2 November 2022: Sembcorp Industries Ltd (SCI SP), Tsingtao Brewery Company Limited (168 HK)

Singapore Trading Ideas | Hong Kong Trading Ideas | Market Movers | Trading Dashboard

Sembcorp Industries Ltd (SCI SP): Ongoing projects to uphold business growth

- BUY Entry – 2.95 Target – 3.20 Stop Loss – 2.83

- Sembcorp Industries Ltd is a leading energy and urban solutions provider, driven by its purpose to do good and play its part in building a sustainable future. It aims to deliver innovative solutions that support the energy transition and sustainable development. The company provides utilities and integrated services for industrial sites such as power, gas, steam, water, wastewater treatment and other on-site services. Sembcorp Industries has a proven track record of transforming raw land into sustainable urban development across Asia.

- Appointed to build and manage energy storage facilities. The Energy Market Authority (EMA) has appointed Sembcorp Industries to build, own and operate 200 megawatt/200 megawatt-hour of energy storage systems (ESS) in Jurong Island, the regulator announced on Oct 26. The ESS is currently being installed across two sites on Jurong Island and spans two hectares of land. When operational in November, it will be the largest ESS deployment in Southeast Asia, and one of the fastest of its size to be deployed. The ESS function as large-scale batteries to store energy and dispense it at other times when needed. In view of the ongoing volatility in the global energy market, it can be used to store energy to provide reserves to the power grid when needed, freeing up power generation plants to generate more electricity to meet demand.

- Joint study agreement. PT Sembcorp Energy Indonesia, the wholly-owned subsidiary of Sembcorp Industries, has signed a joint study agreement with Pertamina Power Indonesia and IGNIS Energy Holdings, to explore the feasibility of a commercial-scale development of clean hydrogen production in Indonesia. This will allow them to evaluate the potential development of clean hydrogen production facilities from green energy sources in Sumatera, Indonesia to harness the country’s large renewable energy potential.

- Partnerships for future benefits. Sembcorp Industries has entered strategic partnerships with the Japanese government and various corporations to progress hydrogen and other decarbonisation initiatives. The collaborations will enable Sembcorp to access and leverage Japan’s highly advanced technology in hydrogen development and deployment. With Singapore’s power sector currently making up 40% of the nation’s total carbon emissions, hydrogen is the most promising alternative fuel to natural gas, which addresses 95% of the country’s energy needs today. These partnerships inked by Sembcorp will underpin the Singapore government’s ambitions for low-carbon hydrogen to potentially support up to 50% of its power needs by 2050.

- Updated market consensus of the EPS growth in FY22/23 is 197.3%/-21.4% YoY respectively, which translates to 6.5x/8.3x forward PE. Current PER is 7.4x. Bloomberg consensus average 12-month target price is S$4.01.

(Source: Bloomberg)

Sembcorp Marine Ltd (SMM SP): Acquisition of KOM

- RE-ITERATE BUY Entry – 0.128 Target – 0.140 Stop Loss – 0.122

- Sembcorp Marine Ltd offers engineering solutions for the offshore, marine, and energy industries. The Company provides rigs and floaters, repairs and upgrades, offshore platforms, and specialised shipbuilding. With a combined docking capacity of 2.3 million dwt, it offers one of the largest ship repair, ship conversion, and offshore and marine-related facilities in East Asia. Its global hub now spans eight shipyards strategically located around the world.

- Revision of previous merger deal. On October 27, Sembcorp Marine Ltd scrapped a deal to merge with Keppel Corp’s offshore and marine unit and form a new company, in favour of directly acquiring 100% of Keppel O&M from Keppel for S$4.50 billion ($3.19 billion). This will lower the value of Keppel’s unit by S$378 million from the S$4.87 billion valuation it received in April. Hence, giving Sembcorp Marine’s shareholders a larger stake, of 46 percent, compared with 44 percent in the previous deal, in the combined firm and shortens the time required to complete the deal, which is expected to close by the end of the year. Additionally, Keppel will distribute 49 percent of Sembmarine shares in-specie to its shareholders and retain a 5 percent stake, half the size of the stake it would have had under the older terms.

- Enlarged entity. With a larger entity after the acquisition of Keppel O&M, Sembcorp Marine will be in a better position to deal with deteriorating macroeconomic conditions such as high inflation, rising interest rates, volatile oil prices, and concerns about energy security amid geopolitical tensions. Post-acquisition the enlarged Sembmarine would have a total net order book of more than S$18bn.

- Secured new projects. Prior to the announcement of the acquisition, Sembcorp Marine announced on 20 October that it secured two floating liquefied natural gas (LNG) facilities conversion projects from global infrastructure company New Fortress Energy. The hull conversion and fabrication of topsides for the first floating LNG liquefaction facility is scheduled for delivery in the first half of 2024. Work on the second floating LNG liquefaction facility project is expected to be contracted to Sembcorp Marine at a later date.

- Updated market consensus of the EPS growth in FY22/23 is 90.8%/96.7% YoY respectively, which translates to 28.2x/18.0x forward PE. Current PER is 53.1x. Bloomberg consensus average 12-month target price is S$0.12.

Tsingtao Brewery Company Limited (168 HK): FIFA World Cup is coming

- Buy Entry – 58.5 Target – 65.0 Stop Loss – 55.3

- Tsingtao Brewery Company Limited, together with its subsidiaries, engages in the production, distribution, wholesale, and retail sale of beer products worldwide. The company sells its beer products primarily under the Tsingtaoand and Laoshan brand names. It also provides wealth management, and agency collection and payment services; and financing, construction, and logistics services, as well as technology promotion and application services.

- FIFA World Cup Qatar 2022 in two weeks. The once in every four years FIFA World Cup is going to take place from November to December 2022. This is the largest global sports event after the Tokyo Olympic Games, and it is expected to attract a record high of spectators as most countries have eased COVID restrictions. Accordingly, it will stimulate sales of alcohol and other drinks. The beer feast will take place during the world cup period.

- 3Q22 earnings review. 3Q22 revenue grew by 16.0% YoY to RMB9.8bn. 3Q22 net profit attributable to shareholders of the company grew by 18.4% YoY to RMB1.4bn. 9M22 revenue grew by 8.7% YoY to RMB29.1bn. 9M22 net profit attributable to shareholders of the company grew by 18.2% YoY to RMB4.3bn.

- The updated market consensus of the EPS growth in FY22/23 is 19.7%/14.3% YoY, respectively, translating to 23.1×/20.2x forward PE. The current PER is 20.0x. Bloomberg consensus average 12-month target price is HK$87.04.

(Source: Bloomberg)

China Oilfield Services Limited (2883 HK): Upbeat outlook and sound fundamentals immune to the market sell-off

China Oilfield Services Limited (2883 HK): Upbeat outlook and sound fundamentals immune to the market sell-off

- RE-ITERATE Buy Entry – 8.70 Target – 9.90 Stop Loss – 8.15

- China Oilfield Services Limited is a comprehensive oilfield service provider. The Company mainly operates through four business segments. The Drilling Services segment is mainly engaged in the provision of oilfield drilling services. The Oil Field Technical Services segment is mainly engaged in the provision of oilfield technical services, including the logging, drilling fluids and directional drilling services. The Geophysical and Engineering Exploration Services segment is mainly engaged in the provision of seismic prospecting and engineering exploration services. The Marine Support Services segment is engaged in the transportation of supplies, including the delivery of crude oil, as well as refined oil and gas products. The Company mainly operates its businesses in domestic and overseas markets.

- Longlasting high oil prices to uphold ongoing Capex. The oil and gas sector will be the best performer among the rest in 2022 thanks to upbeat oil prices. The underinvestment in the oil and gas sector since 2015 started to turn this year as the supply gap widened due mainly to the Russia-Ukraine military conflict. The expectation of long-lasting high oil prices attracts increasing fund flows to the upstream sector. According to Bloomberg, the capex in exploration and production from global integrated oil companies is expected to grow by 9.2%/8.6% in 2022/2023.

- A large-size contract was secured. The company announced that it has made a major breakthrough in overseas markets, signing several long-term drilling rig service contracts with a first-class international oil company in the Middle East, with a total contract amount of approximately RMB14bn.

- 9M22 earnings review. 3Q22 revenue grew by 26.4% YoY to RMB9.0bn, and 9M22 revenue grew by 21.9% YoY to RMB24.2bn. 3Q22 net profit attributable to shareholders of the company jumped by 47.6% YoY to RMB960.7mn, and 9M22 net profit attributable to shareholders of the company jumped by 48.2% YoY to RMB2.0bn. The improvement was driven by the recovery in the upstream E&P activities.

- The updated market consensus of the EPS growth in FY22/23 is 827%/27% YoY, respectively, translating to 14.8×/10.8x forward PE. The current PER is 43.5x. Bloomberg consensus average 12-month target price is HK$10.87.

United States

Top Sector Gainers

| Sector | Gain | Related News |

| Investment Trusts/Mutual Funds | +13.77% | Earnings Outlook For Texas Pacific Land Trust Texas Pacific Land Corp (TPL US) |

| Other Metals/Minerals | +3.54% | Copper price jumps on weaker dollar Freeport-McMoRan Inc (FCX US) |

| Oil Refining/Marketing | +3.08% | Marathon Petroleum reports booming Q3 with net income surging more than 6x Marathon Petroleum Corp (MPC US) |

Top Sector Losers

| Sector | Loss | Related News |

| Internet Retail | -3.20% | Stocks Drop in Countdown to Fed as Rally Sputters: Markets Wrap Amazon.com Inc (AMZN US) |

| Internet Software/Services | -3.02% | Stocks finish lower as Wall Street braces for key Fed decision Alphabet Inc (GOOGL US) |

| Telecommunications Equipment | -1.57% | Wall St slips as jobs data dents hopes for Fed rate deceleration Apple Inc (AAPL US) |

Hong Kong

Top Sector Gainers

Sector | Gain | Related News |

Gamble | +4.80% | China Residents Can Now Travel To Macau Using e-Visa, Casino Stocks Gain Galaxy Entertainment Group Ltd (27 HK) |

Airline Services | +4.06% | Chinese Airlines Are Expanding International Routes Cathay Pacific Airways Ltd (293 HK) |

Biotechnology | +3.73% | China Markets Rally After Unconfirmed Social Posts on Reopening WuXi Biologics (Cayman) Inc (2269 HK) |

Top Sector Losers

Sector | Loss | Related News |

Telecomm. Services | -1.08% | US curbs on microchips could throttle China’s ambitions and escalate the tech war China Mobile Ltd (941 HK) |

Coal | -0.71% | China Is Doubling Down on Coal Despite Its Green Ambitions China Shenhua Energy Co Ltd (1088 HK) |

Consumer Electronics | -0.47% | China to impose consumption tax on e-cigarettes from November Smoore International Holdings Ltd (6969 HK) |

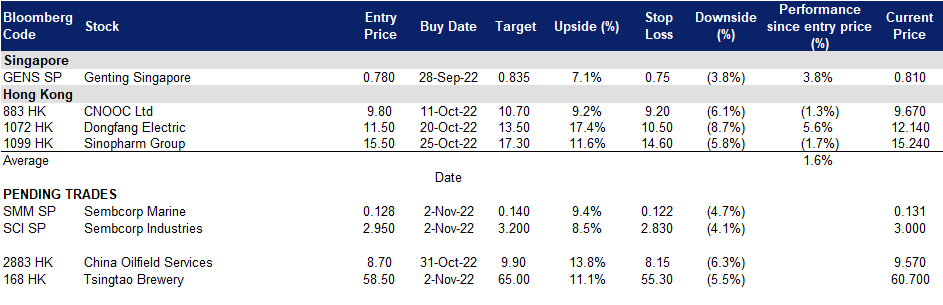

Trading Dashboard Update: No stock additions/deletions.