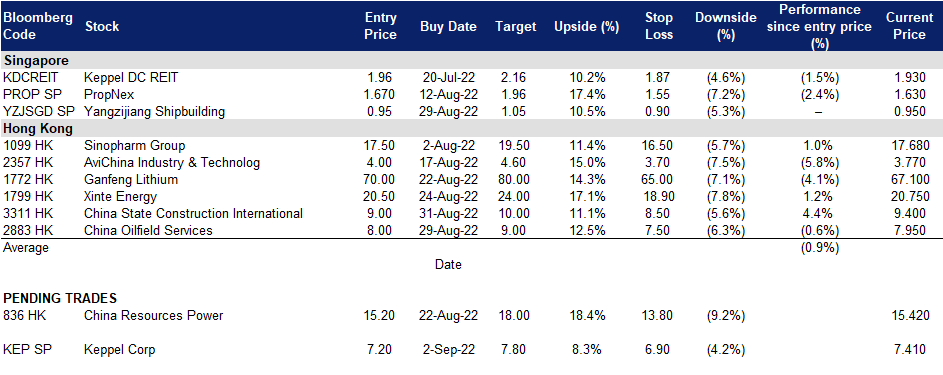

2 September 2022: Keppel Corp Ltd (KEP SP), China Oilfield Services Limited (2883 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Keppel Corp Ltd (KEP SP): Back to more than 4 years high

- BUY Entry 7.2 – Target – 7.8 Stop Loss – 6.9

- Keppel Corporation is a Singaporean conglomerate headquartered in Keppel Bay Tower, HarbourFront. The company consists of several affiliated businesses that specialises in offshore & marine, property, infrastructure and asset management businesses.

- Share buyback notice. Keppel released a share buy back notice on 31 August 2022. They purchased a total of 809,000 shares for a total of S$5.85mn, paying between S$7.16 to S$7.24 per share, to be held as treasury shares.

- Develop Singapore’s first hydrogen-ready power plant. The plant will be constructed on Jurong Island, with construction to be undertaken by a consortium comprising Mitsubishi Power Asia Pacific and Jurong Engineering. The plant will be owned by Keppel Sakra Cogen (KSC), presently a wholly-owned indirect subsidiary of Keppel Infrastructure. It is intended that Keppel Asia Infrastructure Fund LP (KAIF) and Keppel Energy will hold 70% and 30% equity interests in KSC respectively. The Keppel Sakra Cogen Plant, which is expected to be completed in the first half of 2026, will be designed to operate on fuels with 30% hydrogen content with the capability of shifting to run entirely on hydrogen, although it will initially run on natural gas as its primary fuel. The advanced combined cycle gas turbine (CCGT) power plant will also be able to produce steam for use in industrial processes for the energy and chemicals customers on Jurong Island.

- 1H22 earnings review. Net profit rose 66% YOY to S$498 million in 1H2022. Keppel announced an interim dividend 15 SG cents per share. Revenue in 1H22 was S$3,356 million as compared to 1H21 S$2,888 million.

- Updated market consensus of the EPS growth in FY22/23 is -13.5%/7.0% YoY respectively, which translates to 15.3x/14.3x forward PE. Current PER is 11.6x. Bloomberg consensus average 12-month target price is S$8.69.

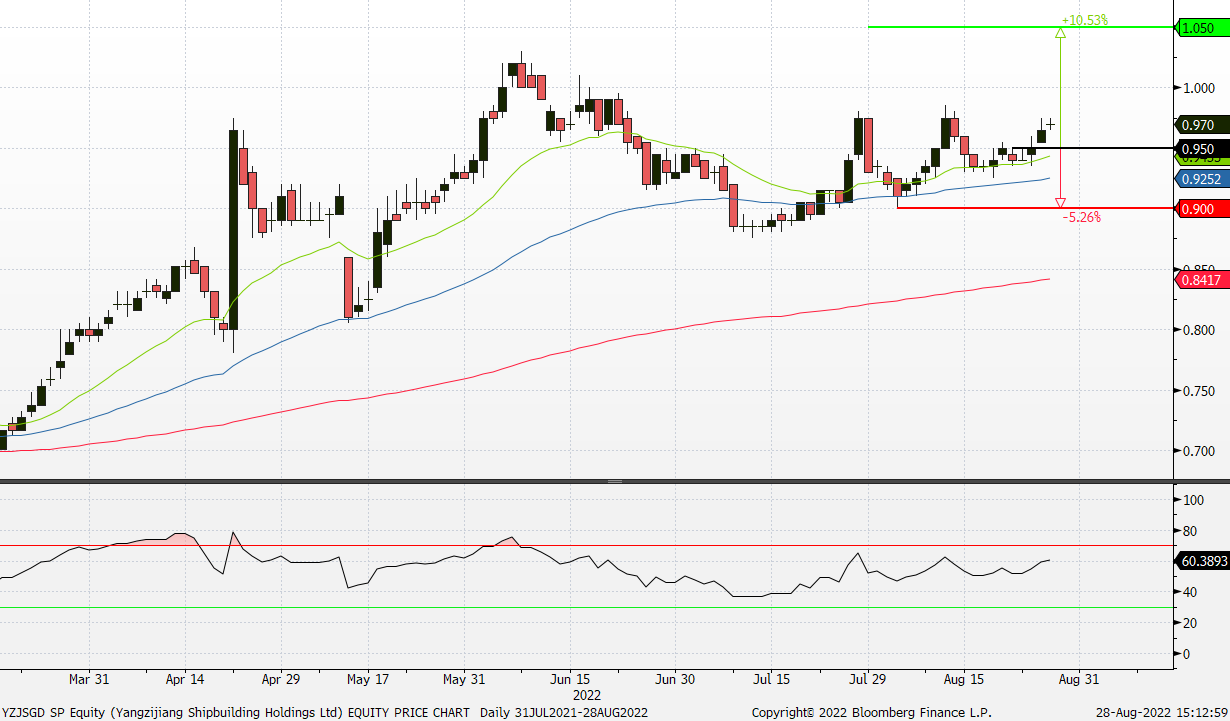

Yangzijiang Shipbuilding (YZJSGD SP): Solid fundamentals to buffer impacts from a volatile market

Yangzijiang Shipbuilding (YZJSGD SP): Solid fundamentals to buffer impacts from a volatile market

- RE-ITERATE BUY Entry 0.95 – Target – 1.05 Stop Loss – 0.90

- Yangzijiang (YZJ) produces a range of commercial vessels, including mini bulk carriers, bulk carriers, multi-purpose cargo vessels, containerships, chemical tankers, offshore supply vessels, rescue and salvage vessels and lifting vessels. It operates two shipyards, with the older yard located in Jiangyin city. The yard spans about 800 m of deep-water coastline and covers an area of about 200,000 sqm (excluding the coastal area). YZJ’s newer yard is located in Jingjiang city. The yard has 1,940 m of deep-water coastline, production area of 1,508,857 sqm, a drydock that can accommodate two 100,000 dwt vessels and two half 100,000 dwt vessels at one time.

- FY22 (YE June) earnings review. 4Q22 revenue grew by 14.8% YoY to S$22.0mn, and FY22 revenue grew by 11.8% YoY to S$82.5mn. 4Q22 gross profit grew by 9.6% YoY to S$11.3mn, and FY22 gross profit grew by S$44.0mn. 4Q22 Net profit grew by 22.7% to S$5.9mn. FY22 new profit grew by 9.7% YoY to S$19.8mn. The company proposed a final dividend of 6 SG cents and a special dividend of 2 SG cents.

- Secures additional orders for green vessels. YZJ announced that it clinched orders for four 8,000 TEU LNG dual-fuel containerships by repeat customer PIL and will be progressively delivered in 2025. The vessels will be equipped with a membrane containment tank system that was co-developed in-house, and demonstrates its focus on moving up the value chain to more complex LNG vessels. The orders bring total new orders secured YTD to USD990m for 16 vessels. As at writing, YZJ has a total order book value of US$8.15bn for 137 vessels, which is expected to keep its yard facilities at a healthy utilisation rate till mid-2025.

- Undemanding valuations with a decent DPS. The Street is fairly bullish on YZJ’s prospects with 7 BUY, and only 1 HOLD ratings, and an average 12M TP of S$1.30. The street expects FY23F/24F EPS growths to be 11.9%/12.6%. YZJ is currently trading at an undemanding 6.5x and 5.8x FY23F/24F P/E and 5.2%/6.6% FY23F/24F dividend yield respectively.

(Source: Bloomberg)

China Oilfield Services Limited (2883 HK): Near-term tailwinds to boost oil prices

- RE-ITERATE Buy Entry – 8.0 Target – 9.0 Stop Loss – 7.5

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- Possible OPEC output cut. Oil prices closed slightly higher amid the overall market sold-off, driven by signals from Saudi Arabia that OPEC could cut output. Brent crude futures rose US$0.98 to settle at US$100.79/bbl. U.S. West Texas Intermediate (WTI) crude futures dropped 4 US cents to settle at US$92.95/bbl.

- Upcoming US$1tn China infrastructure expansion. To turn the downturn of the economy, China’s central government announced an allocation of RMB6.8tn (US$1tn) of government funds for construction projects. The key sectors to be benefited are renewable energy (solar and wind), water, urban infrastructure, and data centers. The fiscal spending will indirectly boost the demand for oil, pushing oil prices to edge higher. The long-lasting high oil prices help positive sentiment and activities of the upstream exploration and production.

- 1H22 earnings review. Revenue increased by 19.5% YoY to RMB15.1bn. Profit attributable to owners of the company grew by 37.6% YoY to RMB1.1bn. The growth was driven by the gradual recovery of the offshore oil and gas industry and the demand for drilling rigs. As of 30 June 2022, the company operated and managed a total of 57 drilling rigs, including 44 jackup drilling rigs and 13 semi-submersible drilling rigs. In 1H22, the operating days for the company’s drilling rigs amounted to 8,017 days, representing an increase of 1,439 days or 21.9% compared with the same period of last year. The calendar day utilisation rate of drilling rigs was 77.4%, representing an increase of 12.1 percentage points compared with the same period of last year.

- Updated market consensus of the EPS growth in FY22/23 is 827.0%/23.5% YoY respectively, which translates to 11.8x/9.6x forward PE. Current PER is 56.1x. Bloomberg consensus average 12-month target price is HK$10.4.

(Source: Bloomberg)

China State Construction International Holdings Limited (3311 HK): Infrastructure theme to turn around

China State Construction International Holdings Limited (3311 HK): Infrastructure theme to turn around

- RE-ITERATE Buy Entry – 9.0 Target – 10.0 Stop Loss – 8.5

- China State Construction International Holdings Limited is an investment holding company principally engaged in construction contracts business. The Company is also engaged in infrastructure project investments, facade contracting business and infrastructure operation. The Company operates its business through four segments: Hong Kong, Mainland China, Macau and Overseas. Through its subsidiaries, the Company is also engaged in building construction, civil and foundation engineering works.

- Upcoming US$1tn China infrastructure expansion. To turn the downturn of the economy, China’s central government announced an allocation of RMB6.8tn (US$1tn) of government funds for construction projects. The key sectors to be benefited are renewable energy (solar and wind), water, urban infrastructure, and data centers.

- 1H22 results review. Revenue jumped by 47.9% YoY to RMB53.8bn. Gross profit grew by 20.0% YoY to RMB 7.2bn. Profit attributable to owners of the company grew by 20.1% YoY to RMB4.2bn. The company declared an interim dividend of HK$0.24. As of 30 June 2022, the company registered a steady growth with newly signed contracts amounting to HK$90.48bn, representing a YoY increase of 28.3%.

- Updated market consensus of the EPS growth in FY22/23 is 22.8%/14.7% YoY respectively, which translates to 6.0x/5.2x forward PE. Current PER is 6.2x. FY22F/23F dividend yield is 5.1%/5.8%. Bloomberg consensus average 12-month target price is HK$12.06.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Biotechnology | +1.95% | Why did Moderna stock rise today? Positive recommendations, approvals for COVID shot Moderna Inc (MRNA US) |

| Home Improvement Chains | +1.41% | Retail Earnings Provide Insight on Consumer Economy Home Depot Inc (HD US) |

| Pharmaceuticals: Major | +1.37% | Moderna, Pfizer Variant-Targeting Covid Boosters Get EU Nod Pfizer Inc (PFE US) |

Top Sector Losers

| Sector | Loss | Related News |

| Steel | -5.27% | Why BHP, Freeport-McMoRan, and Steel Dynamics Stocks Sank Thursday BHP Group Ltd (BHP US) |

| Other Metals/Minerals | -3.52% | Copper Price Analysis: Sinks almost 3%, eyeing a fall towards $3.2505 ahead of YTD lows Freeport-McMoRan Inc (FCX US) |

| Semiconductors | -2.70% | Chip wreck: Nvidia sinks sector after U.S. restricts China sales NVIDIA Corp (NVDA US) |

- Okta Inc (OKTA US) cratered 33.7% despite a top and bottom line beat in the recent quarter. A slew of Wall Street banks downgraded shares of the cybersecurity software company, citing troubles as it integrates Auth0, which it acquired last year.

- Bed Bath & Beyond Inc (BBBY US) fell 8.6% midday after a handful of analysts said its turnaround plan, announced Wednesday, isn’t enough to fix its struggling business. Raymond James downgraded the stock Thursday, saying new financing and company plans to close stores and lay off employees “only kicks the can down the road.”

- NVIDIA Corp (NVDA US) sank 7.7% amid news that the government is restricting the sale of some of its chips to China. Shares of Advanced Micro Devices Inc (AMD US), which was also ordered to stop selling artificial intelligence chips to China, fell 3.0%.

- MongoDB Inc (MDB US) shed 25.3% after the cloud computing company said it expects a wider-than-expected loss in the third quarter. The company beat Wall Street’s top and bottom line expectations and shared strong revenue guidance.

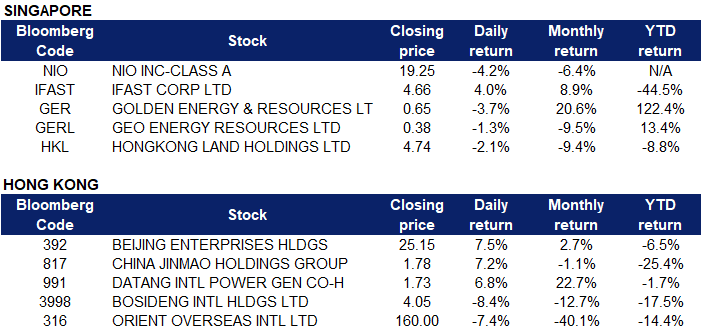

Singapore

- NIO Inc (NIO SP) shares fell 4.2% yesterday. Chinese EV makers are preparing to report August deliveries on Thursday. Warren Buffett trims his stake in BYD ahead of the deliveries report. Deutsche Bank cut its price target on NIO ahead of the delivery of its Q2 earnings on September 7.

- iFAST Corp Ltd (IFAST SP) rose 4.0% yesterday. FSMOne.com Singapore, the business-to-consumer (B2C) division of Mainboard-listed iFast, has launched the FSMOne debit card. The card will allow FSMOne.com’s clients to pay for expenses from their cash account, which includes their investment proceeds, dividends and available balance. “We are excited to introduce the FSMOne Debit Card because our investors can now invest, trade, spend and earn, in one place and be continuously rewarded,” says Lim Chung Chun, CEO of iFast, who adds that the launch of the card will add more value for the company’s clients.

- Golden Energy & Resources Ltd (GER SP) and Geo Energy Resources Ltd (GERL SP) fell 3.7% and 1.3% respectively yesterday. One of China’s biggest cities, Chengdu, announced a lockdown of its 21.2 million residents as it launched four days of citywide COVID-19 testing, as some of the country’s most populous and economically important urban centres battle outbreaks. All residents in Chengdu, the capital of Sichuan province, were ordered to stay largely at home from 6 p.m. on Thursday, with households allowed to send one person per day to shop for necessities, the city government said in a statement. Industrial firms engaged in important manufacturing and able to manage on closed campuses were exempted from work-from-home requirements.

- Hongkong Land Holdings Ltd (HKL SP) dropped 2.1% yesterday. Office property markets in Hong Kong and mainland China are likely to see declining rents for the rest of the year, according to a consultancy ranking that places them in the bottom half of a list of 22 Asia-Pacific markets. “The continued closure of the border between Hong Kong and China mainly affects the recovery of Hong Kong in regards to attracting mainland companies and the return of Chinese tourists,” Choi said. The impact on the office property market is apparent in Hong Kong. According to data from JLL, the vacancy rate for prime office space in July inched up to 9.6 per cent from 9.4 percent in June – close to the record high of 9.8 per cent recorded in September 2021.

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Coal | +1.79% | China’s carbon emissions fall 8% as economic growth slows Yancoal Australia Ltd (3668 HK) |

Telecomm. Services |

+1.34%

| Strike telecom fraud at the root China Unicom Hong Kong Ltd (762 HK) |

Conglomerates | +1.06% | After long drought, China plots ambitious water infrastructure push CK Infrastructure Holdings Ltd (1038 HK) |

Top Sector Losers

Sector | Loss | Related News |

Travel & Tourism | -3.19% | China Locks Down Megacity Chengdu as Covid Zero Intensified Trip.com Group Ltd (9961 HK) |

Airline Services | -2.47% | China’s Guangzhou, Shenzhen tighten COVID-19 curbs as parts of north join in China Eastern Airlines Corporation Limited (670 HK) |

Environmental Energy Material | -2.43% | From backwater to clean energy base, China’s Gansu accelerates green development Xinyi Solar Holdings Limited (968 HK) |

- Beijing Enterprises Holdings Ltd (0392 HK) rose 7.5% yesterday, after releasing its interim results recently. Beijing Enterprises operating income in the first half of the year was HK$45.99 billion, a year-on-year increase of 13.9%; the profit attributable to shareholders was HK$5.03 billion, a year-on-year decrease of 20.4%; the basic earnings per share were HK$3.99, and interim cash was proposed. Dividend of 50 HK cents per share. Excluding the impact of one-off events, the profit attributable to shareholders of the company amounted to HK$5.47 billion, an increase of 10.8% from HK$4.94 billion in the same period last year.

- China Jinmao Holdings Group Ltd (0817 HK) rose 7.2% yesterday together with Chinese property stocks. On August 31 the State Council held an executive meeting pointing out that the reform method of “delegating power, regulating and serving” should be used to promote the effectiveness of the policies to stabilise the economy. The detailed policy rules are expected to be released in early September, and efforts will be made to expand effective demand. To support rigid and improved housing needs, local governments should make good use of the policy toolbox for “one city, one policy”, and flexibly use the phased credit policy and special loans to guarantee the delivery of buildings. It is expected that the follow-up restrictions on purchases and sales will be further loosened, mortgage interest rates, taxes and fees are expected to be reduced, and supportive policies for home buyers and housing enterprises will be accelerated.

- Datang International Power Generation Co Ltd (0991 HK) gained 6.8% yesterday. CITIC Construction Investment released a research report saying that compared with the first quarter, the company’s thermal power loss was further narrowed, mainly because the increase in the proportion of long-term coal to reduce the company’s fuel costs; the increase in profits from hydropower business was mainly due to the increase in power generation due to the increase in water inflows that exceeded expectations. The increase in profit of photovoltaic wind power is mainly due to the increase in power generation driven by the increase in installed capacity. The bank believes that with the complete implementation of the long-term coal policy, the profitability of the company’s thermal power business is expected to be restored.

- Bosideng International Holdings Ltd (3998 HK) fell 8.4% yesterday, after it announced that a Yingxin International Investment Co Ltd, a controlling shareholder of the company that it will be cooperating with China International Capital Corporation Hong Kong Securities Co Ltd and JPMorgan Securities Limited to enter into a block transaction agreement. The Placing Agent has agreed to place 230 million existing shares of the Company with a par value of US$0.00001 each held by the Seller at a price of HK$3.94 per share to parties independent of and unconnected with the Company. The Sale Shares represent approximately 2.12% of the Company’s total issued shares as of the date of this announcement.

- Orient Overseas (International) Ltd (0316 HK) shares fell 7.4% yesterday. China Merchants Securities released a research report saying that the current macroeconomic pressure is sluggish, inflation in the United States is high, and the Federal Reserve has continuously raised interest rates, which has reduced global demand. With the gradual liberalisation of the epidemic in various countries and the repair of supply chains, the potential for container shipping prices to return to pre-epidemic levels will gradually increase.

Trading Dashboard Update: Cut loss on RH Petrogas (RHP SP) at S$0.200. Add China Oilfield Services (2883 HK) at HK$8.0.