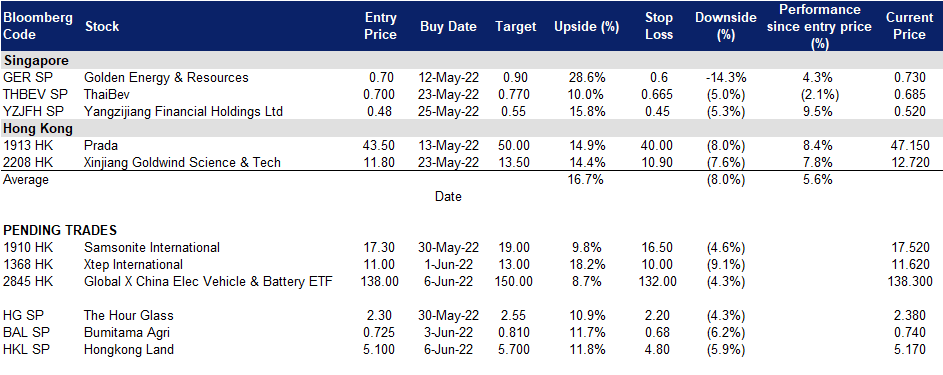

6 June 2022: Hongkong Land Holdings Limited (HKL SP), Global X China Elec Vehicle & Battery ETF (2845 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

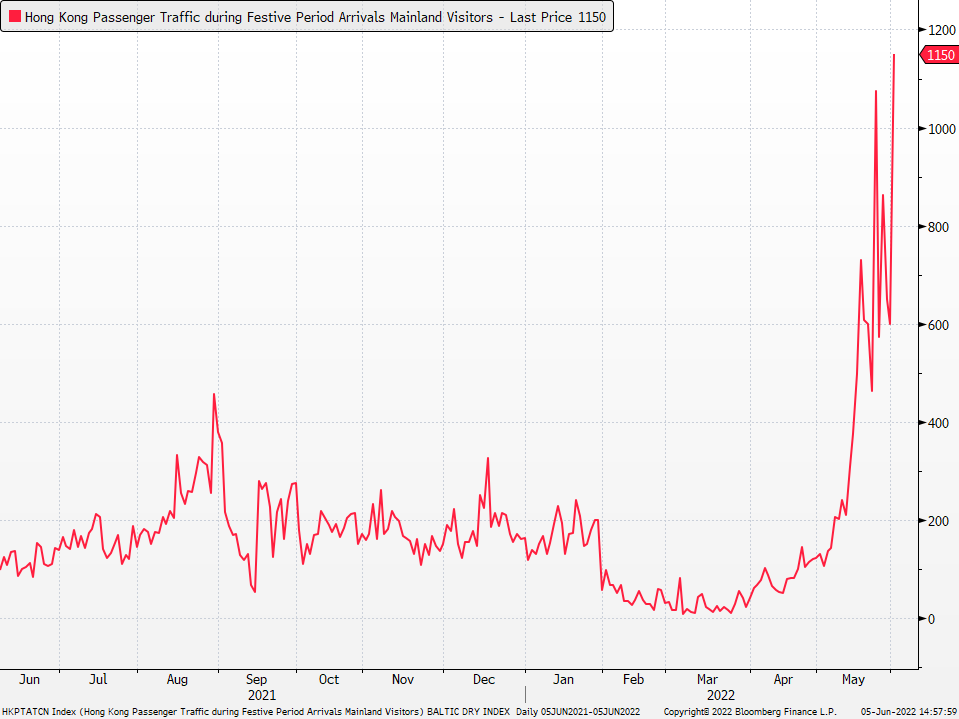

Hongkong Land Holdings Limited (HKL SP): Hong Kong’s reopening on track

- BUY Entry – 5.1 Target – 5.7 Stop Loss – 4.8

- Hongkong Land Holdings Limited operates as a property investment, development, and management company. The Company owns and manages prime offices and luxury retail properties in Asian gateway cities, principally in Hong Kong and Singapore. Hongkong Land serves customers in Asia.

- Surg in arrivals to Hong Kong. Almost 9,000 mainland Chinese entered the city by plane last month, compared with just over 6,000 from March 2020 through April this year, according to the latest official immigration data. Hong Kong has lifted flight bans for quite a number of countries, reduced quarantine days requirement for vaccinated residents, and increased the supply of quarantine hotels in April and May. Last Wednesday, the city further loosened measures around Covid-19 testing in a bid to boost visitors.

- Retail sales unexpectedly rebound. According to the Census and Statistics Department, Sales value rose 11.7% YoY in April, compared to a 13.8% plunge YoY in March. In April, sales volume increased 8.1% YoY, beating the 10.8% decline YoY forecast by economists.

- Positive consensus estimates. Hongkong Land currently has a positive consensus estimate of 7 BUYS, 4 HOLDS and 2 SELLS, with a 12M TP of US$6.00. The updated market consensus of the EPS growth in FY22/23 is 1.2%/5.8% YoY, respectively, translating to 12.3×/11.6x forward PE. FY22F/23F dividend yield is 4.3%/4.3% respectively.

Hong Kong Passenger Traffic: China Mainland Visitors

(Source: Bloomberg)

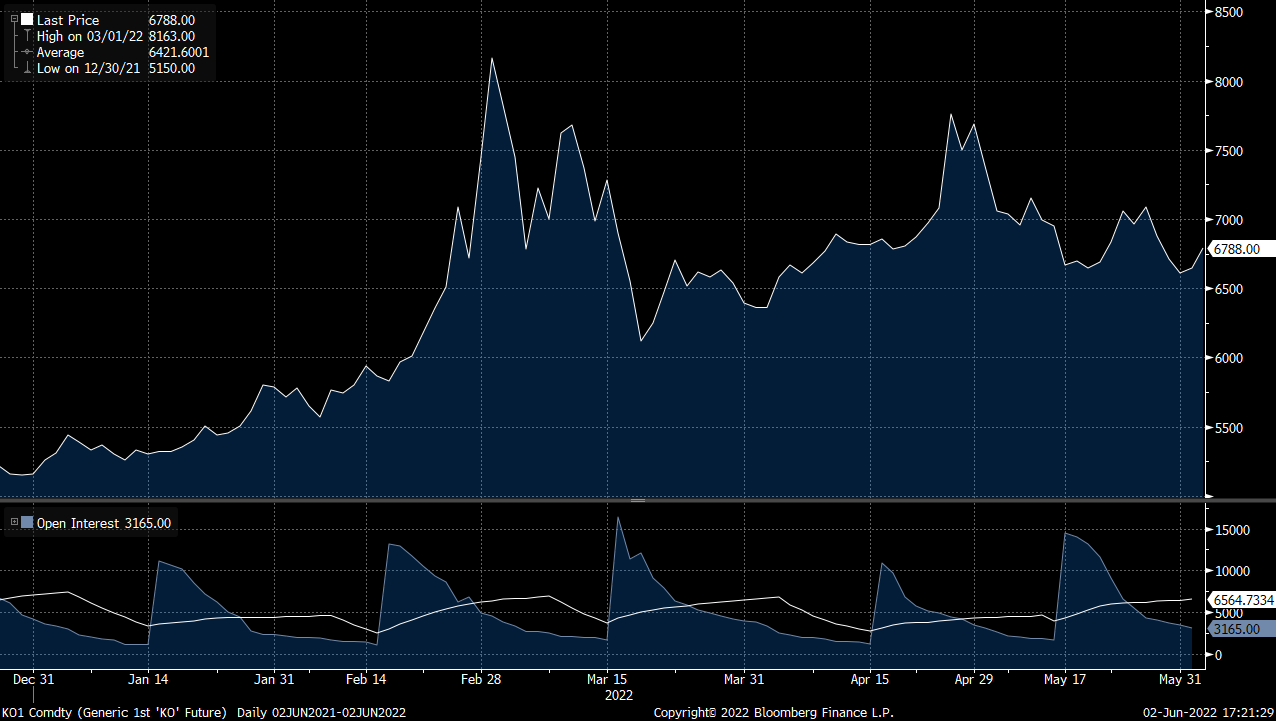

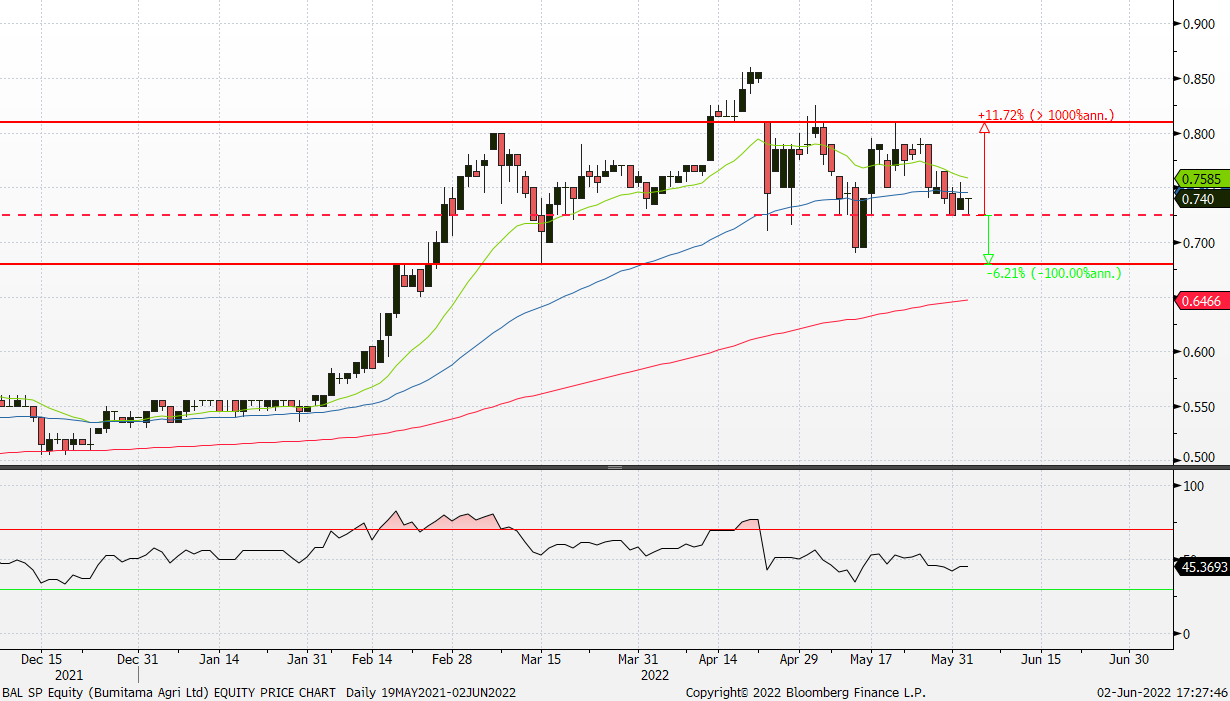

Bumitama Agri Ltd (BAL SP): Palm oil prices on another run

Bumitama Agri Ltd (BAL SP): Palm oil prices on another run

- RE-ITERATE BUY Entry – 0.725 Target – 0.810 Stop Loss – 0.680

- Bumitama Agri Ltd is an Indonesia-based producer of crude palm oil and palm kernel with oil palm plantations and mills located in three provinces of Indonesia, namely Central Kalimantan, West Kalimantan and Riau. Its primary business activities are cultivating and harvesting oil palm trees, processing fresh palm fruit bunches from its oil palm plantations, plasma plantations and third parties into crude palm oil and palm kernel, and selling crude palm oil and palm kernel.

- Stellar 1Q22 financials. Revenue rose 69% YoY to IDR 3,899,550 mn in 1Q22 while gross profit rose 195.9% to IDR 1,500,622mn. Gross profit margin improved significantly to 38.5% in 1Q22, compared to 22.0% in 1Q21. Overall net profit grew 423.6% to IDR 873,023mn in 1Q22, while net margins stood at 22.4%, compared to 7.2% in the previous period.

- Cloudy production outlook in Malaysia. State agency Malaysian Palm Oil Council (MPOC) on Wednesday lowered its production outlook for the world’s second largest producer and pegged prices to remain above 6,000 ringgit ($1,367.37) a tonne this year. The Malaysian Palm Oil Council forecast Malaysia’s 2022 production at 18.6 million tonnes, below previous expectations and after Indonesia has cancelled a long-awaited plan to send a batch of workers to operate in labour-starved Malaysia’s palm oil plantations. MPOC pegged Malaysia’s benchmark palm oil prices to remain between 6,500-6,800 ringgit until the end of July, and ease to 6,300-6,500 ringgit until September due to the resumption of Indonesian exports, Mohd Izham said.

- Indonesia’s export ban. Despite efforts made by Indonesia to cool palm oil prices, Indonesia has so far re-entered the export market only slowly with export volumes allowed significantly low. The government expected to allocate 1 million tonnes of palm oil exports based on domestic sales made during the export stoppage. So far, permits have been issued for 87,109 tonnes of refined, bleached and deodorised (RBD) palm oil and 90,255 tonnes of RBD olein, while the rest were issued for cooking oil, according to trade ministry data provided by Oke.

- Positive consensus estimates. Bumitama Agri currently has a positive consensus estimate of 4 BUYS, 0 HOLD and 0 SELL, with a 12M TP of S$0.97.

Generic 1st Crude Palm Oil (K01 Comdty)

(Source: Bloomberg)

Global X China Elec Vehicle & Battery ETF (2845 HK): A big tailwind catalyst for the automobile sector

- Buy Entry – 138 Target – 150 Stop Loss – 132

- The investment objective of the Fund is to provide investment results that, before fees and expenses, closely correspond to the performance of the Solactive China Electric Vehicle and Battery Index. The Manager will primarily use a full replication strategy through investing directly in constituent stocks of the Index in substantially the same weightings in which they are included in the Index.

- Slash purchase tax for small-engine cars by half. China’s Ministry of Finance said in a statement that it will reduce the purchase tax for cars priced at RMB 300,000 and below, and with 2.0-liter engines or smaller to 5% from the previous 10%. The move will come into effect from June 1 through the end of 2022. It is expected that the tax reduction could boost automobile sales by 2mn units in 2022. Previously, the authorities discussed with automakers about extending subsidies for EVs that were set to expire in 2022. There is no purchase tax for EVs this year, but the government could lower the planned purchase tax from 10% to 5% in 2023.

- Exposure to China’s EVs and related market leaders. The ETF’s main components include the domestic largest EV maker, BYD (002594 CH), the global largest domestic EV battery maker, Contemporary Amperex Technology (300750 CH), and the domestic largest lithium miner, Ganfeng Lithium (002460 CH).

- Resumption of a technical uptrend. Shares have broken out of the downward channel and resumed the uptrend. Yesterday, the stock closed near an intraday high and closed above the 50dMA with an increase in volume.

(Source: Bloomberg)

Xtep International Holdings Ltd (1368 HK): 618 shopping spree to shore up sales

Xtep International Holdings Ltd (1368 HK): 618 shopping spree to shore up sales

- RE-ITERATE Buy Entry – 11.0 Target – 13.0 Stop Loss – 10.0

- Xtep International Holdings Ltd is a China-based company principally engaged in the design, development, manufacturing, sales, marketing and brand management of sports products, including footwear, apparel and accessories. The Company operates its businesses through three segments. The Mass Market segment’ signature brand is Xtep. The Athleisure segment’s signature brands are mainly K-Swiss and Palladium. The Professional Sports segment’s signature brands are Saucony and Merrell. The Company distributes its products both in the domestic market and to overseas markets.

- Two upcoming turnaround catalysts. Shanghai said on Sunday “unreasonable” curbs on businesses will be removed from June 1 as it looks to lift its COVID-19 lockdown, while Beijing reopened parts of its public transport as well as some malls and other venues as infections stabilised. June 18th is the upcoming shopping festival. The pent-up demand, as well as big sales promotions to drum up customers, will turn around the last two months’ gloomy retail sales.

- 1Q22 operational updates. Retail sell-through growth (including offline and online channels) grew by 30%-35% YoY. Retail discount level arrived at around 25%. Retail inventory turnover was around 4 months.

- The updated market consensus of the EPS growth in FY22/23 is 24.4%/25.1% YoY, respectively, translating to 21.2×/17.0x forward PE. The current PER is 26.4x. Bloomberg consensus average 12-month target price is HK$13.96.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Oil & Gas Production | +1.7% | Oil jumps after Saudi Arabia hikes crude prices ConocoPhillips (COP US) |

| Oil Refining/Marketing | +1.6% | Oil jumps after Saudi Arabia hikes crude prices Marathon Petroleum Corp (MPC US) |

| Integrated Oil | +1.2% | Oil jumps after Saudi Arabia hikes crude prices Exxon Mobil Corp (XOM US) |

Top Sector Losers

| Sector | Loss | Related News |

| Motor Vehicles | -6.5% | Feeling ‘super bad’ about economy, Musk wants to cut 10% of Tesla jobs Tesla Inc (TSLA US) |

| Telecommunications Equipment | -3.7% | N/A Apple Inc (AAPL US) |

| Semiconductors | -3.1% | Dow falls 300 points, Nasdaq drops 2%, as major indexes notch weekly losses Nvidia Corp (NVDA US) |

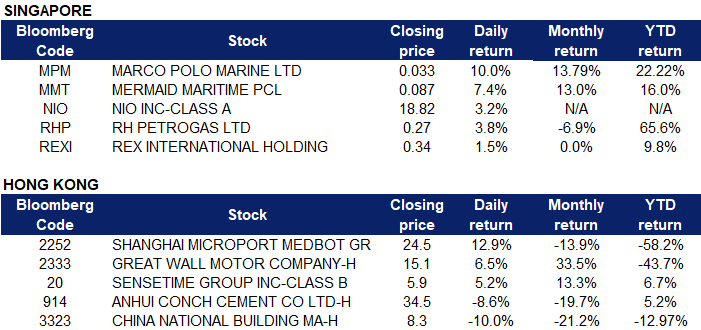

- Marco Polo Marine Ltd (MPM SP) shares rose 10.0% on Friday. RHB Group Research analyst Jarick Seet has maintained his “buy” call on Marco Polo Marine (MPM), with an unchanged target price of 4 cents as the company is on track for turnaround and better performance. In his June 3 note, Seet says MPM’s 1HFY2022 utilisation rate has recovered to pre-pandemic levels and rises YoY, driven by strong demand from both the oil and gas (O&G) and offshore wind farm sectors. RHB expects utilisation rates to pick up to 70%-80% from the current 60% by the end of the year. Fellow shipping peer, Mermaid Maritime PCL (MMT SP) shares rose 7.4% on Friday.

- Nio Inc (NIO SP) shares rose 3.2% on Friday. Recently, Nio reported it delivered 7,024 EVs in May, which was up 38% from April and just about 5% year over year. Nio confirmed its production picked up pace in May after a shutdown, and said it plans to ramp up production and deliveries even further in June. In addition, China has announced a range of measures to support auto sales and the sputtering economy, including a halving of the tax on purchases of small-engine cars with sticker prices of up to about $45,000. In a report issued Wednesday, Fitch said it expects sales for the world’s largest auto market will climb 3.9 per cent this year after 3.8 per cent growth in 2021.

- RH Petrogas Ltd (RHP SP) and Rex International Holding Ltd (REXI SP) shares rose 3.8% and 1.5% respectively on Friday. WTI crude futures traded lower below $116 per barrel on Friday, but were still set for a sixth weekly advance after a keenly anticipated OPEC+ meeting delivered only a modest increase in output despite speculations of a bigger supply boost. The group of major producers decided to increase output by 648,000 barrels per day in July and August instead of the previously agreed 432,000 bpd, in a move that was seen as hardly enough to compensate for lost supply from Russia. Russian output dropped by 1 million bpd since its invasion of Ukraine and is likely to fall even further as the EU’s ban on Russian oil kicks in.

Singapore

- Marco Polo Marine Ltd (MPM SP) shares rose 10.0% on Friday. RHB Group Research analyst Jarick Seet has maintained his “buy” call on Marco Polo Marine (MPM), with an unchanged target price of 4 cents as the company is on track for turnaround and better performance. In his June 3 note, Seet says MPM’s 1HFY2022 utilisation rate has recovered to pre-pandemic levels and rises YoY, driven by strong demand from both the oil and gas (O&G) and offshore wind farm sectors. RHB expects utilisation rates to pick up to 70%-80% from the current 60% by the end of the year. Fellow shipping peer, Mermaid Maritime PCL (MMT SP) shares rose 7.4% on Friday.

- Nio Inc (NIO SP) shares rose 3.2% on Friday. Recently, Nio reported it delivered 7,024 EVs in May, which was up 38% from April and just about 5% year over year. Nio confirmed its production picked up pace in May after a shutdown, and said it plans to ramp up production and deliveries even further in June. In addition, China has announced a range of measures to support auto sales and the sputtering economy, including a halving of the tax on purchases of small-engine cars with sticker prices of up to about $45,000. In a report issued Wednesday, Fitch said it expects sales for the world’s largest auto market will climb 3.9 per cent this year after 3.8 per cent growth in 2021.

- RH Petrogas Ltd (RHP SP) and Rex International Holding Ltd (REXI SP) shares rose 3.8% and 1.5% respectively on Friday. WTI crude futures traded lower below $116 per barrel on Friday, but were still set for a sixth weekly advance after a keenly anticipated OPEC+ meeting delivered only a modest increase in output despite speculations of a bigger supply boost. The group of major producers decided to increase output by 648,000 barrels per day in July and August instead of the previously agreed 432,000 bpd, in a move that was seen as hardly enough to compensate for lost supply from Russia. Russian output dropped by 1 million bpd since its invasion of Ukraine and is likely to fall even further as the EU’s ban on Russian oil kicks in.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Textile & Apparels | +2.31% | Cotton rally squeezes Asian garment makers, threatens recovery from Covid Texhong Textile Group LtdTexhong Textile Group Ltd (2678 HK) |

Commercial Vehicle | +1.73% | China’s tax-cutting policy expected to boost $45 billion in auto sales: experts Sinotruk (Hong Kong) Limited (3808 HK) |

Petroleum & Gases Equipment & Services | +1.36% | Oil prices fall as investors await OPEC+ policy, eye Saudis China Oilfield Services Ltd (2883 HK) |

Top Sector Losers

Sector | Loss | Related News |

Construction Materials | -1.68% | China Raises Pressure on Banks to Help Struggling Developers Anhui Conch Cement Co Ltd (914 HK) |

Environmental Goods | -1.21% | China Leans on Policy Banks to Deliver $120 Billion Stimulus Realord Group Holdings Ltd (1196 HK) |

Medicine | -0.96% | China Trumpets Victory Over Covid Again in Front-Page Editorial Hansoh Pharmaceutical Group Company Ltd (3692 HK) |

- Shanghai MicroPort MedBot Group Co Ltd (2252 HK) Shares jumped 12.9% last Thursday after the company announced it proposed to apply to the relevant regulatory authorities in the PRC for the allotment and issue of not more than 116,062,930 A Shares and proposed to apply to the Shanghai Stock Exchange for the listing of, and permission to deal in, the A Shares on the Sci-Tech Board.

- Great Wall Motor Company Limited (2333 HK) Shares rose 6.5% last Thursday. There was no company-specific news. China’s Ministry of Finance said in a statement that it will reduce the purchase tax for cars priced at RMB 300,000 and below, and with 2.0-liter engines or smaller to 5% from the previous 10%.

- SenseTime Group Inc (20 HK) Shares rose 5.2% last Thursday and closed at a two-month high. Previously, some institutes believed that the company’s digital sentinel convenient access system will see strong demand in 2Q/3Q as the company was the first batch of qualified suppliers of the digital sentinel convenient access system in Shanghai. The market scale of the system was expected to be RMB40bn.

- Anhui Conch Cement Co Ltd (914 HK) Shares fell 8.6% last Thursday. China National Building Material Co Ltd (3323 HK) Shares fell 10% last Thursday. Cement stocks fell as CLSA expected the sale volume to drop by 12% YoY in May due to supply chain disruptions, weak demand, and unfavourable weather conditions. Meanwhile, cement suppliers have difficulties passing high material costs on to customers amidst soft demand.

Trading Dashboard Update: No additions/deletions of stocks.