KGI DAILY MARKET MOVERS – 7 October 2021

Market Movers | Trading Dashboard

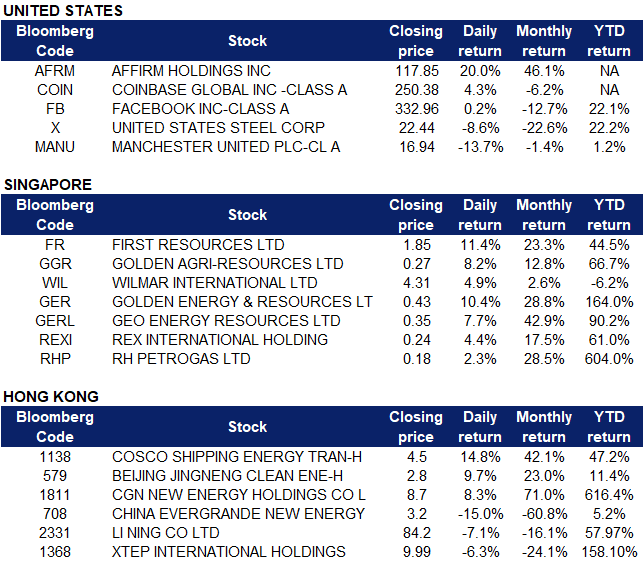

Market Movers

United States

- Affirm Holdings (AFRM US) shares surged 19.95% after it was announced that retail company Target will be partnering Affirm and Australian buy-now-pay-later firm Sezzle to help its customers “take advantage of our best deals”. Over the past few months, Affirm has already bagged partnerships with Amazon, Shopify and Walmart. Affirm will be offered as an option for customers spending more than $100 on purchases at Target.

- Coinbase Global (COIN US) shares jumped 4.29% on Wednesday trading after Goldman Sachs reiterated its buy rating on the stock, saying that it expects a top-line beat when the company reports earnings in November. The stock also rose in tandem with rising bitcoin price (which rallied to a near five-month high of $55,000) due to the company’s reliance on trading revenue.

- Facebook (FB US) CEO Mark Zuckerberg responded to both the Wall Street Journal’s multi-part series “The Facebook Files” that covered problems at the social network and whistleblower Frances Haugen’s testimony yesterday in a Facebook post. Zuckerberg defended the company’s efforts to promote the “safety, well-being and mental health” of users and argued that the accusations “don’t make any sense”. Additionally, Reuters reported that Facebook’s outage on Monday caused a surge in alternative platforms, allowing alternatives such as Telegram and Snap (SNAP US) to steal a bit of growth from the company. The stock dropped 1.3% in premarket trading before bouncing back to close 0.2% higher at $333.64.

- United States Steel Corporation (X US) shares fell 8.65% after Goldman Sachs analyst Emily Chieng downgraded the stock from neutral to sell and lowered her target price to $21, citing that “the market may be anticipating a correction in the coming months as additional import volumes arrive and new capacity begin operations.” U.S. steel prices have more than doubled from historical levels YTD, and Goldman analysts said that they expect the price of steel to pull back sharply early next year.

- Shares of football club Manchester United (MANU US) got the red card on Wednesday trading, as the stock plunged 13.66% to close at $16.94. It was announced on Wednesday morning that the Kevin Glazer Irrevocable Exempt Family Trust and the Edward S. Glazer Irrevocable Exempt Trust, insider shareholders who own a total of 40.4 million shares of the company, will be selling 9.5 million of those shares “at market price” in a secondary offering that will close on 8 October.

Singapore

- First Resources Ltd (FR SP), Golden Agri-Resources Ltd (GERL SP), Wilmar International Ltd (WIL SP). Palm oil sector shares rose collectively yesterday on rising palm oil prices. First Resources’ shares rose 11.4%, Golden Agri’s shares rose 8.2% and Wilmar’s shares rose 4.9%. Malaysian palm oil futures continued to break fresh record highs to above MYR 4,855 per tonne in October, lifted by expectations that higher prices of oil and shortages of canola would push more biodiesel feedstock demand towards palm oil, along with shrinking inventories and output disruptions in the two world’s largest producers Indonesia and Malaysia.

- Golden Energy & Resources Ltd (GER SP), Geo Energy Resources Ltd (GERL SP). Coal sector shares rose collectively yesterday on rising coal prices, extending its rally over the last week. Golden Energy shares rose 10.4% while Geo Energy’s shares rose 7.7%. Coal futures soared to fresh record highs of US$269.5 per metric ton for a 7th consecutive session on Wednesday, extending the year-to-date gain to more than 200%. China is facing a coal shortage due to soaring demand from manufacturers, industry and households while supply remains tight on imports constraints due to coronavirus restrictions and as the country reduced production to cut emissions. This week Chinese Vice Premier Zheng ordered state-owned energy giants to secure fuel supplies for winter at any cost. We currently have an OUTPERFORM recommendation for Golden Energy with a TP of S$0.64 and Geo Energy with a TP of S$0.42.

- RH Petrogas Ltd (RHP SP); Rex International Holding Ltd (REXI SP). Oil sector shares rose collectively yesterday, in tandem with rising oil prices. RH Petrogas shares rose 2.3% while Rex International shares rose 4.4%. WTI crude futures traded around US$79 a barrel yesterday, reaching a new high since November 2014, while Brent crude futures traded around US$83 a barrel yesterday, reaching a new high since October 2018. Factors driving oil prices include tight supply and soaring natural gas and coal prices putting additional pressure on the energy market. We currently have an OUTPERFORM rating for Rex International, with a 12M TP of S$0.33, implying an upside of 37.5% as of yesterday’s closing price of S$0.24.

Hong Kong

- COSCO Shipping Energy Transportation Co Ltd (1138 HK). Shares rose 14.8% yesterday on rising oil prices. The company is involved in oil tanker shipping, transporting crude oil, LNG, and LPG. WTI crude futures traded around US$79 a barrel yesterday, reaching a new high since November of 2014, while Brent crude futures traded around US$83 a barrel yesterday, reaching a new high since October 2018. Factors driving oil prices include tight supply and soaring natural gas and coal prices putting additional pressure on the energy market.

- Beijing Jingneng Clean Energy Co Ltd (579 HK), CGN New Energy Holdings Co Ltd (1811 HK) Clean energy stocks rose collectively yesterday. Beijing Jingmeng’s shares rose 9.7% yesterday and closed at its highest since December 2015. CGN Energy’s shares rose 8.3% and closed at an all-time high. HSBC Research upgraded both companies from a NEUTRAL rating to BUY, raising its target price for Beijing Jingneng from HK$2 to HK$3.2 and CGN New Energy from HK$1.75 to HK$3. According to the report, in the face of supply shortages, Chinese utility stocks are expected to continue to benefit from higher levels and flexible electricity prices under market transactions. Industrial users of green power such as wind power and solar energy are expected to benefit even more from the high demand. The bank prefers stocks with a clear green transformation plan, and expects that nuclear power dispatch on the grid will increase, as nuclear power has no emissions and can replace coal power in the current environment.

- China Evergrande New Energy Vehicle Group Ltd (708 HK) Shares declined 15% yesterday, after a rebound on Monday when China’s state-backed Global Times reported that Hopson Development was the buyer of a 51% stake in the property business for more than HK$40bn. Evergrande requested a halt in the trading of its shares on Monday pending an announcement about a major deal. However, as of yesterday, investors are still awaiting the confirmation of the deal, which could have likely sparked renewed fears over Evergrande’s possibility of default.

- Li Ning Co Ltd (2331 HK), Xtep International Holdings Ltd (1368 HK) Sporting sector shares fell collectively yesterday. Li Ning’s shares dropped 7.1% while Xtep’s shares dropped 6.3% yesterday. SPDB International recently released a research report stating that the recent weakness in the performance of China’s sportswear industry is mainly due to the market’s underwhelming expectations of the recent slowdown in the overall retail sales growth of the sportswear industry. The recent stock price correction has helped the market gradually return to rationality and readjust its expectations for the retail sales growth rate of domestic sportswear brands in 2H21 and 2022. The bank believes that the long-term growth of China’s sportswear industry remains, and driven by more rational market sentiment, the stock price is expected to rebound in the fourth quarter as consumer sentiment recovers. According to Bloomberg consensus, Li Ning currently has a rating of 43 BUYS, 1 HOLD and 0 SELL, with a 12M TP of HK$109.11, implying an upside of 29.6% as of yesterday’s closing price of HK$84.20. Xtep currently has a rating of 27 BUYS, 0 HOLD and 1 SELL, with a 12M TP of HK$16.92, implying an upside of 69.4% as of yesterday’s closing price of HK$9.99.

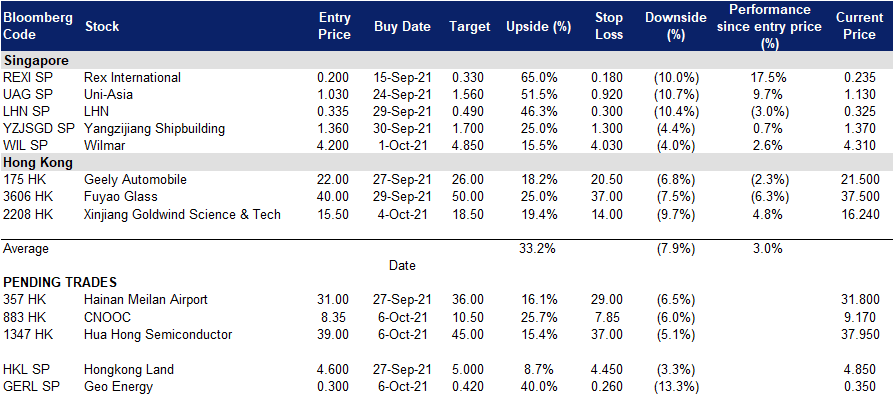

Trading Dashboard

Related Posts: