6 January 2023: Genting Singapore Ltd (GENS SP), Shandong Gold Mining Co., Ltd. (1787 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Genting Singapore Ltd (GENS SP): Greet Chinese visitors

- BUY Entry – 0.955 Target – 1.000 Stop Loss – 0.920

- Genting Singapore is best known for its award-winning flagship project Resorts World Sentosa, one of the largest fully integrated destination resorts in South East Asia. Genting Singapore is one of the constituent stocks of the FTSE Straits Times Index. The principal activities of Genting Singapore and its subsidiaries are in developing, managing and operating integrated resort destinations including gaming, hospitality, MICE, leisure and entertainment facilities.

- Pent-up demand for travel. Singapore’s international visitor arrivals fell slightly to 816,250 in November after hitting a record of 816,758 tourists in October, according to the Singapore Tourism Board’s latest figures. China has scrapped the international travel restrictions, and residents in China now are free to go overseas. Singapore is one of the popular attractions and will see a surge of Chinese visitors in 2023.

- RWS 2.0 expansion. Genting Singapore’s $4.5 billion mega expansion of RWS is proceeding expeditiously as planned. RWS will add two new zones to Universal Studios Singapore – Minion Park and Super Nintendo World – as well as a new oceanarium. The Oceanarium will be three times the size of the SEA Aquarium and encompass a research and learning centre. RWS will also refurbish the Hard Rock Hotel Singapore, Hotel Michael and Festive Hotel, which have around 1,200 rooms in all, in phases from the second quarter of 2022 through 2023. Festive Hotel will be refashioned into a business-leisure and work-vacation hotel, while the Resorts World Convention Centre will be refurbished.

- 3Q22 results. Genting reported a significant improvement in its 3Q results ended in September. For the period, earnings reached $135.8 million, versus $60.7 million in the year-earlier; revenue in the same quarter was $519.7 million, more than double $251.5 million in 3QFY2021, led by increases in both gaming and non-gaming revenue. Non-gaming revenue soared 144.3% YoY to S$137.3 million.

- Updated market consensus of the EPS growth in FY23/24 is 59.6%/10.1% YoY respectively, which translates to 20.5x/18.6x forward PE. Current PER is 64.5x. Bloomberg consensus average 12-month target price is S$0.98.

(Source: Bloomberg)

Hongkong Land Holdings Ltd (HKL SP): Recovery has kick-started

Hongkong Land Holdings Ltd (HKL SP): Recovery has kick-started

- RE-ITERATE BUY Entry – 4.65 Target – 4.95 Stop Loss –4.50

- Hongkong Land is a major listed property investment, management and development group. The Group owns and manages more than 850,000 sq. m. of prime office and luxury retail property in key Asian cities, principally Hong Kong, Singapore, Beijing and Jakarta. The Group also has a number of high quality residential, commercial and mixed-use projects under development in cities across China and Southeast Asia, including a 43% interest in a 1.1 million sq. m. mixed-use project in West Bund, Shanghai.

- Updates on Hong Kong’s reopening of the border. Hong Kong government is working to resume quarantine-free travel with mainland China by as early as January 8th which is also the first date that China fully drops all the COVID quarantine measures. The rebound of visitor arrivals in Hong Kong in 4Q22 was promising. In November 2022, the number of tourist arrivals increased to more than 113,000 from 80,000+ in October. The property market is expected to recover along with the influx of visitors, especially those from China.

- Hong Kong’s property market to bottom out. Recent studies showed that Hong Kong’s home sales value in 11M22 fell 40% YoY to HK$107bn, the lowest level since 2008. The full-year total number of units sold is expected to be lower than 11,000 in 2022. The poor performance was due to restrictive lockdown measures and the ensuing exodus of residents. However, reopening borders and normalising international travel will help recovery in the housing market. Meanwhile, the retail sector is expected to recover faster as the number of tourist arrivals will increase throughout 2023.

- Updated market consensus of the EPS growth in FY23/24 is 11.0%/4.5% YoY respectively, which translates to 11.2x/10.7x forward PE. Current PER is 13.2x. Bloomberg consensus average 12-month target price is S$4.84.

Samsonite International S.A. (1910 HK): Chase the upward momentum

- Buy Entry –21.5 Target – 25.5 Stop Loss – 19.5

- Samsonite International S.A. is a Hong Kong-based company principally engaged in the design, manufacture, sourcing and distribution of luggages, business and computer bags, outdoor and casual bags, travel accessories and slim protective cases for personal electronic devices. The Company operates its business through three segments. The Travel Bag segment is engaged in travel products with suitcases and carry-ons of three main categories, including hard-side, soft-side and hybrid luggages. The Casual Bags segment is engaged in daily use, including different types of backpacks, female and male shoulder bags and wheeled duffel bags. The Business Bags segment is engaged in business use, including rolling mobile office bags, briefcases and computer bags.

- China to see a peak of the current COVID wave by February 2023. China has further lifted COVID measures since early November, and ensuing COVID outbreaks spread across cities with dense populations. However, most cities release a timetable of peak estimates before or during the Chinese New Year period. Meanwhile, China is expected further to lift the quarantine restrictions for inbound tourists in 1Q23. Accordingly, China’s tourism sector is expected to recover quickly in 2023.

- Global tourism to continue to recover in 2023. According to the Economist Intelligence Unit Tourism in 2023 report, the global tourism arrivals will increase by 30% YoY in 2023, following growth of 60% YoY in 2022, but will remain below pre-COVID levels. Meanwhile, EIU also expects international arrivals to recover back to 2019 levels in 2024.

- 3Q22 results review. Net sales jumped by 42.0% (+54.7% constant currency) YoY to US$790.9mn. Operating profit jumped by 140% YoY to US$121.8mn. Profit attributable to the equity shareholders arrived at US$58.2mn in 3Q22 compared to a loss of US$5.2mn in 3Q21. The turnaround of the business and financials was due mainly to the effects of the COVID-19 pandemic on demand for the Group’s products moderated in most countries due to the continued rollout and effectiveness of vaccines leading governments in many countries to further loosen socialdistancing, travel and other restrictions, which has led to the continuing recovery in travel. However, the Chinese government reinstated travel restrictions and social distancing measures in an effort to combat further outbreaks of COVID-19, which has slowed the Group’s net sales recovery in China.

- The updated market consensus of the EPS growth in FY23/24 is 43.9%/16.3% YoY respectively, translating to 14.4x/12.4x forward PE. The current PER is 12.3x. Bloomberg consensus average 12-month target price is HK$27.42.

Shandong Gold Mining Co., Ltd. (1787 HK): Gold is coming back

Shandong Gold Mining Co., Ltd. (1787 HK): Gold is coming back

- RE-ITERATE Buy Entry –14.8 Target – 16.5 Stop Loss – 14.0

- Shandong Gold Mining Co., Ltd. is a China-based company principally engaged in the mining, processing and sales of gold. The Company operates two segments. The Gold Mining segment is engaged in the mining of gold ore. The Gold Refining segment is engaged in the production and sales of gold. The Company is also engaged in the distribution of other metals extracted during the gold ore smelting process, such as silver, copper, iron, lead and zinc. The Company conducts its businesses in domestic and overseas markets.

- Gold to shine. An inflationary recession has been increasingly a market consensus theme in 2023. The 2023 global economic growth projections were lowered several times during 2022. The latest forecast from IMF in December 2022 was 2.7%. The global economy lacks growth engines from the major economies such as the US, China, EU and Japan lack. Meanwhile, geopolitical risks are expected to remain high. Safe haven assets will be favoured this year.

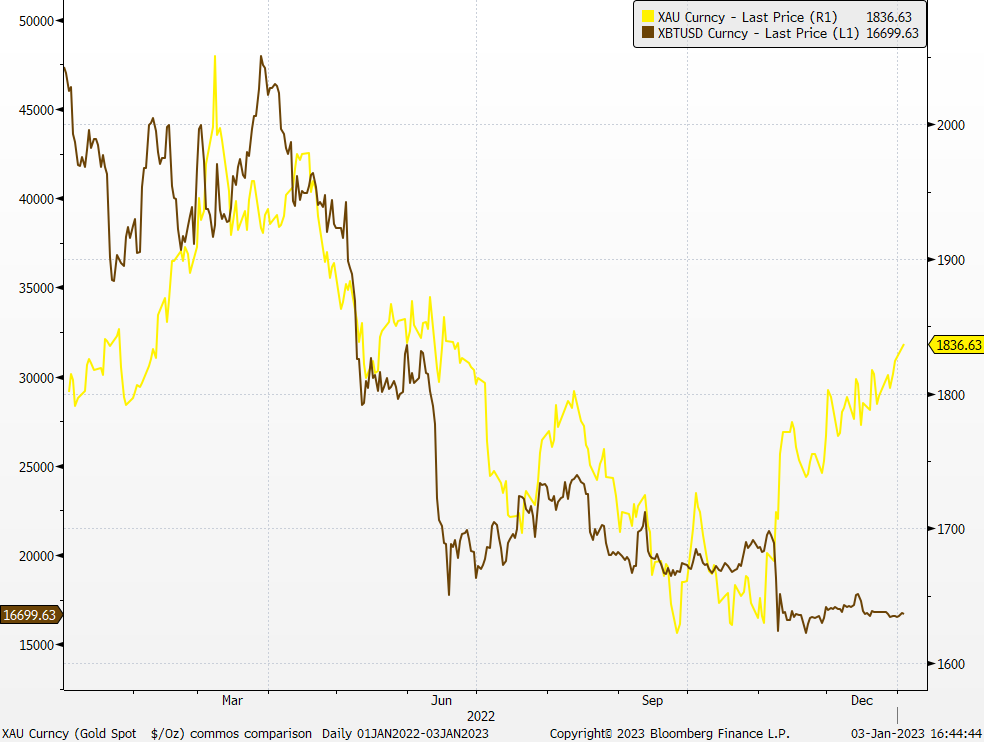

- Crypto’s doom could be gold’s boom. The recent rally of gold price coincided with the plunge in the bitcoin price due to the failure of FTX. The inflexion point in December has broken the positive correlation between gold and bitcoin, implying an influx of fund flows from cryptocurrencies. Gold price continues to recover, and it was trading at around US$1,835/oz, a high since June 2022.

Gold and Bitcoin price comparison

- 3Q22 earnings update. Operating income jumped by 71.7% YoY (after adjustment) to RMB10bn. Net profit attributable to owners of the company jumped by 90.0% YoY (after adjustment) to RMB137.0mn.

- The updated market consensus of the EPS growth in FY23/24 is 68.9%/20.4% YoY respectively, translating to 26.4x/21.9x forward PE. The current PER is 40.7x. Bloomberg consensus average 12-month target price is HK$15.5.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Energy Minerals | +1.49% | Oil Rises After US Inventory, Export Figures Cheer Market Exxon Mobil Corp (XOM US) |

| Communications | +1.12% | T-Mobile’s Cisco Core Unlocks 5G Capabilities T-Mobile Us Inc (TMUS US) |

| Non-Energy Minerals | +0.51% | China warns of risk to critical resources, aims to strengthen domestic exploration and mining Vale SA (VALE US) |

Top Sector Losers

| Sector | Loss | Related News |

| Technology Services | -2.37% | Amazon to axe 18,000 workers as more US tech firms cut jobs Microsoft Corp (MSFT US) |

| Health Services | -2.00% | Fitch Ratings’ 2023 Outlook: Public Finance Stable Amid Weakening Macro Environment UnitedHealth Group Inc (UNH US) |

| Process Industries | -1.41% | Here’s why Linde shares have dropped so much this week but why we still like it long term Linde PLC (LIN US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Household Appliances | +2.78% | From home appliance to automotive MCUs: China’s Midea Group targets EV sector Haier Smart Home Co Ltd (6690 HK) |

Other Minerals | +2.75% | Viewpoint: Asia looks beyond China for lithium refining Tianqi Lithium Corp (9696 HK) |

Airline Services | +2.42% | Airlines slam ‘knee-jerk’ Covid-19 test plan for China’s tourists China Southern Airlines Co. Ltd. (1055 HK) |

Top Sector Losers

Sector | Loss | Related News |

Coal | -1.31% | China allows four firms to resume Aussie coal imports – sources Yancoal Australia Ltd (3668 HK) |

Semiconductors | -0.76% | GT Voice: US chip restrictions on China to harm Japanese companies Shanghai Fudan Microelectronics Company (1385 HK) |

Software | -0.69% | China’s Tech Giants Brace for a New Era of Slower Growth Kingdee International Software Group Co. (268 HK) |

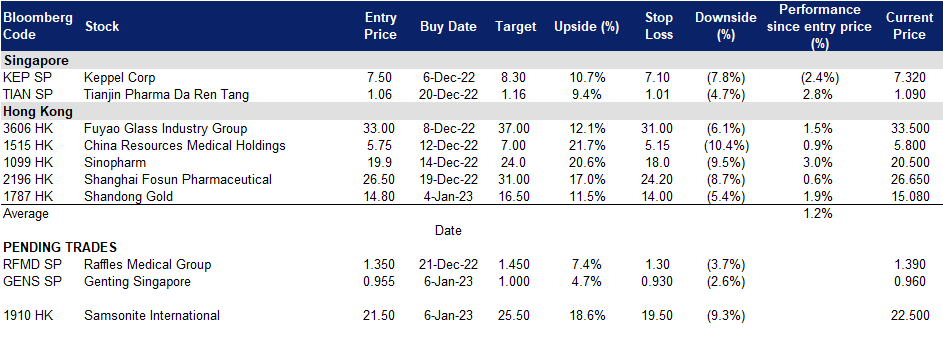

Trading Dashboard Update: Take profit on Hongkong Land (HKL SP) at S$4.80. Add Shandong Gold (1787 HK) at HK$14.80.

(Source: Bloomberg)

(Source: Bloomberg)