KGI DAILY MARKET MOVERS – 4 March 2021

Micro E-mini S&P 500 Index Futures

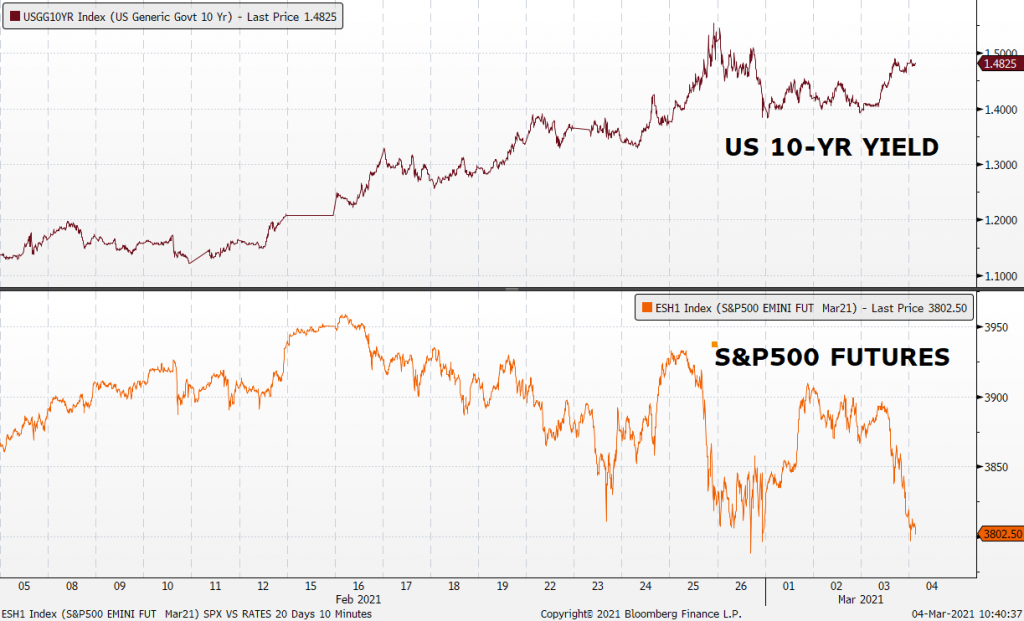

While we are optimistic on the fundamentals of the S&P 500 Index in 2021, interest rates and the steepening of the yield curve are likely to dominate the trading action of global equity benchmarks over the coming few months.

Active traders can now use the micro E-mini S&P and Micro E-mini Nasdaq-100 to execute strategies around the clock in a smaller-sized contract than the standard E-mini contracts.

Market Movers – What’s Hot

United States

- Rotation into cyclicals continues to shine with funds flowing into oil stocks. Among the largest gainers included HollyFrontier (HFC US; +6%; US$39.03), Diamondback Energy (FANG US; +5%; US$74.44) and EOG Resources (EOG US; +4%; US$66.99). Highly valued technology stocks are seeing large outflows, dragging the main indices lower, while value stocks are outperforming.

- Electric Vehicle stocks were among the worst performers last night with shares of Li Auto, XPeng and Nio dropping by 4-5%. The sell-off in the sector is partly attributed to Tesla’s (TSLA US; -5% to US$653.20) underperformance, as well as the global chip shortage that is likely be a short-term overhang for the Chinese auto sector.

- Cruise lines stocks such as Carnival Corp (CCL US;+4%; US$28.67) and Norwegian Cruise Line (NCLH US; +6%; US$33.13) outperformed the broader market on more analysts upgrades. Macquarie upgraded the cruise line sector to outperform from neutral, highlighting that the worst of the pandemic is likely in the rear view mirror and that government restrictions could be lifted in the coming months. Macqurie has called NCLH the best-positioned operator, and upgraded its target price to US$48 from US$18.

- Trading Dashboard Update: Remove Crowdstrike (CRWD US) at 210.62 and Axcelis Technologies (ACLS US) at 38.47. Add Fastly (FSLY US) at 68.0 and Micron (MU US) at 90.00

- Earnings Watch: Snowflake (4 Mar), Broadcom (5 Mar), Costco (4 Mar), Kroger (4 Mar).

Hong Kong

- HengTen Networks Group Ltd (136 HK) +14.87%, closing at HK$10.66. Shares were trading higher due to a technical rebound after it dropped from HK$17.8

- Angang Steel Co Ltd (347 HK) +14.84%, closing at HK$4.18. Steel sector was trading higher as demand for steel products and prices remain at high levels in China.

- Aluminum Corporation of China Limited (2600 HK) +13.22%, closing at HK$4.11. BlackRock, Inc. increased its holdings by 12.21mn shares at an average price of HK$4.03.

- China Hongqiao Group Ltd (1378 HK) +11.56%, closing at HK$11.1. The non-ferrous metal sector jumped as inflation concerns continue to haunt, driven by higher economic recovery expectations. LME aluminium prices are trading near multi-year highs.

- Zijin Mining Group Company Limited (2899 HK) +10.59%, closing at HK$12.32. FTSE Russell announced the inclusion of the stock in the China A50 Index, and also as the non-ferrous metal sector jumped on inflationary expectations.

- Trading Dashboard Update: Remove Xiaomi (1810 HK) at 25.85 and Yidu Tech (2158 HK) at 45.10. Add China Modern Diary (1117 HK) at 2.50

Singapore

- SPH (SPH SP) +4% to S$1.33 this morning on potential uplift from the IPO of its 0.1% stake in South Korean e-Commerce Firm Coupang. On a potential valuation of US$50bn for Coupang, SPH’s stake would be worth US$50mn. We think Coupang may trade much higher than its initial IPO price and therefore give a higher valuation to SPH. SPH’s stakes in other firms such as iFAST (IFAST SP) is also expected to boost it portfolio of investments. iFAST shares have gained 469% over the past one year.

- First Resources (FR SP) +2% to S$1.43 on potential bargain hunting following a 17% drop in its share price from the 52-week peak of S$1.72 that it traded at in mid-January 2021. 2H2020 net profit declined 6% YoY to US$60mn despite higher revenues as it booked expected credit losses arising from changes in fair value of biological asseta nd unquoted investments. The company raised full year dividends to 2.0 Sing cents, higher than the 1.725 Sing cents dividend in the prior year.

- Singapore Banks continue to be in positive terrority this morning on a brighter economic outlook and higher interest rates. Singapore’s economy is forecasted to grow 4% to 6% this year, bouncing back from a 5.4% contraction in 2020. Shares of DBS, UOB and OCBC are up between 0.5-1.0% is early morning trade today.

- Trading Dashboard Update: Add Keppel DC REIT (KDCREIT SP) at 2.70

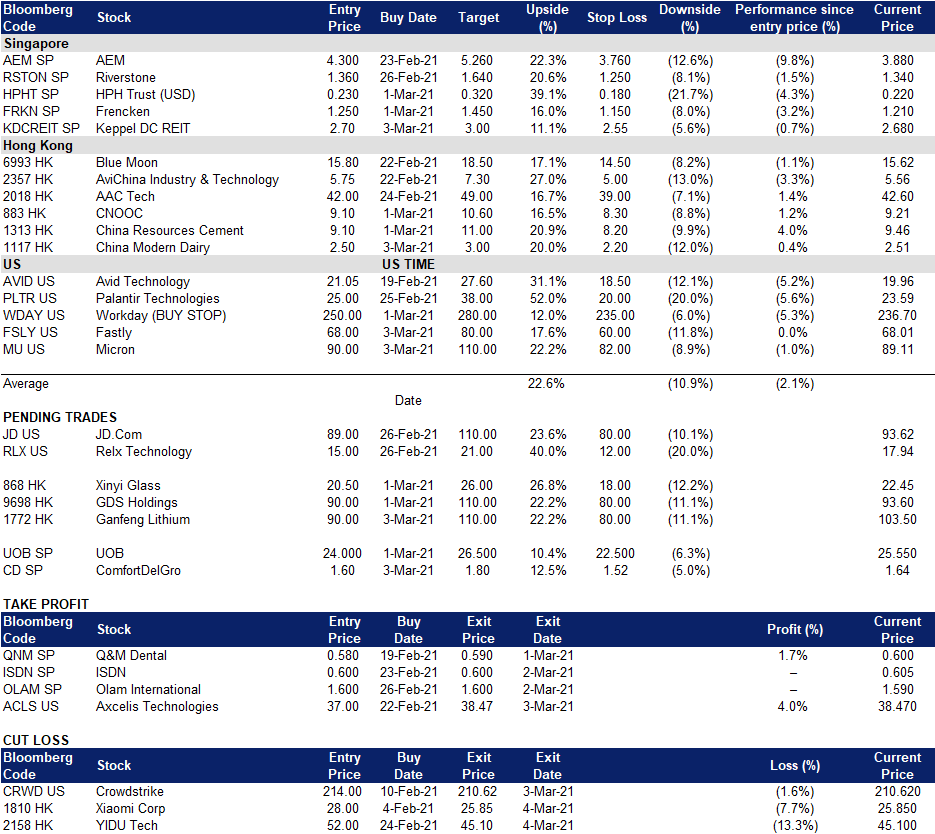

Trading Dashboard