KGI DAILY MARKET MOVERS – 9 March 2021

FX Movers – USD/CNH

USD has moved higher with currency markets now focused on the rising US yields; the benchmark US 10-year Treasury note surged to 1.61% on Monday before paring gains to hover near its 1-year high. Equity markets have reacted to both the rise and the velocity of change in rates.

With the FOMC meeting scheduled next week (16-17 March), there is the possibility that the Fed will embark on slowing the steepening yield curve and start buying long bonds. Additionally, China’s credit impulse has been decelerating since November last year. Taken together, we expect the USD/CNH to rise to around 6.5500 and 6.6000 in the short-term.

Market Movers – What’s Hot

United States

- Rotation out of tech continues, with the Dow Jones index up 1%, while S&P500 is down 0.5% and NASDAQ is down 2.4%. Funds continued to flow into value plays and financials, with the airline sector seeing the strongest gains yesterday. Biggest gainers were JetBlue (JBLU) +9.8%, Spirit Airlines (SAVE) +7.3% and United Airlines (UAL) +7%.

- Autohome (ATHM US) -12.5% closing at US$96.34, wiping out year-to-date returns for investors. Autohome is planning to dual list onto the Hong Kong Stock Exchange next Monday, and is one of various Chinese tech ADRs that saw significant downwards pressure on Monday’s trading.

- Stitch Fix (SFIX US) -22.9% after-hours at US$52.83 after posting 4Q20 results with lower than expected sales and announcing a weaker outlook due to shipping delays.

- Gamestop (GME US) +41.2% closing at US$194.50 as the delivery of the new stimulus check nears. A survey from Deutsche Bank shows that a large proportion of retail investors may use their stimulus checks in the equity market, a favourable sign for sentiment stocks that were part of late January’s short squeeze saga.

- Earnings Watch: AMC (10 Mar), Oracle (10 Mar), JD.com (11 Mar), DocuSign (11 Mar)

Hong Kong

- The overall Hong Kong market remained soft as the US market continued to be sold off, and northbound fund flows exceeded southbound flows. The top sectors that plunged included:

- Technology: Meituan (3690 HK) -8.37%, closing at HK$308.8. Kuaishou Technology (1024 HK) -6.67%, closing at HK$266. Xiaomi Corp (1810 HK) -8.59%, closing at HK$22.35. JD.com, Inc. (9618 HK) -5.93%, closing at HK$336.2. Tencent Holdings Ltd (700 HK) -5.38%, closing at HK$642.5.

- Automobile: BYD Co Ltd (1211 HK) -10.21%, closing at HK175.1. China Evergrande New Energy Vehicle Group Ltd (708 HK) -6.13%, closing at HK$49. Geely Automobile Holdings Limited (175) -9.45%, closing at HK$22.05. Great Wall Motor Company Limited (2333 HK) -10.27%, closing at HK$19.74.

- However, top sectors that outperformed due to a rising interest rate expectation and upbeat oil prices included:

- Banking: Agricultural Bank of China Ltd (1288 HK) +4.23%, closing at HK$3.2. HSBC Holdings PLC (5 HK) +3.58%, closing at HK$47.75. Industrial & Commercial Bank of China Ltd (1396 HK) +1.65%, closing at HK$5.51. Bank of China Ltd (3988 HK) +1.41%, closing at HK$2.88.

- Oil and Gas: PetroChina Co Ltd (857 HK) +4.1%, closing at HK$3.05. CNOOC Ltd (883 HK) +2.04%, closing at HK$9.50. China Petroleum & Chemical Corp (386 HK) +1.37%, closing at HK$4.44.

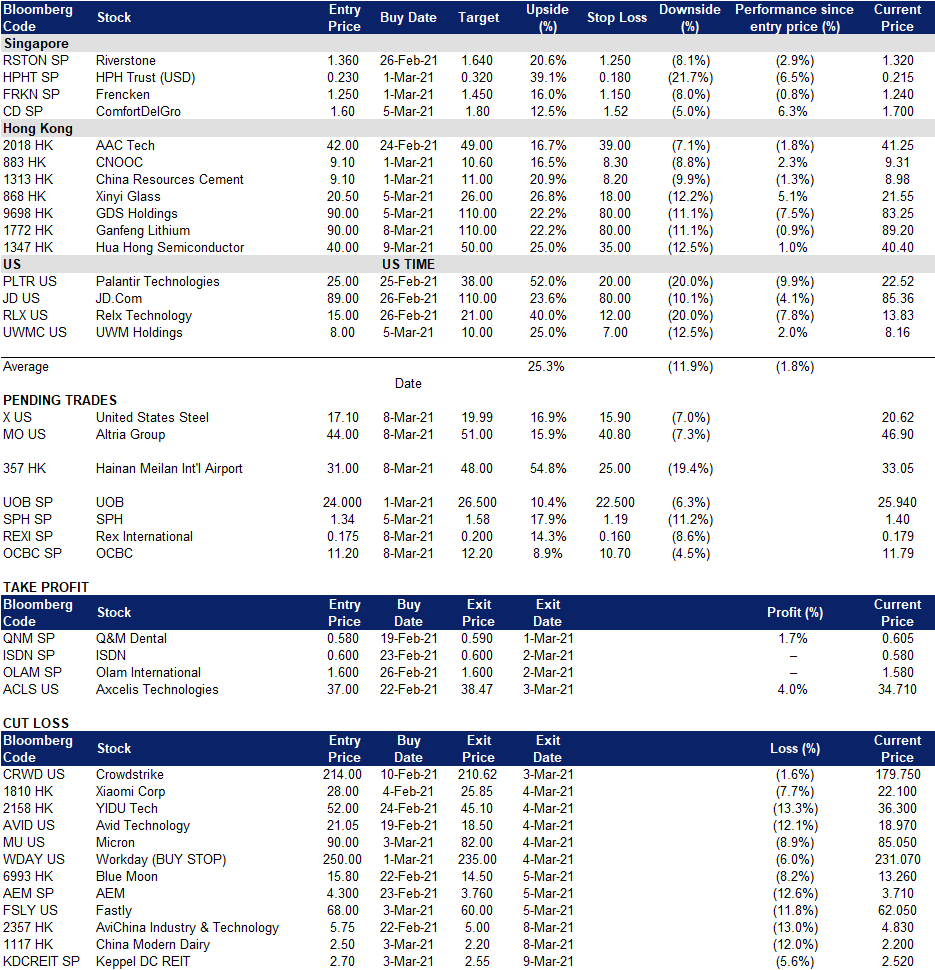

- Trading Dashboard Update: Added Ganfeng Lithium (1772 HK) and Hua Hong Semiconductor (1347 HK). Remove China Modern Diary (1117 HK) and AviChina Industry & Technology (2357 HK).

Singapore

- The Jardine Group of companies were the talk of the town after news emerged that it was going to consolidate its holdings into a simplified company structure. The move will see Jardine Matheson acquiring 15% of Jardine Strategic that it does not already own in a deal valued at US$5.5bn. Jardine Strategic (JS SP; +19.5%; US$32.80), Jardine Matheson (JM SP; +15.5%; US$62.00) and Dairy Farm (DFI SP; +4.7%; US$4.70) were the biggest gainers yesterday among the large-cap companies. In morning trading today, the three stocks are higher by 1 – 5%.

- Singapore Banks continue to be in positive terrority this morning on a brighter economic outlook and higher interest rates, and following the positive lead from Wall Street banks such as JPM, WFC and GS which gained 1-2% in overnight trading. Singapore’s economy is forecasted to grow 4% to 6% this year, bouncing back from a 5.4% contraction in 2020. Shares of DBS, UOB and OCBC are up between 1 – 2% this morning.

- Industrial REITs are underperforming this morning after JPMorgan issued a contrarian UNDERWEIGHT on Singapore industrial REITs, expecting that this sector is vulnerable to the recent steepening of the yield curve as it offered a lower yield and distribution per unit (DPU) growth compared to other sectors. A steeper yield curve has historically led to a 16% decline in S-REITs, according to JPMorgan. REITs such as Keppel DC REIT (KDCREIT SP), Mapletree Logistics Trust (MLT SP) and Mapletree Industrial Trust (MINT SP) are down 1-4% this morning.

- Trading Dashboard Update: Remove Keppel DC REIT (KDCREIT SP) at S$2.55.

Trading Dashboard