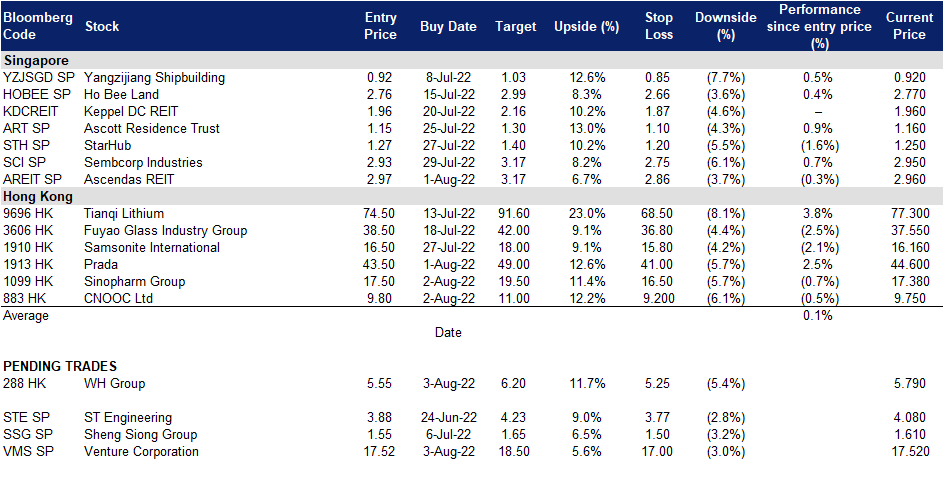

03 August 2022: Venture Corporation (VMS SP), WH Group Ltd (288 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Venture Corporation (VMS SP): Bullish read-through from IQOS

- BUY Entry 17.52 – Target – 18.50 Stop Loss – 17.00

- Venture (VMS) is a global provider of technology services, products and solutions with established capabilities spanning marketing research, design and development, product and process engineering, design for manufacturability, supply chain management, as well as product refurbishment and technical support across a widely diversified range of high-mix, high-value and complex products. Venture has built know-how and intellectual property with expertise in several technology domains. VMS manages a portfolio of more than 5,000 products and solutions and continues to expand into new technology domains through its collaborations with customers and partners in selected ecosystems of interest.

- Key customer, Philip Morris International reported “excellent 2Q22 IQOS performance”. One of VMS’s key clients, Philip Morris International (PMI US) reported better-than-expected 2Q22 earnings and increased its expected growth rate for earnings. During the quarter IQOS, a VMS-linked product, saw more than 1.1m pro forma user growth, which underpinned pro forma smoke-free net revenues growth of 10.3% YoY to US$4.3bn. PMI also saw continued success of its IQOS Iluma in Japan with strong acquisition and conversions.

- After posting strong 1Q22, supply chain issues mitigated. Recall that VMS posted stronger-than-expected 1Q22 earnings of S$84m with six out of seven domains recording growth due to strong customer demand. Additionally, VMS also saw improved ability to overcome supply chain disruptions on several initiatives from its R&D labs. Management also highlighted that based on its customers’ orders and forecasts, VMS anticipates a steady demand outlook across its various technology domains such as Lifestyle & Wellness, Life Science, Instrumentation, Test & Measurement Technology and Advanced Industrial domains. Recent new product launches have been well received by end-customers and have contributed to additional growth.

- FY22F results to mark a YoY bounce. The Street currently has 11/2/0 BUY/HOLD/SELL ratings and an average TP of S$21.29. Based on consensus estimates, FY22F revenue/operating profit should jump 12.7%/15.4% YoY to S$3.5bn/S$407.5m respectively. The will in turn push FY22F EPS to 12.6% higher. In line with this, the street is expecting FY22F DPS to expand 3.1%YoY to 77.3¢ (FY21: 75¢) implying a fairly attractive yield of 4.4%. At current prices, VMS would trade at 14.6x forward P/E, more than 0.5sd away from its 2-year average of 15x. VMS is due to announce 1H22 results on 5 August after trading closes.

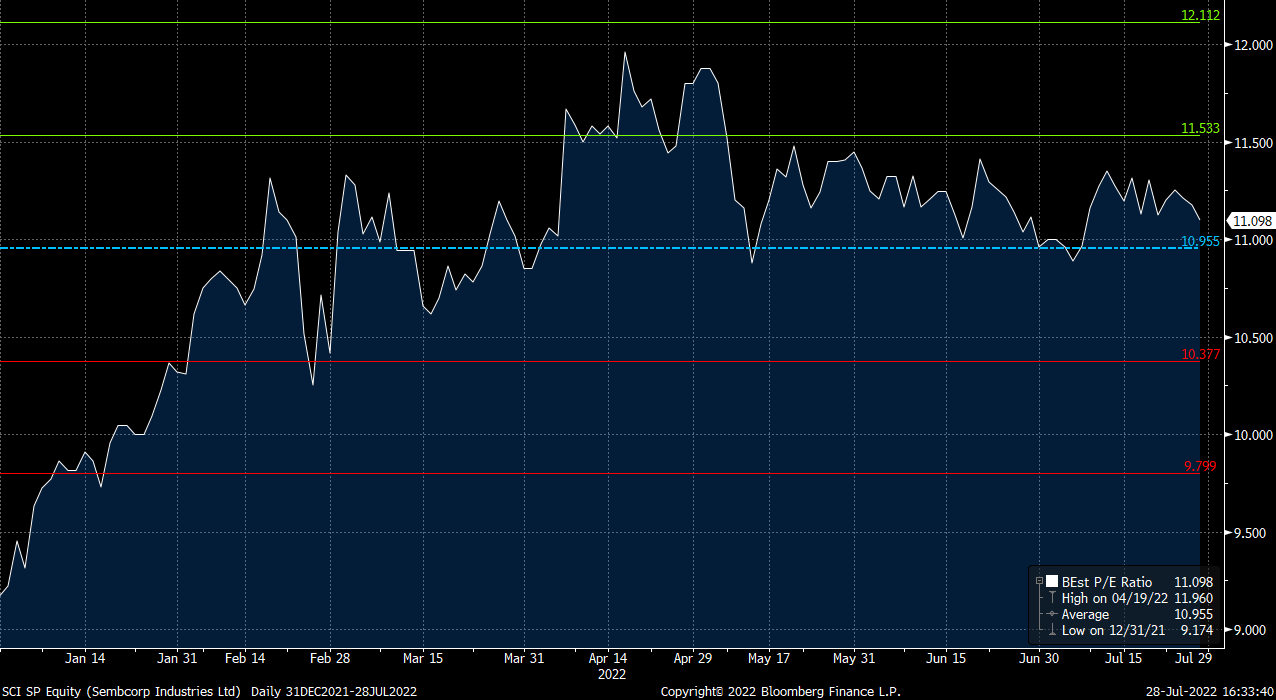

Sembcorp Industries (SCI SP): High power prices to be sticky amidst high inflation environment

- RE-ITERATE BUY Entry 2.93 – Target – 3.17 Stop Loss – 2.75

- Headquartered in Singapore, Sembcorp Industries (SCI) leverages its sector expertise and global track record to deliver solutions that support energy transition and sustainable development. By focusing on growing its Renewables and Integrated Urban Solutions businesses, SCI aims to transform its portfolio towards a greener future and be a leading provider of sustainable solutions. SCI has a balanced energy portfolio of 16.5GW, with 7.0GW of gross renewable energy capacity comprising solar, wind and energy storage globally. SCI also has a track record of transforming raw land into sustainable urban developments, with a project portfolio spanning over 13,000 hectares across Asia.

- Media reports on electricity wholesale price spike. On 18 July, media reported that Singapore’s wholesale electricity price surged for a second time during the week, a sign of further volatility in the market amidst a global power crunch. The cost of 1 megawatt-hour jumped to more than S$4,200, close to the pricing cap of S$4,500. The high price was also sticky for the longest period this year, with the pricing staying for 3 hours. The latest prolonged surge implied a tightness in the market that could not easily be mitigated. High prices would also incentivise power generation companies such as SCI to sell more electricity. Prices staying high thus suggests a fundamental lack of sufficient capacity.

- Share price erased gains despite positive profit guidance. SCI’s share price has essentially given up all gains that were made during its positive profit guidance. Recall that SCI announced that it was looking at stronger-than-expected 1H22 performance driven by its conventional energy segment as electricity prices in Singapore and India remained high. Recall that SCI’s FY21 performance was already substantially stronger on a YoY basis. FY21 turnover/adjusted net profit jumped 43%/57% YoY to S$7.8bn/S$472m mainly on contributions from conventional energy again. Notably, sustainable solutions also saw turnover improve 17% YoY.

- Forecasts upbeat with room for further rerating. The Street currently has 9/2/0 BUY/HOLD/SELL ratings and an average TP of S$3.45. Based on consensus estimates, FY22F gross revenue/net profit should pick up by 9.7%/6.6 YoY to S$8.55bn/S$503m respectively. In line with this, the street is expecting FY22F DPU to jump 28% YoY to 6.4¢ (FY21: 5.0¢) or at a 2.2% yield. At current prices, SCI would trade at 11.1 forward P/E roughly at the YTD average of 11x, although this might change if the street starts a round of upgrades in the event of stronger-than-expected SCI results and more bullish guidance. SCI is due to announce 1H22 results on 5 August before trading commences.

(Source: Bloomberg)

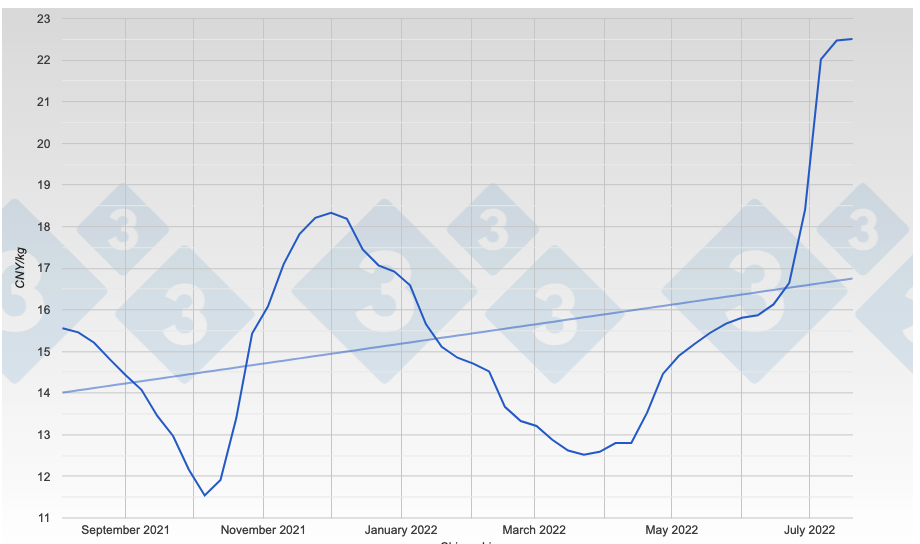

WH Group Ltd (288 HK): Expensive pork

- Buy Entry – 5.55 Target – 6.20 Stop Loss – 5.25

- WH Group Ltd is an investment holding company mainly engaged in the pork business. The Company operates its business through three segments. The Packaged Meats segment is engaged in the production, wholesale and retail of low temperature and high temperature meat products. The Pork segment is engaged in the slaughtering, wholesale and retail of fresh and frozen pork and hog farming businesses. The Others segment is engaged in the slaughtering and sales of poultry. The Segment is also engaged in the sales of ancillary products and services such as provision of logistics services, manufacturing of flavouring ingredients and natural casings, manufacture and sales of packaging materials, operating finance companies, property development companies, a chain of retail food stores, sales of biological pharmaceutical materials, trading of meat related products and others.

- Live pig price surged in 2Q22. As of 20th July, the average live pig price arrived at RMB22.51/kg, up 35.2% MoM. The rise in pig prices occurred after the recent reopening of schools, factories, and restaurants, which caused an increase in pork consumption, coupled with a decrease in imports and slaughtering of pigs.

Pig price in China – Live

Source: Pig333.com

- 1Q22 results review. Total operating income dropped by 24.7% YoY to RMB13.8bn. Net profit dipped by 1.6% YoY to RMB1.5bn. The operating margin increased by 3.6ppts to 13.8%. Shuanghui Development’s external sales volume of meat products increased by 1.8% YoY to 0.76mn metric tonnes. The company will be announcing the 1H22 interim results on 16th August.

- The updated market consensus of the EPS growth in FY22/23 is 72.5%/6.1%% YoY, respectively, translating to 7.1×/6.7x forward PE. The current PER is 9.8x. FY22F/23F dividend yield is 6.1%/7.1% respective. Bloomberg consensus average 12-month target price is HK$7.93.

(Source: Bloomberg)

Prada S.p.A. (1913 HK): The hedge against inflation realised

- RE-ITERATE Buy Entry – 43.5 Target – 49.0 Stop Loss – 41.0

- Prada SpA is an Italy-based company engaged in the fashion industry. The Company is a parent of the Prada Group. The Company, along with its subsidiaries, is engaged in the design, production and distribution of leather goods, handbags, clothing, eyewear, fragrances, footwear and accessories. Prada SpA manufactures jackets, trousers, skirts, dresses, sweaters, blouses, as well as perfumes and watches, among others. The Company trades its products through several brands, such as Prada, Miu Miu, The Church and The Car Shoe. Prada SpA operates in approximately 70 countries through directly operated stores, franchise operated stores, a network of selected multi-brand stores and department stores. Prada Spa operates through numerous subsidiaries, including Artisans Shoes Srl, Angelo Marchesi Srl, Prada Far East BV, Tannerie Megisserie Hervy SAS and Prada SA, among others.

- Upbeat 1H22 results. Net revenue grew by 22.5%/22.2% at constant exchange rates of 1H21/1H19 to EUR1.9bn. Net sales of the retail channel grew by 26.4%/37.7% at constant exchange rates of 1H21/1H19. 1H22 GPM was at 77.7% compared to 74.3% in FY21 and 71.7% in FY19. Net profits jumped by 95.5% YoY to EUR189mn. 1H22 net sales in Europe and Americas jumped by 58.4% YoY and 55.6% YoY. Though Asia Pacifc remained the largest net sales contribution, the net sales of which dropped by 3.8% YoY during the period.

- Resilient luxury goods consumption amidst inflation and recession concerns. The inflation and recession fears haunted average consumers rather than the affluent class. The market leader LVHM also reported better than expected 2Q22 results. Besides a resilient demand from wealthy consumers, luxury brands companies have adjusted their selling prices against inflation. Meanwhile, according to a report by Bain & Company, China luxury goods market will see a rapid recovery in the second half of the year from the short-term impact caused by the epidemic.

- The updated market consensus of the EPS growth in FY22/23 is 47.3%/23.6% YoY, respectively, translating to 33.5×/27.1x forward PE. The current PER is 37.4x. Bloomberg consensus average 12-month target price is HK$53.47.

(Source: Bloomberg)

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Technology Services | +1.78% | Europe Passed New Tech Rules. That Was the Easy Part DoorDash, Inc (DASH US) |

| Consumer Services | +0.37% | Uber Surges Most Since 2020 as Demand Eases Worries on Inflation Airbnb, Inc (ABNB US) |

| Health Services | +0.18% | Goldman Warns Against Being ‘Too Early’ in Fading Recession Risk Centene Corp (CNC US) |

Top Sector Losers

| Sector | Loss | Related News |

| Communications | -1.74% | Stocks fall a second day on U.S.-China tensions, hawkish comments from Fed leaders AT&T Inc (T US) |

| Non-Energy Minerals | -1.43% | Copper price falls as Taiwan tensions spark risk-off selling Southern Copper (SCCO US) |

| Distribution Services | -1.33% | Ripples From Pelosi Trip May Take Time to Impact Global Markets McKesson Corporation (MCK US) |

- PayPal Holdings, Inc (PYPL) Shares jumped 11.35% in after-hours trading after the company announced the 2Q22 results. Revenue grew by 9% YoY to US$6.8bn. 2Q22 adjusted EPS increased from US$0.88 in 1Q22 to US$0.93 (1Q21: US$1.15). For full-year 2022, the company now expects adjusted EPS of US$3.87-US$3.97, topping the consensus of $3.85, and increased from its prior range of US$3.81-US$3.93. Revenue is expected to reach US$27.85bn (consensus of US$28.2bn). It also said activist investor Elliott Management has an over US$2bn stake in the fintech company.

- Prudential Financial, Inc (PRU US) Shares fell 2.88% in after-hours trading after the company announced the 2Q22 results. 2Q22 adjusted operating EPS of US$1.74 trailed the US$2.33 consensus and fell from $3.17 in 1Q22 and from $3.60 in 2Q21. The current quarter includes a net after-tax charge from its annual assumption update and other refinements of US$2.94 and an after-tax gain on the sale of a block of legacy variable annuities of US$1.76. Assets under management were US$1.41tn in 2Q22 vs. US$1.62tn in 1Q22 and US$1.73tn in 2Q21.

- Advanced Micro Devices, Inc (AMD US) Shares fell 6.94% in after-hours trading after the company announced the 2Q22 results. Revenue jumped by 70.1% YoY to US$6.6bn. 2Q22 Non-GAAP EPS arrived at US$1.05. For 3Q22, AMD expects revenue to be approximately US$6.7bn, plus or minus US$200mn (US$6.83bn consensus), an increase of approximately 55% YoY led by growth in the Data Center and Embedded segments. AMD expects the non-GAAP gross margin to be approximately 54%. For FY22, AMD re-affirms revenue to be approximately US$26.3 bn, plus or minus US$300mn (US$26.18bn consensus), an increase of approximately 60% over 2021 led by growth in the Data Center and Embedded segments. AMD continues to expect non-GAAP gross margin to be approximately 54%.

- Airbnb, Inc (ABNB US) Shares fell 8.25% in after-hours trading after the company announced the 2Q22 results. 2Q22 revenue jumped by 56.7% YoY to US$2.1bn, missing the estimates by US$10mn. 2Q22 GAAP EPS was US$0.56, beating estimates by US$0.13. 2Q22 nights and experiences booked grew by 25% YoY to 103.7mn. From a profitability perspective, the company had its most profitable Q2 ever with a net income of US$379mn. ABNB sees 3Q22 revenue between US$2.78bn and US$2.88bn (consensus revenue estimate of US$2.78bn). It also announced a US$2bn share repurchase program.

- SolarEdge Technologies, Inc (SEDG US) Shares plunged 13.25% in after-hours trading after the company announced the 2Q22 results. It reported 2Q22 GAAP EPS of US$0.95, beating estimates by US$0.02. However, its revenue of US$727.8mn, despite growing 51.6% YoY and coming in at an all-time high for the company, missed expectations by US$1.89mn. For 3Q22, the company sees its revenue to range from US$810mn to US$840mn (consensus revenue estimate of US$820.90mn).

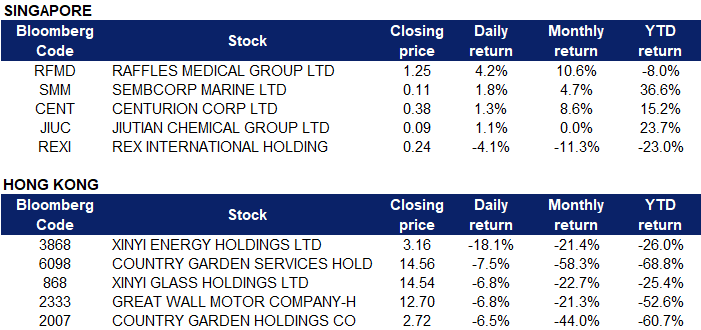

Singapore

- Oil exploration and production company Rex International (REXI SP) slumped 4.1% as oil prices continued to fall on a bleak outlook for fuel demand with data pointing to a global manufacturing downturn just as OPEC+ producers meet this week to decide whether to increase supply. Surveys showed on Monday that factories across the United States, Europe and Asia struggled for momentum in July as flagging global demand and China’s strict COVID-19 restrictions slowed production. Brent crude was down 1.4%, to $98.63/bbl, while U.S. West Texas Intermediate crude fell 1.1% to $92.89/bbl.

- Centurion Corporation (CENT SP) gained 1.3% after it announced positive profit guidance, which would see a “substantial increase” in 1H22 PATMI by “not less than 250% on a YoY basis”. The increase in net profit is primarily attributable to the recovery in the group’s operating performance. CENT noted a net fair value gain in 1H22 as compared with a net fair value loss of approximately S$14.5m in 1H21, in relation to its investment properties. It added that the gain was also mainly due to revenue contributions from the group’s newly expanded portfolio of purpose-built workers accommodation (PBWA) and accommodation related business, as well as a “robust” recovery in occupancy rates in its portfolio of PBWA and purpose-built student accommodation across Singapore, the United Kingdom and Australia.

- Jiutian Chemical (JIUC SP) gained 1.1% after it announced positive profit guidance, which would see a significant increase in consolidated net profit, compared to the corresponding prior year period. The expected profit growth is mainly due to increase in average selling price of JIUC’s main products. As China’s post Covid-19 economic recovery gathered momentum, JIUC continued to experience strong demand for our main products of Dimethylformamide (“DMF”) and methylamine.

- Raffles Medical (RFMD SP) gained a further 4.2% after the street raised their TPs, implying potential upside of 13.6% to 32% from last close of S$1.25. Raffles Medical’s 1H22 results had exceeded market expectations, forming around 75-83% of consensus full-year estimates. As such, the street raised earnings estimates for the FY22-24 period. As of the last update, the street is currently expecting RFMD to report flat FY22F EPS of S$0.045 on revenue of S$740.6m (+2.3% YoY). Although, FY22F DPS is expected to jump to S$2.5¢ from FY21’s S$2¢

- Sembcorp Marine (SMM SP) gained 1.8% while Keppel Corp (KEP SP) closed flat after media reports that the Competition and Consumer Commission of Singapore (CCCS) had launched a consultation exercise to seek the public’s views on the proposed merger of SMM and KEP’s offshore and marine unit. CCCS will be assessing whether the proposed combination, if carried into effect, would infringe the Competition Act 2004, which prohibits mergers that have resulted, or may be expected to result, in a substantial lessening of competition within any market in Singapore

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

NA | NA | NA |

Top Sector Losers

Sector | Loss | Related News |

Alternative Energy | -3.78% | GT Investigates: US ‘evil bill’ against Xinjiang wreaks havoc on global supply chains, green push Xinyi Energy Holdings Ltd (3868 HK) |

Environmental Energy Material | -3.71% | China unveils plan to push green growth in industrial sector GCL Technology Holdings Ltd (3800 HK) |

Conglomerates | -3.63% | China calls Pelosi’s expected Taiwan visit ‘provocative’, continues military drills CK Hutchison Holdings Ltd (0001 HK) |

- Xinyi Energy Holdings Ltd (3868 HK) Shares plunged 18.13% yesterday after the company announced its 1H22 interim results. Revenue grew by 13.1% YoY to HK$1.26bn. Profit attributable to the equity holders of the company grew by 0.4% YoY to HK$623.1mn. The company declared an interim dividend of 7.7 HK cents, up 4.1% YoY. Goldman Sachs slashed the TP to HK$5.9 from HK$6.3 but maintained a BUY rating. The bank believed that the new projects built this year would be delayed but would accelerate in 2023. The installed capacity in FY22/23/24 is expected to be 873MW/1010MW/1094MW respectively.

- Xinyi Glass Holdings Ltd (868 HK) Shares fell 6.79% yesterday and closed at a 52-week low after the company announced its 1H22 interim results. Revenue grew by 0.5% YoY to HK$13.6bn. Profit attributable to the equity holders of the company plummeted by 38.5% YoY to HK$3.3bn. The company declared an interim dividend of 40 HK cents, down 39.4% YoY. Credit Suisse slashed TP to HK$27.1from HK$30 but maintained an OUTPERFORM rating. The bank believed that rising raw material costs and inventory levels suppressed the float glass segment’s profit margin.

- Country Garden Services Holdings Co Ltd (6098 HK) Shares fell 7.5% yesterday and closed at a three-year low. Country Garden Holdings Co Ltd (2007 HK) Shares fell 6.53% yesterday and closed at a five-year low. Bearish sentiment on the China property sector remained as investors were concerned that the developers would utilise funds with the associate property management companies.

- Great Wall Motor Company Limited (2333 HK) Shares fell 6.75% yesterday following the automobile sector correction. There was no company-specific news. The overall broad market was sold off due to the concerns about the escalation of geopolitical risks as the US House of Representatives Speaker Nancy Pelosi will visit Taiwan this week.

Trading Dashboard Update: Add Sinopharm Group (1099 HK) at HK$17.5 and CNOOC Ltd (883 HK) at HK$9.80.