2022年1月10日: 大华银行 (UOB SP), 中国铝业 (2600 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

SINGAPORE

大华银行 (UOB SP):休斯顿,我们起飞了!

- 买入:买入价:27.90,目标价:30.00,止损价:27.00

- 以总资产计,大华银行是新加坡第三大银行。截至2020年底,该公司总资产为4,310亿新元,净利润为29.2亿新元。该银行在19个国家拥有500多家办事处,提供一系列商业和个人银行产品和服务。

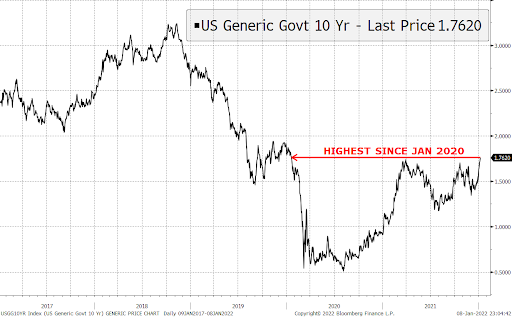

- 利率起飞。在上周美国失业率有所改善后,市场正越来越多地消化美国将在3月份加息的预期。美国10年期国债收益率上周升至1.80%的高点,达到疫情前的水平。此外,接受彭博社 (Bloomberg) 调查的经济学家现在预测美联储甚至可能在今年下半年开始收缩资产负债表。

- 积极的市场预期。大华银行目前的股价为1.1倍的2021财年市盈率,预计2021-23财年股息收益率为4.2% – 5.2%。在未来三年内,每股收益预计将以平均每年21%的速度增长。整个市场对该股的评价是看涨的,评级中有18个买入评级和2个持有评级,没有卖出评级。12个月平均目标价为31.46新元,这意味着该股较上个收盘价有11%的上升空间。我们预计,将于2月第一周公布的第四季度业绩将是积极的,这将导致银行股整体评级上升。

益资源 (FR SP):棕榈油价格再次接近历史高点

- 重申买入:买入价:1.60,目标价:1.80,止损价:1.55

- 公司成立于1992年,2007年在新加坡交易所上市,是该地区领先的棕榈油生产商之一,管理着印尼廖内省、东加里曼丹省和西加里曼丹省超过20万公顷的油棕种植园。集团的核心业务活动包括种植油棕榈,收割,并将其磨成粗棕榈油 (CPO) 和棕榈仁 (PK)。此外,该集团通过其炼油厂、分馏厂、生物柴油和果仁粉碎厂,将其CPO和PK产品加工成更高价值的棕榈基产品,如生物柴油、精制、漂白和脱臭 (RBD) 油酸和RBD硬脂酸、棕榈仁油和棕榈粕。

- 棕榈油价格回到历史高点。新年来临之际,棕榈油期货价格飙升至接近历史高点,原因是人们担心马来西亚7个州的大雨可能会减缓棕榈油生产。南半岛棕榈油生产商协会(Southern peninsula Palm Oil Millers Association)表示,预计马来西亚半岛地区12月份棕榈油产量将环比下降8.5%。

- 2021年第四季度的业绩是关键的催化剂。鉴于棕榈油价格走强,且该公司缺乏对冲措施,我们认为第四季度业绩可能会令人意外地上升。该公司计划于2022年2月25日公布全年业绩。

- 有超过市场共识的股价表现空间。在过去一年里股价上涨了20%之后,分析师们变得更加谨慎。截至2022年1月6日,评级中仍有5个买入,4个持有,但略低于去年同期的7个买入。然而,在市场普遍持谨慎态度的背景下,我们认为该公司在公布全年业绩时还有更大的表现空间。

棕榈油期货

HONG KONG

中国铝业 (2600 HK): 股票价格滞后于期货价格

- 买入:买入价:4.25,目标价:5.00,止损价:3.95

- 中国铝业股份有限公司是一家主要从事氧化铝、原铝和铝合金产品的生产和销售业务的中国公司。该公司通过五个部门开展业务。氧化铝部门从事氧化铝、精细氧化铝及铝矿石的生产和销售业务。原铝部门从事原铝、碳素产品、铝合金及其他电解铝产品的生产和销售业务。能源部门主要从事煤炭开采、火力发电、风力发电、光伏发电及新能源装备制造等。贸易部门主要提供氧化铝、原铝、铝加工产品及其他有色金属产品和煤炭等原材料、辅材贸易及物流服务。总部及其他营运部门从事其他有关铝业务的研究开发及其他活动。

- 铝期货价格跃升至两个月高点。LME铝期货在2022年第一周收于2904.25美元/吨,上涨了3.5%,是自2021年10月25日以来的最高水平。一方面,中国在年初开始季节性地建立库存;另一方面,印尼突然颁布了煤炭出口禁令,这引发了人们对亚洲地区铝生产的担忧,因为电力供应可能会受到影响。与此同时,天然气价格上涨导致欧洲电力价格上涨,推动铝期货价格上涨。

- 货币政策:中国放松而美国收紧。第一大和第二大经济体在货币政策方面不同步是不寻常的。中国央行已经降低了存款准备金率 (RRR) 和贷款市场报价利率 (LPR),而美国正在讨论更早的缩表日期,并将要进入加息周期。对大宗商品而言,这将是一个好坏参半的信号。然而,由于奥密克戎感染病例的激增,供应链问题仍然存在。因此,硬商品价格在短期内将保持平稳。

- 市场对22/23财年每股收益增长的最新共识分别为18.1%/13.4%,对应8.7倍/8.7倍的远期市盈率。当前市盈率为11.3倍。彭博社 (Bloomberg) 的12个月平均目标价为6.47港元。

LME铝期货价格走势

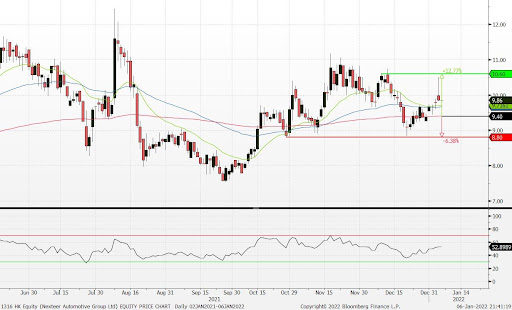

耐世特 (1316 HK):类似福特和通用汽车的交易走势

- 重申买入:买入价:9.4,目标价:10.6,止损价:8.8

- 耐世特汽车集团有限公司是一家投资控股公司。该公司通过其子公司主要为汽车制造商和其他汽车相关公司设计和制造转向和传动系统、高级驾驶辅助系统(ADAS)和自动驾驶(AD)及零部件。该公司的业务遍及美国、墨西哥、波兰和中华人民共和国。该公司产品的主要市场是北美、欧洲、南美、中国和印度。该公司拥有约27个制造工厂、1个全球技术中心、2个以上区域技术中心、1个软件服务中心和约13个客户服务中心。该公司的子公司包括耐世特美国控股有限责任公司、罗德斯有限责任公司、Steering Solutions IP Holding Corporation、重庆耐世特转向系统有限公司、CNXMotion LLC和东风耐世特转向系统(武汉)有限公司。

- 福特汽车 (Ford Motor) 创下了20年来的新高。福特F150皮卡的电动版F150闪电的需求如此之大,以至于该公司不得不停止预订。这款皮卡的预订量已达到20万辆。公司首席执行官提到,他们将把闪电的全部产能提高到7万或8万台。另一家汽车巨头通用汽车 (GM US) 也计划在其家乡密歇根州投资超过30亿美元生产电动汽车。北美是耐世特的主要收入贡献,在过去5年里占全年总收入的60%以上。通用汽车和福特是耐世特的两个主要客户。通用汽车的电动皮卡,电动雪佛Silverado,使用耐世特的所有产品线产品,包括HO REPS、滚珠花键轴杆半轴及转向管柱。福特的F150闪电采用了公司的的REPS系统和10-FIT高可用性技术,以及动力转向管柱。

价格表现与福特和通用汽车相似

- 最新的市场共识是,22/23财年每股收益同比增长分别为52.2%/20.2%,即11.1/9.3倍远期市盈率。当前市盈率是16.0倍。彭博社 (Bloomberg) 的平均12个月目标价为12.64港元。

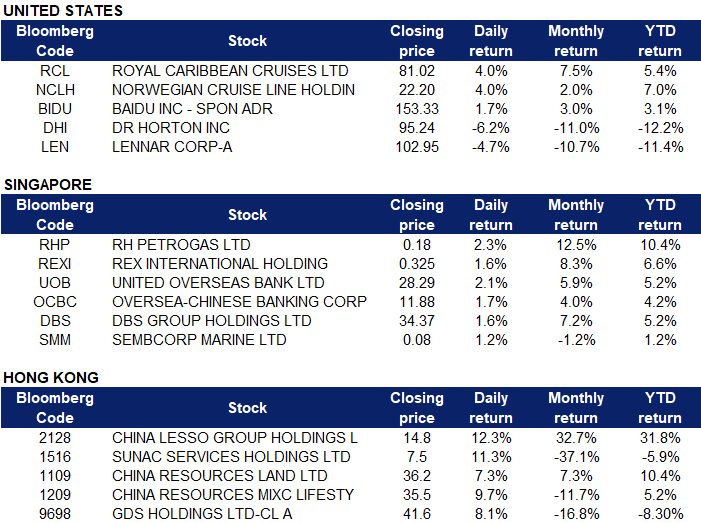

MARKET MOVERS

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oil & Gas Exploration and Production | +1.9% | Analyst Releases Latest Multi-Year Oil Price Forecast |

| Banks | +1.5% | 10-year yield rises after unemployment rate falls to 3.9%, continuing big increase to start 2022 |

| Insurance | +0.9% | NA |

Top Sector Losers

| Sector | Loss | Related News |

| Auto | -3.0% | Why Tesla, Rivian, and Lucid Stocks Are All Over the Map Today |

| Semiconductors | -3.0% | Profit From the Tech Sell-Off With These Inverse ETFs |

| Consumer Durables & Apparel | -2.9% | NA |

- Cruise stocks, Royal Caribbean Cruises Ltd (RCL US) and Norwegian Cruise Line Holdings Ltd (NCLH US) both gained 4% on Friday after Stifel analyst Steven Wieczynski declared 2022 was going to be the “Year of the Cruise!”. Given that cruises “massively underperformed” versus other reopening stocks last year, Wieczynski likes the setup for cruise stocks as top choices for investors playing the continued reopening in 2022. While he believes the ongoing omicron surge may cause some delays or noise around getting back to full speed, cruise lines should get back to somewhat normal operations through 2022 and eventually approach cash flow breakeven, he says. Specifically, Wieczynski named Royal Caribbean as his top pick for the year.

- Baidu Inc (BIDU US) extended its gains last Friday and shares rose 1.7%. The Chinese search engine and artificial intelligence firm said on Thursday that the electric vehicle being developed by its carmaking arm, Jidu Automotive, will have level 4 autonomous driving capability, which means these cars do not require human interaction in most circumstances. The as yet unnamed model will be unveiled at the Beijing car show in April. Analysts said that Baidu’s announcement was meant to signal to Chinese drivers that its vehicles will probably be the most advanced among all smart cars on the mainland next year.

- Homebuilding shares DR Horton Inc (DHI US) and Lennar Corp (LEN US) declined 6.2% and 4.2% on Friday, as the continued rise in Treasury yields and mortgage rates weighed heavily on the home-builders sector. The yield on the 10-year Treasury note, which is used to calculate mortgage rates, rose 4.0 basis points to a 2-year high of 1.773%. The fear is that higher rates could make homes less affordable.

Singapore

- RH Petrogas (RHP SP) and Rex International Holdings Ltd (REXI SP) shares gained 2.3% and 1.6% respectively yesterday, in tandem with rising Crude and Brent oil prices. WTI crude futures hovered near $80 per barrel on Friday while Brent crude futures held above $82 per barrel, both heading towards their third weekly advance, as the market tightened due to a civil unrest in Kazakhstan and supply outages in Libya. The supply disruptions came as OPEC+ kept its existing policy of modest monthly output increases, citing a mild and short-lived impact on fuel demand from the omicron variant. Meanwhile, US crude stockpiles fell lower than expected while gasoline and distillate inventories rose, raising concerns about fuel demand among investors.

- Bank stocks, United Overseas Bank Ltd (UOB SP), Oversea-Chinese Banking Corp Ltd (OCBC SP) and DBS Group Holdings Ltd (DBS SP) rose collectively on Friday, likely due to a spillover effect from the US, after the Fed’s FOMC meeting minutes were released last week. The Fed, now expected by traders to raise interest rates in March and begin reducing its asset holdings soon afterward, will provide the dollar with an edge over other major currencies. Financial markets are now pricing in at least three US rate hikes this year. Additionally on Thursday, UOB Kay Hian Research analyst Jonathan Koh, recommends OVERWEIGHT on the Singapore banking sector, citing that interest rates would be on an upcycle after quantitative easing (QE) tapering is completed by March 2022. Koh is recommending BUY on both DBS with a target price of S$40.28, and OCBC with a target price of S$16.12, with a 2023 dividend yield of 4.5% and 4.8% respectively.

- Sembcorp Marine Ltd (SMM SP) shares rose 1.2% on Friday, after the company announced that it has completed its first floating production unit newbuild – the Vito Regional Production Facility for Shell Offshore Inc. The successful delivery further demonstrates the Group’s Tuas Boulevard Yard value proposition as a one-stop production facility capable of fabricating, assembling and installing larger and heavier integrated structures which help fulfil business objectives of safety, quality, time and cost.

Hong Kong

Top Sector Gainers

| Sector | Gain | Related News |

| Petroleum & Gases Equipment & Services | +3.61% | Oil Tops $80 After OPEC+ Sticks To Plan To Ease Cuts |

| Insurance | +2.06% | China’s insurance industry sees premium income growth in Jan-Nov 2021 |

| Infrastructure | +2.01% | China plans its first ‘free data port’ in Guangzhou as Beijing eyes total control over cross-border information flows |

Top Sector Losers

| Sector | Loss | Related News |

| Electricity Supply | -2.55% | Japan asks Indonesia to revoke coal export ban as China, South Korea shrug off supply worries for now |

| Toys | -2.26% | LEGO to create additional capacity at Jiaxing factory in China |

| Environmental Energy Material | -1.92% | China’s ‘artificial sun’ sets world record in a bid for clean energy |

- China Lesso Group Holdings Ltd (2128 HK) shares gained 12.3% on Friday. Zhongtai Securities stated that leading pipe material companies are actively engaged in municipal administration and hydropower business, with expectations that approximately 20% of municipal business income will contribute to the revenue of these companies. In addition, the price of building materials and raw materials have fallen, expecting to ease cost pressure on enterprises. According to Bloomberg consensus estimates, China Lesso Group Holdings currently has a rating of 13 BUYS, 0 HOLD and 0 SELL, with a 12M target price of HK$23.93.

- Sunac Services Holdings Ltd (1516 HK), China Resources Land (1109 HK). Property sector shares rose collectively on Friday. Shares rose 11.3% and 7.3% respectively. China called on banks to boost real estate lending in the first quarter and eased a key debt restriction for developers, a sign that the authorities are becoming increasingly concerned about the industry’s liquidity crisis. At the same time, borrowing by major property firms used to fund mergers and acquisitions will no longer be counted towards the “three red lines” metrics that limit debt. Regulators are dialling back the intensity of a multi-year crackdown on the nation’s real estate sector as they try to engineer a soft landing after years of debt-fuelled expansion.

- China Resources Mixc Lifestyle Srvcs Ltd (1209 HK) shares rose 9.7% on Friday. The company previously announced that it plans to acquire Yuzhou Property for RMB1.06bn. Haitong Securities believes that the acquisition will broaden the company’s project layout in Fujian, Anhui, Zhejiang and other regions, thereby increasing the company’s competitiveness. Considering the company’s leading position in the industry coupled with strong shareholder background, Haitong Securities issued an OUTPERFORM rating on the company, with a reasonable range of HK$35.84-39.61 per share.

- GDS Holdings Ltd (9698 HK) shares rose 8.1% on Friday. The company recently announced its upcoming business plans which align with China’s carbon neutrality policy moving forward. Yi Bin, Vice President of GDS Technology and Chief Architect of Smart DC, said: “Focusing on the core business segments of green and low-carbon, agile delivery and intelligent operation, we have built the first Turbo, D-Pre and X-BP series of products. The first-generation Smart DC creates the ultimate experience for customers in using new technologies to build zero-carbon DC, prefabricated digital construction delivery, and full-stack intelligent management.”

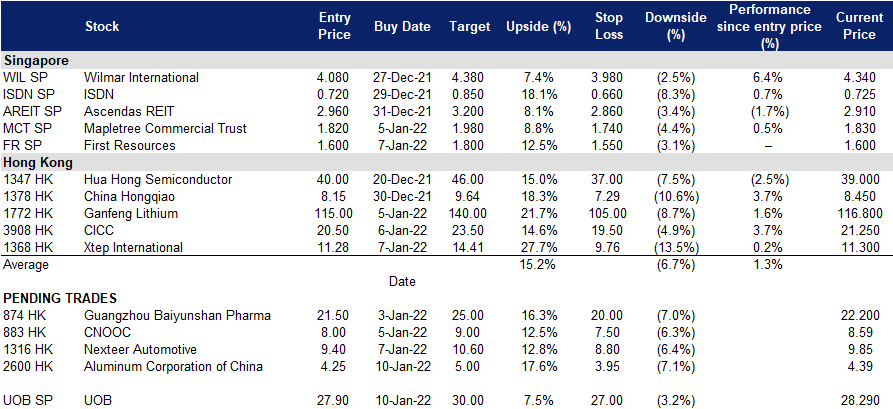

Trading Dashboard

Trading Dashboard Update: Add Xtep International (1368 HK) at HK$11.28. Cut iFast Corp (IFAST SP) at S$7.86.

(Click to enlarge image)