |

Top Sector Losers

|

Sector |

Loss |

Related News |

|

Biotechnology |

-2.34% |

WuXi Biologics (Cayman) Inc (2269 HK) |

|

Construction Materials |

-2.23% |

Anhui Conch Cement Company Limited (914 HK) |

|

Software |

-2.12% |

Volkswagen plans over 1 bln euro investment in software JV in China – sources Kingsoft Corporation Limited (3888 HK) |

- AIM Vaccine Co Ltd (6660HK) Shares jumped 48.86% on the second day of its debut on HKEX, and its market cap arrived at HK$30bn.The company is the largest private vaccine enterprise which principally engages in the research and development, manufacturing and sales of vaccine. The Company’s vaccine candidates include messenger RNA (mRNA) corona virus disease 2019 (COVID-19) vaccine, inactivated COVID-19 vaccine, broad-spectrum COVID-19 vaccine, PCV13, PPSV23 and MCV4. In terms of 2021 approved lot release volume(excluding COVID-19 vaccines), AIM accounted for a 7.4% market share in the PRC. In terms of 2021 sales revenue (excluding COVID-19 vaccines), AIM accounted for a 2.1% market share in the PRC.

- China Resources Cement Holdings Limited (1313 HK) Share fell 9.51% last Friday after the company announced a profit warning for its 9M22 earnings. The company expected its profit attributable the owners to significantly decrease YoY due mainly to the increase in unit costs of sales of cement products and lower sales volume.

- NIO Inc (9866 HK) Shares plummeted 10.47% last Friday. There was no company-specific news. Li Auto Inc (2015K) Shares plummeted 14.75% last Friday. Its 3Q22 EV deliveries grew by 5.6% YoY to 26,524 units, slightly above the latest guidance of 25,500 units but below the previous guidance range of 27,000-29,000 units. EV sector plunged as UST yields and Dollar index rose again.

- Kingsoft Corporation Limited (3888 HK) Share plummeted 15.93% last Friday after the company announced that it planned to make an impairment provision for the investment in Kingsoft Cloud with a range between c.RMB5.6bn to RMB6.5bn, beore tax, and c.RMB5.0bn to RMB5.9bn, net of tax.

Trading Dashboard Update: No stock additions/deletions.

(Source: Bloomberg)

(Source: Bloomberg)