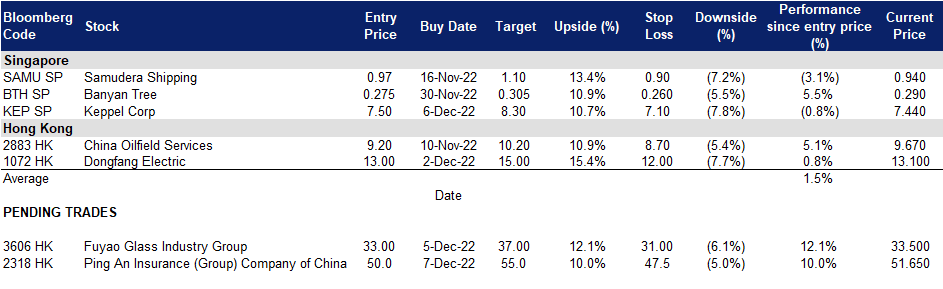

7 December 2022: Keppel Corp Ltd (KEP SP), Ping An Insurance (Group) Company of China, Ltd (2318 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Keppel Corp Ltd (KEP SP): Reviving infrastructure expansion in the post-COVID era

- RE-ITERATE Entry – 7.50 Target – 8.30 Stop Loss – 7.10

- Keppel Corporation is a Singaporean conglomerate headquartered in Keppel Bay Tower, HarbourFront. The company consists of several affiliated businesses that specialises in offshore & marine, property, infrastructure and asset management businesses. It is increasingly focused on transition energy and renewables, and is pivoting to renewables for a more sustainable future.

- Merger Votes. On 8 December, the group held its extraordinary general meeting to vote on the proposed merger of its offshore and marine (O&M) unit with Sembcorp Marine online.

- Keppel Infrastructure. The investing unit of Keppel Corp is investing about 30 million euros (S$42.6 million) to take a 49.9 percent stake in a new joint venture (JV) with Swiss-based energy company Met Group. The JV will be called Keppel MET Renewables. The company will pursue renewable energy projects across Western Europe. It targets to “scale up rapidly” to at least one gigawatt of operating and ready-to-build renewable energy projects. Additionally, Keppel New Energy, a subsidiary of Keppel Corporation’s infrastructure arm, will be collaborating with Pertamina Power Indonesia and Chevron New Energies International to explore the development of green hydrogen and green ammonia projects using renewable energy in Indonesia.

- New contract. Keppel Offshore & Marine, through its wholly-owned subsidiaries, has entered into new bareboat charter contracts with ADES Saudi Limited Company for two KFELS B Class jack-up rigs, Cantarell III and Cantarell IV. The new bareboat charters will be for a period of five years, expected to commence in the first half of 2023, and projected to generate total revenue of about $155 million for Keppel O&M, which includes modification works to prepare the rigs for deployment.

- Updated market consensus of the EPS growth in FY22/23 is -4.5%/-1.8% YoY respectively, which translates to 14.2x/15.2x forward PE. Current PER is 11.9x. Bloomberg consensus average 12-month target price is S$9.18.

Banyan Tree Holdings Ltd (BTH SP): Strong traveling demand

Banyan Tree Holdings Ltd (BTH SP): Strong traveling demand

- RE-ITERATE BUY Entry – 0.275 Target – 0.305 Stop Loss – 0.260

- Banyan Tree Holdings Ltd is a global hospitality group that has grown in its roots in Southeast Asia and is currently operating in 23 countries. The group’s headquarters is in Singapore, allowing it to have easy access to the majority of its properties located in Southeast Asia. BTH currently manages over 60 hotels and plans to continue expanding, with this number being forecasted to increase to 109 hotels in 2025. Among its holdings, Thailand and Maldives are the most prominent.

- Pent-up demand. As the pandemic measures begin to ease globally, we expect tourism rates to return to the pre-covid numbers or even higher. The global hotel industry continues to navigate challenges stemming from the pandemic as well as more recent headwinds from labour shortages, inflation, and geopolitical concerns. The hotel business has been recovering smoothly as more countries gradually open their borders for cross-border travel.

- Focus on wellness. With wellness being an important brand value for BTH since its inception, BTH differentiates itself from its competitors by focusing on well-being of its associates and guests. Last year, the company launched Wellbeing Sanctuaries, combining club floors or resort wings, dedicated dining options, spas, and multifunctional practice spaces into an exclusive journey. All the executive club floors have been converted into well-being sanctuaries.

- Expansion. Instead of conforming to the norm of expanding the ecosystem by going upscale, most of Banyan Tree’s new brands are in the mid-tier segments of the market. In response to the emerging markets of Asia exploding post-covid, BTH now is focusing on regional and midscale tourism; it unveils new concept hotels that will diversify its portfolio of guests, appealing more to current travellers, millennials. Most of the new moderately priced sub-brands will initially focus on Asia, taking advantage of the undersupply in the region.

- 1H22 results. Banyan Tree’s revenue more than doubled to S$119 million. Operating Profit achieved S$26 million vs previous loss of S$16 million.

- Technical TP of S$0.305; fundamental TP of S$0.400. While we have a technical TP of S$0.305 based on short-term technical factors, we initiated a coverage with a fundamentals-based TP of S$0.400. Our fundamental TP is based on 1.24x FY23F P/S as we expect FY22 earnings to improve due to the slow recovery and reopening of the industry. Read the full fundamentals-based report here.

(Source: Bloomberg)

Ping An Insurance (Group) Company of China, Ltd (2318 HK): Some relieves for property developers

- Buy Entry – 50.0 Target – 55.0 Stop Loss – 47.5

- Ping An Insurance (Group) Company of China, Ltd. is a personal financial services provider. The Company provides insurance, banking, investment, and Internet finance products and services. The Company operates its businesses through four segments. The Insurance segment provides life insurance and property insurance, including term, whole-life, endowment, annuity, automobile and health insurance. The Banking segment is engaged in loan and intermediary businesses with corporate customers and retail business. The Assets management segment is engaged in security, trust and other assets management businesses, including investment, brokerage, trading and asset management services. The Internet Financing segment is engaged in the provision of Internet finance products and services.

- Reopen gateways for developers to finance. On November 28th, China’s securities regulator lifted a ban on equity refinancing for listed firms, allowing eligible listed developers to issue shares to buy property-related assets, replenish working capital or repay debts. Meanwhile, the authority will promote developer financing through the listing of qualified projects via real estate investment trusts (Reits), and will encourage the setting up of property-focused private equity funds. The measures will give some room for developers to solve the near-term liquidity crunch and reduce defaults on borrowings.

- Another 25bps of RRR cut. Last week, The People’s Bank of China announced that it will cut the reserve requirement ratio for most banks by 25bps, effective on December 5th. There will be RMB500bn injected into the economy. This was the second time of RRR cut this year. The general year-end liquidity crunch is expected to be mitigated to some extent.

- 9M22 earnings review. Total revenue declined by 3.2% YoY to RMB952.7bn in 9M22. Operating profit attributable to shareholders of the parent company rose 3.8% YoY to RMB123.3bn. Profit attributable to the parent declined by 6.34% YoY to RMB76.5bn. Total premium income rose by 3.6% YoY to RMB587.5bn.

- The updated market consensus of the EPS growth in FY22/23/24 is -0.3%/29.5%/14.2% YoY respectively, translating to 7.5×/5.8x/5.1x forward PE. The current PER is 7.8x. Bloomberg consensus average 12-month target price is HK$64.79.

Fuyao Glass Industry Group Co Ltd (3606 HK): Benefiting from the booming EV trend

Fuyao Glass Industry Group Co Ltd (3606 HK): Benefiting from the booming EV trend

- RE-ITERATE Buy Entry – 33.0 Target –37.0 Stop Loss – 31.0

- Fuyao Glass Industry Group Co Ltd is a China-based company, principally engaged in the manufacture and distribution of float glasses and automobile glasses. The Company’s products portfolio consist of automobile glasses, such as coating glasses and others, which are applied in passenger cars, buses, limousines and others, and float glasses. The Company distributes its products within domestic markets and to overseas markets.

- High-value-added products are the growth driver. In 9M22, the high value-added products such as panoramic roof glass, windshield glass with a camera, head-up display glass, and soundproof glass accounted for 43.8% of the overall product mix. Accordingly, the overall ASP increased by 11.0% YoY during the period. Moving forward, the increasing demand for EVs will drive the growth of the utilization of smart glass and energy conservation glass.

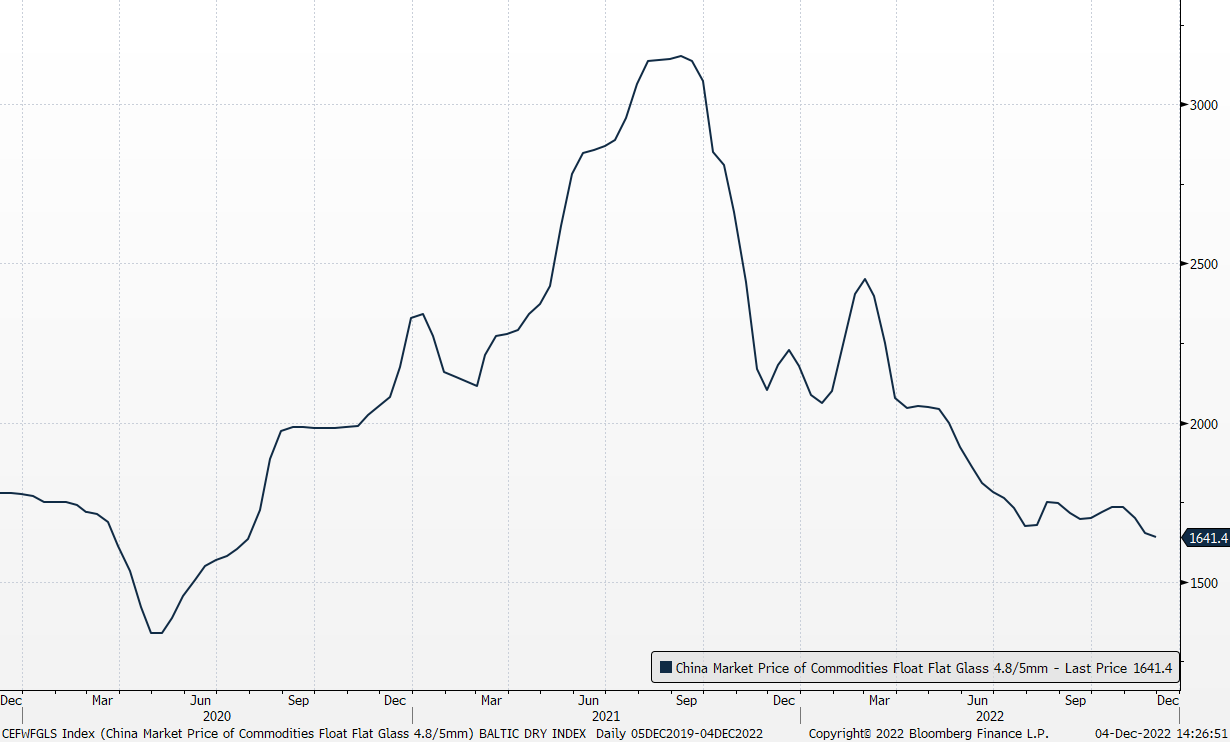

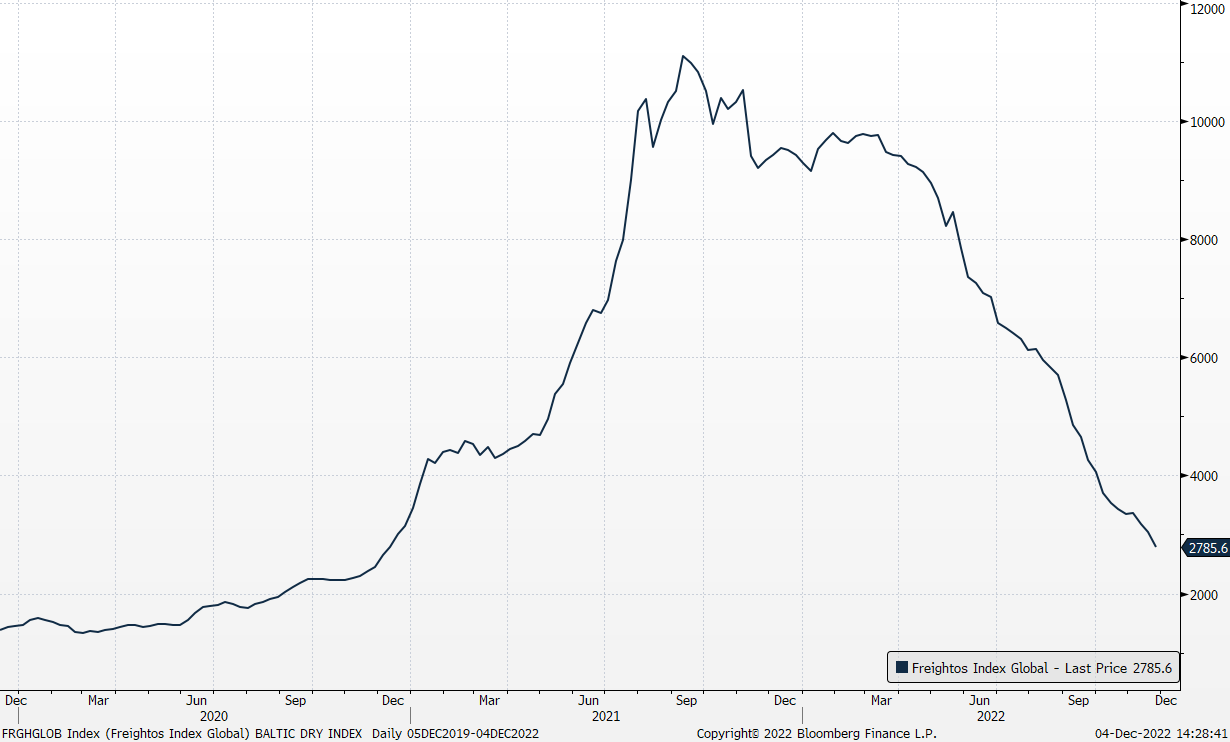

- Falling raw material and shipping costs. Float glass prices further dropped in November due to soft demand and excessive inventories. Meanwhile, global freight rates had been trending downward with the gradual normalization of the global supply chain. Both tailwinds will help margin improvement in the near term.

China Float Flat Glass 4.8/5mm price

(Source: Bloomberg)

(Source: Bloomberg)

Global Container Freight Index

(Source: Bloomberg)

(Source: Bloomberg)

- Record high quarterly performance. 3Q22 operating revenue jumped by 34.3% YoY to a historical high of RMB7.5bn. 9M22 operating revenue grew by 19.2% YoY to RMB20.4bn. 3Q22 gross profit jumped by 66.1% YoY to RMB2.6bn. 3Q22 GMP increased by 6.6ppts to 34.9%. Profit attributable to owners of the company jumped by 83.8% YoY to RMB1.5bn. NPM grew by 6.6ppts to 20.4%.

- The updated market consensus of the EPS growth in FY22/23 is 46.5%/10.0% YoY respectively, which translates to 17.0x/15.5x forward PE. The current PER is 21.3x. Bloomberg consensus average 12-month target price is HK$46.45.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Steel | +0.82% | US, EU weigh climate-based tariffs on Chinese steel, aluminium -Bloomberg News BHP Group Ltd (BHP US) |

| Managed Health Care | +0.65% | BlackRock Singles Out Health Care as Its ‘Largest Overweight’ Position UnitedHealth Group Inc (UNH US) |

| Major Telecommunications | +0.41% | Verizon Business Signs NaaS Partnership with Wipro Verizon Communications Inc (VZ US) |

Top Sector Losers

| Sector | Loss | Related News |

| Miscellaneous | -4.51% | S&P 500 closes lower for a fourth straight day as recession worries jolt markets Bluegreen Vacations Holding Corp (BVH US) |

| Movies/Entertainment | -3.19% | Will Disney’s Biggest Gamble Pay Off This Week? Walt Disney Co/The (DIS US) |

| Oil & Gas Production | -2.83% | Russia’s Jan-Nov oil output up 2% ahead of EU ban, price caps ConocoPhillips (COP US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Electronic Component | +4.28% | Foxconn expects Covid-hit China plant to resume full production around year-end, source says Sunny Optical Technology (Group) Co. Ltd (2382 HK) |

Gamble | +3.03% | China set to ease COVID curbs further as markets cheer change of tack Galaxy Entertainment Group Limited (0027 HK) |

Airline Services | +2.26% | Stock Market Pulls Back Further At Midday; Airline Stock Breaks Out Cathay Pacific Airways Ltd (293 HK) |

Top Sector Losers

Sector | Loss | Related News |

Software | -2.32% | Asia stocks slip as resurgent Fed fears offset China reopening hopes SenseTime Group Inc (0020 HK) |

Biotechnology | -2.11% | Hong Kong stocks snap rally as analysts warn of ‘zigzags’ in China economy, reopening exuberance WuXi Biologics (Cayman) Inc (2269 HK) |

Automobile Retailing, Maintenance & Repair | -1.83% | Volkswagen faces growing backlash in China over malfunctioning software in ID Series Zhongsheng Group Holdings Ltd (881 HK) |

Trading Dashboard Update: Add Keppel Corp (KEP SP) at S$7.5. Take profit on Genting Singapore (GENS SP) at S$0.90.

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)

(Source: Bloomberg)