3 March 2023: Comfort Delgro (CD SP), Cathay Pacific Airways Ltd (293 HK), Tapestry (TPR US)

Singapore Trading Ideas | Hong Kong Trading Ideas |United States Trading Ideas | Sector Performance | Trading Dashboard

Comfort Delgro (CD SP): Tourism recovery

- RE-ITERATE BUY Entry 1.20 – Target – 1.27 Stop Loss – 1.17

- ComfortDelGro Corporation Limited provides land transportation services. The Company offers bus, taxi, rail, car rental and leasing, automotive engineering services, inspection and testing services, driving center, insurance broking services, and outdoor advertising.

- Increasing Travel Demand. Singapore’s international visitor arrivals rose to 931,530 in January, setting a new record since the onset of the pandemic, according to the latest figures from the Singapore Tourism Board (STB). Alongside the recent re-opening of China’s international border, Singapore tourism is bound to increase in the coming months. This would drive growth in the transportation sector with the further recovery in tourism in Singapore.

- High dividend payout. Following Comfort Delgro’s 4Q22 financial results, the company has recommended a final dividend of S$0.0176 per share, and a special dividend of S$0.0246 per ordinary share to commemorate the 20th anniversary of the company’s listing on the Singapore Exchange. ComfortDelGro’s total dividend payout for 2022 stands at S$0.0848 per share, versus S$0.042 per share in 2021. This showcased the favourable performance of the company for FY22.

- 4Q22 results review. Revenue rose 9.0% YoY to S$1.9bn; net profit increased 63.3% YoY to S$57.8mn in 4Q22 from S$35.4mn in 4Q21. FY22 earnings of S$173.1mn, up 40.7% YoY from S$123.0mn.

- Updated market consensus of the EPS growth in FY23/24 is 6.24%/10.99% respectively, which translates to 14.2x/12.9x forward PE. Current PER is 13.3x. Bloomberg consensus average 12-month target price is S$1.50.

Yangzijiang Shipbuilding (BS6 SP): Benefitting from positive US data

- RE-ITERATE Entry – 1.32 Target – 1.45 Stop Loss – 1.25

- Yangzijiang Shipbuilding Holdings Limited builds a wide range of ships. The Company produces a wide range of commercial vessels, mini bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels, and lifting vessels.

- Benefitting from a stronger US Dollar. Following the most recent US strong nonfarm payroll data for the month of January, the US dollar index saw a rebound with the positive results. Yangzijiang Shipbuilding Holdings Limited, whose financial results, as well as operations, which are mainly denominated in USD, can benefit from the appreciate of the US dollar in upcoming months.

Share price and dollar index comparison

(Source: Bloomberg)

- Dropping Iron Ore and Steel prices. Hard commodities, such as iron ore and steel, saw a price decline following the appreciation of the US dollar. This allows the company to find opportunities in lowering their cost of production, whereby iron ore and steel make up a key component of the production of a ship.

- Visibility on secured contracts. As of 3Q22, the company’s total order book value reached US$10.27bn which extended the company’s top line visibility to mid-2025. This allows the company to have a confirmed and visible stream of revenue for the upcoming years.

- Company Outlook. The company’s outlook is positive in the upcoming months, with the rebound of the U.S. dollars as economic pressure starts to ease. There is also clear visibility on the company’s revenue stream given that its’ order book are filled till mid-2025. The re-opening of China’s economy also allows the company to re-accelerate the production of its business. This suggests that the company’s performance is likely to continue to improve in the near future.

- The updated market consensus of the EPS growth in FY23/24 is 23.02%/6.83% YoY respectively, which translates to 8.35x/7.82x forward PE. Current PER is 10.28x. FY23F/24F dividend yield is 4.18%/4.33% respectively. Bloomberg consensus average 12-month target price is $1.54.

Cathay Pacific Airways Ltd (293 HK): Free air tickets

- RE-ITERATE BUY Entry – 7.84 Target – 8.30 Stop Loss – 7.61

- Cathay Pacific Airways Ltd is a company mainly engaged in the provision of international passenger and cargo air transportation. Together with its subsidiaries, the Company operates business through its four operating segments. The Cathay Pacific and Cathay Dragon segment provides full service international passenger and cargo air transportation under the Cathay Pacific and Cathay Dragon brands. The Air Hong Kong segment provides express cargo air transportation offering scheduled services within Asia. The HK Express segment provides a low-cost passenger air transportation offering scheduled services within Asia. The Airline Services segment provides supporting airline operations services include catering, cargo terminal operations, ground handling services and commercial laundry operations.

- Promoting tourism. The Hong Kong Tourism Board launched the “Hello, Hong Kong” campaign offering 500,000 air tickets and over a million Hong Kong Goodies visitor consumption vouchers to attract visitors, businesses, and investors to the city after Covid-19 curbs. Part of this initiative is the HKIA’s “World of Winners” Tickets Giveaway Campaign to stimulate air traffic and promote the recovery of Hong Kong’s aviation industry, tourism, and economy. Majority of the tickets will be distributed in phases by three home-based airlines, Cathay Pacific Airways, Hong Kong Express and Hong Kong Airlines, through their respective channels in major passenger markets by different mechanisms such as lucky draw, first-come-first-served, “Buy 1 or more – Get 1 Free”, or games. Additionally, some tickets will be provided to travel trade and government bodies for promoting tourism in Hong Kong. Around 80,000 tickets will be given away to Hong Kong residents in summer 2023, and some tickets will be given away in the Guangdong-Hong Kong-Macao Greater Bay Area. A total of more than 700,000 tickets will be given away across various markets through different channels. The distribution of the tickets will be 65% through airlines and their agents, with the remaining reserved for tourism-related sectors to support inbound tourism and promote Hong Kong.

- “World of Winners” in Singapore. The Tickets Giveaway Campaign will be rolled out in phases with the first phase starting from 1 March 2023 at Southeast Asia market. Cathay Pacific is offering 12,500 round-trip air tickets to tourists from Singapore between noon on 2 March and 11:59pm on 8 March.

- 1H22 earnings. Revenue in 1H22 was HK$18,551mn , up 17.0% YoY from HK$15,854mn. Loss attributable to the shareholders reduced by 33.9% from HK$7,565mn to HK$4,999mn.

- The updated market consensus of EPS in FY23/24 is HK$0.54/HK$0.67 respectively, which translates to 14.7x/11.8x forward PE. Bloomberg consensus average 12-month target price is HK$9.54.

(Source: Bloomberg)

Prada SpA (1913 HK): Expensive taste

- RE-ITERATE BUY Entry – 52 Target – 56 Stop Loss – 50

- Prada SpA is an Italy-based company engaged in fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through a numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Lyst index. Lyst, a reporting index that uses shopper data to rank popular fashion brands quarterly, has released its latest report for October to December 2022, marking its fifth year of customer insights. This unique index ranks fashion’s top brands and products by gathering shopping data from two hundred million customers globally. The determination of brand heat on the Lyst index chart goes beyond sales and views. It also includes social media mentions, activity, and engagement stats from around the world to determine which brands top the rankings. In Lyst’s latest report, Prada ranked at the top followed by Gucci and Moncler.

- World’s biggest luxury spenders. Growing global affluence has led to an upswing in luxury spending, contributing to Mr. Bernard Arnault’s rise as the world’s richest person through his luxury-goods powerhouse LVMH. Despite the pandemic, there was high consumer confidence, and South Koreans have emerged as the world’s top per-capita spenders on luxury brands. According to a Morgan Stanley report, South Korean nationals accounted for over 10% of total retail sales by high-end brands such as Prada, Moncler, Bottega Veneta, and Burberry Group, with spending on personal luxury goods rising 24% to 21.8 trillion won (S$23.2 billion) in 2022.

- Rise of social media marketing. Social media marketing has risen in recent years, with brands utilizing these platforms to reach more users. Brands engage celebrities and influencers to create content by sending them new products and occasionally paying them a fee. The popularity of South Korean pop culture has led top fashion houses and luxury brands to sign South Korean stars as ambassadors, influencing fans to purchase endorsed products through various advertisements.

- 1H22 earnings. Revenue in 1H22 was €1.9 bn, up 22% YoY. Retail Sales rose 26% YoY to €1.7 bn.

- The updated market consensus of the EPS growth in FY22/23 is 54.5%/18.5% YoY respectively, which translates to 35.5x/30.0x forward PE. Current PER is 41.92x. Bloomberg consensus average 12-month target price is HK$55.42.

Tapestry (TPR US): Hedging against inflation

- RE-ITERATE BUY Entry – 42.8 Target – 47.0 Stop Loss – 40.7

- Tapestry, Inc. provides luxury accessories and branded lifestyle products in the United States, Japan, Greater China, and internationally. The company operates in three segments: Coach, Kate Spade, and Stuart Weitzman.

- High-end consumption will remain in the post-COIVD era. Under the macro environment of continuous inflation, luxury goods giants have successively raised the unit prices of products to maintain profit margins. The tourism industry in various countries is expected continue to recover this year, which will grow the industry’s sales further. High-end consumers are less sensitive to luxury prices. Price hikes and hunger marketing keep attracting consumers’ attention.

- Mixed 2Q23 results but better FY23 outlook. In 2Q23, revenue slightligh dropped by 5.4% YoY to US$2.03bn, missing estimates by US$10mn. Non-GAAP EPS beat estimates by US$0.06 and arrived at US$1.33. FY23 revenue is expected to reach US$6.6bn, up 2%-3% YoY on a constant currency basis. Diluted EPS is expected to range from US$3.70-US$3.75.

- The updated market consensus of the EPS growth in FY23/24 is 7.6%/12.7%, respectively, which translates to 11.6x/10.3x forward PE. Current PER is 12.5x. Bloomberg consensus average 12-month target price is US$51.33.

(Source: Bloomberg)

Star Bulk Carriers Corp. (SBLK US): Recovering shipping activites

- RE-ITEREATE BUY Entry – 24.0 Target – 27.0 Stop Loss – 22.5

- Star Bulk Carriers Corp., a shipping company, engages in the ocean transportation of dry bulk cargoes worldwide. The company’s vessels transport a range of major bulks, including iron ores, coal, and grains, as well as minor bulks, such as bauxite, fertilizers, and steel products.

- Baltic Dry Index turning around. The supply chain disruptions have tapered substantially, and freight rates have been falling over the past few months. However, China is entering a period of seasonal replenishment of inventories, including coal, iron ore, copper, aluminium, and etc. In 2H23, the manufacturing and economic recovery is expected to accelerate. Currently, BDI is at 883, and the recent low was 530. The average from 2017-2019 is 1380.

Baltic Dry Index

(Source: Bloomberg)

- Tailwinds from Southeast Asia countries. India will continue to import more coal and other hard commodities as multinational companies move some of the supply chains to India. The ongoing supply chain reallocation to other Southeast Asia countries supports the shipping sector.

- 4Q22 earnings beat. Revenue dropped by 41.0% YoY to US$60.7mn. Non-GAAP EPS was US$0.9, beating estimates by US$0.07. The time charter equivalent (TCE) rate in 4Q22 was US$19,590 compared to $37,406 in 4Q21, which is indicative of the weaker market conditions prevailing during the recent quarter.

- The updated market consensus of the EPS growth in FY23/24 is -43.6%/34.0%, respectively, which translates to 7.3x/5.5x forward PE. Current PER is 4.5x. FY23F/24F dividend yield is 10.5%/16.9%, respectively. Bloomberg consensus average 12-month target price is US$27.98.

United States

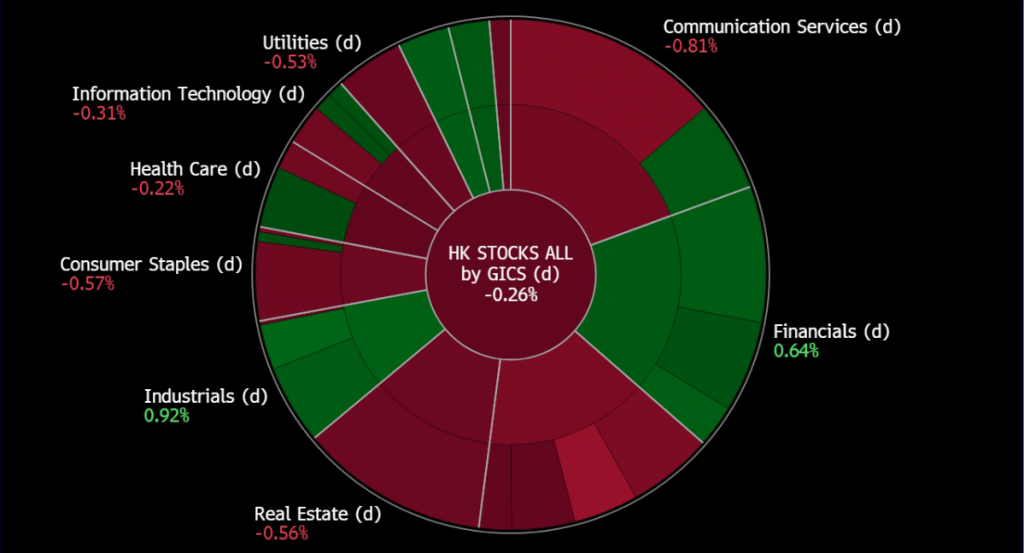

Hong Kong

Trading Dashboard Update: Take profit on Genting Singapore (GENS SP) at S$1.04 and DFI Retail (DFI SP) at S$3.24. Add ConfortDelGro (CD SP) at S$1.20.